Author: Arjun Chand, Bankless; Translation: 0xjs@金

AI agents (you might call them robots) are becoming more and more active in DeFi.

Many now believe that AI agents may become the majority of the cryptocurrency user base in the coming years. You know how we always talk about attracting a billion new users? Well, with the advent of AI protocols, those billion users may actually be just AI agents.

Today, we examine the growing presence of AI agents in DeFi, explore the various roles they already play in the ecosystem, and identify key protocols that can fast track their development.

Let’s take a closer look.

AI agents are the future super users of DeFi

Vitalik’s recent blog posts about cryptocurrency and artificial intelligence have excited many AI enthusiasts. But if you're still keen on technology, you've probably already covered the key topic that Vitalik considers a real use case: AI as a player in a game.

AI has become an important part of the DeFi game. Let’s take a look at seven of their most interesting applications:

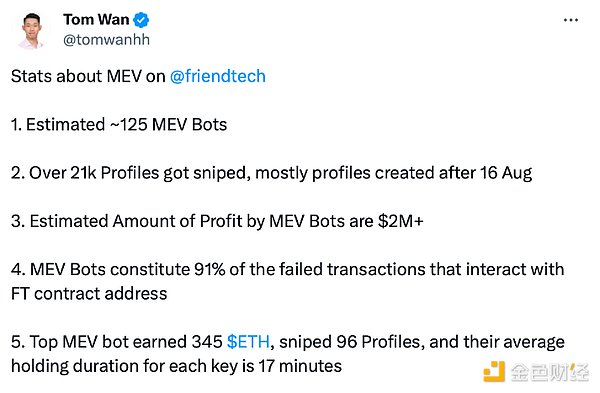

1. MEV Arbitrage Bots

These bots are designed to exploit on-chain arbitrage generated by the ordering of transactions within a blockchain block. Chance. Example: Jaredfromsubway.eth, a MEV bot, is one of the top entities traded on Ethereum, alongside exchanges like Binance on a daily basis.

MEV robot is one of the most active participants on the chain. Everywhere in the ecosystem, from mining NFT coins in seconds to trading shiny new coins on the market, users are going head-to-head with these MEV bots.

True story: After a friend of mine deposited 5 ETH to his friend.tech wallet, within seconds the bot detected the deposit and started targeting his keys, Anticipating profitable trading activity, the price of his key quickly spiked and then plummeted (as the bot quickly realized he was up to no good). All of this unfolds in a matter of seconds, demonstrating the incredible speed at which MEV robots can operate - something the average user cannot physically compete with.

MEV robot made about $2 million by sniping keys on Friend.tech

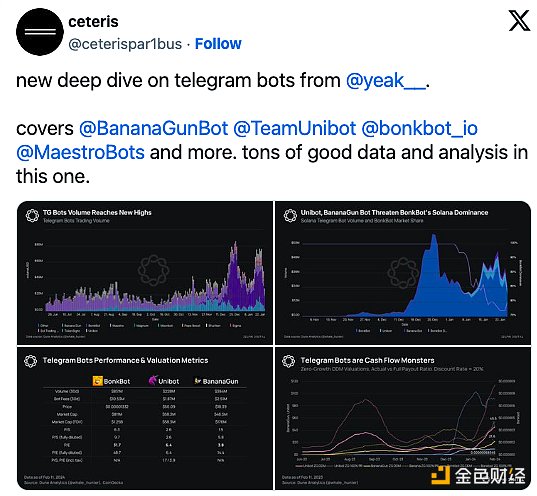

2. Telegram Robots

These trading bots are designed to perform various operations related to crypto asset trading. They offer users the facility to trade any coin (even your favorite meme coins) quickly and easily on Telegram. Example: The number of TG bots such as Unibot and Banana Gun are hitting all-time highs in trading volume.

3. Market making Merchant Robots

These robots provide liquidity to the on-chain market. They do this by placing buy and sell orders on specific assets or becoming an LP in a liquidity pool. Such bots use algorithms to determine the best price point for their orders, aiming to profit from the spread (the difference between the buying and selling price) while maintaining market efficiency. Examples: MM bots on AMM (e.g. Uniswap and “intent-based bridges”).

4. Bots in Games

Bots are very common in regular games, especially as non-player characters (NPCs) and opponents (think FIFA). However, in the field of blockchain gaming, they are just getting started. A cool example is Parallel’s Colony, a game in which AI-powered avatars have their own wallets and interact with each other.

5. Robots in social applications

Frenrug is an on-chain AI agent built using Ritualnet. It chats with users on the application and performs actions based on interactions with users. Buy and sell user keys. Just like the NPCs in the game, but this one doesn't wander around aimlessly. These bots have the added functionality of executing on-chain transactions in real-time, making the in-app experience more interactive.

6. Predictive analysis robots

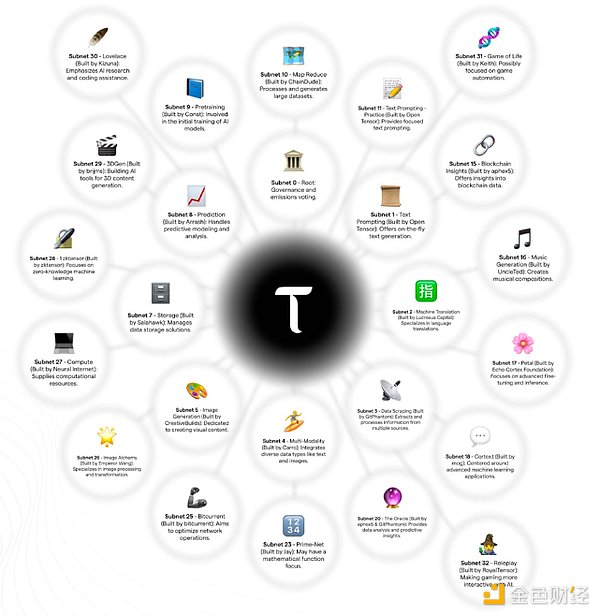

These AI robots use past data and market signals to predict market trends and price changes. These are also sometimes combined with trading bots to buy and sell based on analysis. Example: Numerai, subnet 8 (prediction subnet) on Bittensor.

7. AI agents in prediction markets

Vitalik emphasized in his recent blog post that Omen is a prediction market platform where different AI agents (market creation Agents, AI Mech and transaction agents) collaborate in it. They create, analyze and trade in the market, predicting events in politics, sports, asset prices, etc., similar to Polymarket, but with the participation of artificial intelligence.

Having looked at the different types of AI agents in the ecosystem, let us now explore some of the fundamental protocols that lay the foundation for building the AI agent revolution:

Bittensor

Bittensor builds a dynamic and open marketplace that unites various machine learning models to form an interconnected machine intelligence neural network. Other actors in the network can leverage this grid of machine learning models by building subnetworks. These subnets are specialized protocols for leveraging artificial intelligence for different use cases.

Currently, the Bittensor ecosystem has 32 subnets. Each subnet can be viewed as an active market for AI agents, known in the Bittensor ecosystem as subnet miners, who participate in and solve problems in ongoing incentive-based competition. For example, in Subnet 8 (the “Prediction Subnet”), subnet miners compete to predict future price movements in financial markets such as Bitcoin.

Autonolas

The Autonolas stack enables the development of crypto-native autonomous services that run continuously and perform operations on their own. These agent services act as multi-agent systems (MAS) where multiple AI agents collaborate to perform complex functions.

For example, one can build an AI agent for predicting markets on Autonolas, called a "predictive agent." The agent can be programmed with customized data analysis strategies to aid the decision-making process and actively participate in prediction markets.

Built on Autonolas AI agents are already making progress in the DeFi field. A recent blog highlighted that over 9% of Safe transactions on the Gnosis chain can be attributed to autonomous services running on the Olas network. Entering 2024, it’s even more impressive – on many days, more than 75% of Safe transactions on the Gnosis chain are powered by AI agents. The high engagement rate of AI agents is a surprising detail that many people haven’t noticed yet. One popular way they are used on the Gnosis chain is to act as autonomous signers for Safe multi-signature transactions.

DAIN (Decentralized Autonomous Infrastructure Network)

DAIN is a global network of AI agents designed to trade, interact, and cooperate with each other. This is achieved through DAIN’s API, which serves as a standardized framework for AI agents to communicate and collaborate to perform complex operations.

While DAIN’s website is currently under development, AI agents are already being built on top of its stack. Take Asset Shield as an example, it is powered by DAIN. It deploys Asset Shield as an autonomous signer for multi-signature setups on Squads, thereby enhancing security.

Here’s how it works: AI agents become part of Squads’ multisig, programmed to sign or reject transactions based on specific rules. For example, an AI agent might automatically block any transaction exceeding 1000 SOL or flag those that look suspicious. The criteria for suspicious transactions are set by the user and may be similar to the logic Rabby Wallet uses to alert users of suspicious transactions - for example, when you're dealing with a new website, it will prompt you to think twice before confirming.

Conclusion

The AI intelligent economy has arrived. Artificial Intelligence’s impact on cryptocurrencies is no longer a distant possibility; it’s happening now.

As AI infrastructure protocols mature, the development of complex AI agents and their application across use cases will only become easier. All signs point to an exciting possibility: AI agents will be a unique catalyst for this bull market.

Once AI agents become the future power users of cryptocurrency, we can expect the number of interactions, transactions, and collaborations between them to grow exponentially. This surge will require massive amounts of computing power and storage capacity. To meet these needs, the industry may look to decentralized physical infrastructure network (dePIN) projects. Projects such as Akash, Filecoin, GenesysGo, io.net, Render, and Grass operate at the intersection of AI and resources such as computing, storage, and bandwidth and can play a key role in meeting the growing needs of AI agents.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance