Non-fungible tokens (NFTs) have been making headlines in recent years. While many are trying to figure out why NFTs exist, demand has skyrocketed, institutions have been built, and the term has entered our collective consciousness.

However, there is an obvious problem: NFTs are difficult to use, and most of them are fraudulent. But these questions create opportunities to provide answers. NFTs are ripe for accessibility and legitimacy, and now is the time for a change. With the influx of money, the NFT market is beginning to mature, and the momentum for this change is gaining momentum. We are entering a new era of NFTs - NFT 2.0 - an era in which the technology will be more accessible to the mainstream and the underlying value proposition of NFTs will be more transparent and reliable.

Reflections on the rise of NFTs

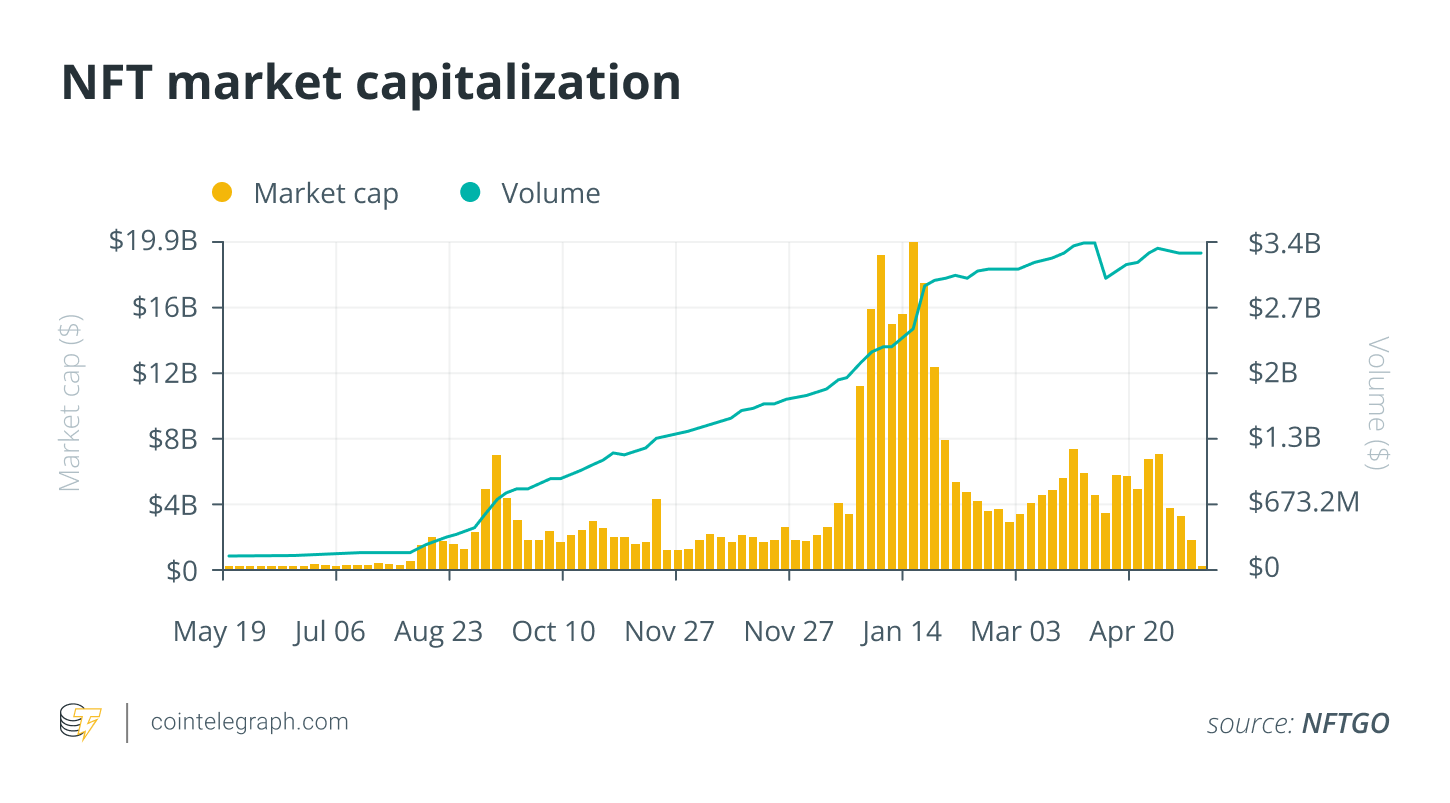

Although it has just been born, NFT has already exploded in the encryption field, with a transaction volume of more than 17 billion US dollars in 2021. That figure is expected to soar to $147 billion by 2026. What's even more impressive is that this data is held by fewer than 400,000 people, and the average transaction volume per user is as high as $47,000.

While the industry is rising rapidly, NFT has also undergone tremendous changes since its inception. For example, the free-minted CryptoPunks rose to blue-chip status in 2017, peaking at $11.8 million at a Sotheby's auction last year. A few years later, Larva Labs, the company that created CryptoPunks, was acquired by Yuga Labs, the parent company of Bored Ape Yacht Club, for an undisclosed sum.

Evolution of NFTs

Considered a fad in the early days, NFTs are now showing massive staying power, catching the attention of A-list celebrities and brands, and even appearing in Super Bowl commercials. Companies like Budweiser, McDonald’s, and Adidas have airdropped their own NFT collections, while Nike has also entered the NFT space with the acquisition of RTFKT Studios.

As companies decide on their NFT strategies, the entire field has mirrored the rapid technological innovations of the past few decades. It took about 10 years for the iPhone to get its current version, and NFTs have evolved from 8-bit pixel images and pinball-style blockchain games to high-fidelity 3D animations and complex "play while earning" mechanisms, and in A massively multiplayer experience in just a few years.

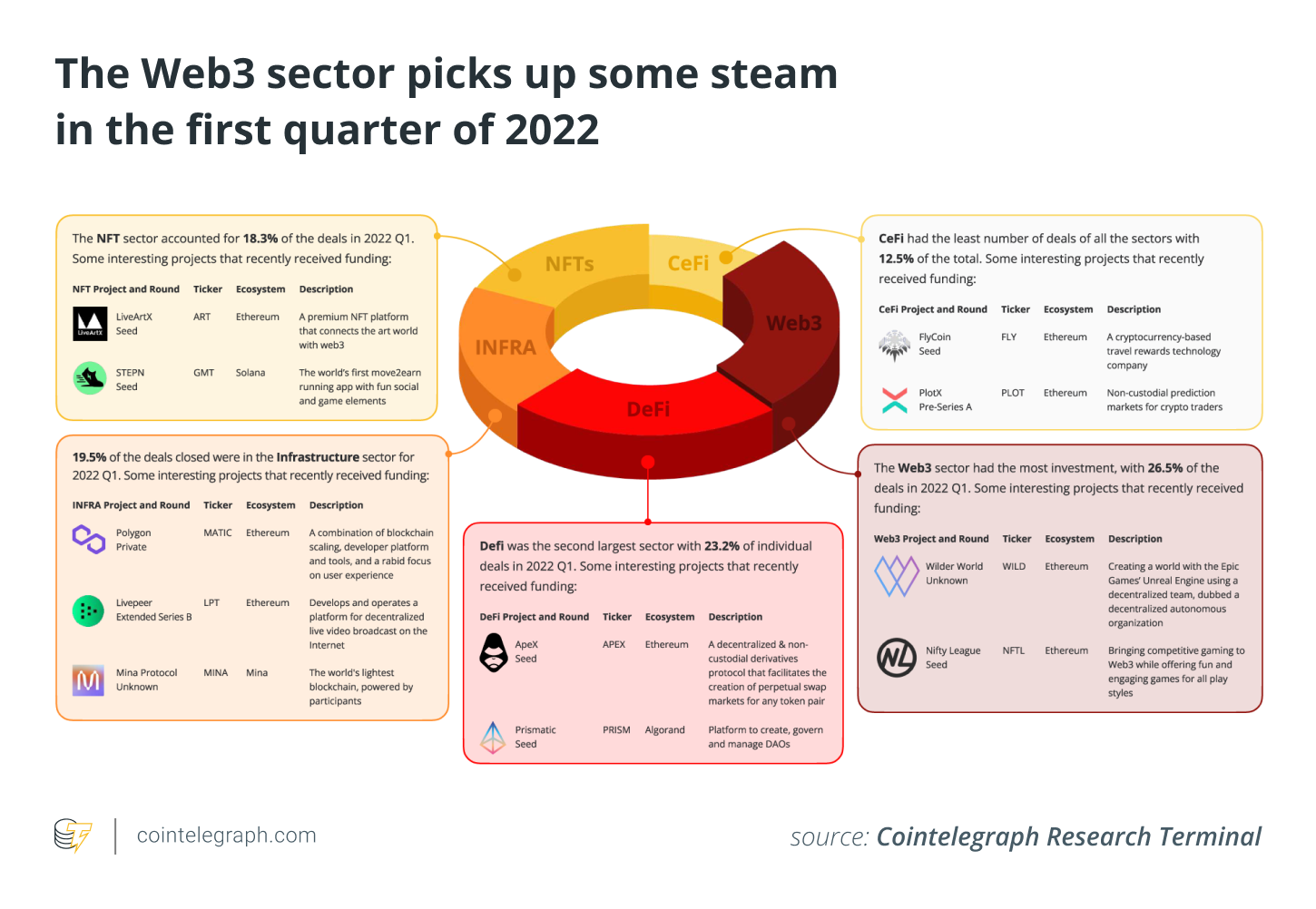

While NFTs continue to grow, so does the ecosystem of pick-and-shovel solutions. The emergence of a large number of NFT casting platforms and tools has greatly lowered the barriers to entry, which has led to a deep saturation of the market. As of March 2022, there are more NFTs than public websites, creating a lot of noise that is difficult for many to break through.

"There are now more NFTs on OpenSea than there were websites on the internet in 2010. Soon, there will be more NFTs than websites, or even webpages. This growth has important implications for how we should index NFTs." @xanderatallah

The staying power and massive trading volume of this asset class has changed the way creators enter the space. Many rushed with their Web3 strategies, or used their fans as a source of liquidity, leaving behind a pile of false, disorganized, and abandoned projects. Simply put, most companies and creators are not ready for Web3, and they need more hands-on guidance and superior services than tools.

like email

Ultimately, NFTs seem to be headed in the same direction as emails. There was a time in the 1990s when companies needed to hire experts to write email code for them. Early adopters set up lucrative agencies capable of servicing Fortune 500 companies and executing early digital strategies. The information gap gave these agencies enormous leverage until technological advances (and education) made it easier for brands themselves.

Likewise, we are now in an era where brands are looking to experts to educate and prepare them for their Web3 future, and it is only a matter of time before they disintermediate them completely and manage their Web3 strategy entirely in-house. Getting started with NFTs and crypto is a fairly complex process that many simply cannot handle. However, some companies are finding ways to abstract the more difficult aspects of crypto and create channels for deeper engagement with fans.

For the Mainstream: NFT 2.0

Current NFTs are not designed for mainstream consumption. The new system is not smooth for consumers; the volatility is hurting real fans; and it's distorting the relationship between artists and fans. There is so much dissonance between the price tag of NFTs and the value they can provide to consumers, and many series are facing severe demand shocks due to failure to execute their own roadmaps.

Core buyers of NFTs are increasingly able to spot lies and scams, which means they are less likely to mint new NFTs. Although we can easily see a decline in NFT sales, the reality is that NFT needs a lot of elimination to weed out those who hope to get rich overnight and more effectively motivate real creators in this field. When vaporware is wiped out in a bear market, antifragile companies that can weather the storm from Web2 to Web3 will thrive. If the timing is wrong, agencies and platforms will be obsolete, but those companies that are ready for the email-style shift will grow high-margin, high-touch programs while capturing long-tail revenue streams.

This has important implications whether you are a creator, potential user or investor in this space. The NFT space will grow and develop rapidly. Don't blink so you don't miss the perfect moment.

This article was written in collaboration with Mark Peter Davis and Sterling Campbell.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Bitcoinworld

Bitcoinworld Beincrypto

Beincrypto Coindesk

Coindesk Nell

Nell Nell

Nell Nulltx

Nulltx Bitcoinist

Bitcoinist Nulltx

Nulltx Cointelegraph

Cointelegraph