Author: a16z Partner Chris Dixon, Source: Stanford Blockchain; Compiler: Deng Tong, Golden Finance

The Internet can be said to be one of the most important inventions of the post-war era, making modern life possible. Technology that makes many conveniences possible. Although it began as an open and non-profit network, today much of the Internet's value is monopolized by a small group of tech giants such as Google, Meta, and Amazon. We proposed the vision of blockchain as a new turning point in the evolution of the Internet.

In this article, we will explore some of the topics in Read Write Own, such as placing blockchain within the broader context of the history of the Internet and network economics, discussing "tokens" as The importance of a new digital primitive, exploring the relationship between “casino culture” and “computer culture” in the crypto space, and how blockchain is redefining the concept of digital ownership. In doing so, we will show that by returning value to users, creators, and entrepreneurs at the “edge” of the network, blockchain represents a technological breakthrough that redefines ownership dynamics and unlocks new possibilities for innovation.

(Golden Finance Note: In the book "Read Write Own", the author a16z partner Chris Dixon believes that cultivating creativity and entrepreneurship The dream of the open web is not necessarily dead and, in fact, can be saved by blockchain networks. He compares the movement that aims to provide a solid foundation for everything from social networks to artificial intelligence to virtual worlds to cryptocurrency speculation Separate—a distinction he calls “computers and casinos.”)

The Network Economy and the History of the Internet

To understand the technical and cultural importance of blockchain, we need to situate them within the broader internet in historical context. Fundamentally, what we call the "Internet" today is an intricate "network of networks" built from multiple layers of network protocol technologies, forming the "Internet Protocol Stack." This extends from basic network transport protocols such as IP, or Internet Protocol, to application layer network protocols such as SMTP (Simple Mail Transfer Protocol) for email or HTTP (Hypertext Transfer Protocol) for the World Wide Web, to Abstract social networks within specific applications, such as Facebook and X (formerly Twitter).

Much of the value of the Internet, such as our social networks, financial histories, and medical records, are recorded on these interlocking network structures. Therefore, to understand the modern Internet, we need to understand network design, because the way these networks are designed directly affects how money and power flows within networked systems.

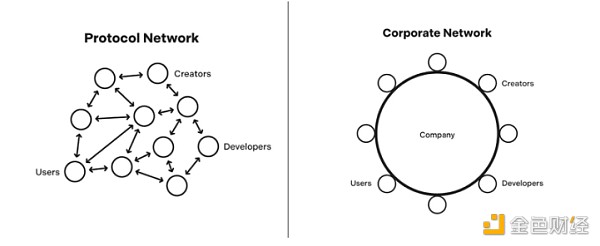

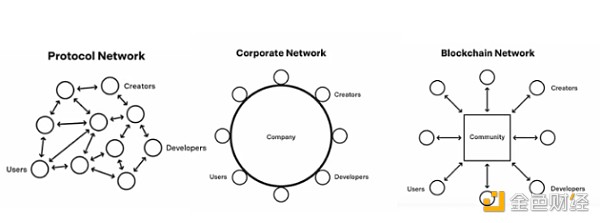

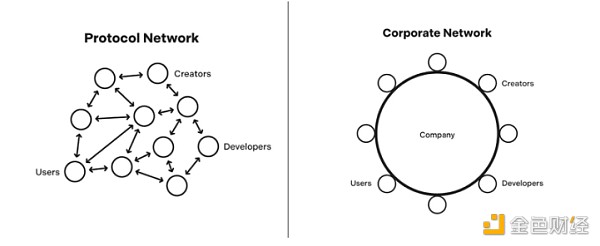

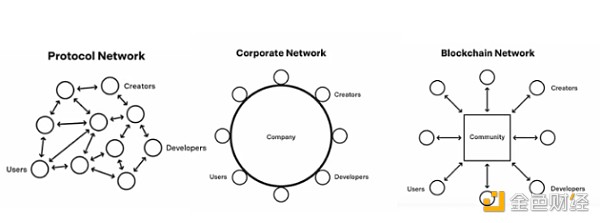

Before the emergence of blockchain technology, there were two main network economic designs: protocol networks and corporate networks.

The protocol network consists of a Group open source rule definitions describe how different participants in the network interact. Since the protocol is completely open source, any participant can easily launch an application using the code, and all value is accrued to the participants of the protocol, rather than charging any centralized entity exorbitant fees for network usage. Like all networks, the value of a protocol increases as more participants join the network. One of the most classic examples of a protocol network is the RSS (Really Simple Subscription) protocol, an open source web subscription format that allows users to subscribe to content from other users and websites they follow. This open source protocol is often used to subscribe to content such as blog entries, news headlines, and podcast episodes.

A corporate network, on the other hand, is a closed-source network, such as Facebook or Twitter, where one company designs, maintains, and distributes the network to advance its own corporate interests. While many of these corporate networks support APIs and an ecosystem of external developers and creators on their platforms, their interests are secondary to the core company's profit motive. As a result, many of these corporate networks have very high “extraction rates,” where the vast majority of the value accumulated by creators, developers, and other users on the network is owned by the platform rather than by the users themselves.

As the modern Internet matures, we have systematically seen closed corporate networks like Facebook or Twitter gradually outperform open protocol networks like RSS. For example, Twitter was actually built as an easy-to-use front end to support RSS, but gradually users began to rely solely on Twitter's platform and network and no longer used RSS. Eventually, Twitter completely supplanted RSS in popularity, and the company decided to end support for RSS subscriptions in 2013.

One of the core reasons why these corporate networks can utilize and replace these open protocol networks is that they have strong financial support and can well promote their own strategic interests. For example, platforms like Amazon, YouTube and Uber are happy to take initial losses to fund their growth and attract users to their platforms. On the other hand, many protocol networks lack systematic financial support for ongoing project development and maintenance due to their decentralized nature, and many developers maintain the network out of pure goodwill. As a result, these open protocol networks cannot compete with the “war chest” of corporate networks. All of this greatly undermines the original purpose of the Internet as an open, public space for sharing and advancing knowledge.

Tokens, computers and casinos

On the other hand, blockchain introduces a new form A network economy that combines the openness of protocol networks with funding mechanisms that enable them to compete with teams on corporate networks. This is achieved by introducing “tokens” as a new primitive that represents both a unit of ownership and a unit of value in blockchain applications.

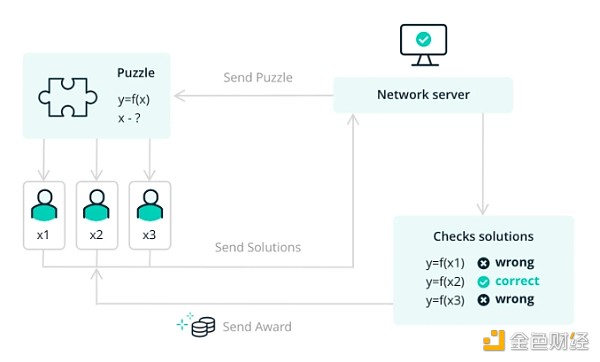

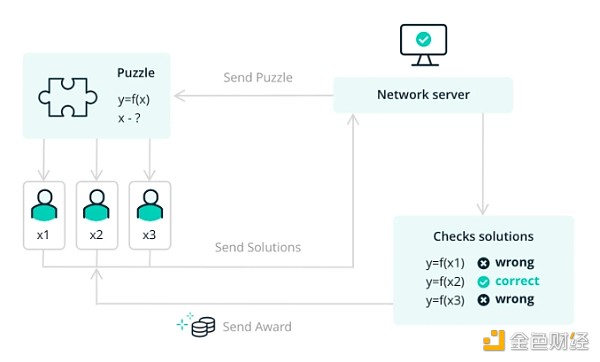

Take Bitcoin, for example, the oldest and most well-known blockchain project. The Bitcoin blockchain essentially acts as a massive, decentralized “ledger” (similar to an Excel spreadsheet) that permanently records all financial transactions on the network. This huge "ledger" is maintained and replicated by "miners" or "validators" on millions of computers around the world. These participants are rewarded through Bitcoin "tokens", which are determined by a process called "work." Proof of Work algorithm is determined. Basically, a Bitcoin “token” (BTC) is both a unit of value and a measure of ownership that incentivizes network participants to act in specific ways, such as maintaining financial ledgers via a “proof-of-work” algorithm.

The token provides A flexible framework that can coordinate behavior at scale - we can easily replace Bitcoin's "proof of work" reward algorithm with another algorithm in different applications. Ethereum, for example, uses a “proof-of-stake” algorithm to extend Bitcoin’s Excel-like decentralized ledger into a fully Turing-complete global computer. All of this has created a new discipline in the blockchain industry called “tokenomics,” which blends elements of computer science, economics, and game theory to design effective token rewards for blockchain applications system.

Unfortunately, in the cryptocurrency space, the concepts of “coins” and “tokens” tend to conjure up negative connotations, as well as stereotypes that paint cryptocurrencies as unregulated online casinos. While there are many examples of bad behavior in the blockchain space, such as Terra founder Do Kwon and FTX founder Sam Bankman-Fried taking advantage of the novelty of the industry to pursue fraudulent schemes, this exaggerated portrayal of the cryptocurrency space overshadows the industry real innovation and technological progress.

Roughly speaking, cryptocurrency can be divided into two different cultures: "computer culture" and "casino culture". "Computer Culture" represents developers, entrepreneurs, and visionaries who can place "cryptocurrency" in the context of the broader history of the Internet and understand the technical importance of blockchain in the long term. On the other hand, "casino culture" is more focused on short-term gains and profiting from price fluctuations.

We hope that through more regulatory and legal clarity it will be possible to mitigate the short-sighted and harmful effects of “casino culture”. A potential solution could be to take full advantage of locking schedules and time frames, locking tokens for a specific period of time through technical means (such as staking) or traditional legal means (such as contracts). This could prompt the field to think more about long-term issues, promoting blockchain technology as a force for social good.

Reinventing Digital Ownership

The key to promoting a healthy, vibrant culture in the blockchain industry is leveraging crypto The power of "computer culture" in monetary movements. Fundamentally, tokens give blockchain the ability to redefine the concept of ownership on digital networks. For many blockchain projects, like Bitcoin and Ethereum, no single person or company “owns” the network, because whoever owns the network’s tokens, like ETH or BTC, is the owner of the network, and all of the code for the protocol — such as the algorithms that determine token reward distribution — are all open source.

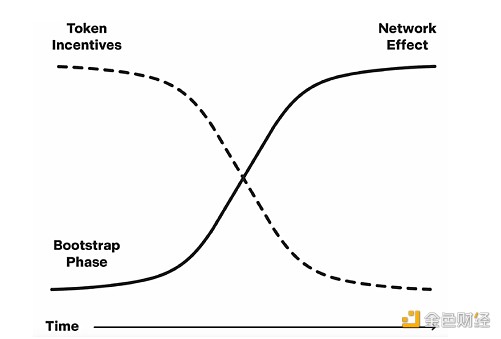

Therefore, blockchain is the natural successor to the open and collaborative spirit of protocol networks. At the same time, because tokens such as ETH and BTC represent units of value that can be exchanged for real money, participants on the blockchain network are also able to fund the development and maintenance of projects to compete with corporate networks.

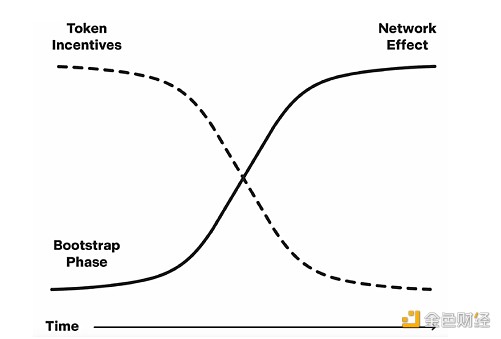

Currently, we have Sees the potential to use “tokens” and other blockchain technologies as a force for social good and give back to the community. For example, Helium enables communities overlooked by traditional Internet service providers to gain Internet access by rewarding users with HNT tokens for setting up wireless hotspot hubs that provide wireless connectivity. By cleverly leveraging token incentives, Helium is able to bootstrap a network of interconnected hotspot hubs to enjoy network effects. This is a classic example of how a token allows smaller companies to overcome the traditional “cold start problem” and disrupt larger existing companies, such as traditional Internet service providers. As the project matures, users holding HNT tokens will also be able to actively participate in the governance of the protocol, giving these early adopters a say in the future direction of the project.

Therefore, blockchain structurally redefines the concept of digital ownership, redistributing the profits of the network to the users and communities that originally created this value. By creating a novel incentive structure for network participants on an open protocol, blockchain breaks the "winner-take-all" model of "corporate networks" and restores the Internet to its original free, decentralized and democratic nature. values.

Blockchain The Future

Today, we are at a turning point in the crypto space. Over the past few years, blockchain infrastructure and technology have seen systematic improvements in many aspects, such as advances in zero-knowledge proofs, modular blockchains, and interoperability solutions. Just as fundamental improvements in GPUs paved the way for ChatGPT’s “killer app,” we believe blockchain infrastructure may soon be able to drive the emergence of a “killer app” in the crypto space that will be more important than ever before. Widespread adoption is similar to the "iPhone moment" in its importance.

As the crypto industry enters a new chapter after the collapse of the past year and a half, we look forward to seeing the various new blockchain projects that may emerge, such as novel social networks, games, and The Metaverse, open source financial infrastructure, and a new AI-centric creator economy driving the next phase of the internet.

Ultimately, blockchain today represents the cutting edge of computing, just like the Internet did in the 1990s. Unlike other cutting-edge technologies such as AI and VR/AR, which primarily enable and benefit the hegemony of big tech companies, crypto represents a truly disruptive force that redistributes value to the edges of the network and empowers its creators , users and participants truly become the owners of the protocol and establish a new "read, write, own" economy in the digital field.

XingChi

XingChi