Author: tedtalksmacro

Source: tedtalksmacro's twitter

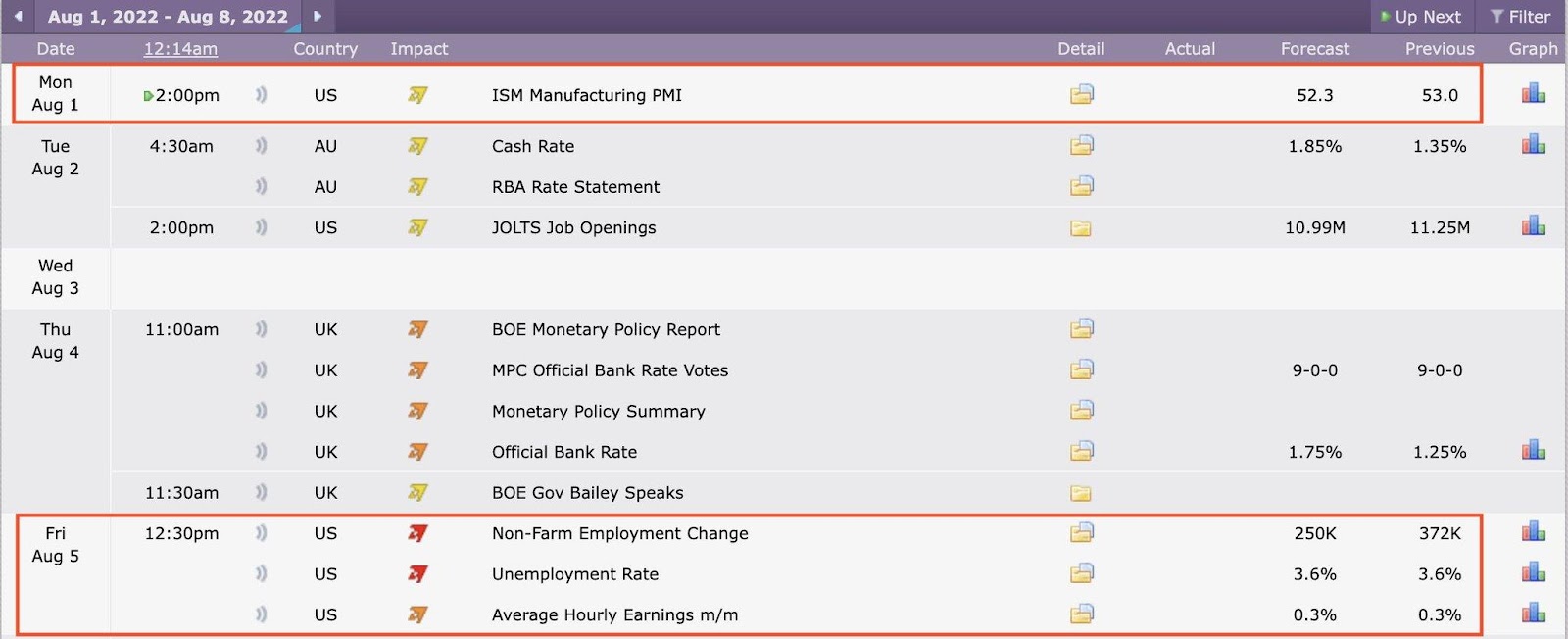

Some key data affecting Bitcoin this week:

1. ISM Manufacturing Purchasing Managers Index (released on Monday)

2. U.S. employment data for July (released on Friday)

The Fed said last week that they are now "totally dependent on the data." This article will help you understand what factors affect asset prices and why.

The ISM Manufacturing Index is a key indicator of U.S. economic performance. It has multiple components, including two areas that have a significant impact on the Fed's monetary policy stance:

1. Employment

2. Stable prices or prices in general

The index has trended lower recently - a sign of declining economic activity, and is expected to decline again in July. Although a reading of >50 usually indicates that the industry is expanding, there is no reason to be concerned.

A reading below 50 indicates that manufacturing is contracting.

The Fed wants to see the price component of the ISM index decline as part of its mandate to "stabilize prices."

If there is a lower price component in the index, Bitcoin could rise, possibly even on weaker-than-expected PMI numbers – bad news is good news.

On the other hand, if there is a higher price composition, or a larger than expected index, expect the price of Bitcoin and risk assets to fall - as it will show that the Fed is not doing enough!

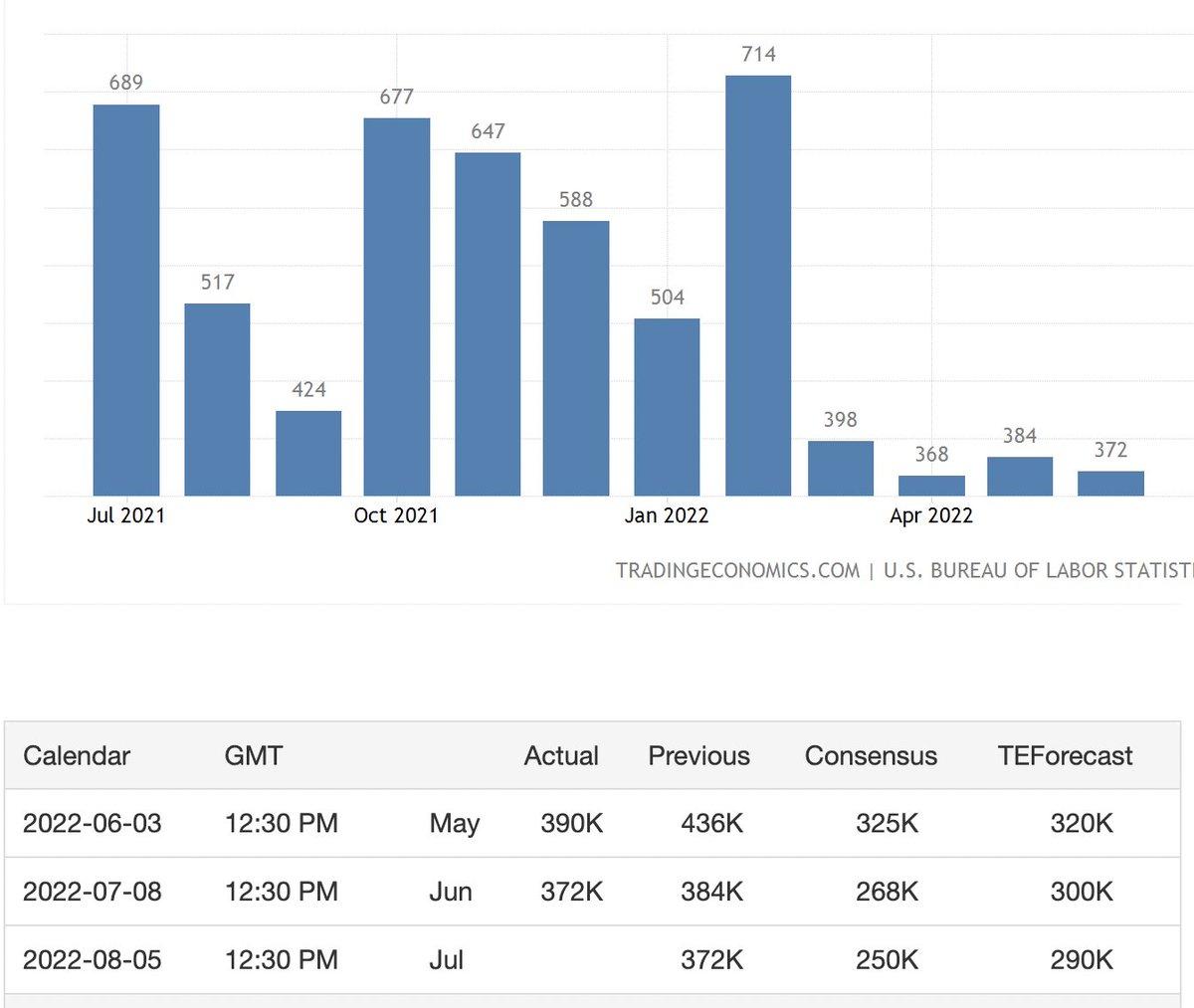

For the second part of the Fed's "maximum employment" mission, Friday's U.S. employment data will be very important.

The fact that the Fed isn't worried about any deterioration in the labor market right now would, in itself, push the Fed to tighten policy more aggressively -- until it does.

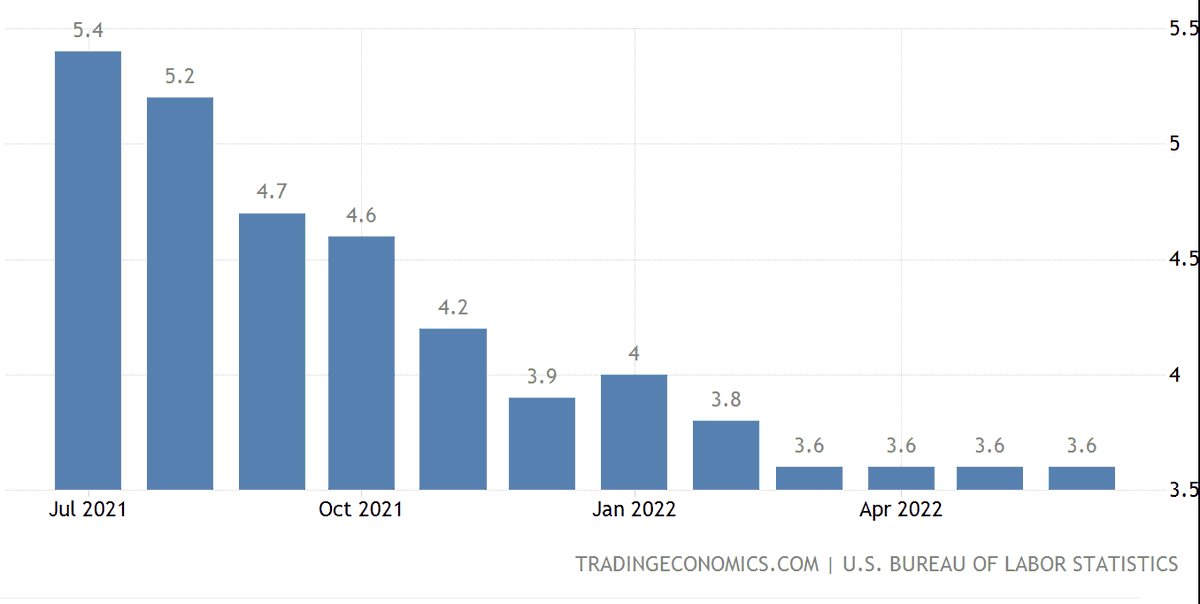

Unemployment has remained stable, a satisfactory part of the Fed's mandate -- despite deteriorating inflation.

Even though the economy is slowing, the U.S. economy continues to add jobs.

If the job market deteriorates, the Fed could panic because neither mandate has been accomplished.

Failure to meet either of its mandates would force the Fed to pivot in a new direction, which could boost risk assets in the longer term.

As such, a higher reading in Friday’s jobs data is expected to be negative for Bitcoin and risk assets, while a lower-than-expected reading would push Bitcoin prices higher in the short-term.

Brian

Brian