Author: David C, Bankless; Translator: Deng Tong, Golden Finance

Few projects have received as much criticism and controversy as Blast this cycle.

Soon after launching, depositors began complaining on Twitter about the opportunity cost of locking up ETH for airdrops. Then, the Munchables NFT project was hacked less than a month after launching, causing the network to fall into an existential crisis due to a $64 million hack (although the funds were later returned). Despite this, Blast has continued to grow, attracting some quality projects and promoting the network as an exciting and experimental DeFi hub for crypto natives.

May is the month when Blast will conduct an airdrop, and it turns out to be very important to check the ecosystem to understand whether the network is strong enough, which will determine whether the project continues to grow after the airdrop or fades into obscurity.

The State of Blast

Analyzing the current state of the network shows that Blast has impressive resilience and expansion capabilities.

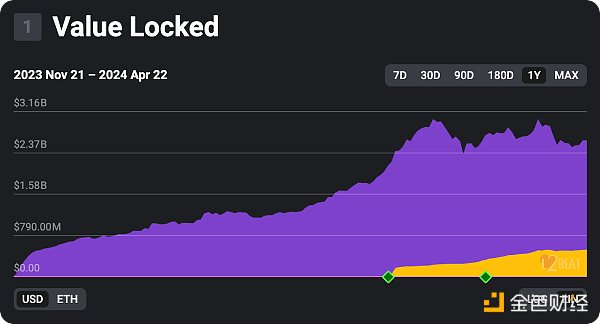

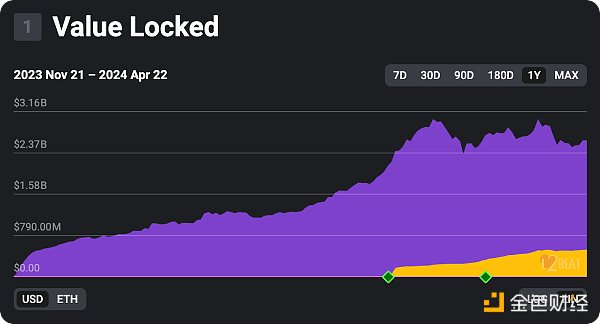

While not growing exponentially, its TVL grew from an initial $2.11 billion to $3 billion twice before and after the Munchables hack. It has stabilized at $2.5 billion during the market’s recent sell-off, despite a gain of about 59% over the past month, making it easily among the top ten in terms of size and among the top five in terms of Rollups.

Analyzing TVL may not provide the best information about actual activity as TPS does, though, which peaked at 9.4 after launch but has now stabilized at 5 TPS. This puts Blast well behind chains like Base, Degen Chain, and Arbitrum. However, this can be explained by the fact that most of the activity on Blast comes from locking up assets to maximize yield, rather than performing frequent trades.

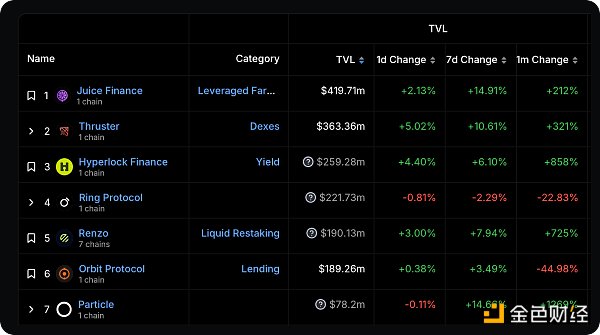

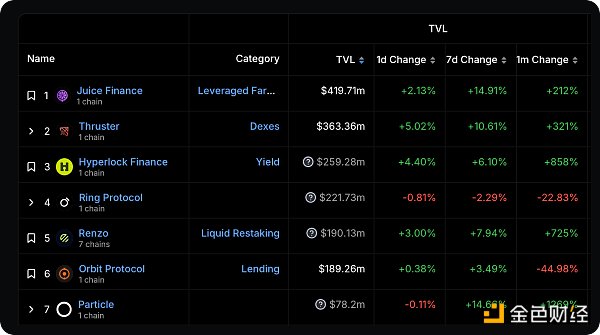

In contrast, while activity numbers may be lower, many projects in the Blast ecosystem have experienced significant growth over the past month. In pursuit of its goal to become the DeFi degen hub, Blast has built a solid foundation equipped with all the verticals needed to achieve this goal.

Juice Finance offers lending/borrowing facilities with enhanced features to maximize yield and points=. Thruster provides the ecosystem with the deep token liquidity needed for trading, enhanced by high-yield projects like Hyperlock Finance built on top of it. Particle Trade’s growth demonstrates demand for its “Uniswap leverage,” while Renzo, one of the largest LRT protocols, injects liquidity into the network.

Together, these projects lay the foundation for Blast’s efforts to become a strong DeFi hub.

Potential Catalysts

Blast is already well-versed in the intricacies of cryptocurrency and is inclined to explore new forms of it.

New projects can leverage this community to guide their protocol designs. It is particularly well suited for SocialFi projects, i.e., those looking to build at the intersection of social networking and DeFi, some of which have recently emerged on Blast.

Fantasy Top, a competition where users “pick” their favorite crypto personalities to compete in a tournament based on rankings like Twitter engagement, is set to launch its mainnet soon after launching its airdrop announcement.

EarlyFans, a SocialFi platform that further tokenizes the relationship between content creators and their audiences through speculative upside, has just launched its Beta ahead of its upcoming airdrop.

DistrictOne caters to communities and influencers looking to expand and leverage their influence by making money through money games featuring sharing, investing, and jackpots.

Overall, Blast’s intentional alignment with crypto-native and degen culture not only solidifies its position in the DeFi space, but also lays the foundation for expansion into developing trends like SocialFi, potentially gaining greater market traction by further intertwining DeFi with culture.

Future Outlook

May holds special significance for Blast with its airdrop on the horizon.

The network’s activity, especially in the DeFi space, has somewhat defied expectations. Remember, there are not only Points, but also Gold — a resource comprising 50% of the airdrop, allocated to Dapps to incentivize and reward the community as they see fit.

As Blast’s key May airdrop event approaches, the network is at an important crossroads. As seen in its recovery from the Munchables hack and steady TVL, Blast has a resilient foundation that has the opportunity to become an indispensable DeFi hub. The success of its airdrop will be critical in determining whether Blast solidifies its position as a pioneering network or becomes just another L2 network.

JinseFinance

JinseFinance