The highly anticipated Arbitrum Nitro network upgrade was finally completed last week, increasing throughput and reducing gas costs for users.

While it's been less than a week since the upgrade was completed, the Nitro is already paying dividends.

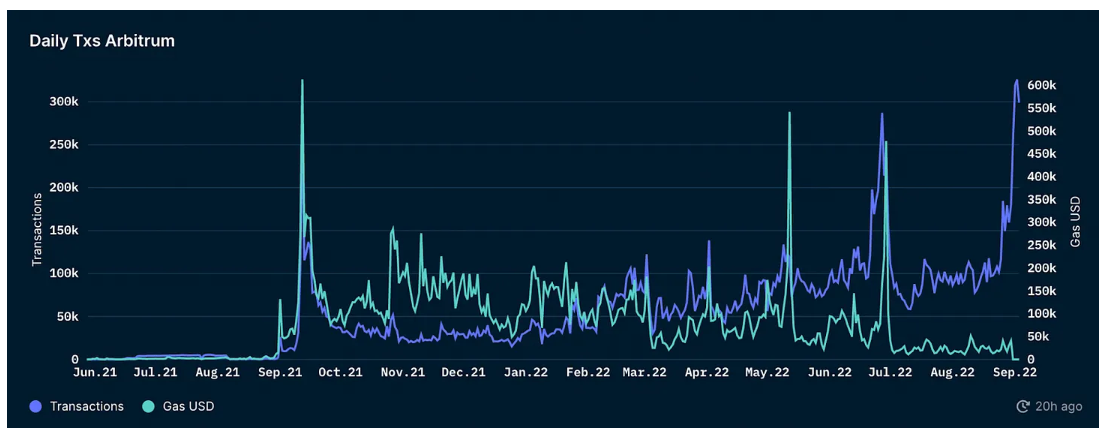

In the 5 days after the upgrade, the total number of transactions on Arbitrum increased by 79.2% compared to the previous 5 days, while the cumulative total gas consumed by the rollup decreased by 47.8% during this period.

In other words, Arbitrum, and Ethereum, are scaling.

Source of Arbitrum’s daily transaction volume and total gas volume: Nansen

Increased transaction volume, and the imminent resumption of the Arbitrum Odyssey (and potential token launch) could fuel further growth for the rollup’s DeFi ecosystem, which has managed to attract close to $1 billion in locked value at L1 or L2 ranked seventh.

In last week's " How to Dig Deeper into the Arbitrum Ecosystem " we covered a number of large protocols promoting organic usage, but there are plenty of other exciting (and smaller) projects based on Arbitrum that will turn L2 into an an innovation center.

Here are a few items I'm following:

1. Vesta Finance

Vesta is a lending protocol. Forked from Liquity , Vesta allows users to stake a variety of decentralized assets, including popular Arbitrum-based tokens such as GMX and DPX, minting stablecoins with 0% interest.

The protocol currently has over $22.6 million in deposits, while the circulating supply of VST is $7.4 million!

Governed by the VSTA token, the project has a market capitalization (MC) of $5.8 million and a fully diluted valuation (FDV) of $77.9 million.

2.Umami Finance

Umami, “Yearn on Arbitrum,” is developing a vault that will earn non-emissions-based yields from Arbitrum-based DeFi protocols like GMX’s GLP. While Umami recently deprecated their V1 vault, which provided depositors with delta neutral (zero overall delta risk) exposure to GLP, the DAO still plans to release V2 later in Q4 2022.

Umami has promoted the trend of paying part of the product and treasury farming revenue share to token holders in ETH, and the Umami treasury currently has a yield of 9%.

UMAMI tokens currently have a market cap of $13.4 million and a fully diluted valuation of $21.2 million.

3. Premia

Premia is an options protocol.

Premia leverages AMMs where users can buy put or call options, and liquidity providers can earn a premium by underwriting these options. Unlike well-known options agreements such as Dopex and Lyra, Premia is unique in that it uses American-style options, that is, options that can be exercised at any time before the expiration date.

The protocol has attracted $7 million in TVL and is governed by the PREMIA token, which currently has a market cap of $14.2 million and a fully diluted valuation of $134.2 million.

4. Y2K Finance

Y2K is a protocol for pricing risk for pegged assets .

The project is developing a series of products that allow users to speculate on whether an asset will be unpegged, or to hedge its exposure. Y2K is also developing a pegged asset lending marketplace, as well as an RFQ order book where users can easily trade between the platform’s different vault tokens.

While an exact date has yet to be confirmed, Y2K is likely to launch sometime within the next few weeks. There are currently no Y2K tokens, although token holders will eventually be able to receive a cut of protocol revenue and vote on emissions from different vaults.

5. Rage Trade

Rage Trade is a perpetual contract exchange.

The goal of the exchange is to build the most liquid ETH perpetual contract through 80-20 treasuries, that is, to make money by transferring 80% of deposits to external agreements, while using the remaining 20% as liquidity for traders , to increase the return on LP. Rage Trade also plans to integrate Layer 0, enabling 80/20 vaults to benefit from any L1 or L2.

Rage Trade’s 80/20 Tri-Crypto Vault is currently live on the testnet, and the protocol plans to launch their mainnet vault on September 7th.

Arbitrum Odyssey

As we can see, there are many exciting and innovative projects on Arbitrum in various fields, and (as paid subscribers will see in this week's trending projects) many others that we didn't touch.

With the advent of Nitro and the arrival of Odyssey, this L2 will grow significantly in the coming months while being a prime example of how Ethereum can and is scaling with L2.

JinseFinance

JinseFinance