Why do bull and bear markets in the currency circle change so frequently? Why is the average lifespan of a blockchain project so short? What exactly is a death spiral? These problems may all be explained by Soros's reflexive theory. This article will first introduce the theory of reflexivity and the application of this theory in the stock market cycle; secondly, analyze the reflexivity in the blockchain industry by comparing the stock market and the currency circle, and explain the reasons for the bull-bear market cycle in the currency circle; finally use the reflexivity Theoretically compare the event of Thai baht abandoning the fixed exchange rate in 1997 and the UST unanchoring event, and make some suggestions for risk management.

reflexive theory

Reflexivity is the reciprocal causality that a leads to b, and b leads to a. When a is human cognition and b is an event in which humans participate, it becomes Soros's reflexive theoretical philosophy. Different from using dichotomy to distinguish thinking and reality, reflexive theory aims to explain: human cognition is an inseparable part of factual results, and real results cannot be separated for independent analysis.

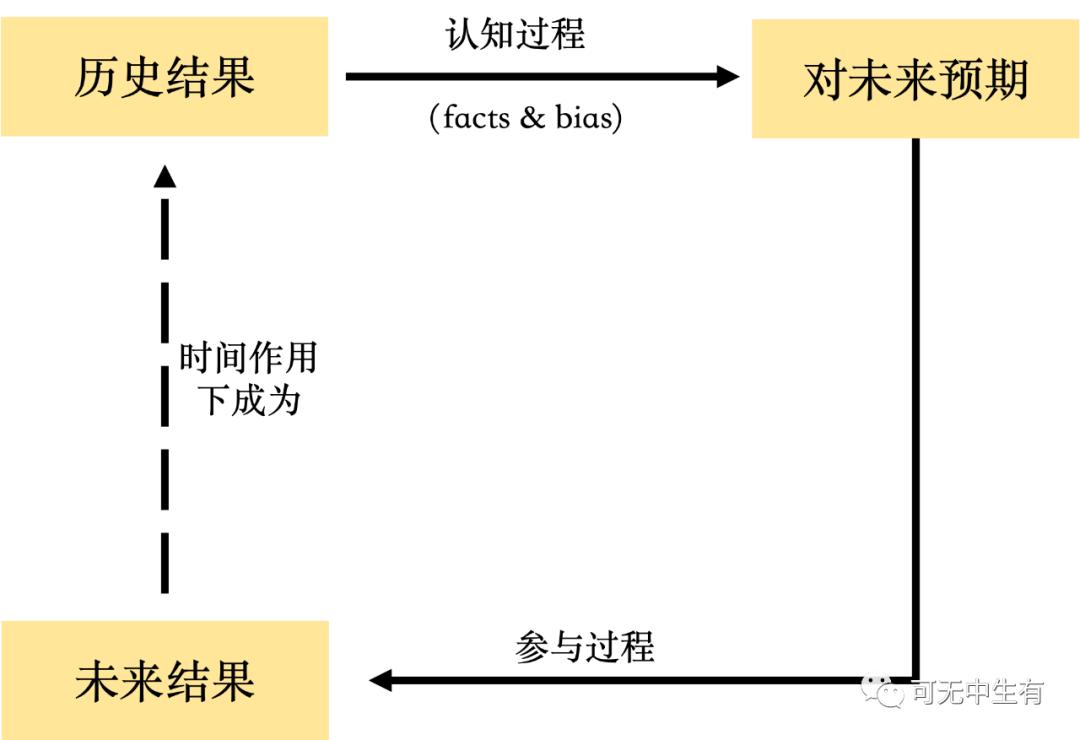

Specifically, a reflexive unit is composed of a cognitive process and a participation process , and there is a two-way feedback loop between the two processes: the cognitive process is from (the last historical reality) result to (the present to the future) Expectations, and the participation process is from (now to the future) anticipation to (future real) results, and the future real results become historical real results under the influence of time, and the cycle repeats. Because of the ex-ante and ex-post asymmetry, each process unit is not repeatable, because even if all observable factors are the same, the perspectives of the participants are likely to change at different times.

In the above-mentioned cognitive process , because human beings can never fully understand the real world, there will be cognitive biases, and this bias will directly affect the next real result through the participation process and thus affect the real world. When the direction of the cognitive bias is consistent with the direction of the real outcome, a self-reinforcing process occurs, leading to the continuous expansion of the bull market and the death spiral of the bear market.

Reflexivity in the stock market

In the stock market, the actual outcome is the stock price , and the stock price depends on two factors- the basic trend and the prevailing bias . The underlying trend is not affected by investors' expectations and is related to factors such as free cash flow and asset value; while prevailing bias is the deviation between the expectations of most participants in the market and the real results. Fundamental trends affect participants' perceptions through a cognitive process that simultaneously generates mainstream biases, which together affect stock prices through a participatory process (investment decisions).

The basic trend and mainstream bias are in turn affected by the stock price . The stock price affects the fundamentals of the company by affecting the company's status, credit rating, consumer acceptance, mergers and acquisitions, etc.; and the positive feedback of the stock price will increase the mainstream bias.

In a typical sequence of market events, the three variables of fundamental trend, prevailing bias, and stock price reinforce each other first in one direction and then in the other, alternating booms and busts.

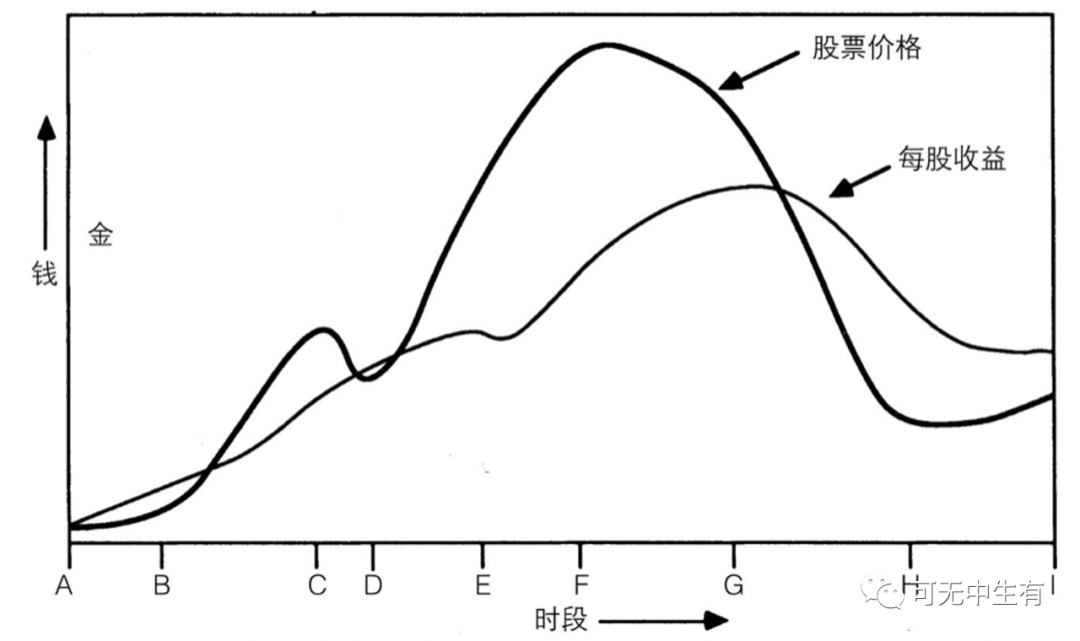

Let's intuitively experience a complete stock market cycle (earnings per share is used to represent the basic trend, and the gap between the stock price and earnings per share represents the mainstream bias): at first, the identification of the basic trend will lag behind to a certain extent, but the The trend is strong enough and showing up in EPS (AB). After the basic trend is recognized by the market, it begins to be strengthened by rising expectations (BC). At this time, the market is still very cautious, and the trend sometimes weakens and sometimes strengthens. Such repetitions may be repeated many times, and only one time is marked in the figure (CD). As a result, confidence started to inflate, and a brief setback in earnings was not enough to shake the confidence (DE) of market participants. Expectations are overinflated and far from reality, and the market cannot continue this trend (EF). The bias is fully recognized and expectations start to drop (FG). The stock price lost its last support, and the plunge began (G). Finally excessive pessimism corrected and market stabilized (HI) -

The reflexivity of the blockchain industry

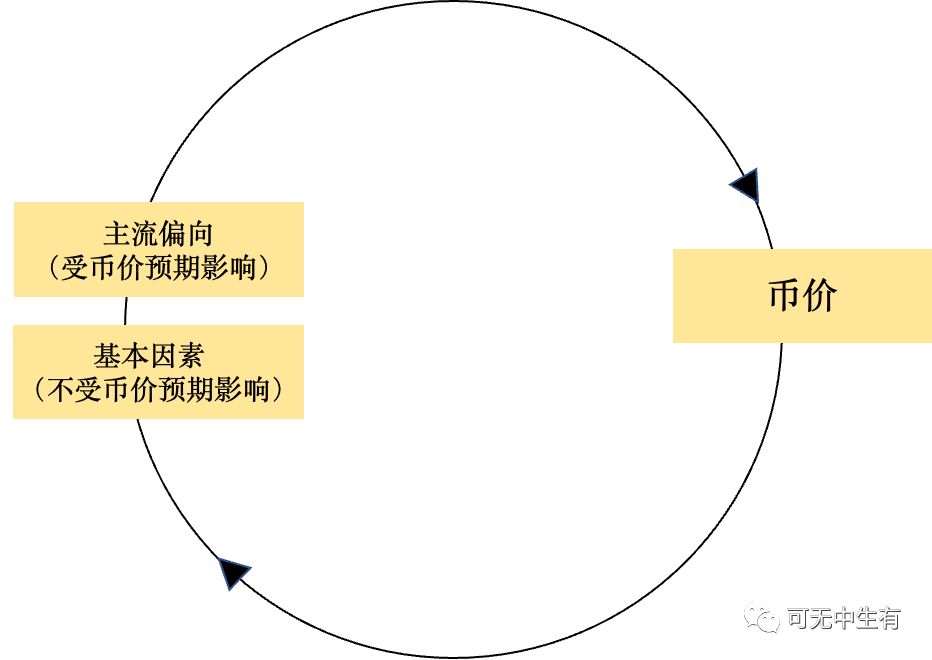

In the blockchain industry, token prices are determined by supply and demand. Under the premise of a certain supply, the demand can be roughly divided into use demand, investment demand and speculative demand. Similar to the stock market, currency prices are also affected by fundamental trends and mainstream bias. The basic trend is composed of capital flows brought about by use demand and investment demand , which are not affected by subjective expectations of currency prices; while the mainstream bias is manifested in capital flows brought about by speculative demand : speculative capital is a rising rate of return (usually In defi projects) and rising currency prices, the role of currency prices is far greater than the rate of return, because as long as the currency value drops slightly, the total return may become negative. Therefore, the expectation of future currency price changes constitutes the main motivation for speculative trading.

There are two major differences between the stock market and the blockchain market in the reflexive process. The first lies in the difference in the impact of the basic trend on the price . The stock price is greatly affected by the basic trend (this is why the value investment theory is evergreen in the stock market); however, due to the large proportion of capital flows brought about by the speculative demand in the current blockchain market, the basic trend has a great impact on the currency price. has little impact. The second difference is that the price affects the basic trend differently . The impact of the stock price on the fundamentals of the company is indirect and relatively small; in the blockchain market, due to the original nature of the token, the currency price directly affects the income of miners/verifiers, employee income, community activity, and new users. Attractiveness and other factors to affect the basic trend, so the impact of the currency price on the basic trend of the project is very important.

After understanding these two major differences, let’s look at the reasons for a complete currency circle cycle : first, assuming that the basic factors remain unchanged, but the market expects the currency price to rise, so the mainstream bias is strengthening, which will lead to an increase in the real currency price. The rise of the currency price will improve the fundamentals of the project by encouraging more verification nodes, community activity and the number of new users; at the same time, the mainstream bias will self-strengthen and continue to expect the currency price to rise, and the rise of the fundamentals and mainstream bias will further drive Currency prices rise. Once a trend is established, it sustains and develops itself until a turning point occurs. This trend will reverse when speculative capital inflows cannot compensate capital outflows due to reduced usage demand, investment capital outflows due to changes in the macro/legal environment, and rising interest/debt outstanding. Thereafter, a self-reinforcing process is initiated in the opposite direction. The expected decline will lead to the strengthening of the mainstream bias, leading to a decline in the currency price; the falling currency price will affect the enthusiasm of miners and nodes, the enthusiasm of the project party and the number of new users, which will make the basic factors worse and bring the price of the currency. A further plunge into a death spiral.

Since the currency price change is a purely reflexive process, it also brings the following general characteristics to the blockchain industry:

- The bull-bear cycle will always accompany the blockchain market, and the conversion speed is faster than other financial markets.

- A good project in a bear market must be good in a bull market, because the rise of the overall currency price will promote the fundamentals, and the positive feedback will continue to increase.

- The project party can add some negative feedback factors to the currency price to slow down the reflexive process, but it cannot stop this trend.

- Defi projects develop the best in the bull market and fall the worst in the bear market, because the fundamentals of defi projects are almost supported by currency prices, so the fundamentals of currency prices rise and become better; the fundamentals of currency prices become worse when currency prices fall death spiral.

- Non-financial projects/projects with a large real use demand are relatively stable in the bear market, but because of the project’s currency issuance, the fundamentals will still be affected by the reflexive impact of the bull-bear market.

- Regarding the question of whether the currency circle is suitable for value investment: Although the fundamentals are greatly affected by the price, the basic factors that are good in the bull market may become unfavorable factors in the bear market; but in the same market environment, relative analysis of the fundamentals is definitely necessary. Of course, in the blockchain industry, data analysis becomes more important .

Reflexivity in UST unanchoring events

There are many similarities between the unanchoring incident of UST and the Thai baht being forced to abandon the fixed exchange rate during the Asian financial crisis in 1997. Soros, who believed in reflexivity, judged that the turning point of the cycle was approaching, and caused market panic by hoarding Thai baht + sudden selling, forcing Thailand to finally give up Fixed exchange rates plunged into a currency crisis. The following will use the reflexive theory to analyze the UST unanchored event from two dimensions before and during the event, hoping to give you some references for risk management before and during the event.

1. Factor analysis before the crisis (short time)

Before the Thai baht was short-sold, the basic factors became worse (excessively high interest rates, long-term current account deficits, and the economic cycle entered a trough), the basic factors were greatly affected by the exchange rate (the economy was completely open to the outside world, and the level of external debt was too high), mainstream bias Phenomena such as aggravation and skeptical emotions are also some omens of the turning point of the reflexive cycle. Based on this, a comparative analysis of the situation before UST unanchored:

The basic factors have deteriorated : the rate of return exceeds the market, and the real return on the chain has been searched. Anchor’s underlying real income sources are POS and lending income. If the real income < Anchor Rate (about 20%), it will be supplemented by bAsset reward & collateral liquidation fees on the chain. Since February this year, Anchor’s reserve The loss amounted to more than 300 million US dollars.

The basic factors are greatly affected by the currency price : Luna, as a chain currency, is related to the survival of the entire chain ecology. As the counterparty of UST, the price fluctuation of UST will be transmitted to Luna, so the anchoring of UST directly determines the development and income of the entire chain. As on-chain earnings are continuously subsidized to depositors, on-chain fundamentals depend almost entirely on currency prices.

Mainstream prejudice intensifies and suspicion emerges : mainstream prejudice is mainly due to the expectation that the project is too big to fail and the project is willing to take over (high degree of centralization), the illusion of over-collateralization based on the current luna price, and LFG's move to buy BTC; and the suspicion This is due to the perception of deteriorating fundamentals, fears of a bear market (sentiment itself is fragile), and fears that the reserve asset/stabilization structure will not be able to withstand a large-scale stampede. Price anchoring has been basically completely dependent on the confidence of the market. It can be seen that once the market panics, it will have a huge impact on unanchoring.

Ex ante risk management inspiration :

- The post-event result is one of the possibilities of all pre-existing expectations, so when we learn ex-ante cognition from the post-event result, we should not only pay attention to the explanatory nature of the post-event result but also pay attention to the difference between the post-event result and the various pre-existing expectations. I personally think that the role of doing more after-the-fact analysis is only to give people an intuition of a trend.

- The early warning factors of deteriorating fundamental factors, greater influence of fundamental factors on prices, and aggravated mainstream prejudice and skepticism may last for a long time, or may usher in an inflection point immediately. As a market participant, setting several early warning lines to do risk management beforehand can avoid large-scale losses.

2. Analysis of the death spiral process (short selling method)

When the Thai baht is being shorted, the attacker first borrows the Thai baht through various channels, then sells it in the market to depreciate the Thai baht, and then buys the Thai baht with foreign currencies such as US dollars and returns it. Since the attack weapon is a forward contract (with leverage), it is more powerful. Initially, in the face of attacks, the Bank of Thailand kept using the US dollars and other foreign exchange in its hands to recover the Thai baht thrown out of the market to keep the price stable. However, the Thai market is highly open and foreign exchange is used for a lot, so it cannot be consumed too much on attackers . Therefore, the Bank of Thailand launched two major measures. The first measure is to increase the overnight interbank lending rate to 1000% and increase the cost of overnight funds. The second measure is to cut off the flow of Thai baht to overseas attackers, and require banks to submit real transaction certificates when transferring Thai baht out of the country. However, the attackers had sufficient ammunition and continued to increase market panic. In the end, the Bank of Thailand was forced to announce the change of the fixed exchange rate system to a floating exchange rate system. The exchange rate quickly fell from 25:1 to 30:1 or even lower.

According to nansen’s on-chain data analysis, the UST unanchoring event was mainly due to the market panic caused by the withdrawal of some giant whales. Some giant whales have already started to withdraw UST from Anchor in April, cross-chain to Ethereum through Wormhole and deposit it into Curve, and then exchange it for other stablecoins through UST-3pool. As early as May 7, LFG had started to buy a large amount of UST on Curve to fight against giant whales. Until May 9, due to the huge amount of selling (several hundreds of millions of dollars), the decoupling of UST caused panic; LFG sold 1.4 billion US dollars of BTC to take over the order, and the entire market fell into a greater panic because of concerns about the decline of BTC. On the morning of May 10th, Jump Trading and LFG stopped selling their Bitcoin reserves, allowing things to escalate. On May 12, LUNA was delisted from all major exchanges, and the price dropped from more than $60 to less than a tenth of a cent.

Inspiration for risk management in the event :

- The short selling of Thai baht and UST is accompanied by competition between the market and centralized organizations. Due to the large number of retail investors in the currency circle, the reaction is slow, so there will be a certain amount of time for the participants to react from the beginning to the end of the competition. In general, when the competition begins, it is basically a signal of the turning point of the cycle. No matter what the outcome is, the trend of continuous self-strengthening will definitely be damaged.

Encrypted assets should be the most reflexive of all assets, which also means that currency prices contain the most human emotions and are the most unpredictable. In other words, the influence of human cognition (conformity or inconsistency with facts) on real results is the greatest in the blockchain industry. Of course, if perfect cognition can be achieved, there will be no room for imagination. After all, to some extent, the world we live in is our imagination.

reference

- "Financial Alchemy" - George Soros

- https://www.szse.cn/aboutus/research/secuities/documents/t20040106_531381.html

- https://www.nansen.ai/research/on-chain-forensics-demystifying-terrausd-de-peg

Brian

Brian

Brian

Brian Huang Bo

Huang Bo JinseFinance

JinseFinance Coinlive

Coinlive

Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist 链向资讯

链向资讯 Cointelegraph

Cointelegraph