Circle has minted hundreds of millions of dollars worth of US Dollar Coin (UDSC) as the second-largest stablecoin by market cap recovers from its recent depegging from the dollar.

USDC, a stablecoin designed to stay pegged to the value of one US dollar, fell in value to as low as $0.87 on March 11 following revelations that Circle had exposure to the collapsed Silicon Valley Bank (SVB).

The stablecoin has since regained its peg and is worth $0.998 at time of writing.

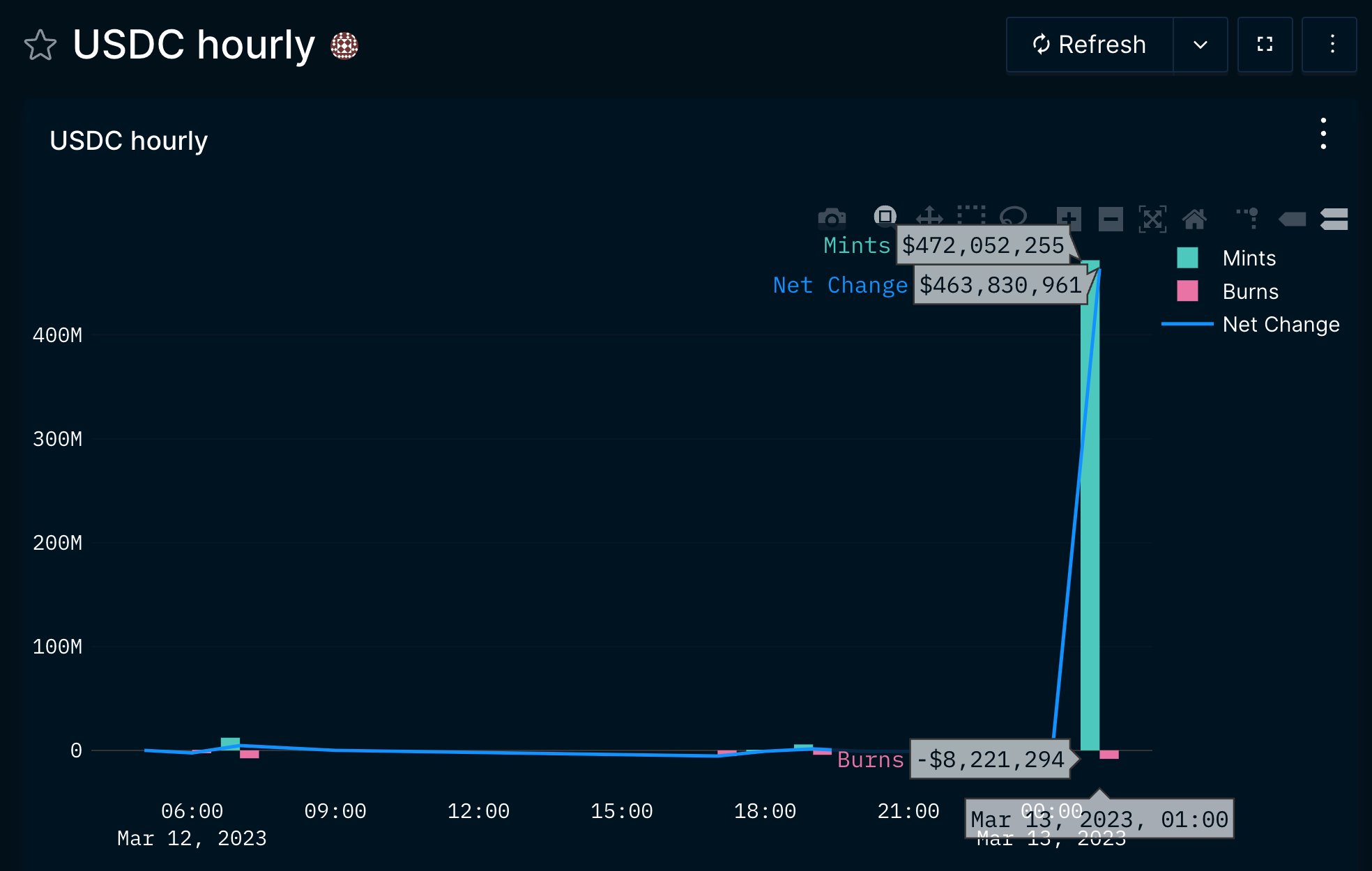

On March 12, blockchain analytics and research firm Nansen found that Circle minted $407,800,000 worth of USDC at once in an apparent sign of the company regaining investor confidence.

“Circle minted $407.8 million USDC about 10 minutes ago

This is the largest USDC minting in the last 7 days

Hourly net change: +$463.8 million.”

Source: Nansen/Twitter

Today, Nansen also spotted Circle burning $314,000,000 worth of USDC.

“Circle just burned $314 million $USDC 10 mins ago.”

Source: Nansen/Twitter

Circle joined a long list of companies in calling for the US government to step in and save SVB and ensure customers regain complete access to all of their funds. The Federal Reserve Board later announced in a press release that the Federal Deposit Insurance Corporation (FDIC) would be protecting the bank’s depositors, both insured and uninsured.

In a new company blog post, Circle CEO Jeremy Allaire commended the government’s actions.

“Trust, safety and 1:1 redeemability of all USDC in circulation is of paramount importance to Circle, even in the face of bank contagion affecting crypto markets. We are heartened to see the U.S. government and financial regulators take crucial steps to mitigate risks extending from the banking system. We’ve long advocated for full-reserve digital currency banking that insulates our base layer of internet money and payment systems from fractional reserve banking risk.”

Davin

Davin