Author: SanTi Li , Feng Yu, Naxida

< p style="text-align: left;">Time flies, and it has been almost 4 years since I last wrote a similar article. It feels very gratifying to review the scene at that time, and 95% of it met expectations. Except for the aviation giant Boeing, which did not take off, As mentioned in the article in 19-20, Bilibili ($19), BTC($3800), Tiger $3 , PDD($19) It has reached 5-10 times of expectations within 2 years, and the subsequent $ACH , $UOS, $NEAR, $ALGO also gave even greater surprises of 10-80x.

However, I also hope to improve my judgment through constant self-reflection and summary, because compared to readers who read the article directly, as a reader Participants in the ocean of information sometimes interfere with their initial judgment due to various off-site factors.

We like to put forward our opinions some time in advance, at a relatively low position or a relatively high position, and let time verify it slowly and silently. Real-time perspectives are often the most attractive, but they are also the most constantly involved in crises, which often require more energy and health. Many people are also experiencing health warnings. I hope everyone can stay healthy and happy in 2024. body and mind. I prefer to find the starting point and the end point, and choose to trust the driver and natural development for the middle road.

Getting back to the subject, it has been more than two and a half years since the last similar article. Next, I will write about a few topics that may be underestimated based on my personal knowledge. And the core starting point:

1. Bitcoin (BTC)

● ;Basic introduction:

BTC was once an anti-inflationary product of the 2008 financial tsunami. It has been around for nearly 16 years since its birth in January 2009. Its underlying Blockchain technology derived from logic technology has directly spawned underlying public chains such as Ethereum, ADA, SOL, AVAX, CFX, and Algo.

Now BTC's own development attributes have further expanded its potential large-scale application scenarios such as Stacks, RGB and other development protocols. My ultimate expectation for the general direction of BTC is actually very simple. Simply as the role of the new E-GOLD in the next few decades, the valuation will be very good. If coupled with the possible further explosion of ecological practical applications, it may gradually become one of the leading assets in the next century.

● The key to core startup:

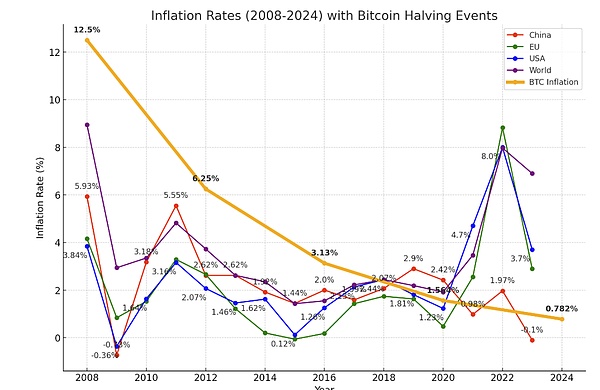

-halving in 2024, Each block reward is 3.125, and the annual inflation amount is: 52560x3.125=164,250 pieces, accounting for approximately 0.782% of the total amount. The inflation rate of around 0.78% is already lower than the annual inflation rate in most developed countries.

1. The U.S. SEC provides a fast channel for ETFs to bring the next round of water storage funds into the industry

2. Grayscale’s position swapping and MGOT selling pressure have passed

3. BTC holding companies are forced to act as saviors caused by traditional financial risks Wait for the selling pressure to pass

Pic 1: Comparison of inflation rates between BTC and China, the United States, Europe, and the world Chart (BTC is halved in 4 years. Note: The expansion rate is more similar to horizontal and vertical lines rather than purely linear. The linear chart is just for beauty)

Figure 1 compares the inflation rates of BTC with those of major countries. The figure does not list the currencies of countries suffering from excessive hyperinflation, such as Zimbabwe, Argentina, and Turkey. From the perspective of expansion rate alone, BTC is indeed worthy of being a research value target for corresponding storage for these countries.

● Expected valuation: $200,000 MC: 4.2 trillion U.S. dollars, as the beginning of a new world, comprehensive coverage Open the application scenario

Reminder: Here is an important reminder that the long-term expected valuation does not mean that the average trend may rise all the way up from the current price level. However, it is possible to experience violent and large-scale fluctuations in the short term. You must remember not to use high leverage to play long-term relationships. I write it here as a reminder.

2. Telegram Ime (Lime)& TON(TON)

● Basic introduction:

Ime Messenger is a special version of Telegram that integrates multi-chain wallets and other functions, allowing Telegram friends to Directly forward multi-chain assets such as BTC, ETH, AVAX, BNB, Polygon, Mantle, AVAX and other assets. Functions such as Binance Pay, Twitter, and direct Google translation of TG conversations have been added and the overall layout and ease of use of Telegram have been optimized.

Telegram’s account and chat history can also be used directly in the Ime version of Telegram without the need for a new account. Similarly, the chat history in the IME version will be automatically synchronized with the original Telegram version, making it easy to switch at any time. The Ime version itself is more like an aggregator that integrates the Web3 world into the TG ecosystem, and TON's role is to bias the chain ecosystem.

TON is a native public chain ecosystem developed on the basis of Telegram. As a public chain project inherited from the original project party of TG, it has brought great benefits to Telegram’s localized ecological development. More development is possible with diversity.

< /p>

< /p>

● Core logic:

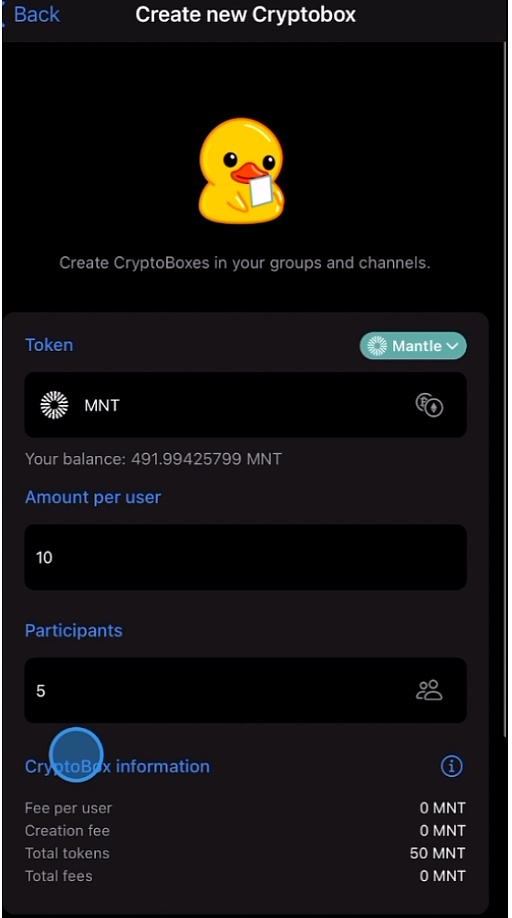

1. The number of users of the Ime version has increased from 2 million in 3 years The number of users has increased to 10 million users, an increase of 500%, and the friendly relationship with Telegram’s founding team has enabled Telegram’s 700 million users to seamlessly connect at any time. The latest multi-chain Token group red envelope function uses Lime as the gas fee. If it is optimized in the future, it will be more A convenient model will be of great benefit to the operation and promotion of the project. Ime's multi-chain integration function can help project parties integrate into the telegram ecosystem more quickly. Currently, LIME's FDV only fluctuates between 5M and 10M, which is far lower than the valuation of many primary market projects.

2. As the underlying public chain native to TG, Ton’s operation level and marketing level are at the forefront of the market, and Telegram users are directly in the original version of TG It can be used, which reduces the teaching cost. Although it cannot be multi-chain and the wallet is a dialog box version of a single-chain wallet, there is enough room for imagination based on TON itself, and the current FDV of TON has exceeded 10 billion U.S. dollars. It can be seen that the market has a strong interest in telegram. expected.

● Key to activation:

Ime Lime:

< p style="text-align: left;">1. Since there are many hard-core technical personnel in Russia and Ukraine, it is necessary to join the core operation PR party to enhance the self-marketing ability of the project

2. Further optimize TG group members to use the red envelope function to issue various TOKEN as rewards to group members

3 . More optimized TG functions are used

4. Russia’s further support and policies for blockchain applications

Ton:

1. The SEC has further relaxed its regulatory attitude towards the official Telegram TON

< p style="text-align: left;">2. Cooperation and output of SocialFi Killer-level projects on the chain

3. By GameFi as the entrance to TG has further increased

● Expected valuation:

Lime: Current MC FDV: $5.7M Expected FDV: $3 B-$5B

TON : Current MC FDV: $10B USD, Expected FDV: $60B

3. Conflux (CFX)

● Basic introduction:

Conflux is a Turing Award winner team, Tsinghua Yao Ban serves as a technical consultant and a Layer 1 public chain supported by underlying calculations The bottom layer is a public chain that creates a long-term development platform for dApps, e-commerce, and infrastructure such as Web3 and the Metaverse. The tree diagram consensus mechanism combines the Proof of Work (PoW) and Proof of Stake (PoS) algorithms. It is also one of the three most successful projects among purely domestic projects that I personally think.

● Core logic:

Conflux ’s unique tree diagram consensus algorithm achieves high scalability and low latency, and the technology is The technology-driven team, the smoothness and convenience of use are similar to the current highly valued blockchain projects such as SOL and ETH. It is quickly integrated with the development speed of mainstream Web3. It only needs to wait for further opening up and the number of users will become more active and it will have greater potential. The popular gameplay will gradually be implemented on CFX.

● Key to startup:

1. Mainland China’s public opinion on blockchain Chain applications, further support and liberalization of the Metaverse

2. The further popularization of Hong Kong, Macau and Taiwan as a pioneer pilot of public chains

3. Cooperation with more official companies such as CITIC and Xiaohongshu has been implemented, and the selling pressure of traditional capital has completely disappeared

4. The development of Conflux itself gradually matures , and the official and smooth support for BTC L2

● Expected valuation:

CFX current MC FDV: $0.9B fluctuating around, expected FDV: $36B-$80B

4. Opulous (OPUL)

● Basic introduction:

Music RWA+Defi projects, in which RWA has already implemented application cooperation with singers, investors can use OPUL to participate in purchasing the copyright of some albums to earn money from subsequent singers' albums Revenue sharing. New feature Opulous OLOAN creates a unique bridge to RWA in the music industry. Provide funds to musicians by staking USDC in the pool, and earn additional income on the pledged USDC

OVAULT is a unique platform on the Opulous staking pool, which allows you to stake USDC to access a diverse music library. Curated by Opulous 's music experts, this library contains popular and well-performing songs.

By participating OVAULT, you can enjoy the music library and get rewards. It’s also a way to participate in the music industry and profit from staking.

● Core logic:

The core music resources and connections behind the company are relatively rich. dittos is also Boss Huang’s music cooperation company. Opulous as a whole is still at the forefront of controlling the pace of the market. It is considered one of the more proficient project parties on the Algorand and Arb chains. Private equity selling pressure has been completely released.

● Key to activation:

Further popularization of music applications and huge profits There is a wave of actual income generated by artists

● Expected valuation:

OPUL Current MC FDV: $ 50M-100M fluctuates around, Expected FDV: $10B-$30B

5. Bilibili (Bili)

● Basic introduction:

Video creation and live broadcast platform, two-dimensional Shengdi Video Platform, a platform where young purchasing power is concentrated, has invested in a bunch of companies, resulting in poor financial results in recent years. So the stock price went from a new high to about to break, stop talking, cheers.

● Core logic:

1. Currently the only one in China that looks A platform that can compete with YouTube

2. Games may be able to catch up with the era of Web3's domain entry

3. User stickiness is very high, but consumer rights are currently a little limited to TV dramas

● After launch Key:

1. Encourage more original and creative educational videos. Nowadays, most Chinese videos are summary videos, and original videos are still much less than those on YouTube. . If this "wasteland" can be activated, it will be a huge source of income for small websites. Many people are willing to pay for high-quality knowledge, but management needs to be stricter to prevent bad money from driving out good money.

2. The investment in the first two years began to gradually generate exit returns.

3. Revise the business distribution. The current live broadcast business and game business are a bit strange mixed with the website

● Expected valuation:

Bili’s current valuation: $3.8B MC FDV , Expected valuation 5 Years : $50-100B

6. Avalanche / Polygon / Near / Algorand/ Solana

● Basic introduction:

Core class Alt- L1 basic public chain underlying architecture, of which AVAX and Polygon are more like the sidechain of Ethereum. Sol / Near / Algo is its own underlying architecture + compatible with EVM + BTC virtual machine or a separate project to add Compatible with Ethereum. Since each public chain has its own unique ecology, the public chain ecology in 2024 is more suitable for each chain to be separated into a large series. I won’t describe too much about the infrastructure of the chain here, otherwise it would take tens of thousands of words to write. Not finished.

● Core logic:

The security of L1’s underlying architecture has become Yu Perfect, although there has been some debate about the security of Sol's underlying infrastructure, there is no doubt that Solana is currently the largest ecosystem besides Ethereum, and even topped the list of popularity for a time. However, with the launch of the Ethereum Matryoshka doll series, the Ethereum ecosystem may also bring more ways to play. AVAX and SOL, Matic are perfect at playing the market rhythm, Near is also very convenient and average, Algo is the best at playing in the market, but its technical team and cooperation are the best.

Other L1s are advancing in a similar way. Now they are all interfering with each other. The public chain ecosystem has also begun to experience a boring two years and finally regained some vitality. .

● Key to activation:

After the macro black swan and thunder are completely exploded , the center of the new era has further moved to the fields of AI, blockchain and informatization, and the desire to explore reservoirs and funds has further increased. Various new defi gameplay methods such as LSD, Restaking, and Rollup have further penetrated into major ecosystems and created a new rainbow (value + bubble).

● Expected valuation:

Future MC FDV:

AVAX: 150B

SOL: 300B

ALGO: 60B-150B (300B----if the team is optimized and designated by US policy)

NEAR: 50B-100B

MATIC: 80B-100B (250B---- If designated by Indian policy)

7. Tiger Securities (Tiger)

● Basic introduction:

A very young brokerage with a good trading experience, very good data supply and chart UI, and sufficient data and financial reports.

● Core logic:

The valuation is low, the virtual license is approved, Next, if you support the deposit of compliant tokens such as USDC, it may significantly increase the transaction volume and its own financial income

● Startup key:

1. Further relaxation of domestic policies and support for compliance KYC

2. Overall recovery of the financial market and water storage

● Expected valuation:

Current FDV, 0.58 B, Expected FDV: 10-20 B

8. style="text-align: left;">● Basic introduction:

The air sensor project that is pro-environmental to monitor air quality, by setting different sensors Green projects that use nodes to transmit air quality data in real time to obtain token rewards

● Core logic:

1. The early valuations were high and the circulation rate was low. With the advent of the bear market and the gradual impact of inflation, prices have fallen sharply. This is a problem that all projects with low early circulation rates are prone to experience.

● Key to activation:

Further attention to environmental infrastructure on a global scale , the focus of discussion on Eco projects entering the blockchain field

● Expected valuation:

Current MC FDV : 2M , Expected FDV: 20M-200M

9. ContextLogic (Wish)

● Basic introduction:

Wish is an American e-commerce company The platform was founded in 2010 by former Google employee Piotr Szulczewski and former Yahoo employee Danny Zhang. Wish’s parent company is ContextLogic Inc., headquartered in San Francisco, USA. The platform mainly sells cheap household items, clothing, jewelry, electronic products, toys, etc.

● Core logic:

In 2020, the expectations were overestimated by consortiums such as Goldman Sachs, resulting in a flat push and falling to the edge of delisting risk. Prices are near lower, and recent market movements and activities have begun to recover, promoting more.

● Key to startup:

1. Further reliance on group buying , especially the expectations of people with downgraded consumption for cheap group purchases

2. If a new large organization enters the acquisition process

3. Financial report and business recovery

● Expected valuation:

Current MC FDV: 0.1B, Expected MC FDV: 2B-10B

10. Waves Enterprises (West)

● Basic introduction:

Waves Enterprise is an enterprise-grade blockchain platform for building fault-tolerant digital infrastructure. As a hybrid solution, Waves Enterprise Mainnet brings together enterprises, service providers and decentralized applications in a trustless environment, leveraging the benefits of public permissioned blockchains to cover a wide range of business use cases. Sidechains are used to build private infrastructure or hybrid infrastructure to store metadata on the mainnet. The platform is powered by Waves Enterprise System Token ($WEST) the native utility token for all network operations

● Core logic:

Enterprise-level public and private chain hybrid blockchain protocols may be more easily accepted by traditional enterprises

● Startup key:

1. Russia’s further support for blockchain technology, Russia’s traditional oligarchs and The consortium responded to relevant policies

2. The further participation of traditional enterprises became more popular.

● Expected valuation:

Current MC FDV: 2- 5M fluctuation, Expected MC FDV: 2B-5B (20-50B ---if designated by Russia)

Summary:

This article analyzes the long-term potential value of some projects. Some have survived the waves, and some have excellent fundamentals and concepts, but The market operation ability is not good, and Bole is needed. Therefore, it has potential, but it does not mean that it will definitely meet expectations, and it may also suffer unexpected blows.

The entire world economy has not yet emerged from the quagmire. It can even be said that it is just like the half-broken ice. The prosperity on the surface cannot cover up the core inside. The vulnerability has not yet been resolved. Some abscesses and tumors have not yet been treated, so at this time, even if the future is very bright for AI and blockchain, as an individual or an organization, it is best to improve some of your own principles.

For emerging public chains such as SEI, TIA and L2, as well as projects with diverse gameplay such as Restaking, LSD, such as Altlayer, manta, dymension , edenlayer, zeta, etc. Since the lock-up time of this round of private equity capital has generally lengthened, early valuations are actually more difficult to estimate. It will test the responsible attitude and habits of the project party itself, because most of the tokens are still in the hands of the project party. If the foundation keeps selling in the early stage, the new project may also be in a 2-year situation. However, it is also possible that the direct valuation of TIA will become the 1982 Lafite, and it will be difficult to estimate quickly in the future.

As for the development of the blockchain industry, I personally think it will be relatively bright in the next few years, but I still have to repeat the warning at the beginning of the article. : The long-term expected valuation does not mean that all the way up from the current price, it may experience violent and large-scale fluctuations in the short term. For example, at a sudden moment, BTC returns to 1K US dollars within 3 days, and then Returning to the 4W situation, although the probability is extremely low, if you can maintain a healthy position in this situation, then there will be no problem.

Be sure not to use high leverage to play long-term relationships. Try to touch as little or no contracts as possible, unless you are doing it for fun and you have enough self-discipline. DYOR is the most important way to maintain long-term investment health.

Statement: This article is not investment advice or financial advice. It is only the author's feelings and opinions. I hope we can learn and make progress together

JinseFinance

JinseFinance

JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Clement

Clement Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist