Author: Chorus One Source: Chorus One Official Website Translation: Shan Ouba, Golden Finance

Dive into TON's staking mechanism and introduce the what, why and how of staking TON.

Introduction to TON Staking

TON utilizes the Proof of Stake (PoS) consensus algorithm, a system in which validators are responsible for proposing and validating new transaction blocks. In TON's PoS model, validators are selected through a competitive election process to ensure the highest level of security and performance.

Election and Verification Process

The election process is at the heart of TON staking. In each consensus round, potential validators submit their application along with their stake and other parameters, which determines the level of maintenance they are willing to perform. The electorate governance contract evaluates these applications and selects validators based on their stake and parameters, aiming to maximize the overall stake of the network.

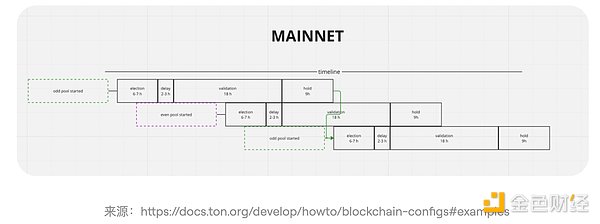

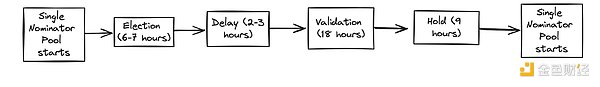

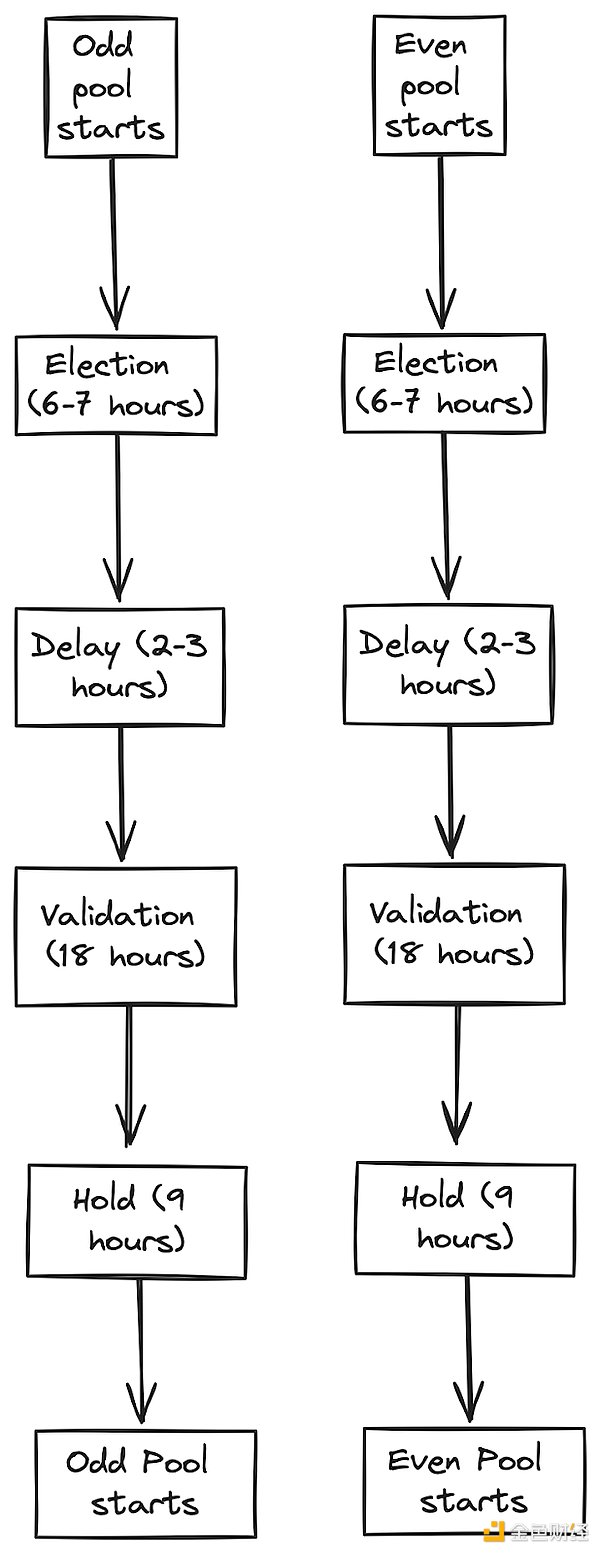

Once selected, a validator will enter a validation cycle, as shown in the timeline diagram below:

Key phases of the validation cycle:

Election (6-7 hours): Candidates apply to become validators.

Delay (2-3 hours): A short waiting period before validation begins.

Validation (18 hours): Validators approve transactions and propose new blocks.

Holding (9 hours): Validators prepare for the next cycle.

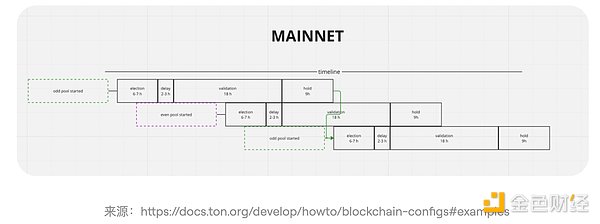

To ensure the continuous operation of the network, TON adopts two types of pools (odd pools and even pools) that run in alternating cycles to provide uninterrupted and seamless validation.

Minimum Stake

To be eligible to participate in the validator election process, validators need to stake at least

300,000 TON. Validators stake Toncoin for a fixed specific period, and the staked amount is refunded together with interest after the validation round ends.

Validator Rewards

Every transaction on TON requires the payment of computational fees (called gas) for network storage and on-chain transaction processing. On TON, as on most blockchain networks, these fees are accumulated in the electorate contract in a reward pool. 50% of the fees paid by users are destroyed and 50% are distributed to validators.

The network also subsidizes block creation by adding a subsidy to the reward pool, with each block in the main chain (called the master chain) receiving a reward equivalent to 1.7 TON. TON's architecture allows for the creation of parallel chains (called work chains). For work chain blocks, the reward is set at 1 TON per block. The network has an inflation rate of approximately 0.3-0.6% per year.

How does TON staking work?

TON offers multiple staking mechanisms to suit different needs and preferences. Let’s explore these options:

1. Nomination Pool

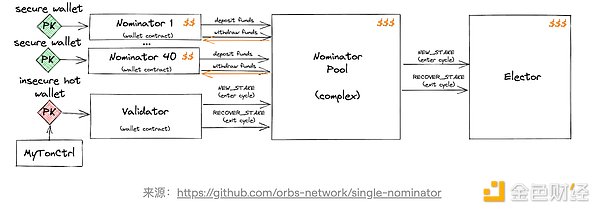

The Nominator Pool is the core of the TON staking ecosystem, providing a collaborative staking method that allows multiple users to pool their Toncoin (TON) tokens and jointly participate in the validation process of the network. This pooling mechanism is designed to democratize staking, allowing a wider range of participants to participate, even if they may not have enough tokens to meet the minimum staking requirements individually.

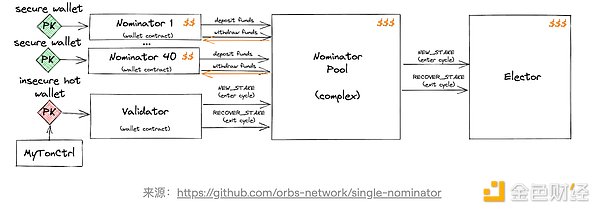

The Nomination Pool allows up to 40 nominators (stakers) to combine their staking power and delegate it to a validator such as Chorus One. This collective staking method not only helps meet the high minimum staking threshold, but also ensures that the network remains secure and robust by leveraging the combined resources of multiple stakeholders.

How the nomination pool works:

Nominators join the pool by staking at least 10,000 TON tokens.

The pool collectively stakes the combined tokens through validators. Operators who manage validators must stake at least 1,000 TON tokens, which is used to prevent bad behavior.

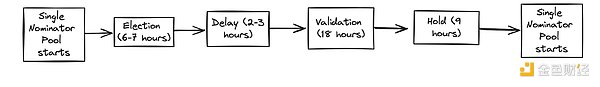

Election process begins: The election phase lasts 6 to 7 hours, and the pool's validators submit their validation applications, along with the combined stake of all nominees.

Delay period: After the election, there is a 2 to 3 hour delay before the validation phase begins.

Validation cycle: Validators then participate in 18-hour validation cycles, during which they propose and validate new blocks of transactions.

Reward distribution: At the end of each validation cycle, the rewards earned are distributed among the nominees in proportion to their stake in the pool.

In order to receive rewards, nominees need to send a transaction of 1 TON to the pool with a specific comment, which will trigger the return of their entire stake and the rewards earned.

Withdrawals: Nominators can withdraw their entire stake and rewards in a single transaction. This mechanism does not support partial withdrawals, so funds must be fully withdrawn when receiving rewards.

To intuitively understand the workflow of the nominator pool, consider the following diagram:

This workflow ensures continuous network validation, with odd and even pools alternating validation cycles to maintain the seamless operation and security of the TON blockchain.

Pros and Cons of Nomination Pools

Pros:

Relatively easy to set up and supported by validators such as Chorus One

Allows multiple nominators to pool their resources, making it easier to meet staking thresholds.

Automatically handles proportional reward distribution.

Cons:

Minimum staking requirement may exclude investors with less than 10,000 TON staked.

Only full withdrawals are allowed, which may be limiting for nominators who need partial access to their funds.

Using hot wallets to pay operating expenses poses potential security risks.

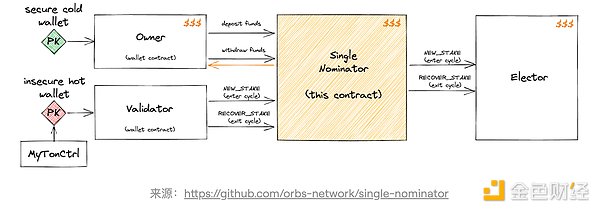

2. Single Nomination Pool

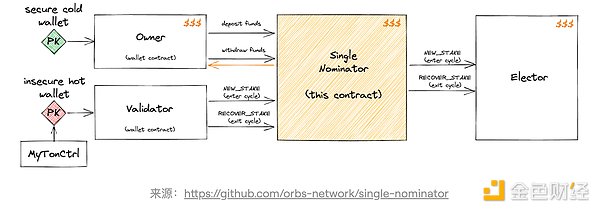

The single nomination pool is a streamlined and secure staking mechanism in the TON ecosystem, designed for validators (also known as solo stakers) who have enough TON for independent staking. This approach reduces complexity and enhances security by focusing on a single nominee, making it ideal for those who prefer a more straightforward staking process.

The single nomination pool allows a single entity to manage the staking process, providing a simplified and secure framework for validators. By eliminating the need for multiple nominees, this mechanism significantly reduces the attack surface and makes it easier to protect staked assets.

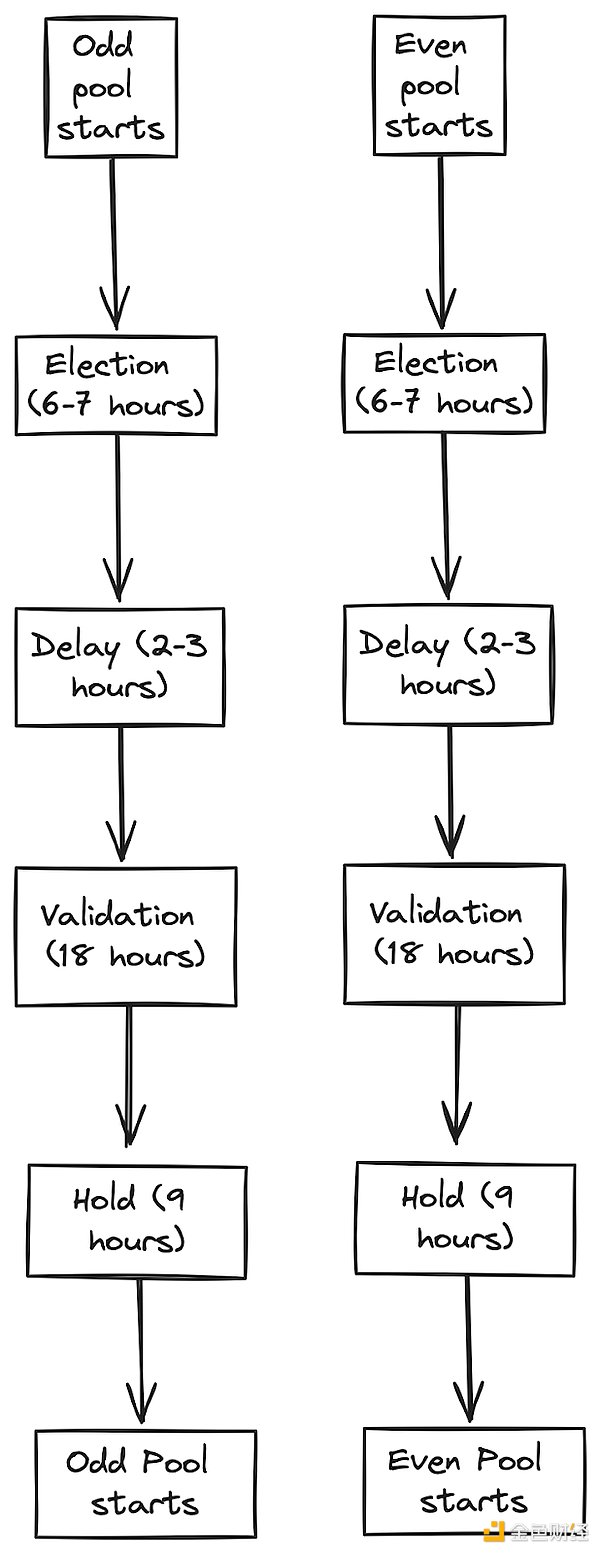

How a Single Nomination Pool Works

Single nomination pools are deployed by validators such as Chorus One.

Only one nominator (who is also the pool owner) stakes their TON tokens. A single nominator can stake any amount of TON as long as they meet the protocol minimum requirements (currently 300,000 TON tokens).

Nominators submit their stake to apply for validation during the election period (6-7 hours).

After the election, there will be a 2-3 hour delay before the validation phase begins.

Validators participate in an 18-hour validation cycle to verify transactions and propose new blocks.

All rewards generated during the validation cycle will be directly issued to the individual nominator.

The mining pool uses cold wallets to store principal pledge funds, which greatly reduces the risk of theft.

Hot wallet operation: Validators use hot wallets to manage operating fees and ensure the security of cold wallets.

To illustrate the workflow of a single nomination pool, consider the following diagram:

This simplified workflow emphasizes the continuous cycle of election, delay, verification, and holding phases, ensuring the seamless operation and security of the TON blockchain.

Pros and Cons of a Single Nomination Pool

Pros:

Easy to deploy and manage a single nomination pool.

Reduces attack surface by using cold wallets to store principal.

Allows partial withdrawals, providing greater flexibility for nominators.

Cons:

Not suitable for groups holding fewer TON tokens or multiple nominators.

Rewards distribution between validators and nominators is not supported, and technical expertise of nominators is required to operate pools or off-chain payments.

All operations rely on a single nominator, which may limit shared or community-based staking.

Single-nominated pools provide a secure and efficient staking solution for individual validators, combining simplicity with enhanced security measures. By focusing on a single participant, this mechanism ensures that the staking process is simple and easy, making it an attractive option for those who want to stake TON independently.

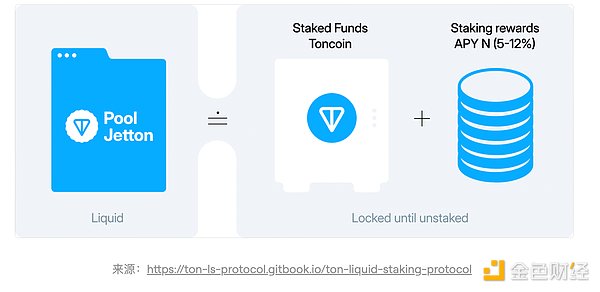

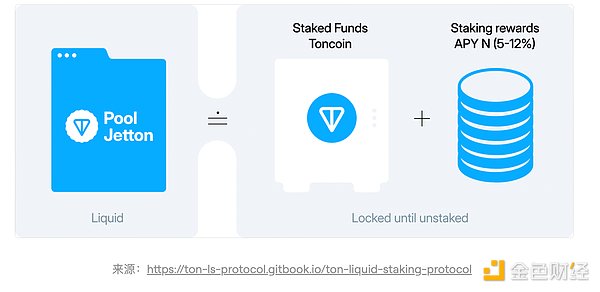

3. Liquidity Staking

The Liquidity Staking Protocol enables TON holders to participate in staking pools to lend funds to validators at a predetermined interest rate. In return, stakers will receive liquidity staking receipt tokens (called Pool Jettons), which represent their share in the pool. These tokens can be redeemed back to TON at any time, allowing stakers to maintain liquidity while earning rewards.

The protocol is user-agnostic and can accommodate users of all capital sizes without any minimum or maximum stake requirements.

How TON Liquid Staking Works

Users stake their TON in a pool managed by the Liquid Staking Contract.

After staking, users receive Pool Jettons, which are liquid staking receipt tokens that represent their share in the pool. These tokens ensure that users can maintain liquidity and withdraw their staked assets when needed.

The staked funds are loaned to validators, who use them to participate in the network validation process. Validators are selected based on staking and maintenance parameters during an election phase, followed by validation cycles.

During each 36-hour validation cycle, validators receive rewards, which are distributed proportionally to all participants in the pool.

Rewards come from the interest paid by validators who borrowed the staked funds. As rewards are distributed, the value of Pool Jettons increases, reflecting the increase in stake in the pool.

Users can deposit and withdraw assets at any time without any predefined restrictions, managed through dedicated smart contracts to ensure accurate accounting and security.

Pros and Cons of TON Liquid Staking

Pros:

User-agnostic design makes it suitable for all users, regardless of their stake size or technical expertise.

Allows partial or full withdrawals at any time, providing liquidity to stakeholders.

Disadvantages:

Deployment and management require greater effort due to the use of multiple smart contracts and DAOs.

Reliance on various smart contracts may increase the risk of vulnerabilities, so strict auditing and security measures are required.

The Liquid Staking Contract provides a versatile and powerful staking solution on the TON blockchain, combining the advantages of liquidity, decentralization, and accessibility. By understanding and utilizing this mechanism, users can participate in network validation more flexibly and securely, thereby contributing to the overall stability and development of the TON ecosystem.

Sanya

Sanya