Follow A16Z into the "AI Brain" era

A16Z, Artificial Intelligence, Follow A16Z into the "AI Brain" Era Golden Finance, Discuss VANA's DataDAO Solution

JinseFinance

JinseFinance

Original title: The DUNA: An Oasis For DAOs

Author: Miles Jennings, David Kerr

Each Anyone active in web3 has heard of the word "DAO", which is the abbreviation of Decentralized Autonomous Organization. The DAO is a key tool to keep the blockchain network open and has been working hard to become the benchmark for web3, but there is a topic that cannot be avoided, and that is law and regulation.

This week, Wyoming passed a new bill that would bring DAOs into the scope of legal entities. This will enable blockchain networks to operate within the confines of applicable laws without compromising their decentralized properties. This is a major breakthrough as it will provide much-needed protection to DAOs and give them the ability to keep blockchain networks open.

Wyoming has a long history of supporting innovative legal entity structures. The state was the first to adopt the limited liability company (LLC), the first to adopt the unincorporated nonprofit organization (UNA), and the first to introduce a subset of its LLC statute for use by DAOs. The new Wyoming law incorporates many of the provisions proposed in the model legislation we released.

This new entity structure is likely to become the industry standard for blockchain networks created in the United States. So, here’s everything you need to know about Wyoming’s Decentralized Unincorporated Nonprofit (DUNA).

On March 7, 2024, SF50, the "Wyoming Decentralized Unincorporated Nonprofit Association Act" was signed and officially became law , effective date is July 1, 2024. The bill is closely related to Wyoming’s existing Unincorporated Nonprofit Association Act, but it is specifically crafted for decentralized organizations.

Just as Wyoming’s previous DAO law (W.S. 17-31 Decentralized Autonomous Organization Supplement) could be considered a “Digital LLC”, SF 50 can be regarded as "Digital UNA".

Also, one can think of it as a Web3 version of a Town Council. The purpose of a Town Council is to protect the standards and operations of the Town by enforcing the rules and covenants of the community, thereby ultimately serving the interests of its citizens, and their homes and businesses.

Similarly, DUNA is designed to secure and support the underlying blockchain network, but like the town council, it is not a company in its own right.

Entrepreneurs around the world are using blockchain technology to build a better Internet, which is the basis for returning the Internet to its open network. But if we let companies own these networks, we'll end up right back where we are today, where our entire digital world is controlled by a handful of giant companies.

Blockchain technology provides a reliable solution to this problem. It makes it possible to create open blockchain networks that are more like public infrastructure than proprietary technology, meaning that anyone can build on top of these networks, just like anyone currently Businesses can be built using open Internet networks (e.g. email, websites, etc.).

DAO is composed of community members who manage the affairs of the open blockchain network. They are a key tool in ensuring that the network remains open, does not discriminate, and does not extract value unfairly. DUNA helps DAOs achieve this goal by solving three key challenges they face. It gives DAOs legal status, enabling them to enter into contracts with third parties and have legal personality. At the same time, it allows DAOs to become taxpayers and provides them with limited liability for the actions of other members. All are commensurate with other legal entity forms and protected by U.S. jurisdiction.

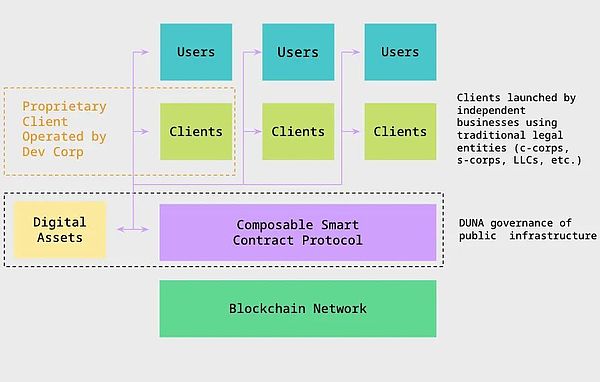

DUNA solves these challenges without adding additional risk to consumers. DUNA can be used for decentralized governance of open blockchain networks, but anyone building consumer-facing applications on top of these open networks (such as social media apps, car services, or music streaming apps) will continue to use traditional The form of a legal entity, such as a corporation or a limited liability company. Although this paradigm includes corporate use, the fundamental difference is that corporations no longer control the underlying network, they only control the user-facing applications. This difference significantly reduces their ability to extract value like web2 companies.

The future of web3: a proprietary client operating using the normal Internet entity architecture, but built on a smart contract protocol and blockchain network run by a DAO on top of public infrastructure.

Membership and participation in the DAO currently face some legal risks. DAOs that fail to use a legal entity for their organization cannot have legal rights, such as paying taxes, and face potential liability risks. At the same time, the lack of a legal entity also threatens the privacy of DAO members. Due to these risks, the failure to use legal entities hinders the decentralization of blockchain networks, limits their growth, and hinders the development of economic models for such systems.

If the DAO fails to adopt a legal entity, these risks could lead to worse outcomes before a better solution emerges. For example, regulatory actions and class actions in the United States claim that the DAO, which has no legal entity, is just a general partnership. While there are several strong arguments to challenge these accusations, such a classification would be disastrous for DAO members, which would expose them to unacceptable tax risks and legal liabilities. As it stands, the advantage is on the side of the regulators and the plaintiffs. If their theory spreads and becomes successful, it could even be the death knell for decentralized governance.

DUNA prevents the possibility of this situation getting worse, solves key challenges facing DAOs, and greatly reduces the risks faced by DAO members. It provides DAOs with a legal status, enables them to sign contracts with third parties, open bank accounts, and provides simple tools for the service process. It allows the DAO to pay taxes and meet its information reporting requirements. It protects the privacy of DAO members from federal intrusion. Also, it provides liability protection to DAO members.

It achieves all these needs without disturbing the way the DAO currently launches and operates. It protects the basic principle of decentralization and makes the DAO An ecosystem that can effectively develop its underlying blockchain network.

The answer is yes. Under Wyoming state law, both UNA and DUNA can engage in for-profit activities. This will include running decentralized exchange protocols, decentralized social media protocols, you name it.

Wyoming’s DUNA regulations also clarify that reasonable compensation is allowed for any services provided to those providing the DUNA ecosystem. This feature will hopefully allow DUNA to compensate members who help fuel its growth without extracting value from users. This is crucial as it ensures that blockchain networks can operate in a decentralized manner and compete with centralized enterprise networks.

For example, using this feature, a DAO can pay its members in exchange for governance participation. In this case, DUNA's rationale for rewarding people for voting or delegating might be that, by regulation, DUNA has no centralized management and therefore needs to rely on its members to manage all of its affairs. Therefore, to ensure the proper management of DUNA, substantial participation is necessary, and DUNA can compensate members to achieve this.

While Wyoming courts will ultimately rule on what compensation is reasonable, there are plenty of real-life examples from nonprofits from which to draw inferences. In addition, the uniqueness of blockchain networks also provides a solid basis for debates about the reasonableness of member compensation. For example, since blockchain networks are typically open source and can be "forked" (copied) by anyone, the continued adoption and development of a particular blockchain network that collects fees and distributes compensation to members, in effect represents This provides users with a tacit recognition of the reasonableness of the compensation paid by the network, otherwise they will launch an alternative network (e.g. via fork).

Nonetheless, the “reasonable” qualifier does place an upper limit on the value that a blockchain network can extract from users and use for member compensation. While those looking to design vertically integrated and centralized blockchain products and services may be confused by the barriers to value extraction, the concept is consistent with, not opposed to, the ethos of blockchain networks. If web3 blockchain networks end up capturing value from users in the same way that web2 enterprise networks do (e.g. Apple charges 30% for AppStore products), then Web3 will be a failure. Wyoming’s approach supports the spirit of web3 while still providing cash flow to digital asset holders. This is a major breakthrough.

Under the Howey test, which is the test used to determine whether U.S. securities laws should apply to digital asset transactions, three elements must be met. There must be (1) an investment of money, (2) in a common enterprise, and (3) a reasonable expectation of profit based primarily on the managerial efforts of others.

Proponents of blockchain technology have long argued that these are unsatisfactory for the vast majority of digital asset transactions. Most of these arguments will be maintained or even enhanced by a DAO taking the form of a DUNA legal entity.

For example, using DUNA can largely resolve the controversy raised by Howey's third article. First of all, DUNA is essentially a decentralized entity. Its underlying structure does not include management functions and has no officers and directors. Second, DUNA members have no legal obligations or rights to maximize profits for the organization. Taken together, these characteristics significantly discount any claim that members may have “reasonable expectations of profit based primarily on the management efforts of others” when purchasing digital assets. Finally, as noted above, the nonprofit nature limits DUNA's ability to distribute the organization's profits to its members, but does allow it to compensate members for their contributions to the organization. Therefore, any member who is paid must profit not from the managerial efforts of others but from his own efforts.

Nevertheless, the U.S. Securities and Exchange Commission (SEC) may attempt to argue that DUNA meets Howey's "common enterprise" requirement because DUNA's membership is tied to the DAO digital asset valuation. However, based on DUNA’s decentralized structure, many counterarguments can be made. In addition, regulators have sought to designate the DAO as a general partnership or unincorporated association under common law, which at least suggests that it would be contradictory to include DUNA as a “joint enterprise.” Finally, the rights of DUNA members are largely a product of DUNA’s governing principles, which are typically rights set out in the underlying governance and protocol smart contracts that make up a DAO, and will exist regardless of whether the DAO formally adopts a DUNA structure. Therefore, if the underlying governance smart contract is insufficient to be defined as a "joint enterprise", there is no reason to argue that the existence of DUNA would change this conclusion.

While the U.S. Securities and Exchange Commission’s (SEC) theories regarding the applicability of U.S. securities laws to digital asset trading are vague and ever-changing, the fact is that they are still subject to Howey Act and subsequent cases. Under the bill, a DAO can adopt DUNA to support its community’s arguments against the application of securities laws to the DAO’s digital assets.

For anyone who has consulted a tax advisor on DAO tax issues, the specific circumstances and circumstances of a project shape the specific issues The most important factors in the answer, and generalizations are no substitute for project-specific advice.

Like LLCs and UNAs, DUNA eliminates the complexity of operating DAOs under U.S. tax law because they can be taxed as corporations. Corporate tax treatment allows UNA and DUNA to meet their tax obligations in a manner that does not require the disclosure of individual members and avoids the complexities of pass-through taxation, solving a common problem with blockchain network DAOs. In addition, the United States has signed a large number of tax treaties with many countries and regions, and provides an environment where tax obligations can be clarified using domestic entities, which is an excellent advantage for DAOs composed of members from multiple countries.

To be clear, all of the above means that the DAO will be subject to tax obligations arising from its activities, which may not be the same as those that currently exist, but ultimately These tax expenditures will significantly reduce the risks associated with membership and provide clarity in an uncertain tax environment. By paying taxes somewhere and having it fall within U.S. tax territory, DAOs are able to address the vast unknowns surrounding their operations and member risks.

Since the DUNA structure was introduced only recently, there has not yet been any in-depth criticism of the structure. However, a number of arguments against the use of UNA (the statutory predecessor to DUNA) had been raised previously. What follows is a summary of these arguments and corresponding counter-arguments in light of Wyoming’s passage of DUNA.

In short, the arguments against using UNA are either resolvable by DUNA or they are unpersuasive. Despite the DUNA structure, the DAO will indeed continue to face uncertainty, but it is undeniable that the uncertainty surrounding the DAO will be significantly reduced. While some may wish for a perfect legal entity structure to emerge that would provide DAOs and blockchain technology with special legal treatment, this is an impractical approach that will hinder their progress from the outset.

Nonprofit status limits flexibility. Some argue that UNA is not an appropriate structure for a DAO due to its non-profit character. This is a fundamental misunderstanding of the “nonprofit” designation. Under regulations, both UNA and DUNA can engage in for-profit activities. Additionally, they allow compensation to be paid to members. Wyoming's DUNA statutes explicitly permit the payment of reasonable compensation (including in exchange for participation in DUNA governance).

Undermining decentralization. Some believe UNA introduces centralization risks. While UNA typically relies on “managers” to manage the day-to-day affairs of UNA, a DAO can easily limit these powers. Regardless, any concerns about centralization have been solved by DUNA, which is specifically designed for large decentralized organizations. It applies whether the number of members is 1000 Overview 10 million. Additionally, DUNA considers a baseline structure that does not include administrative functions, allowing the selection of administrators with limited authority to perform specific tasks authorized by members. For most DAOs, this type of activity is already exercised by protocol foundations and does not pose greater centralization risks. This classification therefore qualifies DUNA for decentralization applicable standards under U.S. securities laws.

Jurisdiction selection. Some argue that the DAO does not belong in any jurisdiction and therefore should not choose to establish an entity in any jurisdiction, including UNA. There are many problems with this argument, simply put, it is a fantasy without considering the consequences it brings. Not utilizing the laws of any one jurisdiction means that a person may be subject to the laws of all jurisdictions. This approach therefore favors would-be attackers (both individual plaintiffs and governments), allowing them to litigate in jurisdictions that are most favorable to them. This is not a theoretical discussion, it is already starting to play out in regulatory litigation against Ooki DAO, as well as class action lawsuits against Compound DAO, Lido DAO, and others. These actions are currently taking place primarily in California on the theory that such DAOs are general partnerships. In the case of Ooki DAO, the court has determined that Ooki DAO is a general partnership, and if this decision is widely replicated, it will be the death knell for web3’s decentralized governance. If the DAO ignores this risk, it is doing so at its own risk.

Permissionless destruction. Some believe that using legal entities undermines the permissionless nature of DAOs because it requires DAO members to join a legal entity. This is incorrect by the definition of DUNA. Holders of DAO digital assets are not required to join their DUNA and are free to choose not to join. Instead, the DAO determines the terms of membership in DUNA in accordance with the DAO’s governing principles.

Unclear use case/not tested in courts. Some believe that because existing UNA legislation does not contemplate the use of blockchain networks, state legislatures may not intend for blockchain networks to use this structure, and the use of blockchain networks for UNA has not yet been tested in the courts. . These arguments are no longer relevant as DUNA was specifically designed for decentralized organizations with the use of blockchain networks in mind. Furthermore, the DAO's use of a disembodied structure has led the courts to apply it to the General Partnership Act, which should be a significant risk to the DAO remaining disembodied.

a16z crypto will work to promote the widespread adoption of DUNA in web3 and make it an industry standard. These efforts will include:

1. Develop decentralized governance proposals for the DAOs we currently participate in to help them adopt DUNA.

2. Assist our existing portfolio companies to adopt DUNA structures related to their decentralization goals.

3. Where appropriate, require its potential portfolio companies in the United States to agree to decentralize and adopt decentralized governance as a condition of investment Adopt DUNA structure. In addition, a16z crypto also intends to invest significant efforts in providing resources to entrepreneurs, law firms, accounting firms, and other advisors to promote the adoption of the DUNA structure.

Adopting the DUNA entity structure can solve most of the uncertainties currently faced by DAO members when participating in DAO activities. Therefore, we hope that through our efforts, DAO members will be able to contribute more and enhance decentralization, a fundamental principle of Crypto. For a16z crypto, this means unleashing the full potential of its engineering and research teams to advance the interests of the DAO.

For background and more information on DAO, UNA, and DUNA, see:

The legal framework of the DAO (October 2021). Provides background on DAOs, discusses the challenges they face, introduces UNA as an excellent choice for a DAO structure, and reviews the history of the structure.

Legal Framework for DAOs – Part 2: Entity Selection Framework (June 2022). Provides a comprehensive argument for why UNA is the only suitable entity structure for a blockchain network DAO.

Legal Framework for DAOs – Part III: Model Decentralized Unincorporated Non-profit Associations Law (March 2024). Introduces DUNA, proposes model legislation to adopt DUNA, and provides a detailed analysis of the provisions of the model legislation.

A16Z, Artificial Intelligence, Follow A16Z into the "AI Brain" Era Golden Finance, Discuss VANA's DataDAO Solution

JinseFinance

JinseFinanceTokens are not equity. They are not even a substitute for equity, so companies should be careful about using this analogy when discussing it internally and explaining it to potential employees.

JinseFinance

JinseFinanceI believe decentralized energy is a worthy pursuit in its own right: it is a vastly undervalued category of crypto projects, and an untapped space for anyone interested in the web.

JinseFinance

JinseFinanceA16Z, what books are a16z employees reading? Golden Finance, only by spending your spare time reading can you outperform others in the bull market.

JinseFinance

JinseFinanceWeb3 governance can serve as a laboratory for democracy, just as online marketplaces enable economists to conduct experiments or social networks provide reams of data for network research.

JinseFinance

JinseFinanceThe 21st century’s shift in power generation from a “hub and spoke” model to a distributed network requires a decentralized grid.

JinseFinance

JinseFinanceOn April 9, 2024, the a16z crypto research and engineering team released a preliminary implementation of Jolt, a new SNARK design approach that is 2x faster than existing techniques, with more improvements to come.

JinseFinance

JinseFinance Cointelegraph

Cointelegraph Cointelegraph

CointelegraphPanelists discussed whether DAOs could have sufficient legal power not only to replace corporate structures, but also to challenge governance models.

Cointelegraph

Cointelegraph