Author: @sal_coin

Source: Twitter

Are you curious about the combination of NFT and DeFi?

This article will provide some core insights.

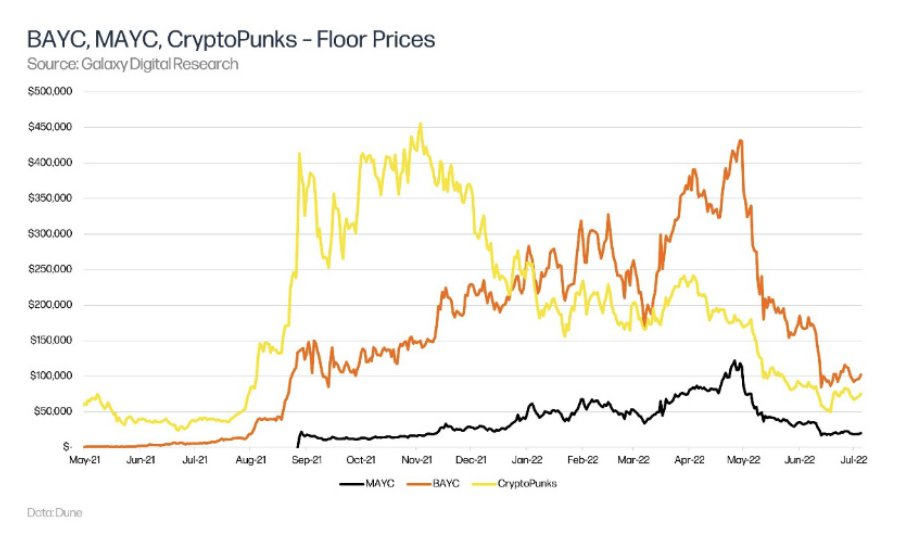

PFP NFTs have dominated the past year, but it's only the beginning. DeFi will power new NFT use cases and further enhance the utility of NFTs.

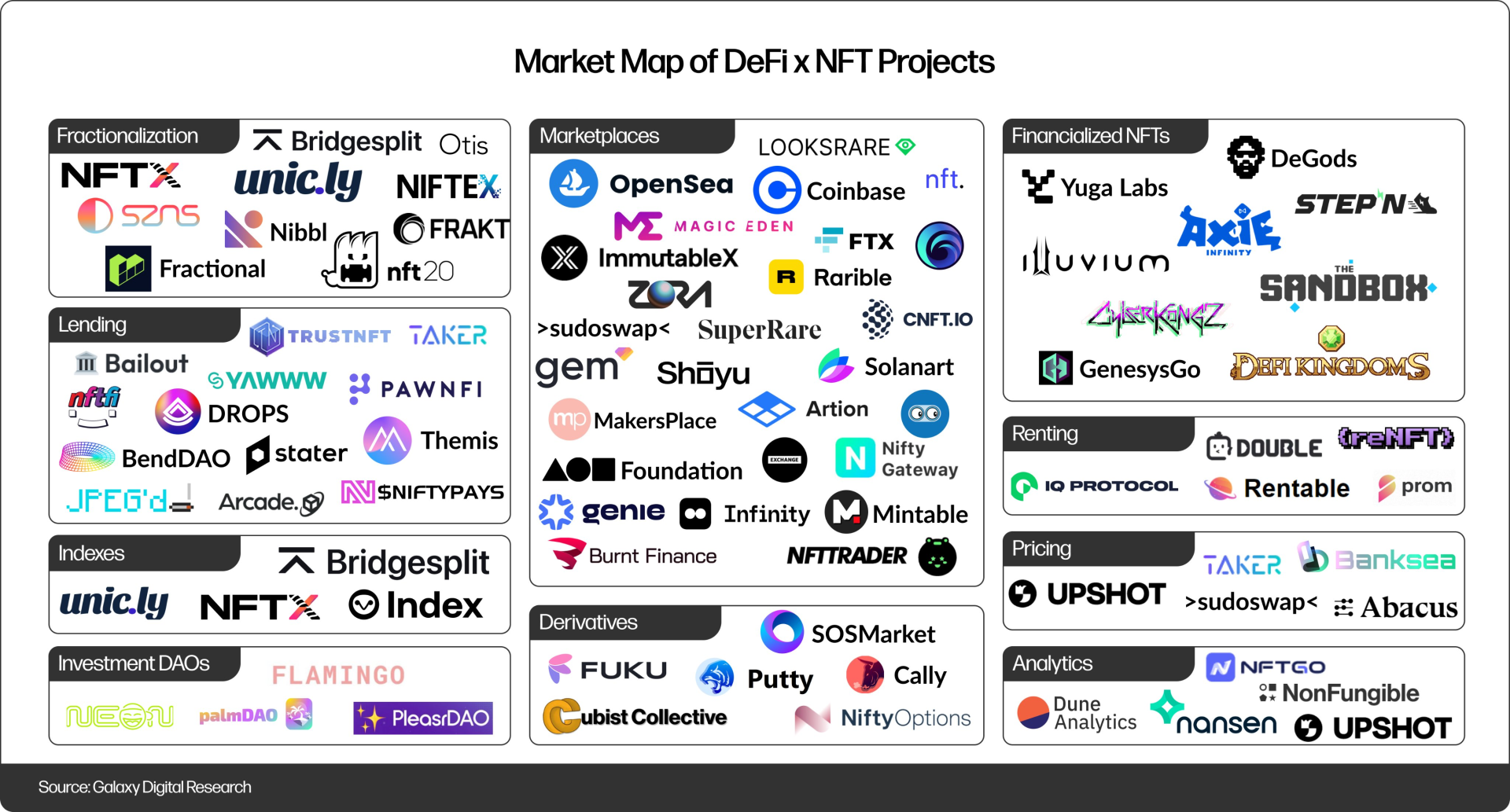

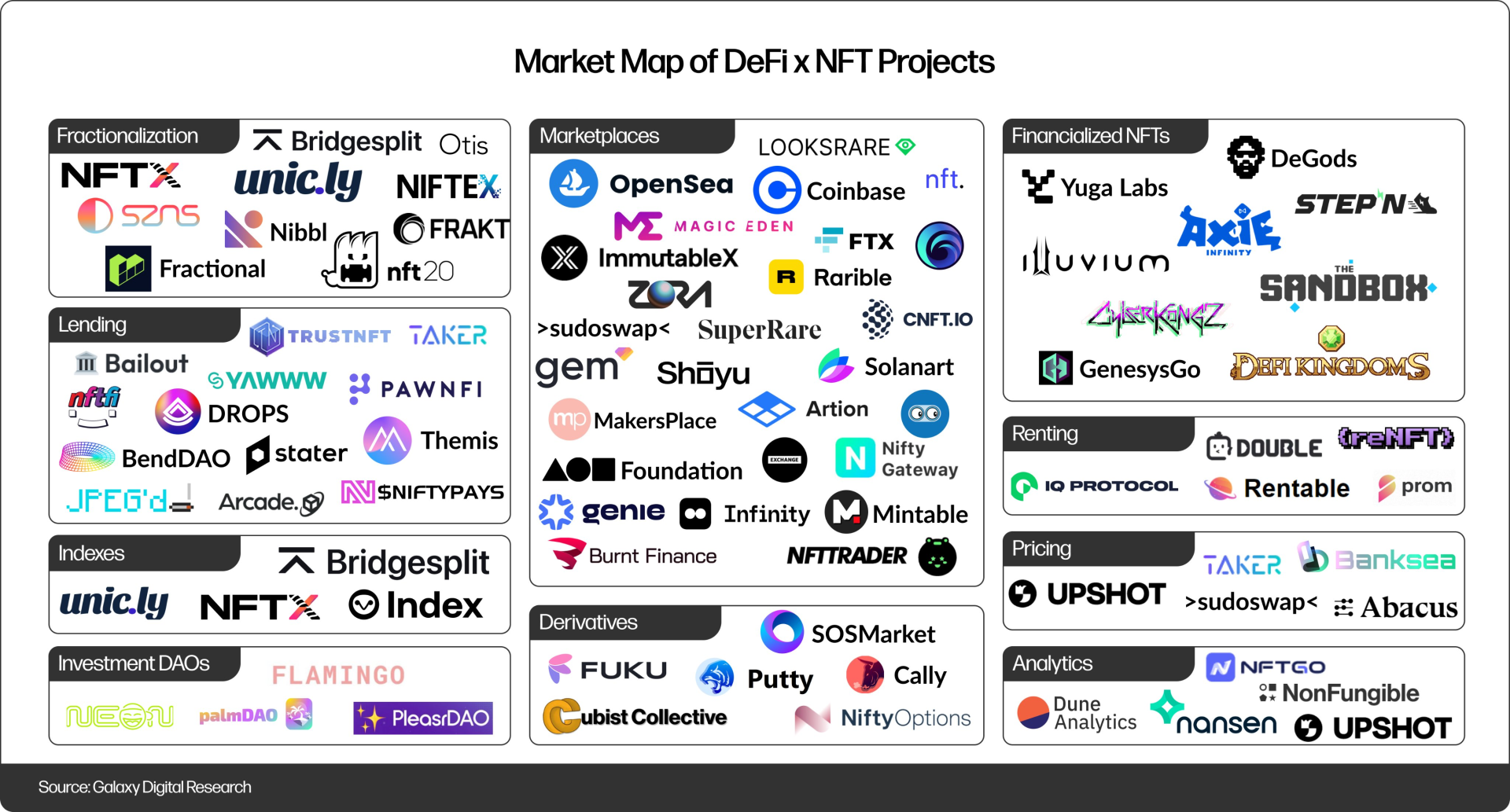

We have seen a large number of NFT + DeFi protocols emerge to solve key problems in this field (such as pricing and liquidity). We group these emerging protocols into the following categories:

Fragmentation

What it is: A protocol that turns NFTs into fungible tokens

Method: lock NFT and issue homogeneous tokens

Examples: @NFTX_ (one series per token), @uniclyNFT (multiple series per token), @fractional_art (tokenize a single NFT)

Advantages: increased liquidity, retail investors can gain price exposure to major (expensive) collections, AMM pools can be built on the basis of collections

Risks: Vulnerable to liquidity crunch, economically viable only for floor price NFTs

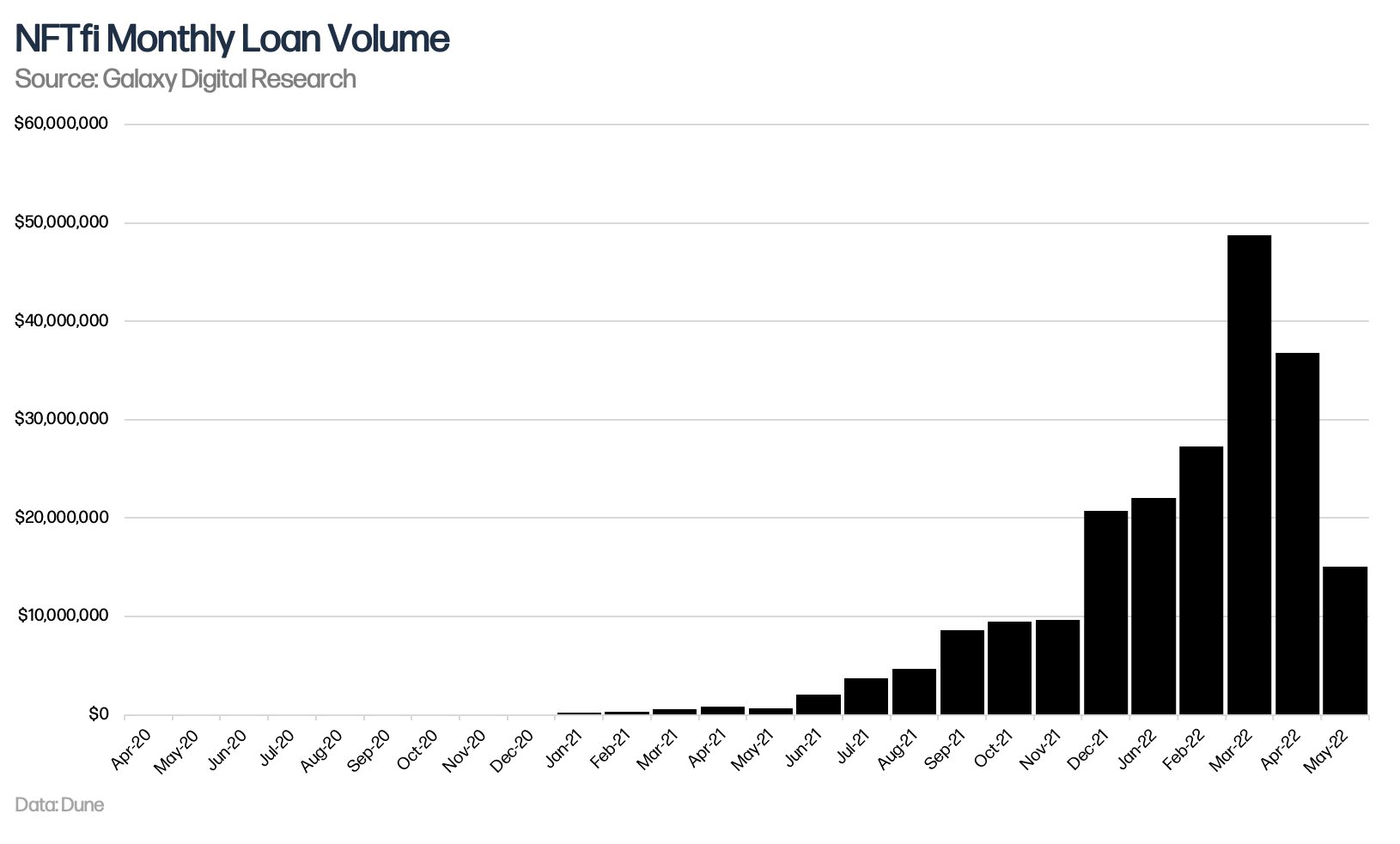

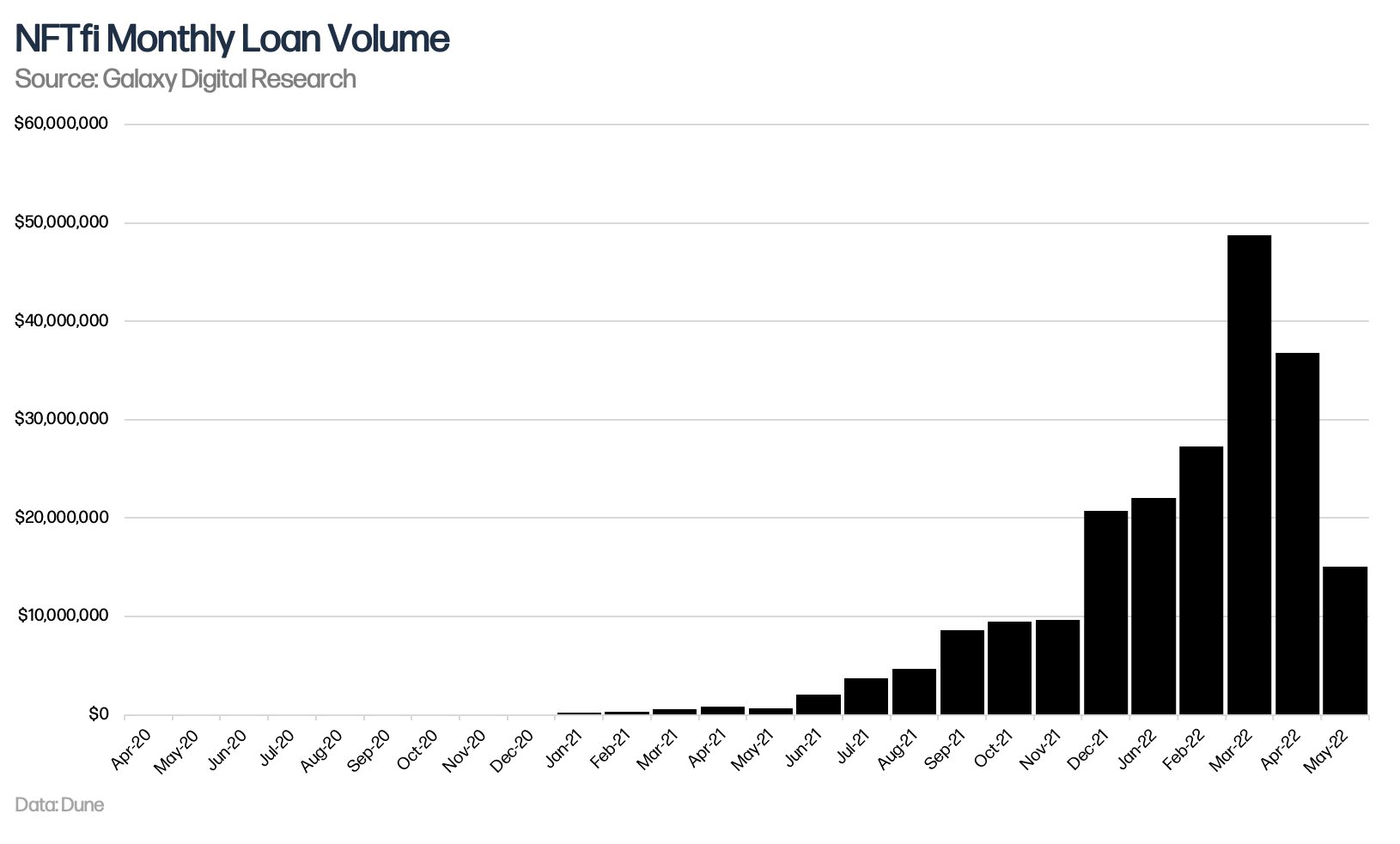

borrow money

What it is: A protocol for issuing loans using NFTs as collateral

Method: peer-to-peer, peer-to-pool (such as Compound), CDP (such as Maker) (CDP: Collateralized Debt Position)

Examples: @NFTfi (peer-to-peer), @dropsnft (peer-to-pool), @JPEGd_69 (CDP)

Advantages: Improve NFT capital efficiency, increase utility, and inject critical liquidity into the NFT market

Risk: NFT price fluctuations may expose retail users to waterfall liquidation, relying on NFT price oracles

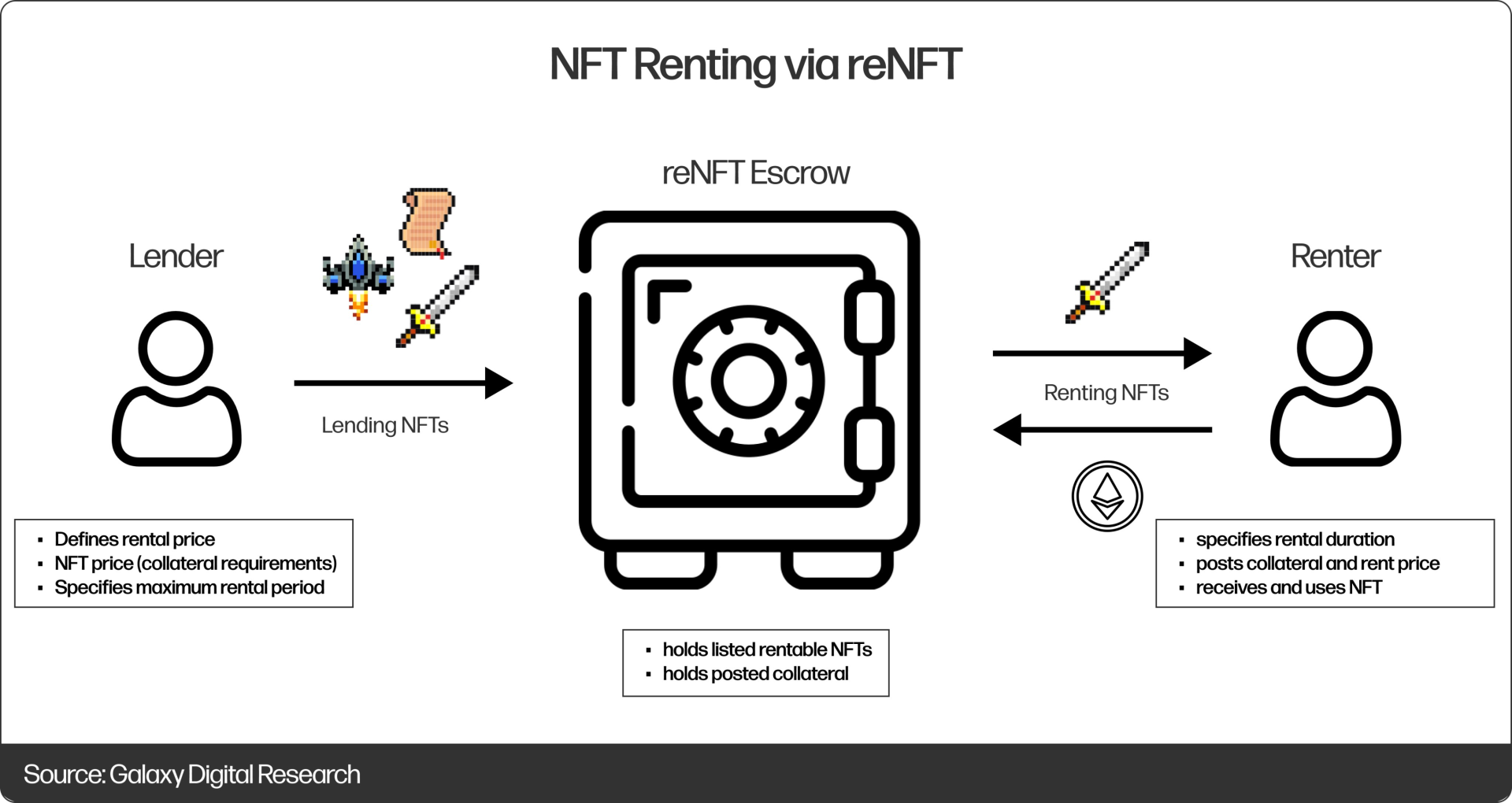

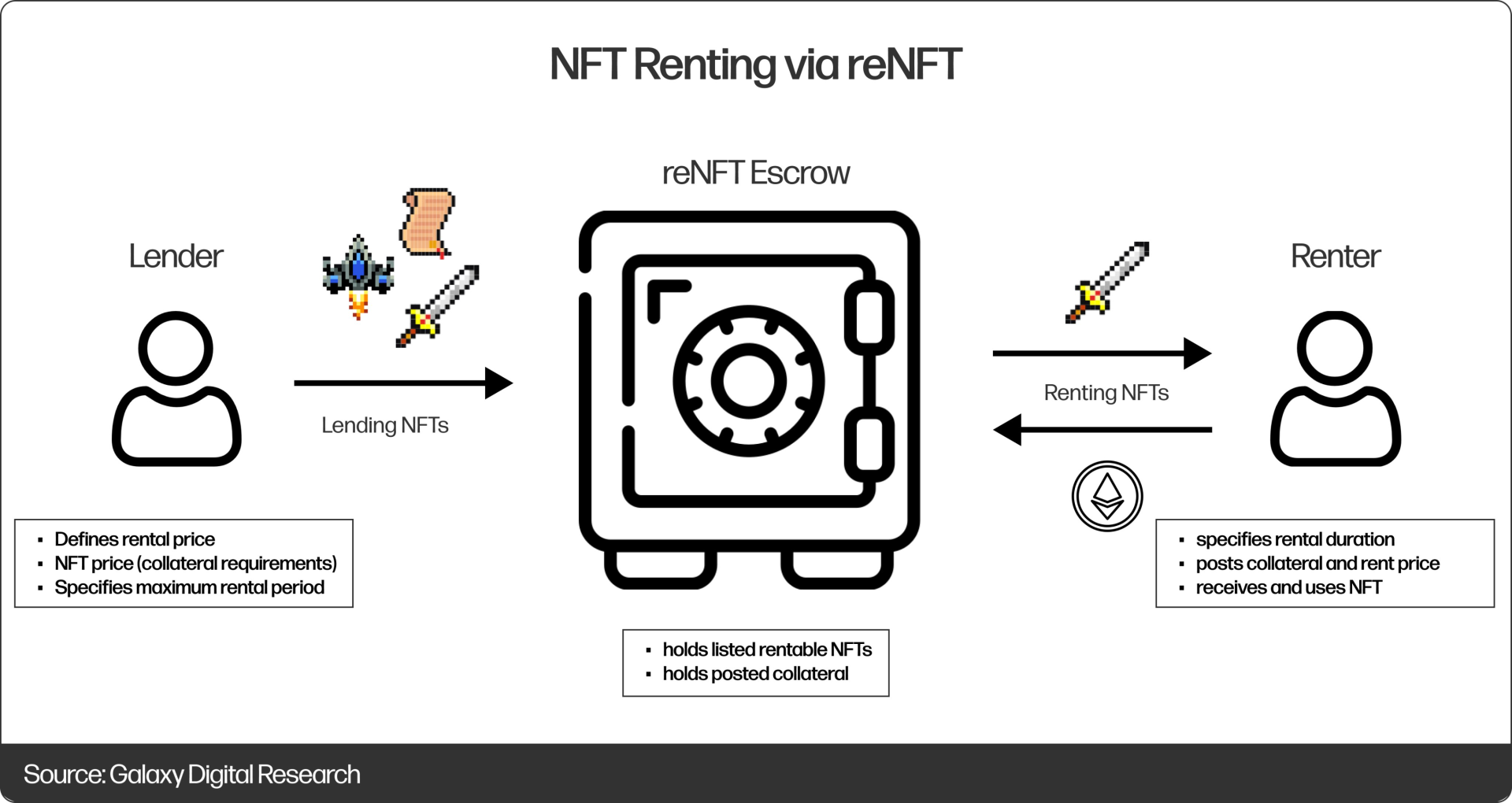

lease

What it is: Commoditizing the utility of NFTs by facilitating NFT rentals

Method: The lender defines the parameters - agreement custody + listed NFT - the agreement leases the NFT to the borrower according to the parameters

Examples: @renftlabs , @DoubleProtocol , @IQLabs_official

Advantages: To attract new users, there is no need for a large number of pre-purchases (such as P2E games, token threshold activities), and holders can also obtain additional income

Risk: Like lending, collections may vertically integrate leasing functions, resulting in fragmented liquidity in the market

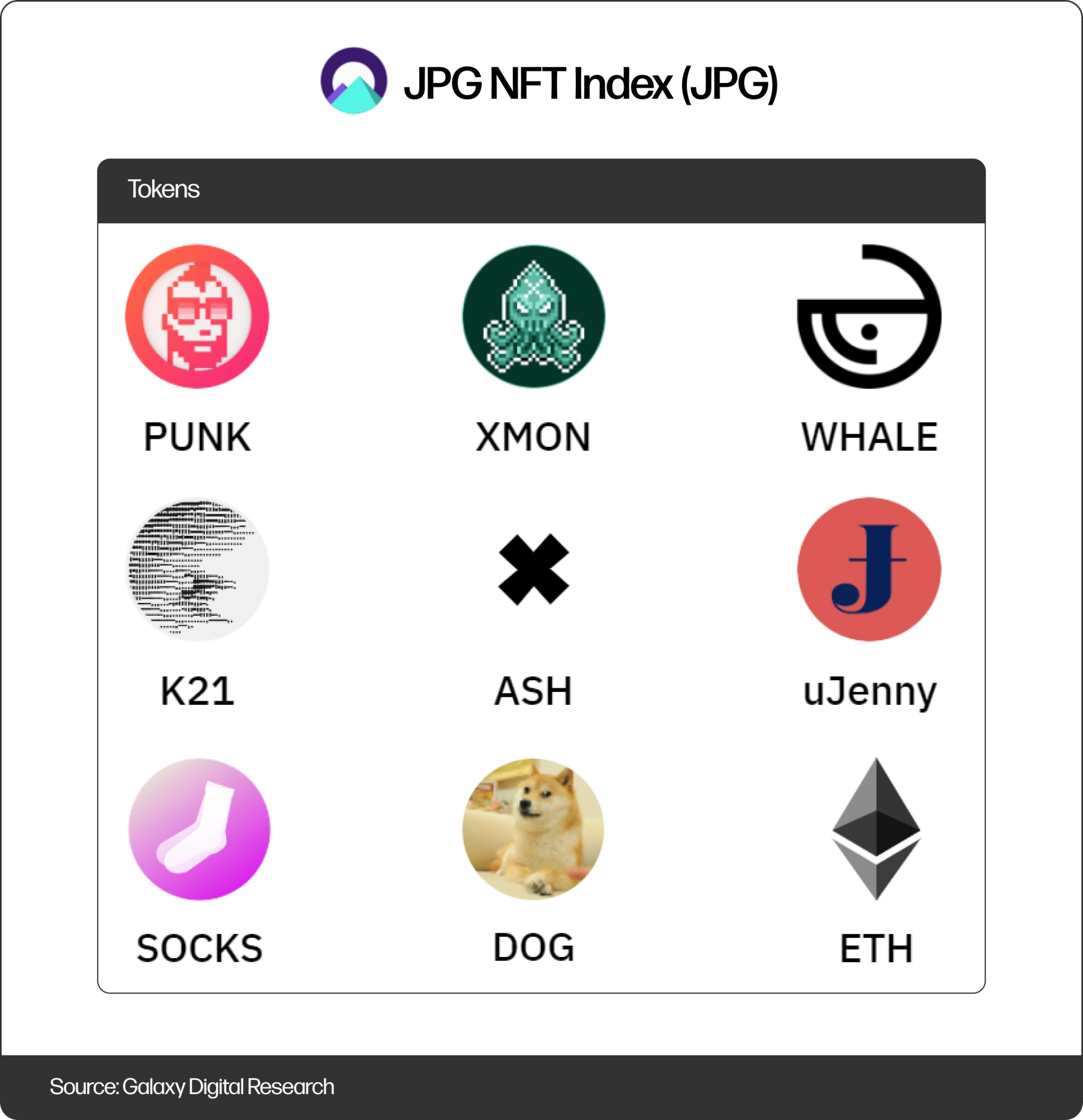

Diversification

What it is: Indices (passively managed) and investing in DAOs (actively managed)

Method: DAO issues fragmented shares (in the form of homogeneous tokens) to their respective NFT portfolios/indices

Examples: @indexcoop,@FLAMINGODAO , @PleasrDAO

Strengths: Extensive NFT exposure, ability to productize risk/portfolio management strategies via DAO

Risks: Coordination around decision making produces suboptimal results (e.g. Index COOP's JPG series), and the NFT space may evolve too quickly for DAOs.

Derivatives

What it is: Prediction markets, options (currently less liquid), and perpetual contracts (may someday)

How (prediction markets): users bet on the binary outcome of the NFT minted secondary price (e.g. will it be higher or lower than X?)

Examples: @CubistNFT , @SOSmarket_io , @AugurProject

Advantages: Options enable hedging/shorting, forecasting markets can absorb some casting pressure, forecasting market data is valuable

Risks: Currently limited utility outside of prediction markets

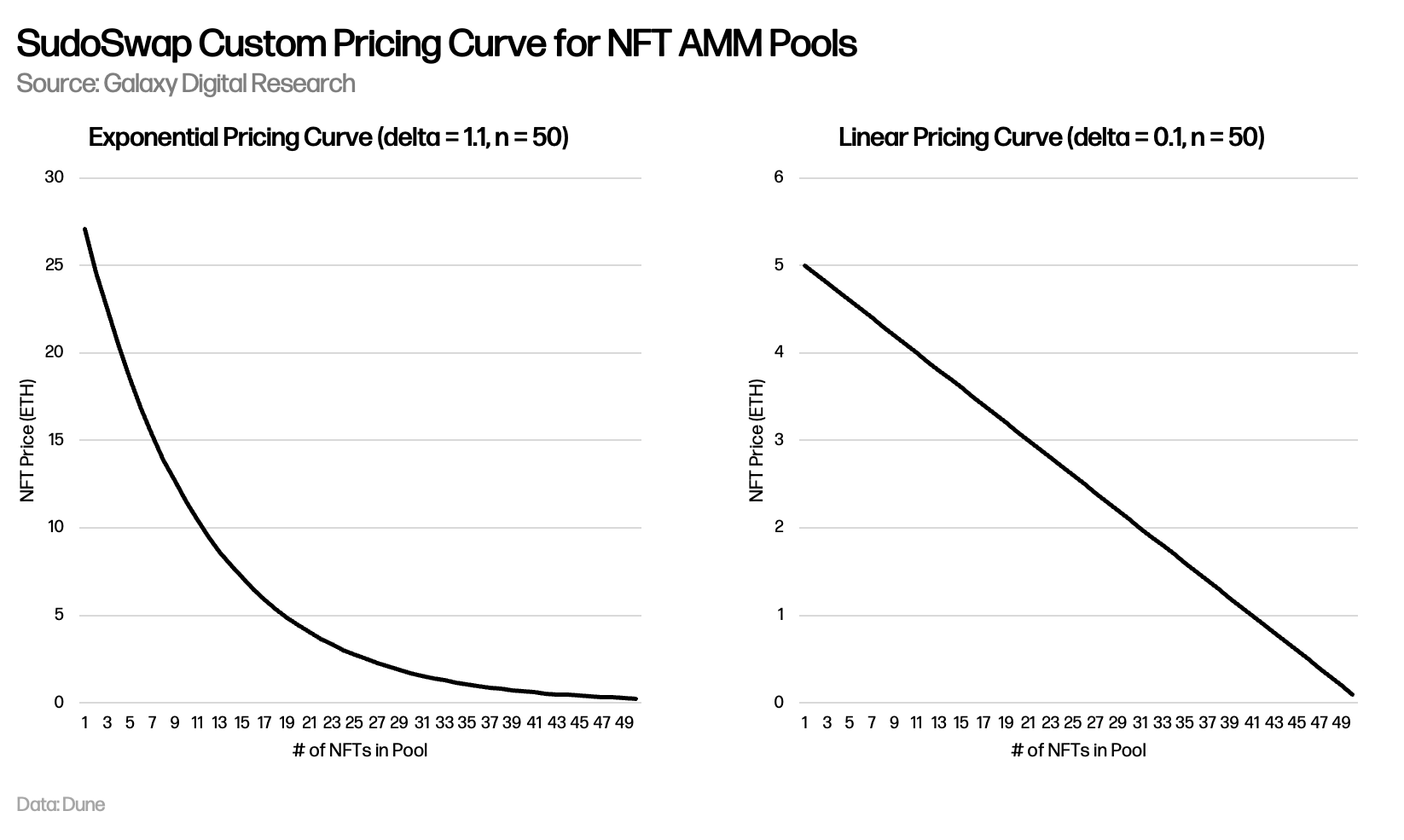

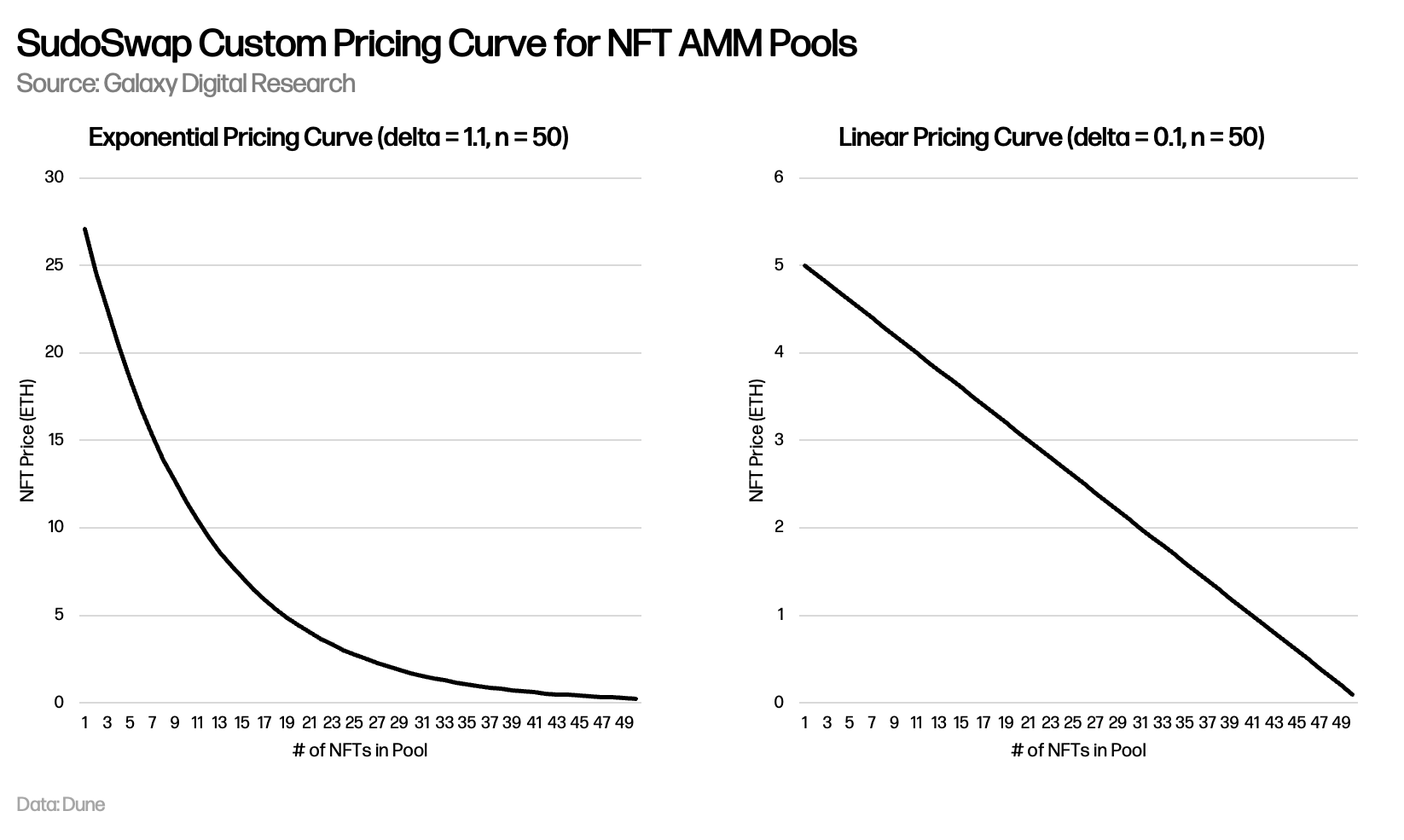

pricing

What it is: Let smart contract code access NFT price data

Method: Various methods including (but not limited to): ML (off-chain), optimistic PoS, AMM

Examples: @abacus_wtf (optimistic PoS), @UpshotHQ (ML), @sudoswap (AMM)

Strengths: Pricing is critical for NFT and DeFi to take off, ML models show promise for NFT pricing

Risks: Most of the methods are only applicable to NFT with bottom price, ML model lacks transparency, PoS model has low capital efficiency, AMM has liquidity difficulties

For a fuller overview, check out the full report by the author with @kinaumov .

JinseFinance

JinseFinance