Changpeng Zhao (CZ) confirmed the recent report that Paxos — a regulated blockchain infrastructure platform based in the US — has been directed to cease minting BUSD per instructions from the New York Department of Financial Services (NYDFS).

“Paxos will continue to service the product, and manage redemptions,” CZ said, adding that “Paxos also assured us the funds are #SAFU, and fully covered by reserves in their banks, with their reserves audited many times by various audit firms already.”

“I have no information about it, other than public news articles. The lawsuit is between the US SEC & Paxos,” CZ added.

CZ did however reiterate his longstanding point that he does not believe BUSD should be subject to securities law, due to what is known as the Howey Test criteria. According to the US Supreme Court, an item can be a security if it meets the following four criteria:

- An investment of money

- In a common enterprise

- With the expectation of profit

- To be derived from the efforts of others

“If BUSD is ruled as a security, it will have profound impacts on how the crypto industry will develop (or not develop) in the jurisdictions where it is ruled as such,” CZ said.

The response comes less than 24 hours after The Wall Street Journal initially reported that the NYDFS instructed Paxos Trust Co. — the issuer of stablecoin Binance USD (BUSD) — to halt any further creation of BUSD.

“Binance will continue to support BUSD for the foreseeable future. We do foresee users migrating to other stablecoins over time. And we will make product adjustments accordingly. eg, move away from using BUSD as the main pair for trading, etc.”

“Given regulatory uncertainty in certain markets, we will be reviewing other projects in those jurisdictions to ensure our users are insulated from any undue harm,” CZ added.

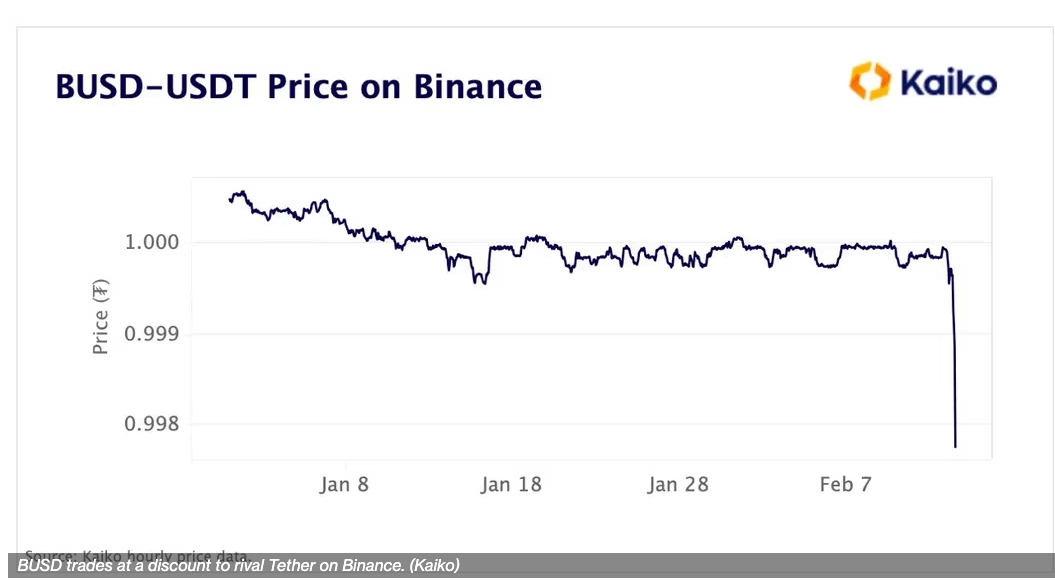

On Feb. 13, BUSD slipped to .9950 against its 1:1 peg of the US dollar in light of the Paxos news.

BUSD – USDT Price on Binance (Source: Kaiko)

Anais

Anais