Author: TPan Source: substack Translation: Shan Ouba, Golden Finance

In the past few weeks, I have heard about a new memecoin - Holdium. Yes, thanks to DJ Khaled for providing the buzzword that allows me to say that. Although most memecoins feel boring, a few of them do introduce new distribution, incentive and retention mechanisms that will gradually spread to other areas of the crypto ecosystem. I think Holdium is one of them.

How does Holdium work?

Created by Nigel Eccles, co-founder of FanDuel, one of the largest sports betting platforms in the United States

Holdium is a memecoin designed to reward holders, especially those who do not sell their airdrop allocations

The team pre-selected 30 different memecoins from the Solana ecosystem to determine which wallets are eligible for the airdrop

Holdium's airdrop allocation will be completed over 18 months, with airdrops occurring monthly

The first airdrop will take place on July 15th

In order to continue to be eligible for the monthly airdrop, holders may not sell or transfer their $HM

If you sell your tokens, your remaining airdrop allocation will be burned, and “we also have to make sure your wallet remembers how paper-thin you are”

What’s Unique About Holdium

Holdium is trying to solve one of the toughest problems in crypto: creating a large-scale, high-quality community, that is, pursuing both quantity and quality, as the saying goes, you can have your cake and eat it too.

Want a large number of users or holders? No problem. Start a points program, join a mission system, and preview upcoming airdrops.

Want to build a high-quality community? No problem. Building a community is done through unscalable efforts, high management, and time. But it’s almost impossible to do in the memecoin space.

I’ve simplified these complexities, but Holdium at least partially solves them.

Quantity: Free Airdrop

Who doesn’t love free airdrops? Over 120,000 wallets have signed up for Holdium, and the team will also airdrop 5% of the token supply to ~140,000 Solana Mobile Chapter 2 holders, which could bring the total number of wallets to over 200,000 by the time the airdrop occurs.

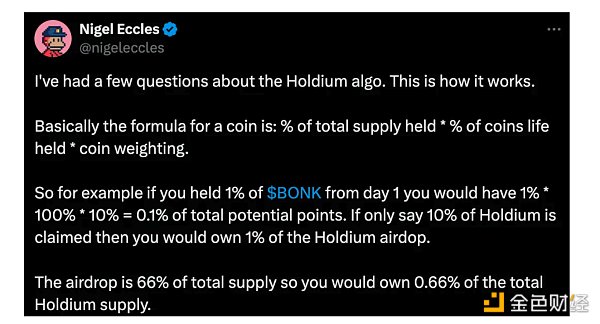

Quality: Allocation Based on Holding

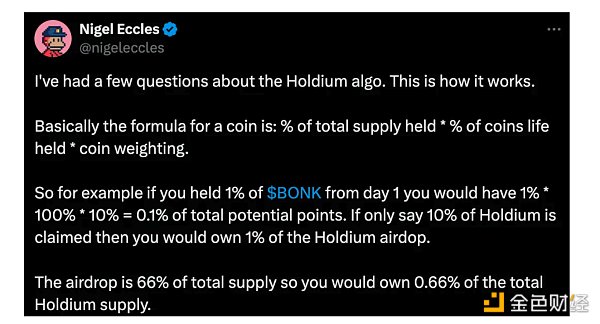

Airdrop allocations are proportional to the amount of memecoin held and how long they’ve been held. Nigel provides an example to illustrate how this works:

The definition of holding also extends to all eligible assets ever held, which means that if you have held eligible tokens in the past, you can also earn Holdium points.

The longer the holding period, the larger the Holdium airdrop amount, which can serve as a proxy for quality.

Game Theory

Holdium’s structure promotes incentives that have yet to be realized at scale in the memecoin space:

If I want to focus on maximizing my airdrop profits, should I sell immediately? Should I wait a few months before selling?

If I have multiple eligible wallets, should I register each wallet separately so that I can sell some of them while others can hold and continue to receive monthly airdrops?

“If you sell your quota early, not only will your remaining airdrops be burned, but we also have to make sure your wallet remembers how big of a paper hand you are…” What does this mean, and what are the criteria for becoming a paper hand?

“Stay on the nice list, keep at it! Who knows, we might have some surprises for the real diamond hands!” What does this mean, and what are the criteria for becoming a diamond hand?

I think a lot of people will overlook the last two points, but it’s worth noting what these “carrots and sticks” are, and how they influence behavior. This will be particularly interesting if Holdium’s market cap catches the attention of the wider field.

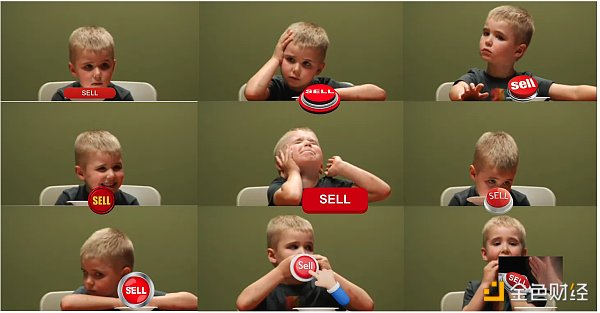

The Memecoin Marshmallow Experiment

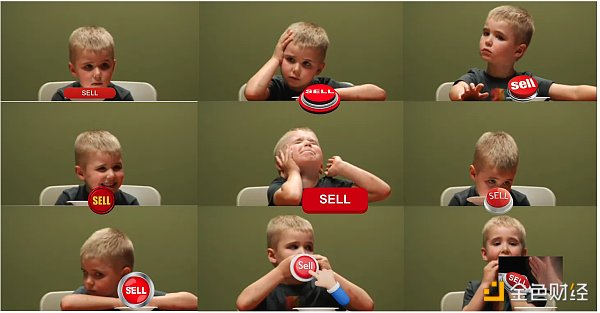

Holdium reminds me of the Stanford Marshmallow Experiment from the 70s, which I remember vividly from my Psychology 101 class in college.

TLDR:Psychologists brought kids into a room and put a snack in front of them. If they waited 15 minutes, they got a second snack. Children who can delay gratification tend to have better life outcomes.

I remember this experiment vividly because the video of the cute kids resisting temptation was memorable, and also because I knew if I participated in the study, I would succeed. I am the kind of person who is okay with delaying gratification, sometimes to an excessive degree.

Although future testing suggests that the results and conclusions are more nuanced than delayed gratification = success, this concept does open up a new area of exploration in motivation.

Marshmallow Experiment Extension: Holdium's 18-month Wait

Holdium is conducting a unique study that extends the original 15-minute marshmallow experiment to 18 months. The real world is much more complex than a closed environment, and blockchain technology can allow those who choose to wait (more accurately, hold tokens) to get more rewards. How do Holdium and other projects take advantage of this mechanism?

Inside Holdium

While the Holdium airdrop is a great opportunity to get free tokens, I think there may also be a cost depending on the actions taken and when they are taken.

The article mentioned earlier that "if you sell your share early, not only will your remaining airdrop share be destroyed, we will also ensure that your wallet remembers how 'paper-worthy' you are..." Does this mean that people who sell in the first month will receive a "scarlet letter" non-transferable token indicating that they are paper-worthy?

Will loyal holders receive the opposite "diamond badge"?

Outside Holdium

These mechanisms may have limited use in the Holdium ecosystem itself. However, if these “scarlet letters” or “diamond medals” can be used in other ecosystems, things get interesting, because these tokens can become potential factors for whitelisting, blacklisting, multipliers or penalties. Holdium holders can become “airdrop magnets” by “inaction”.

Speaking of “airdrop magnets”, Pudgy Penguins has become one of the most well-known airdrop magnets in the industry since I proposed the concept 6 months ago. Pudgy’s Discord server even has a helpful instruction that shows all the opportunities that holders can participate in, and it is still increasing.

These mechanisms have limited meaning in the Holdium ecosystem itself. However, if such scarlet or diamond letters are used in other ecosystems, things get interesting, because these tokens can become potential factors for whitelisting, blacklisting, multipliers or penalties. Holdium holders can become airdrop magnets by inaction.

Speaking of airdrop attractors, since I came up with the concept 6 months ago, Pudgy Penguins has become one of the most prominent airdrop attractors in the industry. The Pudgy Discord even has a helpful command that shows all opportunities for holders, and it keeps growing.

There is one interesting factor missing from the airdrop claims of Pudgy holders (and other eligible collectors according to the criteria), and that is exactly what Holdium is solving: time.

In these airdrops, each Pudgy Penguin receives the same amount of airdrops (if you hold more than one, you receive more, etc.). But what if someone buys a Pudgy Penguin just for the airdrops? There is no reward or penalty for holding time (which, in the grand scheme of things, isn’t a big deal). This suggests an opportunity to reward long-term holders, something we’ve seen in other ecosystems as well.

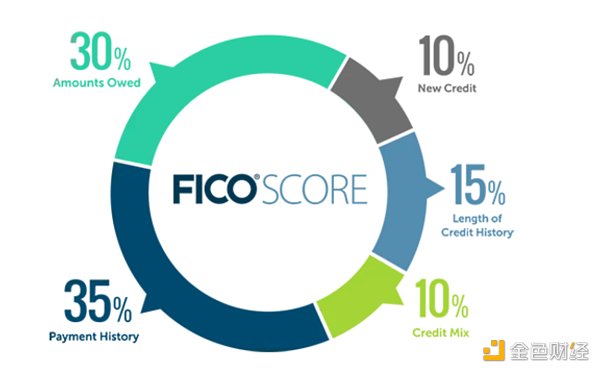

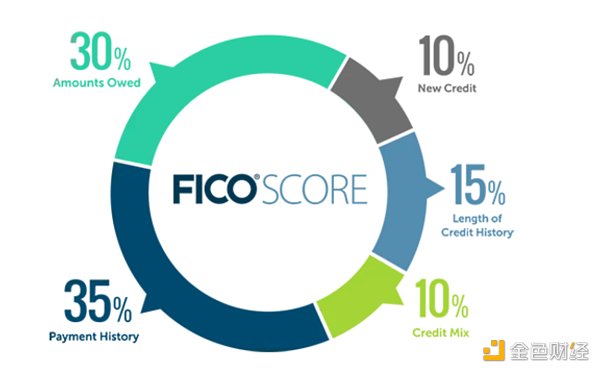

Another simple (and flawed) example of using time as a factor is credit scoring. While it’s not the most important factor, it helps determine creditworthiness.

Understanding who should be rewarded for taking (or not taking) actions will become more important over time. Tools and methods to help determine and standardize this will be an important resource in this space, and as crazy as it sounds, memecoin may indeed help.

JinseFinance

JinseFinance