Author: Carol, PANews

Bitcoin has successfully completed its fourth halving on April 20. After this halving, the block reward has dropped to 3.125 BTC. Halving will first affect the mining industry, and miners' income will plummet in the short term. In addition, halving will also affect Bitcoin's inflation rate. The market expects that the increase in scarcity will drive the price of the currency further up. But the actual situation is that since the halving, Bitcoin has still been adjusted sideways at a high level, and the price has dropped slightly by 3.87%, which has made miners face stress tests and many short-term investors face losses.

In essence, each halving is another dynamic balance of market supply and demand. In this rebalancing process, what trends in market funds are worth paying attention to? How much pressure is the mining industry facing? What is the current demand side of Bitcoin? PAData, a data column under PANews, comprehensively analyzed the current market data, mining data and other demand-side data and found that:

Since March, the proportion of Bitcoin loss chips has continued to rise from 1.28% to 15.18%. The average SOPR index of short-term investors after the production cut is 0.99972, and many short-term investors may suffer losses due to the expectation of production cuts.

After the production cut, the circulation rate of tokens on the chain decreased by 23%, and more chips are in the process of accumulation. From the perspective of time period, since this year, the number of chips with a holding period of 1 month to 3 months, 3 months to 6 months, and 3 years to 5 years has increased significantly; from the perspective of holding addresses with different balances, the number of addresses with balances between 100 BTC and 1000 BTC, and between 1000 BTC and 10000 BTC has increased significantly by more than 1.3%.

After the production cut, miners are facing greater revenue pressure. According to the current coin price and higher electricity costs, the shutdown price is estimated to be $55,000, a significant increase from the lowest shutdown price of $14,300 in August last year.

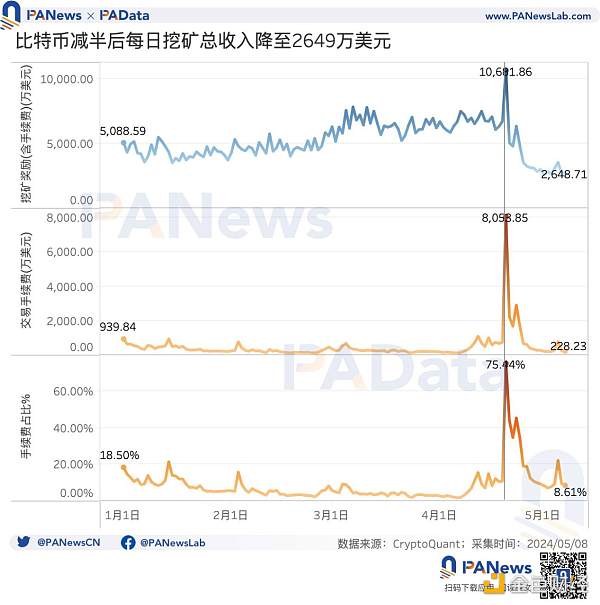

The current total daily mining income is about $26,487,100, a decrease of 51.63% from the average daily income of $54,762,300 before the halving this year. The current daily transaction fee is about $2.28 million, a decrease of 34% from the average daily fee before the halving this year.

Assuming that the transaction fee income remains unchanged, that is, maintaining the current average transaction fee and number of transactions, then to achieve the average daily income level before the halving this year, the coin price needs to reach $94,489.82, which is equivalent to a 51.63% increase from the current coin price.

Assuming that the price of the currency remains unchanged, to achieve the average daily income level before the halving this year, the number of transactions required will reach 1.6737 million, which is equivalent to an increase of 202.49% over the daily average after the halving, or the average transaction fee per transaction will reach 0.00080317 BTC, which is equivalent to an increase of 206.08% over the daily average after the halving.

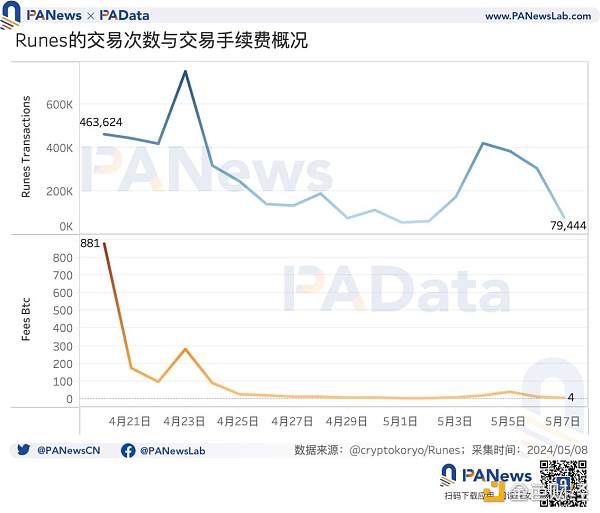

The strong demand at the beginning of Runes' launch can bring huge profits to miners, and it contributed 881 BTC in fees on the first day of launch.

01. After the reduction in production, the proportion of loss-making chips rose to 15%, and the number of large-amount currency holding addresses of more than 100 BTC increased significantly

A potential market consensus is that the price of Bitcoin will rise sharply after the reduction in production. Historical data shows that within one year (365 days) after the past three reductions, the price of Bitcoin increased by 8069.11%, 256.85%, and 478.10% respectively.

But in the short term, the impact of Bitcoin production cuts on prices is slow. In the short term (17 days) after the past three production cuts, the price of Bitcoin increased by 9.73%, 0.97%, and 6.98% respectively. However, since this production cut, Bitcoin has remained sideways at a high level, and is currently (17 days) around $62,400, a drop of about 3.87%.

The price of the currency is not as expected, resulting in a significant increase in the proportion of loss chips in the market. Since the production cut, the price of Bitcoin has fluctuated between $64,900 and $62,400, and the proportion of loss chips has increased from 10.95% to 15.18%. In fact, the price of the currency has been sideways, but the increase in the proportion of loss chips began before the production cut. Since March, the price of Bitcoin has been sideways above $62,500, while the proportion of losing chips has continued to rise from 1.28%. This means that many short-term investors may suffer losses due to the expectation of production cuts.

The SOPR index of short-term investors also confirms this possibility from the side. The index is less than 1, indicating that investors who hold the currency for more than 1 hour but less than 155 days are generally losing money. According to CryptoQuant data, the current index is 1.0022, very close to 1, and the average value of the index after the production cut is 0.99972, which indicates that short-term investors are in a state of overall loss in the near future.

As prices are sluggish, the circulation speed of chips on the chain has also slowed down significantly. According to glassnode data, the current circulation rate (average of the past 7 days) is 0.01044, which is nearly 23% lower than 0.01356 on the day of the reduction, and nearly 33% lower than the beginning of the year, a significant decline.

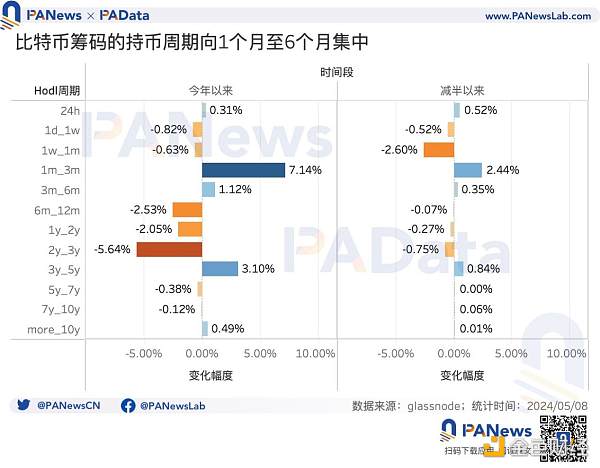

The rapid decline in circulation rate may mean that more chips are in the process of accumulation. From the perspective of time cycle, the number of chips with a holding period of 1 month to 3 months, 3 months to 6 months, and 3 years to 5 years has increased significantly since this year. In particular, the proportion of chips held for 1 month to 3 months has increased by 7.14 percentage points this year, and increased by 2.44 percentage points after halving, indicating a trend of accumulation of holding cycles from short-term to medium- and long-term.

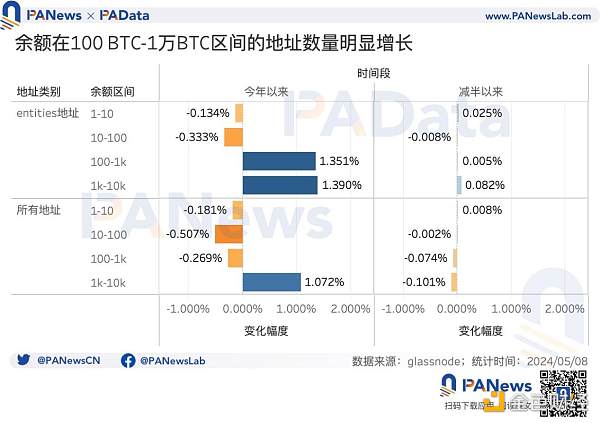

From the perspective of currency holding addresses with different balances, since the beginning of this year, among the addresses marked as Entities (referring to address clusters controlled by the same network entity, which may be exchange addresses, foundation addresses, whale addresses, miner addresses, etc.), the number of addresses with balances between 100 BTC and 1,000 BTC and between 1,000 BTC and 10,000 BTC has increased significantly, increasing by 1.35% and 1.39% respectively, and this phenomenon still exists after halving. Among all addresses, the number of addresses with balances between 1,000 BTC and 10,000 BTC increased by 1.07%. These data show that the number of large holders is growing and the chips are in the process of gathering.

02. After the reduction, the computing power dropped by more than 7%, and the daily mining income dropped to $26.49 million

After the Bitcoin reduction, the computing power of the entire network (referring to the average computing power in the last 7 days) showed a significant decline. According to glassnode data, the current computing power is 582.2 EH/s, a decrease of 7.43% from the day of the reduction. The decline in computing power exceeded the decline in the price of the currency, which may indicate that miners shut down some mining machines in order to maintain interest rates.

According to f2pool data, judging from the shutdown prices of different mining machines, current miners are facing great revenue pressure. Calculated based on the coin price of $62,315.29 on the day of data collection, if the mining machine is located in an area with lower electricity costs, assuming that $0.07/10 million is charged, then the shutdown price is lower than the current coin price, and there are 31 mining machine models that can still make a profit. Among them, the Ant S21Pro has the lowest shutdown price of $32,200, with a daily net revenue of $5.52. According to BTC.com data, the lowest shutdown price was still $14,300 in August last year.

If the mining machine is located in an area with high electricity costs, assuming that the electricity cost is $0.12/kWh, then there are only three types of mining machines that can still make a profit, namely Antminer S21Pro, Antminer S21 Hyd, and Antminer S21, with a shutdown price of more than $55,200.

If the current market conditions cannot improve, then the electricity cost will be an important factor in determining the life and death of miners. If the market conditions improve, to what extent can the pressure on miners be relieved?

Assuming that electricity costs remain low, when the coin price rises to $80,000, the number of profitable mining machines will reach 45, the lowest shutdown price is still Ant S21Pro, and the highest daily net income is Shenma M63S (390T), reaching $12.30. When the coin price rises to $100,000, the number of profitable mining machines will reach 66, the lowest shutdown price is Ant S21Pro, and the highest daily net income is Shenma M63S (390T), reaching $18.41. When the coin price rises, for miners, the types of mining machines available for selection increase significantly, and they can be configured in a diversified manner.

After halving, mining income has plummeted. According to CryptoQuant data, the current total daily mining revenue is about $26.4871 million, down 51.63% from the average daily revenue of $54.7623 million before the halving this year. But it is worth noting that on the day of the halving, due to the launch of the Runes protocol, the mining revenue on that day was about $107 million, 95.06% higher than the average daily revenue before the halving this year.

The strong increase in on-chain demand can make up for the losses brought to miners by the halving through fees. On the day Runes went online, transaction fees reached $80.58 million, accounting for 75% of total revenue. But as the popularity of Runes cools and transaction volume decreases, the current daily transaction fee is about $2.28 million, down 34% from the average daily fee before the halving this year.

Miner mining income (US dollars) = (block reward + transaction fee) * coin price, so the reduction in miner income caused by halving can be directly compensated in two aspects. First, assuming that the transaction fee income remains unchanged, the coin price needs to rise sharply. Second, assuming that the coin price is basically stable, the fee income needs to rise sharply and continuously. Of course, this is a static and simple analysis, the purpose of which is to show the potential impact of Bitcoin halving on coin price and transactions.

According to CryptoQuant data, the average daily mining income before the halving was $54.76 million, and the average daily block volume after the halving was 139 blocks, that is, the average block reward after the halving was 434.23 BTC, the average transaction fee per transaction after the halving was 0.0002624 BTC, and the average daily transaction total number after the halving was 553,328.19 times.

Assuming that the transaction fee income remains unchanged, that is, maintaining the current average transaction fee and number of transactions, then for miners to achieve the average daily income level before the halving this year, the coin price needs to reach $94,489.82, which is equivalent to an increase of 51.63% over the current coin price.

Assuming that the coin price remains unchanged and the transaction fee remains unchanged, the number of transactions required to achieve the average daily income level before the halving this year is 1.6737 million, which is equivalent to an increase of 202.49% over the daily average after the halving.

Assuming that the price of the currency remains unchanged and the number of transactions remains unchanged, the average daily income level before the halving this year requires an average transaction fee of 0.00080317 BTC, which is equivalent to a 206.08% increase from the daily average after the halving.

03. Bitcoin demand is still weak, and TVL and Runes are declining

It is estimated that the impact of the halving on the mining industry is significant, and unprofitable miners will pose a threat to the underlying security of the blockchain. In addition to the price of the currency, transaction fees and the number of transactions are direct reflections of demand. So what is the current demand for Bitcoin?

From the perspective of Runes, according to the @cryptokoryo board data in Dune Analytics, the number of related transactions has dropped from the initial 463,600 to the current 79,400, and the fees have dropped from 881 BTC to the current 4 BTC. From the daily mining income, it can be seen that the strong demand for Runes at the beginning of its launch can bring huge profits to miners. The question now is how to maintain the sustainability of demand for various Bitcoin projects such as Runes.

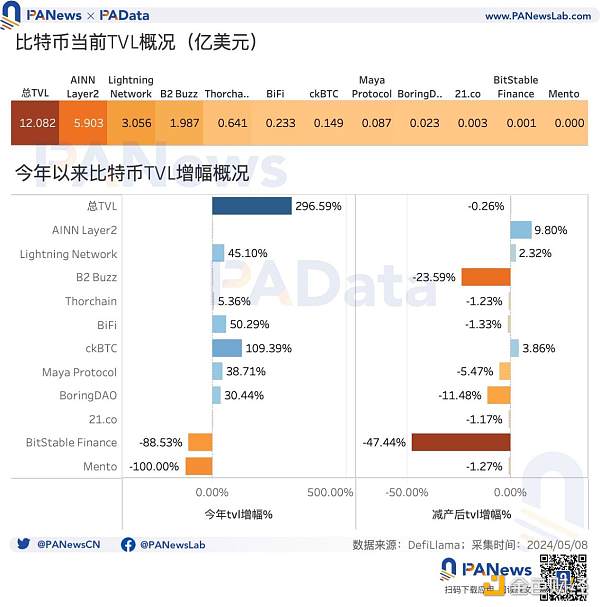

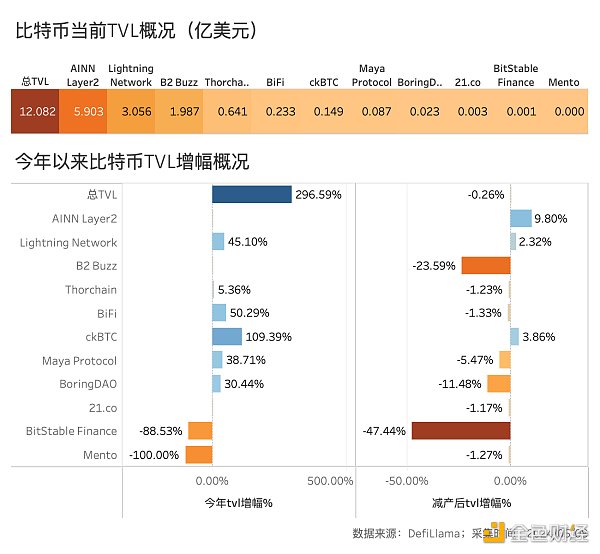

In addition, the DeFi imagination brought by Bitcoin's Layer2 and Runes may also stimulate more demand for use. From the current situation, according to DefiLIama statistics, the current TVL on the Bitcoin chain has reached 1.208 billion US dollars, an increase of 296% since the beginning of this year, and has remained basically stable after halving. Among them, in addition to the Lightning Network, the recently launched AINN Layer2 has also performed well, with a current TVL of 590 million US dollars, becoming the main application in the Bitcoin ecosystem. In addition, applications such as BiFi, Maya Protocol, and BoringDAO have also achieved rapid growth in TVL this year.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice Miyuki

Miyuki JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice Bitcoinworld

Bitcoinworld Beincrypto

Beincrypto Cointelegraph

Cointelegraph