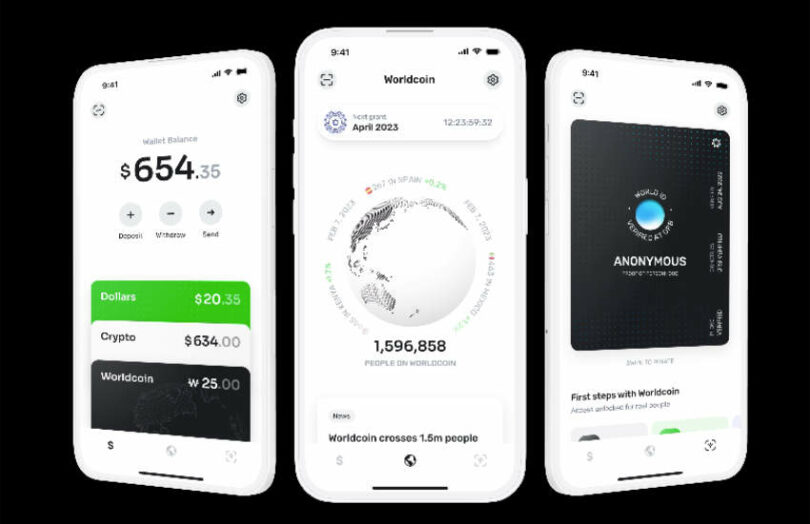

Yesterday the Worldcoin network officially went live with a grand goal of providing biometric digital identity to the world, incentivized with crypto. At first sight the idea seems scarier than it is. Digging deeper, there’s been considerable thought given to the thorny privacy issues and the business model.

However, two realities are inescapable. Firstly it’s almost impossible to design any digital identity solution that is entirely secure and fraud resistant. And despite its aim to decentralize, blockchain has a habit of doing the opposite, and none more so than Worldcoin.

The focus here is on the business savvy, but first let’s clarify what Worldcoin is and is not.

What is a World ID?

The project aims to create a unique digital identity – a World ID – for everyone on the planet by taking a high resolution scan of the iris using Worldcoin designed equipment, the Orb. Much of the motivation relates to Sam Altman’s other big business, AI. If AI displaces human jobs, there might need to be a universal basic income (UBI) which will likely require biometric identity. Plus, AI makes faking identity easier by the day. Hence, India’s Aadhaar identity system uses biometrics to prevent fraud, but unlike Worldcoin, the Indian system stores the actual iris data and fingerprints.

Worldcoin repeatedly says it does not retain the iris scans, unless you choose to share them. Instead, it keeps a hash of the data similar to a fingerprint and stores them all in a private centralized database rather than a blockchain. There’s a singular purpose in retaining the data – to confirm that the iris has not previously been scanned to ensure uniqueness.

At first this seems creepy, but given the system design, the hashed data may not be that useful. Today people leak masses of data using blockchain wallets. If someone buys an NFT you can often explore every crypto transaction that person has ever made. And linking that wallet to a real identity is not that hard.

In contrast, we believe there isn’t a public direct link between the iris hash and everything you do. Using zero knowledge proofs (ZKP), Worldcoin helps to obfuscate the connections between your activities. Ethereum’s Vitalk Buterin did a great analysis of the biometric aspect of Worldcoin and concluded that “these iris hashes leak only a small amount of data.” If a hacker accessed the database, they’d have to somehow get another iris scan from you, and that would only reveal whether or not you’re in the database.

The challenges of security and centralization

The Worldcoin whitepaper argues in favor of biometrics and its custom Orb iris scan hardware on security grounds. In contrast, mobile phone face scans are not especially secure. Know your customer (KYC) verification is usually based on passports and identity documents that not everyone possesses. And KYC can be faked with a bribe. However, Buterin highlights an easy way to fake World ID is to pay someone to link their iris to the briber’s device and public key.

There’s also the issue of custom hardware. Anyone having their eyes scanned is relying on someone’s word that the data is not retained and transmitted somewhere. The manufacturer could insert something dodgy. If Worldcoin eventually decentralizes the manufacturing process, that increases the risk.

Then there’s the centralization aspect. While there are lots of valid complaints about KYC – particularly the problem of retained data – it’s actually a relatively decentralized process. Especially compared to Worldcoin, which wants to operate the identity system of the entire world.

The Tools for Humanity startup co-founded by Altman is helping to launch Worldcoin and it initially stores all the iris hashes and performs the uniqueness verification.

The business savvy behind Worldcoin

For all its cutting edge technology, Worldcoin is underpinned by classic business thinking. Identity can provide a gateway to wallets, which in turn provides a portal to our finances and payments. That makes identity a killer app. Ditto for cross border payments, particularly remittances which are highly dependent on ID for anti money laundering purposes. Worldcoin gets the remittance users to sign up with cash and WLD token giveaways. It plants the idea of a token potentially linked to a possible future universal basic income financed through AI. And it creates a moat with bespoke hardware for iris scans.

As an aside, the World App / wallet is operated by Tools for Humanity, not the Worldcoin Foundation.

If you’re using the wallet for identity and finances, why not use it for payments as well.

Bigger ambitions than Meta / Diem?

Here’s an excerpt about the Worldcoin token WLD in the whitepaper:“The community of users will determine the token’s utility, but a few other use cases in addition to governance could emerge. For example, users may decide to use the WLD token to pay for certain actions in World App or another wallet app, to make other payments (e.g., remittances, tip artists, buy and sell goods and services), or to signal their approval or support for other causes or initiatives. In the long-run, the WLD token may also be treated as a global store of value.”

If Worldcoin takes off like it plans, they may regret not keeping quiet about that last sentence because central banks did a good job of killing off Meta-founded Diem.

The remittance point is an interesting one, because a considerable proportion of the initial two million users of the platform are from emerging economies. Worldcoin has been criticized for exploiting people by encouraging them to have their eyes scanned in return for small amounts of cash and WLD tokens. It’s more concerning if that’s children rather than adults.

These early users in emerging economies have a three fold purpose. They help the startup to perfect the hardware, software and process. They grow the user numbers to two million for launch to help pump the token. And maybe, once there’s sufficient traction, they use the wallet for remittances, probably with some additional crypto incentives.

The Orb is the moat

The crypto sector is highly competitive. For example, the Uniswap decentralized exchange was quickly copied by SushiSwap, which is still a serious competitor.

The team behind Worldcoin are upfront that they are very much a for profit outfit. Whatever the talk of decentralization, for most businesses the goal is to be a monopoly in its niche. That involves some kind of a moat. Network effects work as a moat, but it can take time to build a flywheel. In the meantime, having a custom hardware unit like the Orb for iris scans acts as a moat.

While much of the Orb design code is publicly available, the license means people can’t use it before (roughly) February 2027.

Does it really need the custom hardware? Arguably it could have used existing high resolution iris scanner equipment. However, the real issue is hardware security and ensuring there’s no retention of the iris scans. That’s enough of an argument that the Orb is a necessity and it just happens to create a four year business moat.

The WLD token

Last but not least is the WLD token. It’s not just a token that could power the world’s identity and is backed by OpenAi founder Sam Altman. No. “It may eventually support a path to AI-funded UBI (universal basic income).” That one is probably more targeted at the crypto crowd accustomed to tokens unlocking future benefits.

The supply at launch was 143 million tokens, of which 100 million was ‘loaned’ to market makers for three months.

A quarter of the tokens is retained by insiders, with 9.8% going to the initial development team. The 25% share was expanded from 20% two years ago.

The other three quarters goes to the community, including up to 15% for the network operations and ecosystem.

The WLD token price already experienced a wild rid, doubling from an open of $1.66 to reach $3.30 but falling back to $2.12 in a single day. Currently the market capitalization is $228 million.

One fly in the ointment was the timing of the recent crypto crackdown in the United States. That means you can have your eyes scanned in the U.S. for a World ID, but you can’t receive a Worldcoin token. So for now, it’s the World minus the U.S.

JinseFinance

JinseFinance