Author: Newman Capital

Source: mirror.xyz

introduction

Welcome to the first article in the Back to Basics series. In this bear market, we’ll take a deep dive into some of the blue chip protocols and their native tokens that we believe have shown value and why they have the potential to outperform the market in the long run. The first article in the series focuses on Uniswap.

About Uniswap

Uniswap is a decentralized exchange protocol known for facilitating automated trading of decentralized finance (DeFi) tokens. The platform works with scaling solutions like Optimism, Arbitrum, and Polygon to create greater efficiencies by solving liquidity problems on the Ethereum network.

Uniswap is recognized as the pioneer of decentralized exchanges (DEX). Uniswap V2 adopts the constant product pricing curve of X*Y=K, and Uniswap V3 introduces its centralized liquidity and multiple fee levels.

Uniswap recent trading activity

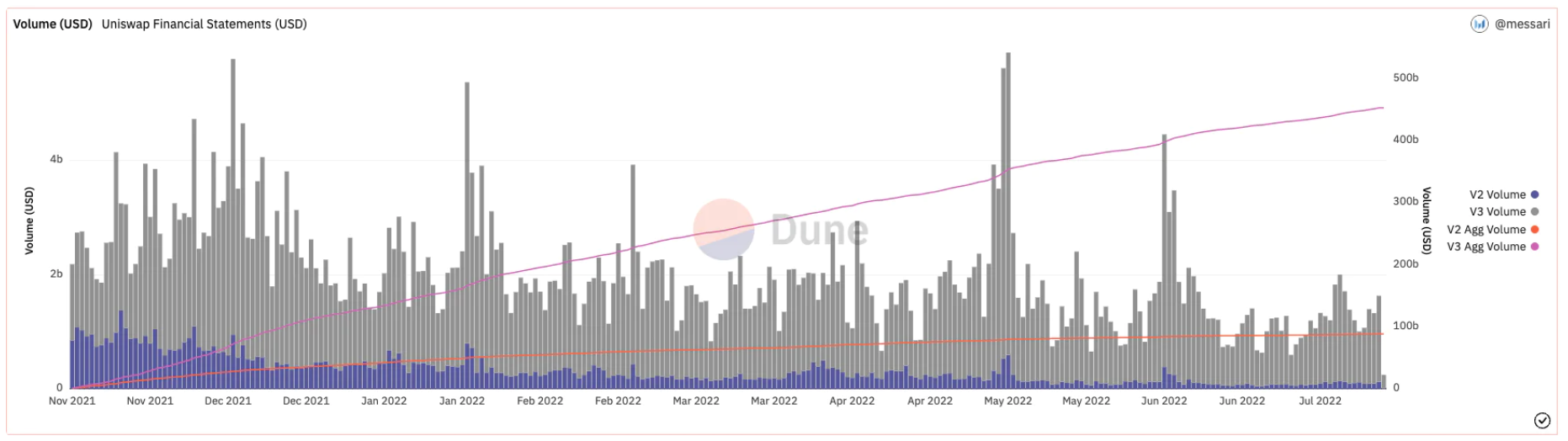

Compared to the previous quarter, the market capitalization of the crypto market fell by more than 50% this quarter. However, Uniswap’s transaction volume in Q2 2022 is only down 8.7% compared to Q1 2022 (see chart below). We believe that part of this relative success is due to market volatility, which is good for DEXs as they serve as the backbone of the crypto economy and are in high demand when prices are volatile. Arbitrage bot activity in the system may be another key aspect. Research shows that up to 75% of trading volume can come from bots when users leave the market.

Uniswap trading volume

token utility

Governance:

UNI holders are responsible for governing the protocol. One of their main responsibilities is to create and vote on proposals that have the potential to determine the future direction of Uniswap. Other obligations include managing treasury funds and identifying tokens that belong to the Uniswap default token list.

Provide liquidity:

Anyone with ERC-20 tokens (including UNI tokens) can contribute liquidity to the pool for token rewards. Users can provide UNI to provide liquidity for pools with large trading volume.

Uniswap DAO

At the time of writing, the Uniswap DAO has more than 342,900 voting members, making it the number one DAO in terms of $2.5 billion held in its treasury. It currently ranks second behind Polkadot in terms of total number of governance token holders.

DAO members have been actively proposing protocol developments. For example, in mid-July, Uniswap deployed to Celo after passing a governance proposal. The Uniswap Grants Program recently revealed its allocated funds, and Wave 8 is the program’s final and largest batch of grants to date.

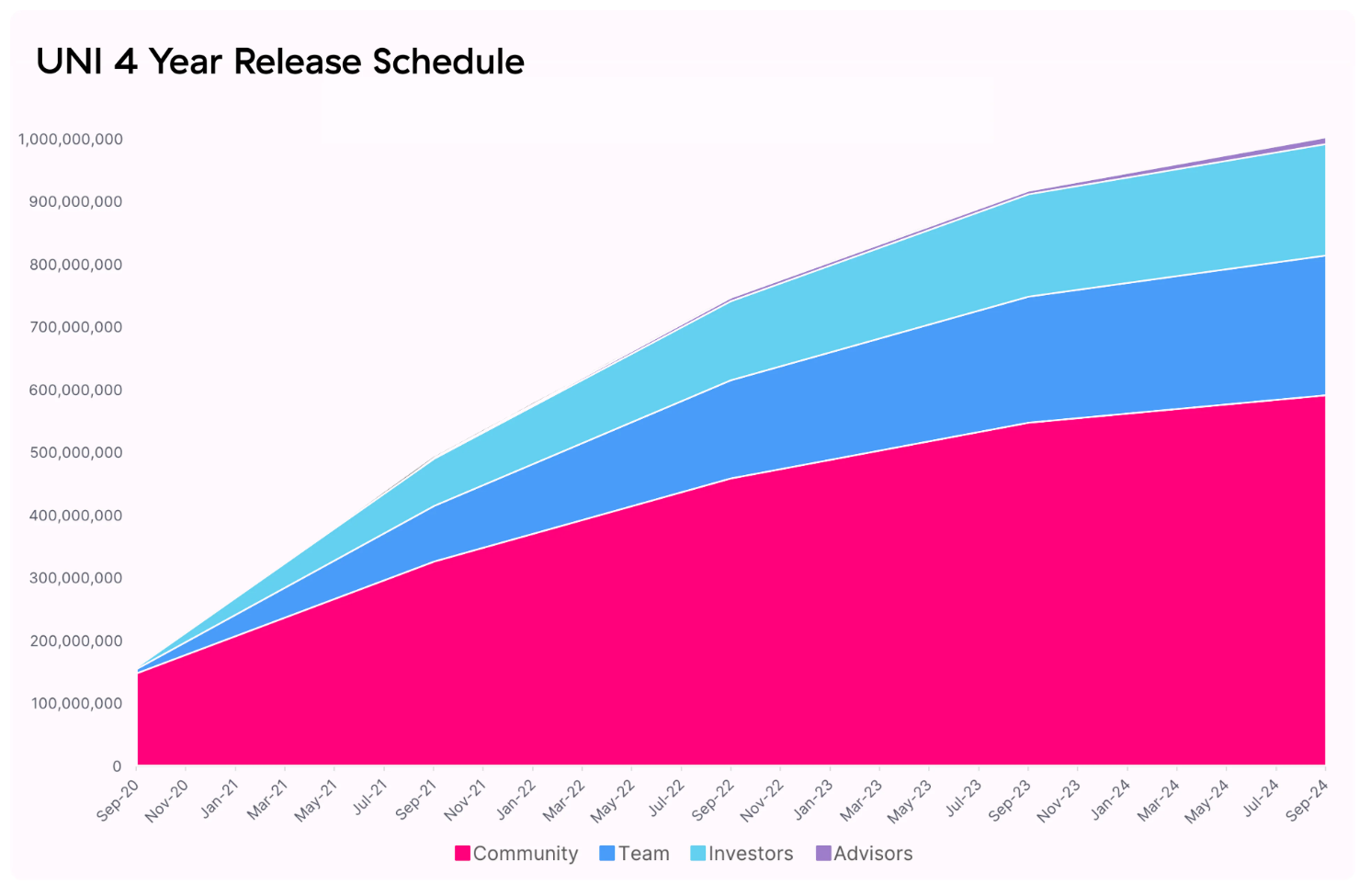

Token issuance schedule

UNI tokens are distributed over four years.

60% of UNI tokens (600,000,000 UNI) are owned by community members.

21.51% (212,660,000 UNI) will be given to team members and future employees over the next four years.

17.8% (180,440,000 UNI) will be given to investors in the next four years.

0.69% (6,900,000 UNI) will be awarded to advisors over the next four years.

UNI Token Issuance Schedule

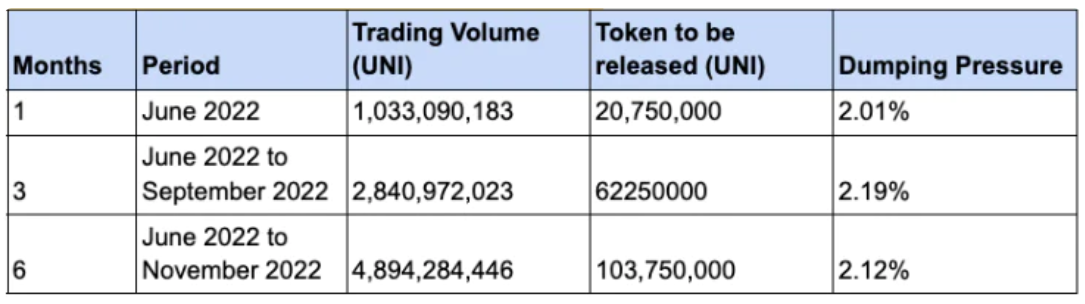

Selling Pressure Analysis

We examine UNI's potential to unlock selling pressure over 1-month, 3-month, and 6-month periods. These valuations are derived from calculating the number of tokens to be released based on UNI's past cumulative transaction volume over that time period.

Calculations suggest that token unlocking may have only a limited impact on price. The impact size can remain relatively consistent across different time frames, mainly because most UNI tokens are already in circulation. The 4-year allocation begins in September 2020 and is expected to end in September 2024. So by the end of July, 71% of UNI will enter the circulating supply.

recent development

Uniswap has had several key updates over the past quarter. For example, the protocol deployed a 1 basis point (0.01%) fee tier on Polygon to attract new users and facilitate protocol growth. In terms of investment, Uniswap launched Uniswap Lab Ventures to continue investing in Web3 projects and participating in Web3 governance. Uniswap is also integrated with Coinbase Dapp, which means that Coinbase users can directly access Uniswap through Coinbase Wallet.

On top of that, Uniswap recently acquired Genie, the first NFT marketplace aggregator. The strategic investment aims to expand Uniswap’s user base, expand into the NFT space, and improve user experience by merging multiple ERC-20 and ERC-721 platforms into one.

Source of income

Uniswap generates revenue in two ways: transaction fees and UNI tokens. Traders pay Uniswap a notional fee for each trade they complete. A variety of factors affect the amount of the fee, including the size, type, and number of pools in which the transaction occurs. Unlike other similar protocols, Uniswap has the option to include these fees as protocol revenue.

Uniswap is obliged to compensate LPs (liquidity providers) who provide liquidity to the pool. Most of the fees go back to liquidity providers, but Uniswap keeps a small portion of them in some trading pools. The UNI governance token is another revenue stream for Uniswap. The token allows UNI holders to vote on proposals such as fee structures and be able to trade on the DEX.

It is worth noting that Uniswap does not currently have any protocol income. However, this may change as a 10-25% protocol fee switch could be implemented in Uniswap V3 if governance allows it.

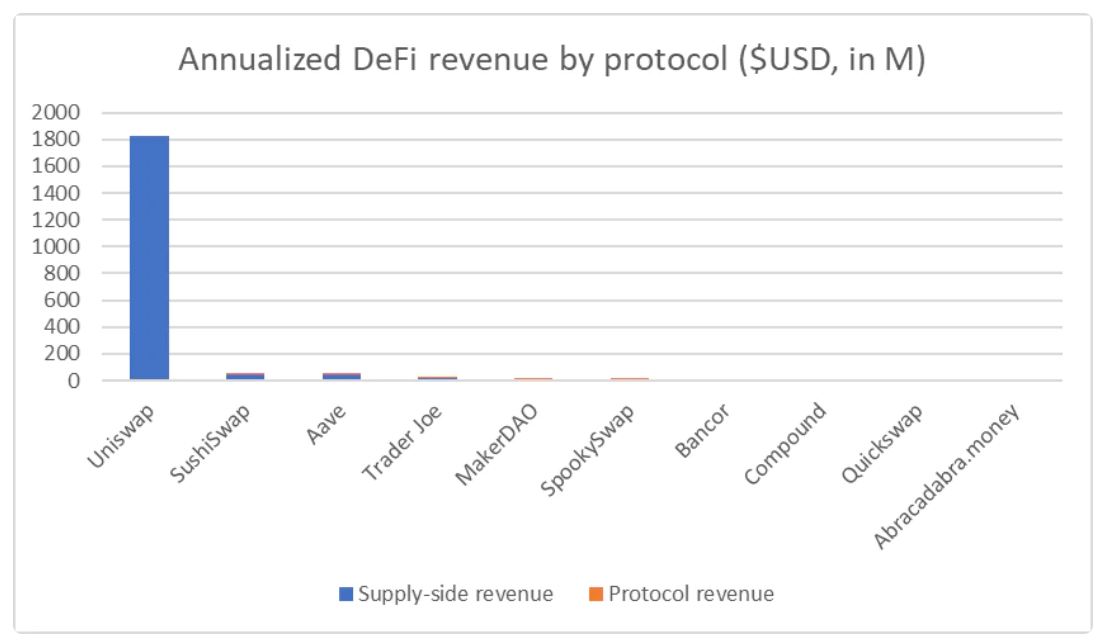

income analysis

Compared to other major DeFi protocols, Uniswap’s current annualized revenue is about $1.83 billion on a 30-day sample. In comparison, other major protocols such as SushiSwap and Aave have annualized revenues of only $55.91 million and $53.01 million, respectively.

Annualized DeFi income of each protocol (30 days)

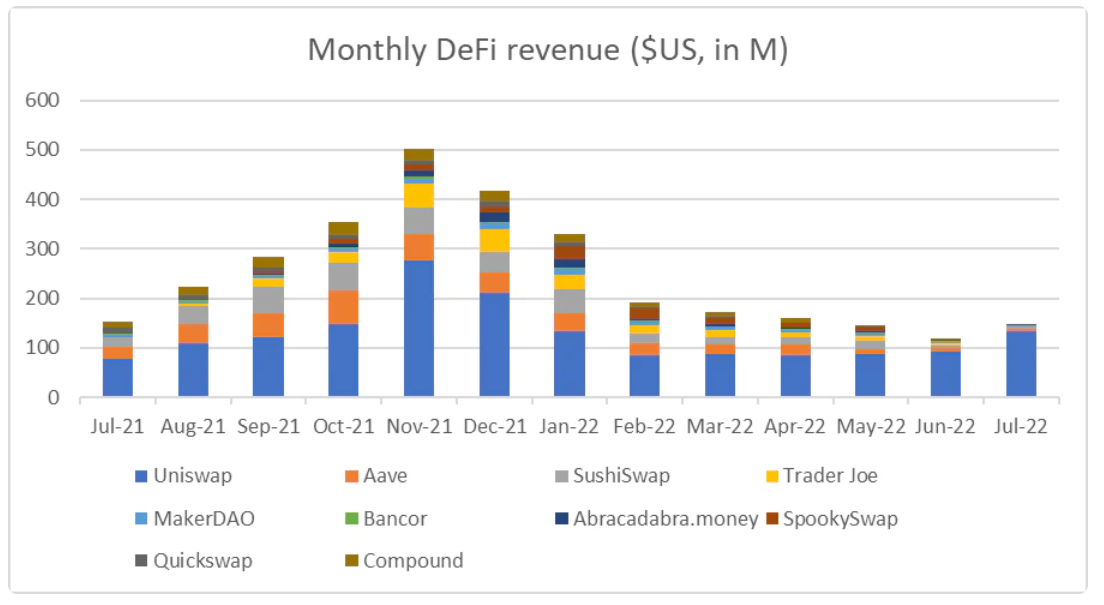

Uniswap’s revenue model also appears to be resilient to market volatility. Uniswap’s monthly revenue has remained relatively stable since the broader cryptocurrency market began this downcycle in February 2022, with a month-to-month decline of 11.33% between February and June 2022. However, its competitor SushiSwap saw a 19.38% quarter-on-quarter decline in revenue during the same period.

Monthly DeFi income

competition analysis

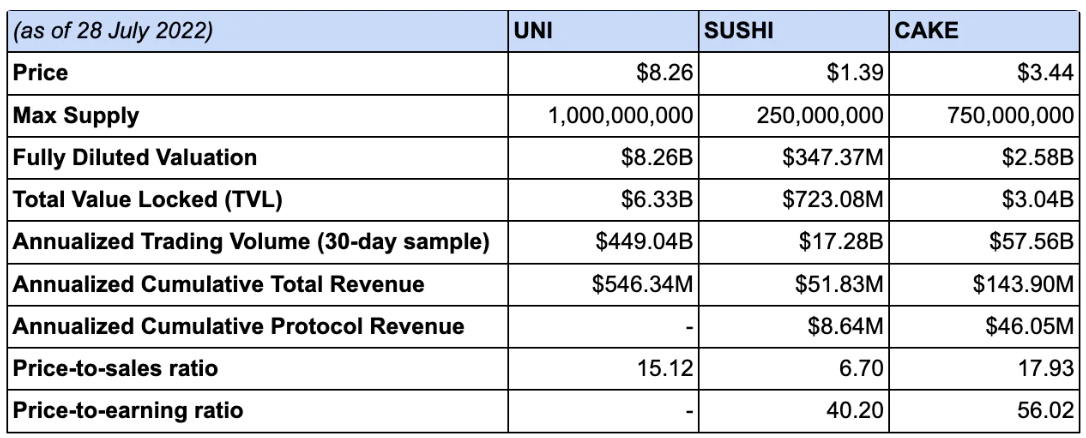

We compared some key market and valuation metrics of the leading DEXs in the market and found that Uniswap has consistently enjoyed a clear advantage over other top DEXes, including SushiSwap and PancakeSwap.

As of this writing, the fully diluted valuations of Uniswap and PancakeSwap are $8.26 billion and $2.58 billion, respectively, a valuation gap of 3.2 times. If we look at the transaction volume, Uniswap processed $449.04 billion in transactions, which is 7.8 times and 26.0 times higher than PancakeSwap and SushiSwap, respectively. According to the LP fees charged by each platform, the price-to-sales ratios (P/S) of Uniswap and SushiSwap are 15.12 and 6.7, respectively. This means that under the same LP fee, investors think that the value of Uniswap is 2.26 times higher than that of Sushiswap.

Since SushiSwap has been adopting an expansion approach and expanding its product line, the difference in PS rate may also mean that investors may think that SushiSwap has higher sustainability risks in the long run. In contrast, Uniswap's sustainability risk may be much smaller.

Source: TokenTerminal and DeFi Llama

price performance

Our price analysis yielded two key findings:

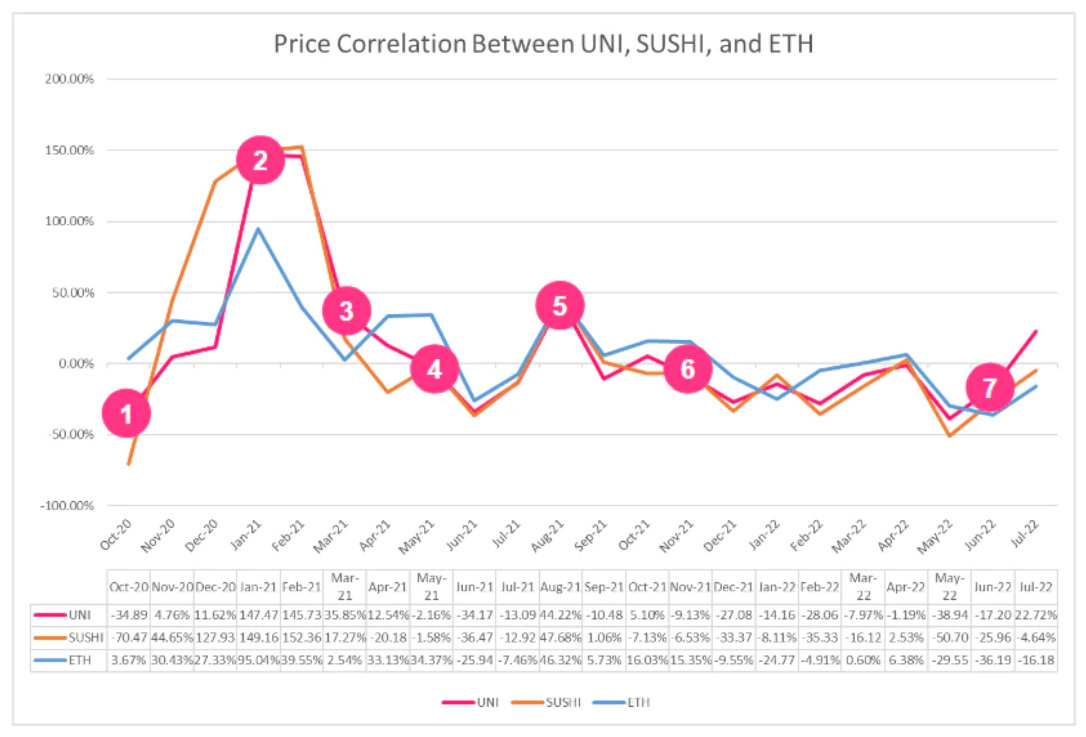

There is a strong correlation in price action between UNI and ETH

In addition to fluctuations in global markets, inflation and federal interest rates have the greatest impact on prices.

The chart below shows the price correlation between UNI, SUSHI, and ETH, along with some key events to watch:

Price correlation between UNI, SUSHI and ETH

This key indicator can be broken down into the following seven parts:

October 2020: UNI launched in September 2020.

January 2021: Uniswap airdrops 4% of total supply to users; SushiSwap announces merger with Yearn finance; ETH grows above $1,000, global markets hit record highs.

March 2021: UNI V3 mainnet is launched, and the price of UNI reaches a peak of $42.88; the price of SUSHI reaches a peak of $16.26, and the distribution of LP token rewards is disclosed; the price of ETH breaks through $4,000 for the first time.

May-July 2021: Wall Street predicts 5% year-over-year inflation, dragging down cryptocurrencies and global markets.

July-September 2021: Crypto markets rallied into early September, triggered by the implementation of the ETH London hard fork and better-than-expected inflation. In September 2021, UNI and SUSHI reached $31.05 and $15.18 respectively, and in November 2021 did not follow the rise of ETH. (Note: ETH reached a historical peak of $4815 in November 2021.)

November 2021: Since November 2021, the entire crypto market has been experiencing a downturn.

June 2022: Uniswap Labs announces the acquisition of Genie, the first market aggregator.

epilogue

Despite a sluggish macro environment and a looming bear market, Uniswap has continued to drive countless transactions, proving that UNI is a blue-chip asset for early adopters. Looking ahead, the jury is still out on whether blue-chip assets like UNI or other rising altcoins will lead the next bull run. Nonetheless, with the investment arm and NFT market aggregator on board, we believe Uniswap is well-positioned to establish itself as the foundation of the crypto economy.

Disclaimer: This information is for informational purposes only and is not intended to be used for any transaction or investment. Newman Capital is not an investment advisor and does not intend to provide you with investment, legal or tax advice. We always recommend that you do your own research before making any investment decisions.

Kikyo

Kikyo

Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Brian

Brian Brian

Brian Alex

Alex Brian

Brian Brian

Brian Kikyo

Kikyo