By: Kyle Waters & Nate Maddrey

Source: Coin Metrics

This article will review the cryptocurrency market in the second quarter of 2022 through market data.

Crypto assets cannot escape the gravity of global financial markets

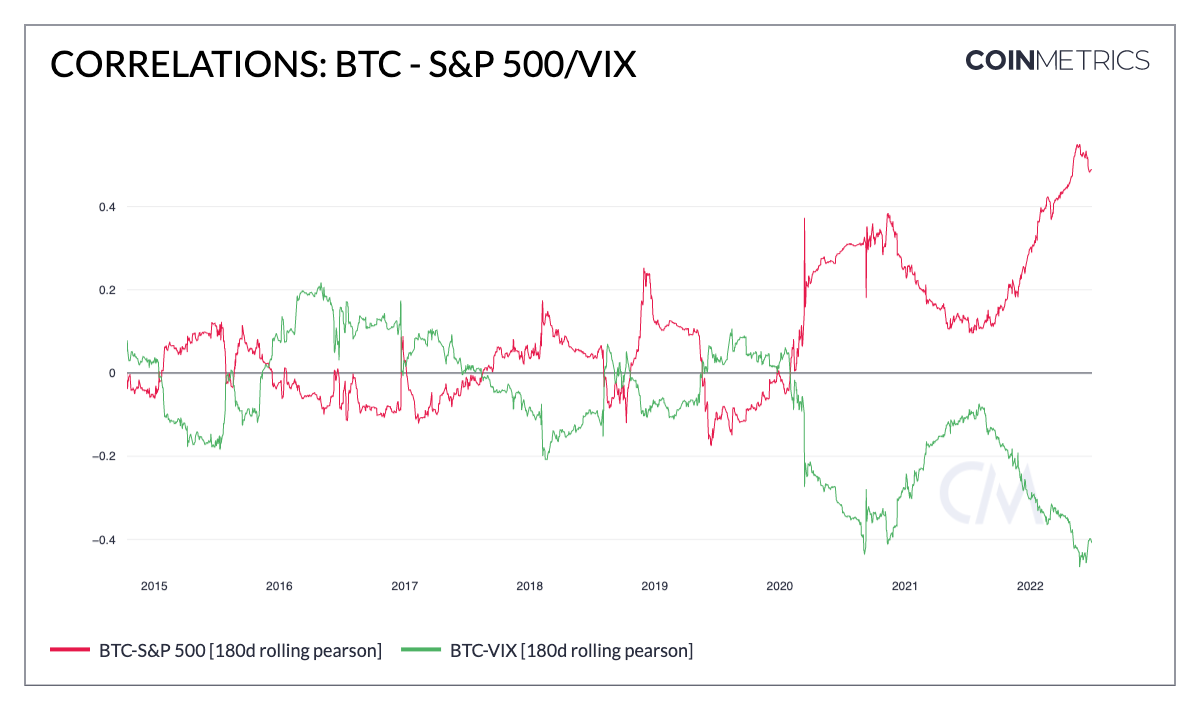

In 2022, data on crypto-asset returns shows that the asset class is increasingly tracking equities, and from the second half of 2021, the correlation between Bitcoin (BTC) and the S&P 500 is getting stronger.

Historically, Bitcoin and the S&P 500 have been very uncorrelated, and this uncorrelation is a desirable characteristic for building portfolios and Bitcoin's potential emergence as a safe asset. But after March 2020, that relationship changed dramatically. After a brief dip in 2021, BTC’s correlation with the U.S. large-cap index is rising throughout 2022. This correlation hit an all-time high in 2Q22, while BTC and the US stock market moved almost in tandem. At the same time, Bitcoin is moving increasingly against risk indices such as the VIX.

Source: Coin Metrics' Formula Builder

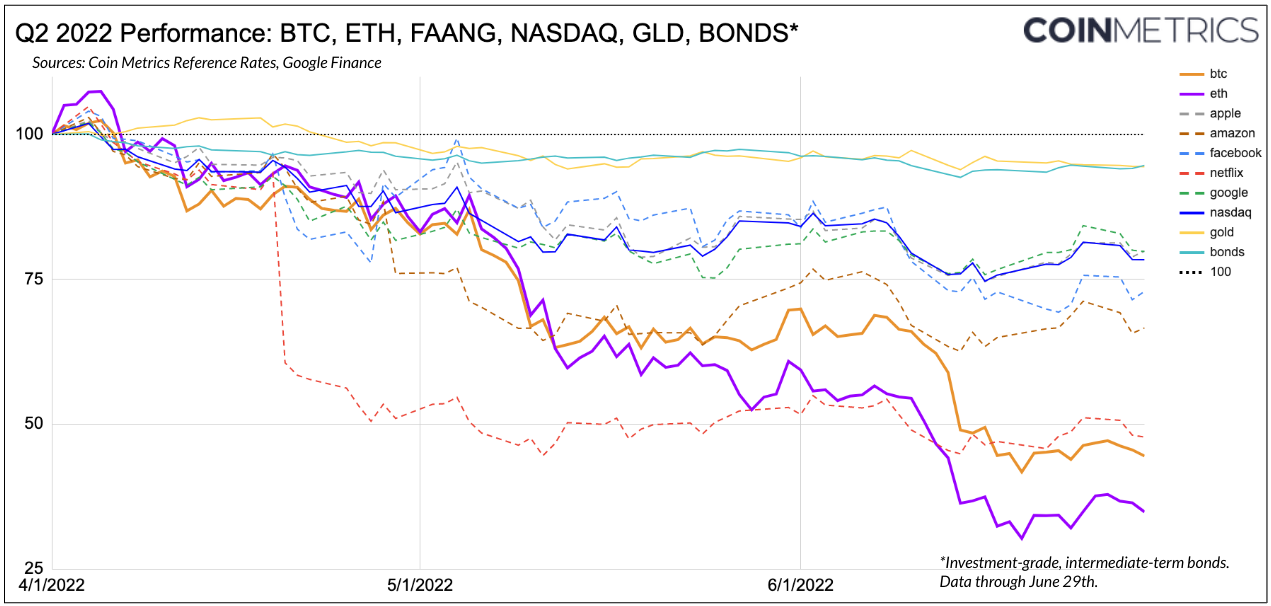

Nearly all asset classes slumped against a rapidly changing macro backdrop, with financial market participants reacting to monetary policymakers' fresh pledge to raise interest rates aimed at taming inflation. U.S. inflation hit an annualized rate of 8.6% in May - the largest year-on-year increase since December 1981 - and the Fed raised the federal funds rate by 0.75% in June.

BTC and ETH fell along with mainstream tech stocks as inflation uncertainty and higher interest rates loomed. Gold, and even bonds have been affected (bond prices are inversely related to interest rates).

Source: Coin Metrics Reference Rates & Google Finance

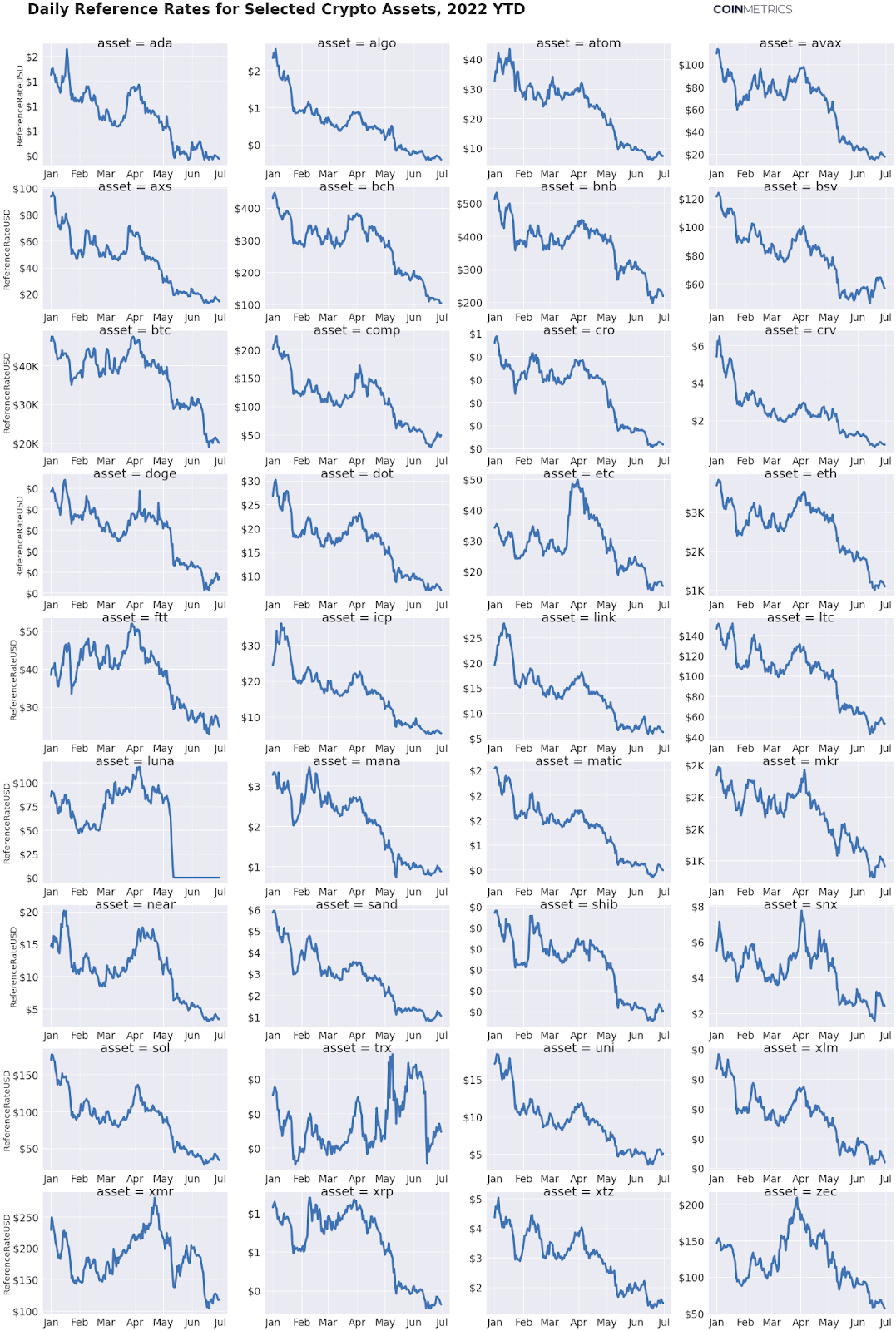

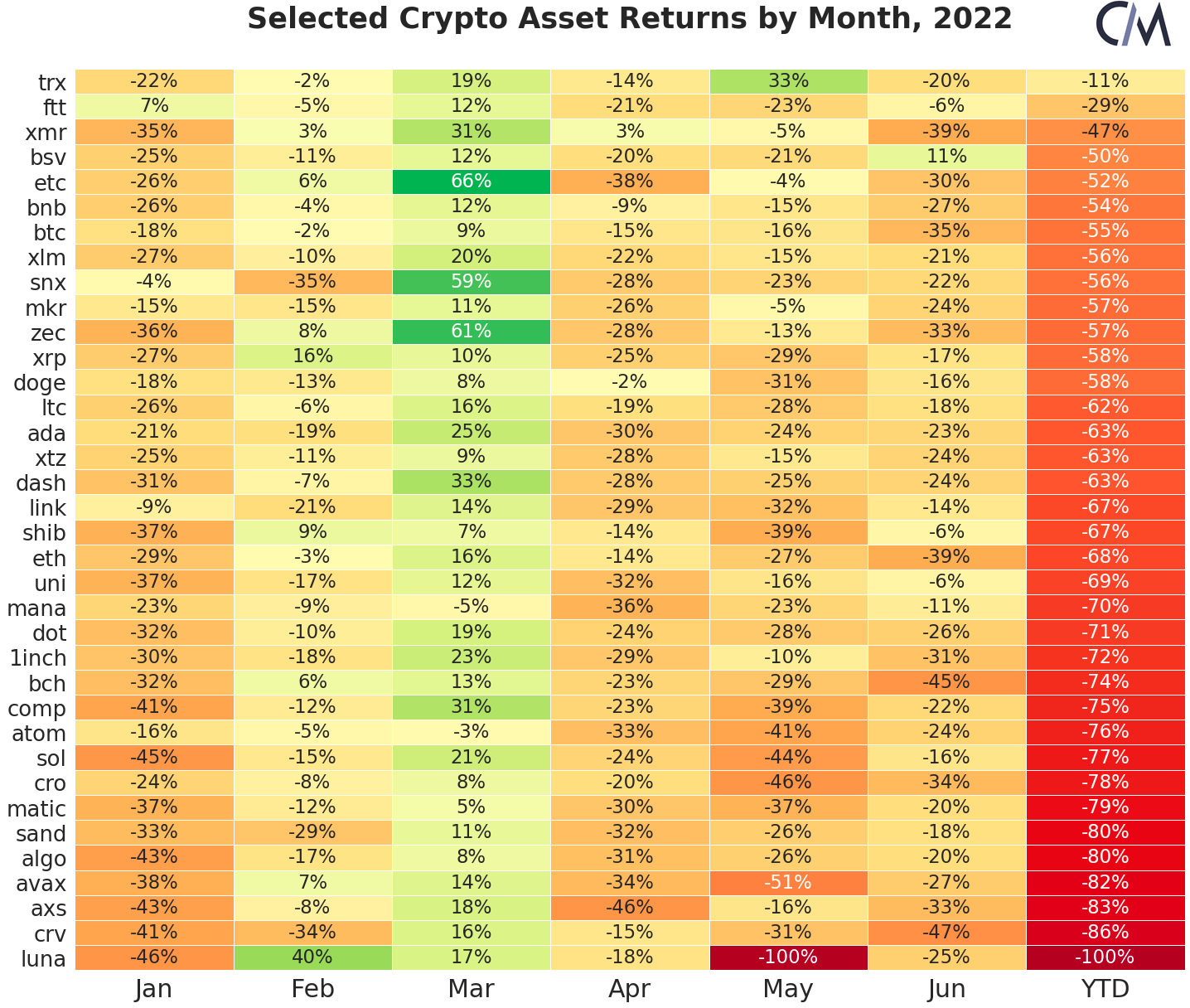

In the cryptocurrency market, all major assets were in decline throughout the quarter, with many of the top assets down by more than a quarter in June alone.

Source: Coin Metrics Reference Rates

(Note: LUNA did not strictly go to zero in May, but fell by more than 99.99%)

The cryptocurrency market will be tested across the board as volatility in financial markets intensifies sharply throughout the quarter.

Stablecoin Review

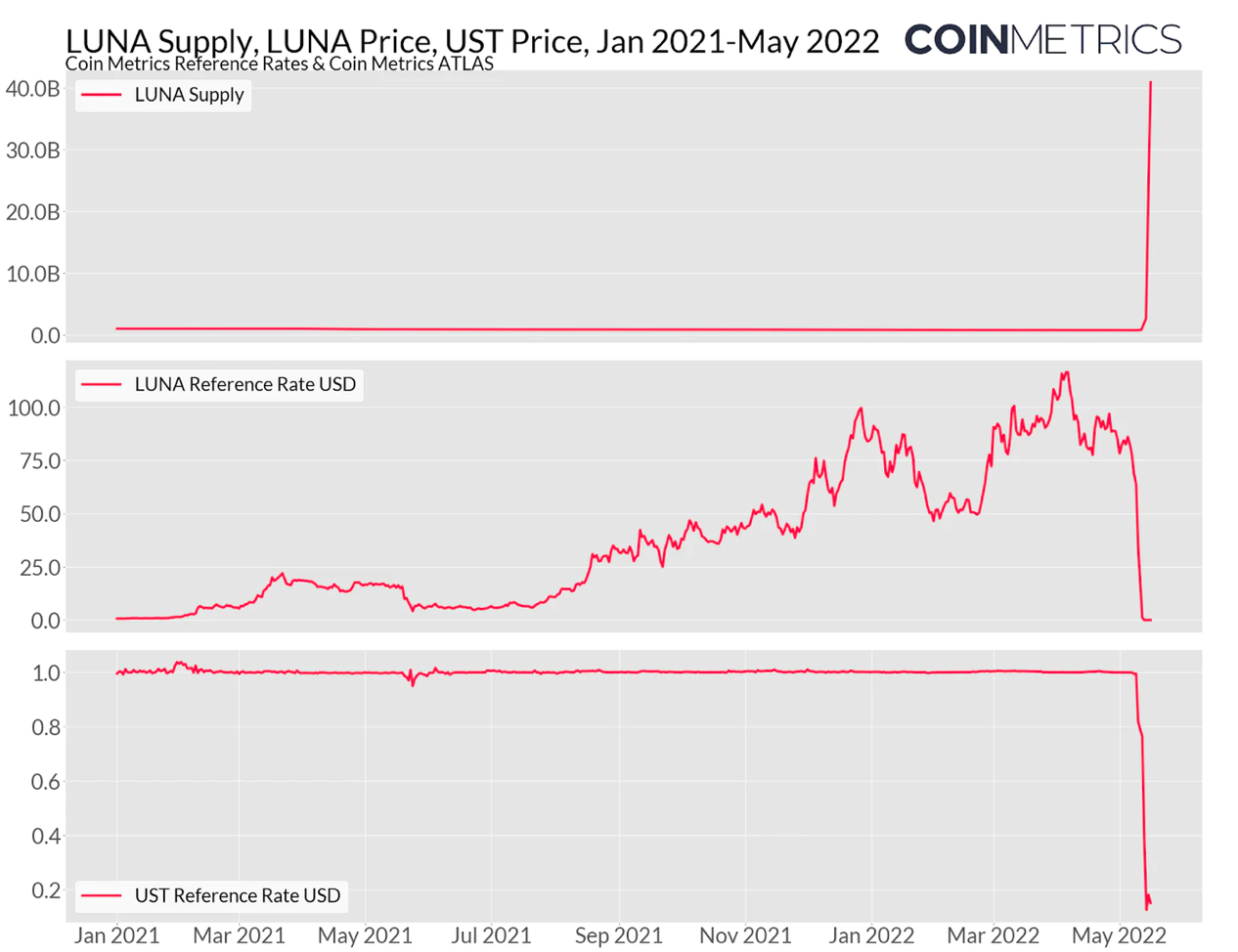

This year's severe turmoil in the cryptocurrency market began in early May when the "algorithmic stablecoin" TerraUSD (UST) began to fall below $1. By May, the supply of UST had ballooned to more than $18 billion. UST is heavily used in some decentralized finance (DeFi) applications, such as Anchor Protocol, which makes UST yield as high as 19.5%. The peg of UST is based on a redemption mechanism where $1 worth of UST can always be exchanged for $1 worth of LUNA, the native token of the Terra blockchain, which can be continuously minted to meet redemption needs.

This mechanism worked when the price of LUNA rose, but like many other failed attempts at currency pegs in the past, this flawed design collapsed as the price of UST and LUNA fell at the same time. As UST holders scramble to exit, the lower LUNA price means that more LUNA is needed to meet the $1 peg, making LUNA continue to be overissued, leading to a vicious circle of vicious inflation.

Source: Coin Metrics ATLAS

The sudden collapse of UST has sparked more scrutiny of the entire stablecoin space. Days after the worst of the UST/LUNA disaster, Tether (USDT) — currently the stablecoin with the largest total supply — faces its biggest deviation from $1 since March 2020, with USDT falling as low as $0.95 at one point , before bouncing back to $0.99.

But despite past price biases and various issues with Tether, USDT has a fundamentally different stabilization mechanism than TerraUSD. In short, Tether holds reserves of cash and cash equivalents, as well as some secured loans and corporate bonds. Tether currently announces the complete reserve category as of March 31, 2022 on its official website.

As the price of USDT fell below $1, arbitrageurs bought USDT at the market price and redeemed it in full at $1. Tether's ability to honor redemptions has been tested.

On May 12, Tether redeemed a total of $3.3 billion, the largest to date. From May 11th to May 14th, Tether processed a total of about $7.5 billion in redemptions, which means that the total supply has decreased from about 81 billion to 73 billion, a decrease of about 9% (Ethereum, Tron and Omni’s USDT; note that although USDT is also issued on other chains, the amount is much smaller).

The chart below shows the daily change in USDT free float supply and total free float supply. The free-floating supply of Coin Metrics removes USDT held in Tether treasury addresses before the final burn.

Source: Coin Metrics' Formula Builder

Since May 11, Tether’s supply has been reduced from 81 billion to 64 billion, and the redemption system appears to be working as planned.

But with increased transparency and security, the total supply of other stablecoins has seen a net increase. Since May 11, the total supply of USD Coin (USDC) on Ethereum has grown from $42 billion to $46 billion.

Source: Coin Metrics' Formula Builder

Circle, the issuer of USDC, previously promised to become a national bank in the United States, regulated by the Federal Reserve, the U.S. Department of the Treasury, the U.S. Office of the General Comptroller of the Currency (OCC) and the U.S. Federal Deposit Insurance Corporation (FDIC). Additionally, USDC is fully backed by cash and cash equivalents and publishes monthly certification reports, making it highly trusted among top stablecoins.

In early May, the number of addresses holding at least $100,000 in USDC on Ethereum surpassed that of USDT, growing strongly to nearly 25,000, while the number of addresses holding the same amount of USDT fell below 17,000.

Source: Coin Metrics' Formula Builder

This may be due to the characteristics of the USDT redemption process, because only large holders have the privilege to redeem USDT and obtain any arbitrage in the process (the minimum redemption set by Tether is $100,000). But it is also possible that some large accounts are de-risking their holdings and moving to USDC, which they believe is safer.

Markets broadly weak as crisis spreads

As prices continued to drop throughout May and June, more questions began to emerge in the crypto lending market. On June 12, Celsius Network, an encrypted asset lender, announced the suspension of withdrawals, exchanges, and transfers for all encrypted asset accounts on the platform.

Celsius’ insolvency issues ostensibly stemmed, at least in part, from a series of risky bets within DeFi, including ETH held as collateral through Lido. Celsius was still suspending withdrawals as of the end of the second quarter and is pursuing solutions such as debt restructuring or a strategic trading plan.

Shortly thereafter, crypto hedge fund Three Arrows Capital (3AC) ran into serious trouble. Cryptocurrency lenders BlockFi and Genesis revealed they had closed out 3AC’s positions after the fund failed to submit new collateral to meet margin calls.

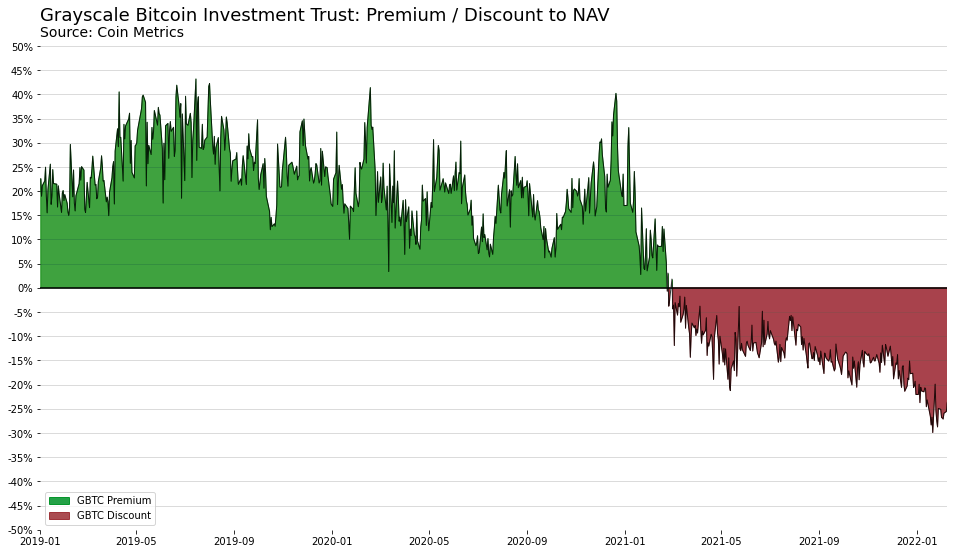

Much of 3AC’s problems appear to stem from the fund’s large position in Grayscale’s Bitcoin Trust (GBTC). Until early 2021, GBTC traded at a higher price than BTC. This has prompted funds like 3AC to take advantage of arbitrage opportunities by borrowing BTC, depositing it in Grayscale, and then getting back GBTC shares and selling them again for a premium.

Source: Coin Metrics; Data Always

According to a January 2021 SEC filing, 3AC held approximately 39 million GBTC shares (valued at nearly $2 billion at GBTC's peak), making the fund the largest single holder of GBTC.

But in 2021 and this year, that premium has become increasingly discounted to NAV, with discounts as low as 30%. With no way to redeem shares of GBTC in exchange for the underlying BTC, large positions like 3AC's have dropped significantly in value over time, adding pressure to any highly leveraged positions. Additionally, GBTC accounts for only a small fraction of BTC’s daily trading volume, making it harder to sell large positions when prices fall. As of June 29, 3AC is in the process of liquidating its remaining assets.

in conclusion

Not just crypto assets, but all financial markets around the world were hit hard this quarter. Still, there are some green shoots of recovery on-chain. The number of Bitcoin addresses holding 0.01 to 1 Bitcoin continues to rise, from 8.9 million at the beginning of the quarter to 9.5 million today.

Additionally, while on-chain activity has decreased somewhat, cheaper gas fees on Ethereum are also more friendly to new entrants, while developers can experiment at a lower cost.

Developers in the crypto space will finally move on, and excitement is mounting over Ethereum’s plans to “merge” into proof-of-stake, which is expected to materialize later this year. Despite the heavy losses, the entire crypto ecosystem is coming back stronger.

Alex

Alex

Alex

Alex Anais

Anais Miyuki

Miyuki Weiliang

Weiliang Catherine

Catherine Kikyo

Kikyo Anais

Anais Catherine

Catherine Joy

Joy Alex

Alex