Author: Bing Ventures Source: X, @BingVentures

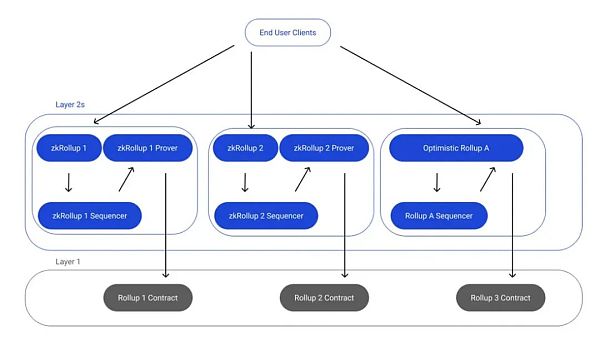

In the blockchain technology and market prospects in 2024, we stand at a crossroads of diversified innovations and numerous challenges. With the innovation of Rollup technology, the breakthrough of ZK-EVM, the rise of decentralized sorters, and the deep maturity of the DeFi ecosystem, the entire industry seems to be entering a new stage of development.

The game between security and decentralization, the delicate balance between user experience and cost-effectiveness, and the infinite possibilities brought by technology integration, these are all Key topics we need to delve into in the coming years.

In 2024, we will witness the arrival of a cryptocurrency "super cycle", not only because of the cyclical effect of economic factors, but also based on the traditional financial world and The integration of decentralized finance will push the crypto market into an unprecedented growth stage, in which "Value Network Effect" (VNE) will become a new standard for measuring the influence of crypto assets.

1. Rollup innovation, ZK-EVM breakthrough and the rise of decentralized sorters

< p style="text-align:center">

Innovative integration of Rollup technology

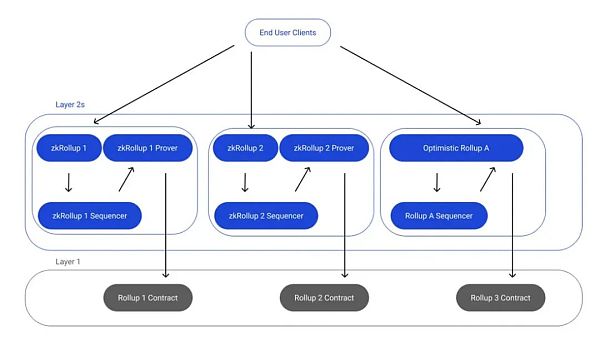

The balance between security and decentralization : Between optimistic rollup and zero-knowledge rollup, we have witnessed a core contradiction - how to maintain the decentralized nature of the network while ensuring data integrity and security. This is not only a technical challenge, but also a philosophical thinking, It also triggered an in-depth discussion of the "Security-Decentralization Equilibrium Theorem".

User experience and Cost-effective optimization: Optimistic Rollup sacrifices transaction speed in exchange for cost-effectiveness, while zero-knowledge Rollup struggles to solve high-cost problems. This prompts us to think about how to balance the two through the "Dynamic Optimization Algorithm", In order to achieve the optimal state of user experience and cost-effectiveness.

Exploration of hybrid Rollup: combining the advantages of optimistic Rollup and zero-knowledge Rollup The combined hybrid Rollup marks the unremitting pursuit of a perfect decentralized network architecture. This attempt not only opens up a new path to achieve higher security and user experience, but also promotes the "Hybrid Decentralization Framework" ) practical development.

MEV’s double-edged sword effect

The expansion of the MEV ecosystem and network censorship: With the rapid development of the MEV ecosystem, network censorship issues have become increasingly prominent, especially among large staking service providers. and among MEV participants. This phenomenon has triggered the exploration of the "MEV Governance Mechanism", aiming to find strategies to balance ecological health and economic incentives.

The battle between decentralization and MEV: The rise of MEV poses a challenge to the principle of decentralization, prompting us to rethink "decentralization" The concept of "Decentralization Value Maximization (DVM)" and how to effectively utilize MEV while maintaining network decentralization.

Breakthrough and integration of cutting-edge technologies

Advanced implementation of ZK-EVM: ZK-EVM optimizes "zero-knowledge computing" by achieving compatibility with Ethereum EVM and improving verification efficiency. ” (Zero-KnowledgeComputation Optimization) breaks new ground and heralds the possibility of improving network efficiency while ensuring privacy.

Innovation of ePBS protocol: As an extension of PBS, ePBS provides the ultimate solution for the Ethereum network by introducing a more flexible market structure. Centralization provides new paths for strengthening. This innovation is not only a technological breakthrough, but also a practical verification of the "Protocol-Level Decentralization Strategy".

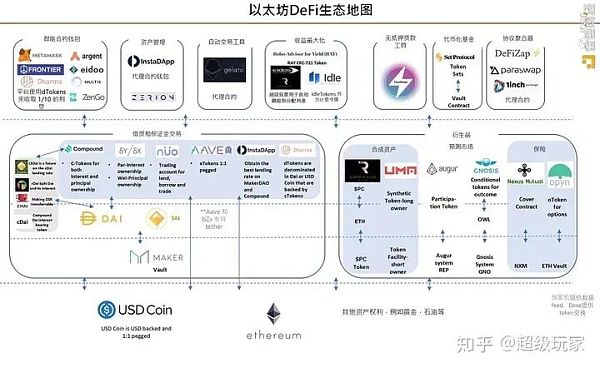

2. Deep maturity of the DeFi ecosystem: Capital efficiency and innovation dance together

Source:

https://defillama.com/lsd

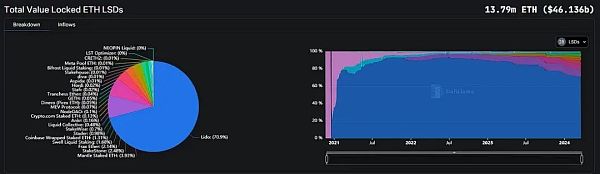

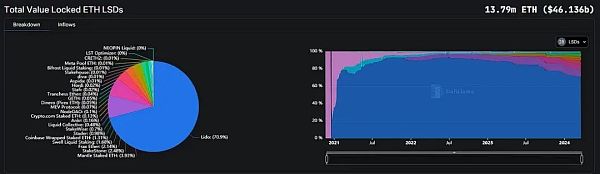

The universe expansion and intelligent evolution of the LSDFi market

With the arrival of 2024, the LSDFi market We are standing at the crossroads of growth and innovation, preparing for a cosmic expansion driven by technological progress and the influx of capital. In the process of this expansion, pledged assets like Lido’s stETH will not only be the darling of the market, but also become a key factor in defining a new era, heralding the blueprint for the continuous evolution of the LSDFi ecosystem. As for the centralized trading platform, its intervention has set off a storm in the arena that redefines the rules.

The LSDFi market in 2024 is expected to become an alchemical furnace where competition and warehouse innovation coexist, with all participants competing for users by providing revenue mechanisms beyond the conventional The attention and favor of capital have given rise to a dynamic and highly competitive ecosystem. Giants such as Lido, Coinbase, and Rocket Poo1 will use their market advantages to build walls for themselves, while emerging forces such as Puffer Finance are looking for innovative breakthroughs to ignite market diversity.

In terms of technological innovation, the LSDFi market in 2024 will witness the widespread application of cutting-edge technologies such as AVS, bringing unprecedented security and efficiency to the entire ecosystem. leap. Especially the launch of the EigenLaver protocol, which not only improves the capital efficiency of the market through an innovative heavy pledge mechanism, but also injects new vitality into the entire LSDFi ecosystem.

Source:

https://zhuanlan.zhihu.com/p/152197695

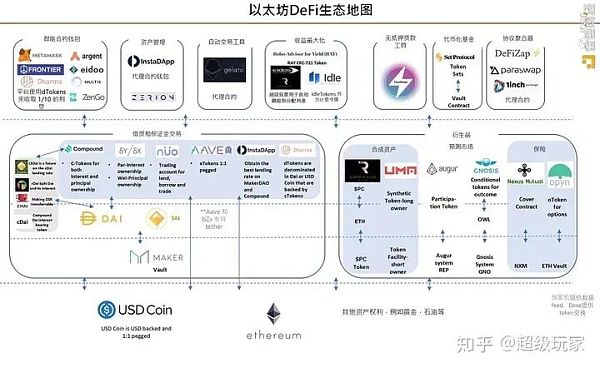

Competitive Alchemy: From Interest Collision to Symbiotic Fusion

In 2024, the evolution of the DeFi ecosystem is showing its depth With maturity, it heralds a synchronized dance of capital efficiency revolution and innovation, which not only shapes new ways of growing wealth, but also reshapes the fundamentals of our interaction with wealth. In this evolution, the emergence and development of DeSvn Protocol has become a leading innovation demonstration, which brings new benefits to the DeFi ecosystem by combining the core values of DeFi - openness, transparency and decentralization - with efficient capital utilization. Injected new vitality.

First of all, the "StakingDerivatives Innovation Model (SDIM)" marks the beginning of the maturity of the DeFi ecosystem. Through SDIM, capital efficiency has been significantly improved, promoting the development of emerging DeFi applications, and bringing unprecedented financial freedom and flexibility to users. This is not only the art of balancing liquidity and income, but a new paradigm that comprehensively improves the experience of DeFi participants. Under this model, through protocols such as DeSvn, users can enjoy high yields, principal security, and investment convenience, while enjoying unique income bonuses from multiple project parties.

Further, "cross-chain liquidity solution" and "physical-digital asset fusion model" (Physical-DigitalAsset FusionModel, PDAFM) will redefine the DeFi market Future sentences. This integration not only increases market liquidity, but also provides a solid foundation for market stability. Under this framework, protocols such as DeSvn Protocol have become "Pioneers of DeFi Super-Applications (PDFSA)", promoting the expansion of the DeFi market into a wider range of financial services through technological innovation and user experience optimization.

As the Ethereum ecosystem continues to mature, 'Liquidity Weaving' and 'DeFiLattice' are expected to become the new Hot concept. Liquidity weaving realizes the seamless connection of liquidity in different assets and platforms through smart contracts and Laver 2 technology, building a powerful liquidity network. The decentralized financial lattice is a more macro concept, which symbolizes In a decentralized world, various financial services and products can be freely combined and reorganized through various on-chain protocols like atoms in a crystal lattice, forming a diverse and highly customizable financial services ecosystem.< /p>

As a DeFi infrastructure project, DeSyn not only provides a platform and framework, but also shows how to organize DeFi organically through its "team battle" concept. Each part of the ecosystem works hard to achieve common goals, thereby obtaining corresponding benefits. This model not only promotes the healthy development of the DeFi ecosystem, but also provides a common platform for participants such as investors, fund managers, project parties, and security agencies. A winning ecosystem. In such an ecosystem, every participant can enjoy the huge benefits brought by efficient capital utilization while ensuring the safety of capital.

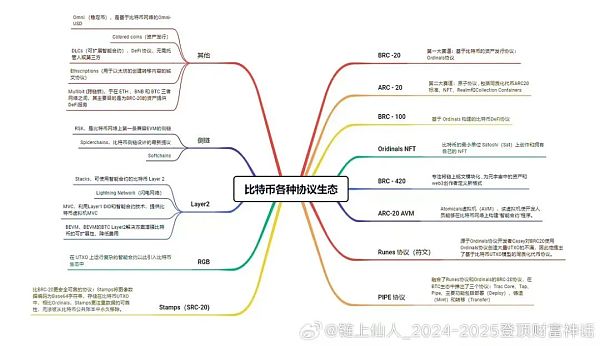

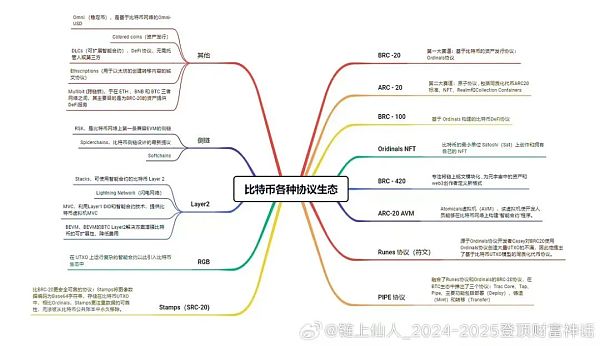

3. The double-edged sword of Bitcoin technological innovation: the choice between innovation and adaptability

Source:

https://www.techflowpost.com/article/detai_15939.html

Exploring Bitcoin When looking at the future context of ecology, we face a two-way challenge. On the one hand, it is the driving force of technological innovation, and on the other hand, it is the balancing force of the adaptability of the existing system. In 2024, this challenge will be significantly reflected in the technological evolution of the Bitcoin network, such as the introduction of emerging protocols such as Ordinals, BRC-20, Atomics, and Runes. They indicate that Bitcoin will no longer simply serve as a store of value, but will A multi-dimensional space expanding into the NFT and DeFi fields.

Co-evolution of technological innovation and ecological adaptation

With With the deep integration of Bitcoin in the global financial system, its value expression is no longer limited to traditional economic indicators, but has begun to be significantly affected by macroeconomic variables, leading to increased market volatility. This change is not only a reconsideration of Bitcoin's positioning as "digital gold", but also a deepening of the confirmation of its status as an independent asset class.

Global Regulatory Environment: Navigating Bitcoin’s Future Course

The dual impact of the global regulatory environment on Bitcoin is obvious. On the one hand, it sets boundaries for Bitcoin’s innovation and application. On the other hand, it also provides a framework for the legalization and widespread acceptance of Bitcoin. In this context, the "Adaptive Regulatory Framework" (ARF) has become the key to understanding how Bitcoin finds its position in global regulatory policies, indicating a future path that can balance regulation and innovation.

4. The unique positioning of Cosmos: the future of decentralized networks

Image source:

https://www.gemini.com/cryptopedia/cosmos-crypto-network-internet-of-blockchains

Cosmos, in the field of blockchain, is reshaping the future of decentralized networks with its innovative architecture and unique perspective. Through its unique Hub-and-Zone model, Cosmos It not only achieves a technological breakthrough in cross-chain interoperability, but also gives developers unprecedented freedom through modular design, allowing them to create and deploy highly customized blockchain applications based on specific needs. This design concept not only It has injected vitality into the innovation of the DeFi ecosystem and outlined a clear development blueprint for Cosmos.

In the continued evolution of the DeFi market, Cosmos has demonstrated Its multifaceted potential, especially through the liquidity staking of ATOM assets, has attracted the attention of users and capital. It is expected that Cosmos can further enhance its DeFi ecosystem in the fields of lending and DEX, increase the usage of cross-chain assets, and broaden the scope of external assets Access.

In terms of future prospects, the diversified applications (dApps) and ecosystem of the Cosmos ecosystem will attract developers and users and increase network activity. The key. Despite facing challenges from competitors such as Solana and Aptos, Cosmos's leading edge in the IBC system has contributed to the practicality of its network. Looking forward to 2024, Cosmos will continue to maintain its ecological diversity and activity, especially In the fields of DeFi, Web3, NFT and games, it is expected that the in-depth development of cross-chain technology will open up new growth space for Cosmos. At the same time, with the increase in IBC dual-network transaction volume and the steady increase in ATOM prices, Cosmos's market valuation is expected to increase significantly.

5. Crypto Wallet Pattern: A New Chapter of Cross-border Revolution and Security

Image source:

https://btc-alpha.com/zh/stories/zh-what-are-the-cryptocurrency-wallets< /p>

Image source:

https://learnblockchain.cn/article/5575

When exploring the evolution trajectory of crypto wallets in 2024, we ushered in a revolution driven by both security and user experience, which revealed the prelude to a new chapter of cross-border innovation and security mechanisms. With the in-depth expansion of the blockchain ecosystem and the increasing awareness of privacy and asset protection, the innovation direction of crypto wallets is moving towards "Smart Contract Driven Security Architecture" (SCDSA) and "Intuitive Interactive User Interface" (IIUI ) evolution. During this process, multi-signature, biometric verification and hardware wallet technologies are developed in parallel, aiming to improve security protection capabilities, while optimizing the user's operating experience, achieving a high degree of unity of security and convenience.

In response to the need to attract and retain emerging users, the design concept of crypto wallets has gradually shifted to "decentralized financial integrated experience" (DeFi-UX), including DeFi core functions such as staking, lending and liquidity mining, as well as deep integration of the expanding NFT market. The construction of this integrated experience not only promotes the widespread adoption of Web3 applications, but also indicates that the traditional positioning of crypto wallets as asset management tools is changing to the role of "Decentralized Identity and Social Interaction Platform" (DIASP).

In this context, the rise of "Account Abstraction" (AA) technology is particularly important. AA technology has brought functional leaps to smart contract wallets, including but not limited to batch transaction processing, gas fee payment and private key recovery, etc., demonstrating the results of the integration of technological innovation and market demand. In addition, as the multi-chain ecosystem continues to grow, cross-chain operations and multi-chain compatibility have become key challenges and turning points in the development of crypto wallets. Crypto wallets in 2024 will not only need to break through this challenge at the technical level, but also achieve revolutionary progress in user experience to ensure the convenience and efficiency of transactions.

To sum up, the future development of crypto wallets in 2024 will be a multi-dimensional evolutionary story centered around smart contract security architecture and intuitive interactive interfaces, among which DeFi- UX and DIASP have become new development directions, while breakthroughs in account abstraction technology and cross-chain compatibility mark major innovations in crypto wallet functions and experience. In this process, the in-depth application of decentralized technology and detailed insights into user needs have jointly promoted a new stage of higher security and better experience for encrypted wallets.

From innovations in Rollup technology to the complex dynamics of the LSDF market to the technological evolution of major crypto assets such as Bitcoin and Cosmos, every step is about the future Exploration and challenging the limits of reality. We insist on continuing to be optimistic about these directions during the bull-short-bear-long cycle. While the future is uncertain, by understanding current technology trends we can be better prepared for the changes to come. After all, in the rapidly developing blockchain industry, today’s cutting-edge may be tomorrow’s norm.

Edmund

Edmund