Author: Avalon Finance, Pell Network, BitCow, & More Source: Revelo Intel Translation: Shan Ouba, Golden Finance

In recent weeks and months, Bitcoin's status as an asset has declined. . Market participants have been waiting for the market leader to break a new all-time high (ATH), but as of the second quarter of 2024, this goal has not yet been achieved. Competition in the Bitcoin L2 field is heating up, and Starknet has announced that it will launch its own Bitcoin L2, named Catnet. The plan involves creating a custom testnet that enables OP_CAT; this is an opcode that would have allowed Bitcoin to support smart contracts from the beginning if it had not been removed early in BTC development. Now, Babylon, a project that provides Bitcoin staking and staking services, is gaining more attention. The protocol is currently in the testnet stage and recently raised about $70 million from investors such as Paradigm.

Nevertheless, Bitlayer has attracted a lot of liquidity and users through its unique BitVM implementation method. Regardless of BTC's price trend, the growth of the Bitcoin ecosystem continues to expand, and Bitlayer has played a leading role in this process. Bitlayer has shown considerable growth since we first reported on this emerging protocol a few weeks ago. The team just presented at GM Vietnam Blockchain Week and will be appearing at EthCC next month, actively promoting their work and the BitVM theory. Bitlayer’s median gas fee is currently quoted at $0.4, and the protocol’s total value locked (TVL) has almost tripled to around $354 million. This puts the protocol in second place among Bitcoin chains ranked by TVL. Bitlayer is second only to Merlin chain, which has significantly more than doubled its TVL in a single day last month. The Bitlayer ecosystem has grown to over 100 dApps.

Bitlayer has only been online for a few weeks and has already shown some impressive growth. The chain has surpassed 1 million transactions, with activity peaking in sync with BTC price. In our last issue, we gave users a brief introduction to the Ready Player One airdrop event, a $50 million developer and protocol team event, with $20 million earmarked for the leaderboard competition. Since then, Bitlayer has implemented a new $23 million Mining Gala event, which ended earlier this week. In today’s edition, we’ll break down some of the key partner projects participating in the event, which make up the majority of Bitlayer’s total TVL, user base, and activity.

Avalon Finance

Avalon bills itself as the first “CeDeFi” lending market. The protocol has over $120 million in TVL on Bitlayer, and its native tokens AVAF and esAVAF can be staked to earn protocol revenue and esAVAF rewards. Modular Protocol’s main product on Bitlayer is its overcollateralized lending market, which allows users to deposit into segregated pools to be used as collateral for borrowing. Both primary and secondary tokens can be deposited, but only BTC can currently be used as collateral for borrowing. Currently, there is nearly $86 million in WBTC on loan, with total deposits of about $180 million. Deposits earn a 2x points multiplier, while borrowing earns 6x points. As a result, the maximum borrowing cap of 1,300 WBTC is almost full, with a utilization rate of about 43% of the used funds. Borrowers can take advantage of up to 60% loan-to-value ratios (LTVs), 85% liquidation ratios, and 10% liquidation penalties. Users can track their points accumulation on the project’s comprehensive leaderboard.

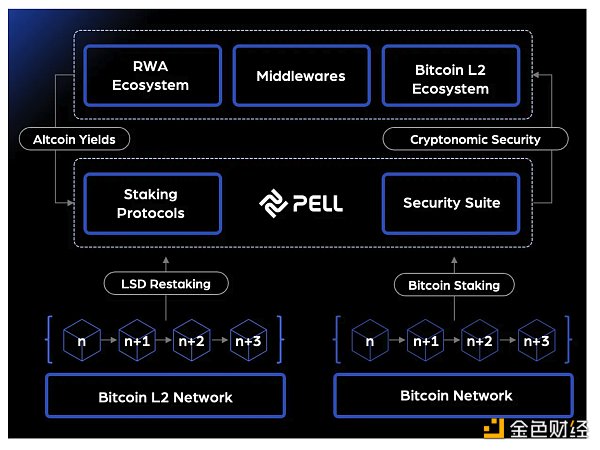

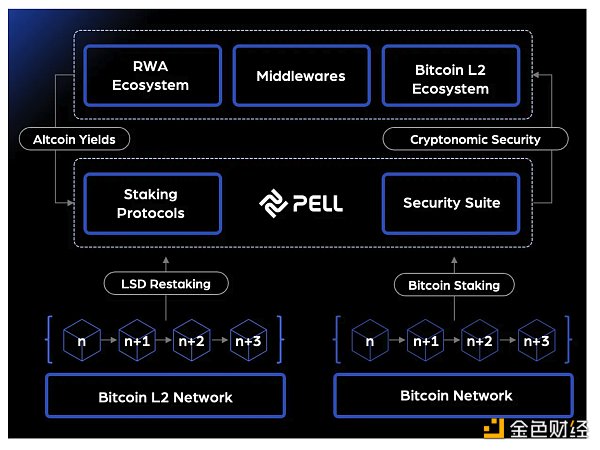

Pell Network

Pell Network has a TVL of approximately $95 million on Bitlayer. Pell Network provides a range of services to the emerging BTC L2 market, including network security features, blockchain operating infrastructure, and yield enhancement. Pell Network is also involved in BTC re-staking, aiming to diversify Bitcoin L2 yields and enhance the security of these chains in the process.

On Bitlayer, users can "re-stake" various assets to earn an additional 15% Pell points reward. In addition to WBTC, the protocol also allows the deposit of various BTC LSDs, of which stBTC accounts for the majority of Bitlayer's TVL. Users can earn additional points by using the protocol for the first time, extending the deposit period, and some basic social interaction tasks.

On Bitlayer, users can "re-stake" various assets to earn an additional 15% Pell points reward. In addition to WBTC, the protocol also allows the deposit of various BTC LSDs, of which stBTC accounts for the majority of Bitlayer's TVL. Users can earn additional points by using the protocol for the first time, extending the deposit period, and some basic social interaction tasks.

In the background, Pell Network essentially aggregates Bitcoin native staking returns and LSD returns, creating a network where stakers can choose to validate newly built modules in the ecosystem.

BitCow

BitCow is the third largest protocol on Bitlayer by TVL, at around $35 million. BitCow acts as an AMM that provides stable exchange and centralized liquidity services. The protocol specializes in serving the expanding Bitcoin L2 ecosystem. In its v1 version, BitCow provides stable exchange services for stablecoins and LSD assets while keeping gas usage to a minimum and maximizing capital efficiency. The equilibrium price will also adjust over time to accommodate the gradually increasing value of LSD assets.

BitCow's v2 version focuses on centralized liquidity for volatility pair trading. Features include automatic pricing, 0 IL, and transparent profit and loss information. Automatic pricing is achieved through the use of external oracles, making it unnecessary for centralized liquidity to manage price ranges. All liquidity for a given asset is automatically concentrated around the price determined by the oracle. This compromise allows LPs to earn higher returns while eliminating the need for LP management agreements and the complexity associated with centralized liquidity.

In its v2 version, BitCow also adopts a dual-token LP solution, one pair represents the volatility asset in the pair, and the other represents the stablecoin in the pair. This entitles volatility token LP holders to the rights and interests of their assets when they appreciate or depreciate. Instead, stablecoin LP holders will remain market neutral and receive trading income from the pair. In addition, the protocol's Trumeme feature allows users to create their own meme coins on the testnet and provide initial liquidity.

JinseFinance

JinseFinance

On Bitlayer, users can "re-stake" various assets to earn an additional 15% Pell points reward. In addition to WBTC, the protocol also allows the deposit of various BTC LSDs, of which stBTC accounts for the majority of Bitlayer's TVL. Users can earn additional points by using the protocol for the first time, extending the deposit period, and some basic social interaction tasks.

On Bitlayer, users can "re-stake" various assets to earn an additional 15% Pell points reward. In addition to WBTC, the protocol also allows the deposit of various BTC LSDs, of which stBTC accounts for the majority of Bitlayer's TVL. Users can earn additional points by using the protocol for the first time, extending the deposit period, and some basic social interaction tasks.