Problems facing DAOs

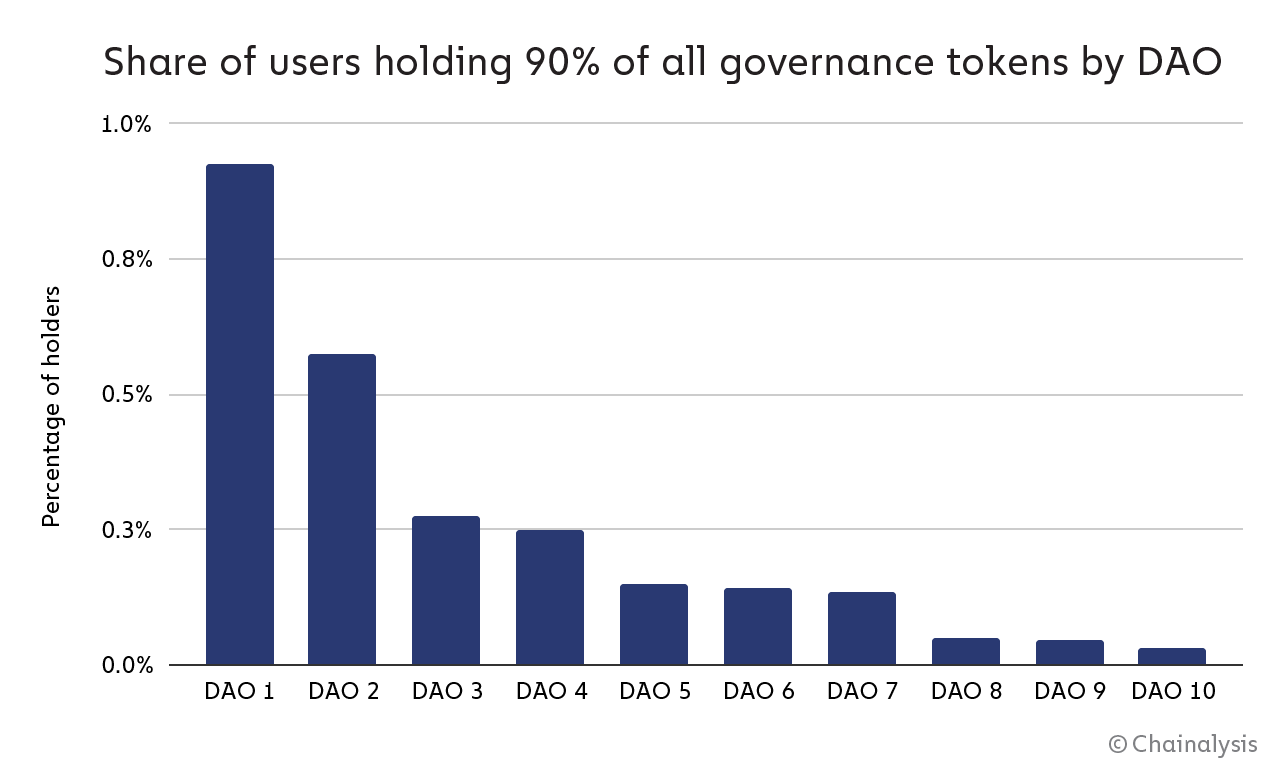

Last week Chainalysis released a report looking at ownership and voting trends in major DAOs, and the results were not surprising:

Most voting power is concentrated in the hands of a few.

This means that the threshold for participation is high (not all members are eligible to vote whether to pass a proposal, and certainly not all members are eligible to propose a proposal).

When a small number of members control such a large share of governance tokens, the question arises: Does the DAO still have the ability to enforce governance in the best interests of the majority of participants?

Another problem we see in DAO governance is low participation and voter apathy - this is something that has been studied before DAOs were born - most participants don't want or don't have the time and interest to actively participate in the decision-making process . Representational institutions and practices have addressed some of these problems, but even with representation, we're still not there.

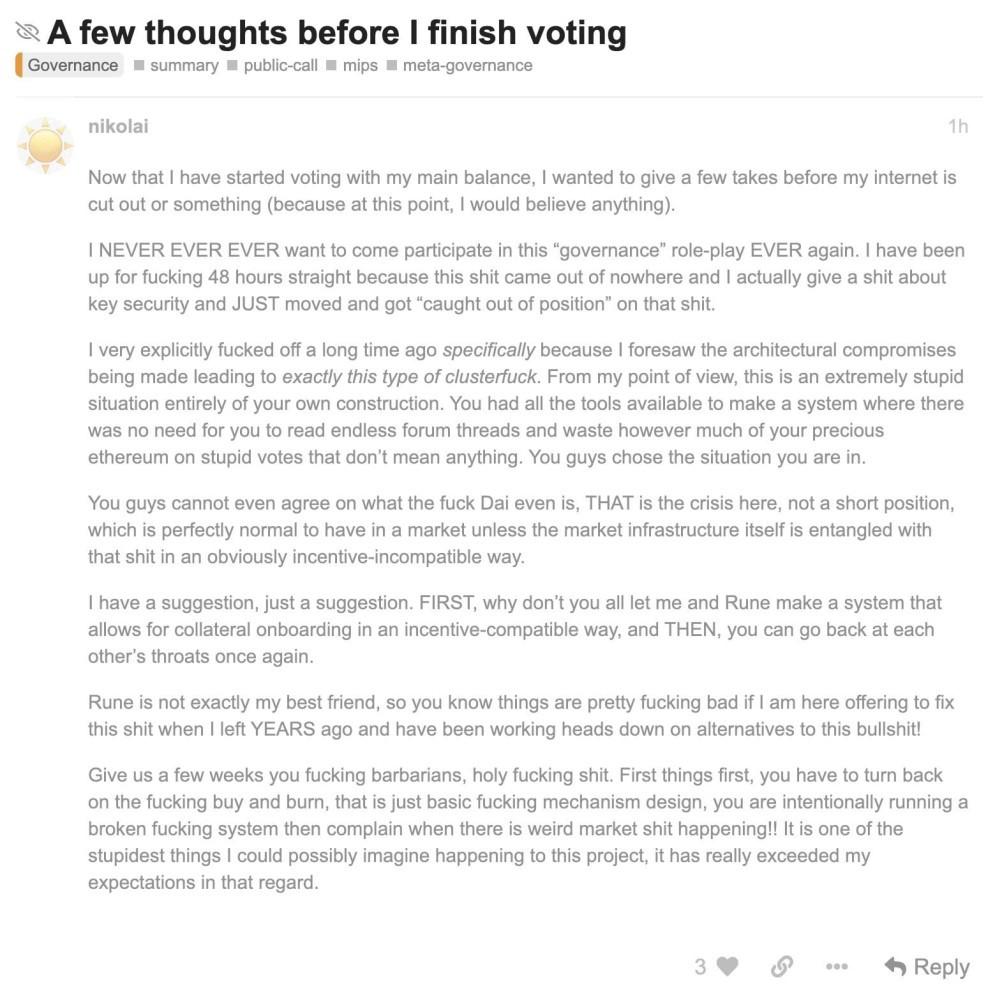

Other critics will blame the decision-making process itself for its lack of ability to agree on the nature of the deal and its goals. Such as the recent dramatic vote from MakerDAO. MakerDAO is TVL’s largest DeFi protocol (nearly $8 billion in total locked value).

It’s worth noting that the vast majority of protocols today don’t even claim to be fully decentralized, the commonly used term is “progressive decentralization” — when launching a project, you know the team, investors and early involvement Participants have most of the interests in the decision-making process of the agreement, but being able to guide the agreement and gradually develop it to a stage where fully decentralized governance can operate effectively is conducive to the healthy development of the project.

Where do we go from here?

If the reality is so bad, what is the long-term goal of DAO governance? How to avoid the concentration of power in the hands of a few, or only in the hands of the rich? Can we see the promise of a transparent and open ecosystem where everyone can participate on a level playing field?

The following will discuss DAO governance from these aspects:

Voting Mechanism and Reputation

DAO tools

DAO structure

Voting Mechanism and Reputation

The most popular solution right now is the Soulbound token, a non-transferable token that contributors earn based on their reputation, contribution, and value-add, which is the same as their investment in DAO governance tokens The dollar value of is not directly correlated.

At DAOstack, we built a protocol based on reputation voting and combined it with a voting mechanism called Holographic Consensus, a mechanism that seeks to solve the problems of voter apathy and voting at scale . It seems premature to propose such a mechanism in 2019.

DAO tools

Mechanisms like this will become more prevalent as DAO tooling infrastructure improves over time to reflect how real value-add translates into reputation and voting power. Several tools are already building solutions for this, including Coordinape, SourceCred, and Karma. As more people participate in DAOs, and more protocols start as DAOs, or evolve into DAOs, we will see a rapid evolution in how they operate. Tools like DeepDAO give users more visibility into DAO contributors, while Tally and CommonWealth help vet active governance proposals and ongoing active votes.

DAO structure

At the same time, we will see rapid innovation cycles in DAO architectures - who says everyone should vote on everything? Corporate structures and governance methods have evolved over hundreds of years - DAOs should be learned and adopted, not reinvented.

Doesn't this contradict itself? Wouldn’t the DAO exist to create a more scalable organization that centralized organizations failed to evolve to, wouldn’t that defeat the purpose of the DAO? I don't think so - the point of decentralization is to reduce centralized points of failure in the decision-making process and create a more transparent system.

One way to solve this problem is to break down governance into smaller parts and give individual groups autonomy in making decisions in their area of expertise - this way you can limit each sub-DAO or group's control over the entire protocol influence while giving it full autonomy to grow, accept new members and carry out its duties.

This concept has opened up a whole new field - service DAO. We will see DAOs spin off independent groups that focus on a specific vector and can provide that service to multiple other DAOs. We have seen the development of fund management DAOs today, such as LlamaDAO serving major DeFi protocols, such as Uniswap, AAVE, IndexCoop, and other service DAOs, such as Cre8rDAO (focused on content creation and distribution) and LexDAO (focused on building DAO for legal aspects of next-gen contracts) and dOrg (a complete collection of Web3 development).

in conclusion

Cryptocurrencies have brought about fundamental, groundbreaking technological change, introducing new business and ownership models that we haven't had before. Of course, it still has many pitfalls and challenges until the proper tools, best practices, and regulations are in place.

In 1995, I couldn't do 99% of the things I can do on the Internet now. Cryptocurrencies and DAO governance are at the same nascent stage, but with powerful tools like digitally native currencies and assets, the design space and room for error is much larger, so we're witnessing a frenzied era of experimentation, with massive prosperity and depression cycle.

This article is compiled from: https://medium.com/@GoldenbergLior/has-dao-governance-all-been-a-show-cb198e369bba

Author: LiorGoldenberg

Weatherly

Weatherly