Author: Firehand, Kevin, Charlotte

1 Introduction: The AI track has become the core narrative of this cycle

The AI track may no longer need to be more popular I won't go into details - the price performance is enough to overshadow all the words. On February 23, 2024, Nvidia's stock price exceeded US$800, and its market value exceeded US$2 trillion, becoming the fastest company in history to grow from a market value of US$1 trillion to a market value of US$2 trillion. On the Crypto track, AI track tokens have performed well in the past few months. Leading tokens such as RNDR, TAO, and FET have all gained more than 3 times. Every important event in the AI field will lead to the completion of related tokens. A rapid growth.

AI has become the most important human technological revolution in this cycle, and accordingly has become the number one track for financial speculation. Blockchain and artificial intelligence are actively exploring the possibility of integrating each other. The Crypto world will benefit from the important progress of AI technology, driving the rapid rise of related leading tokens. Perhaps a few months ago we were still discussing the feasibility of combining AI with blockchain, but now this discussion seems less important.AI has become the core narrative of this cycle, and market sentiment and financial enthusiasm have overwhelmed it. everything.

In our previous overall analysis of the AI track ( Starting from Buterin’s article, what are the subdivided tracks of Crypto×AI that are worth paying attention to?), and a review of the four directions in which Buterin has subdivided the AI track:

AI as a participant: AI games, AI prediction competitions

AI as an interface: various AI applications

AI as the rules of the game: Autonomous Agent underlying protocol, zkML/opML

AI as the goal: decentralized data protocol, decentralization Computing power protocol and decentralized AI model

“AI as a goal” represents Crypto’s decentralized transformation of AI, which is the most narratively interesting Attraction and hype spaceIn terms of implementation, although it is currently unable to compete effectively with centralized businesses, many innovative projects with feasible business logic have been born, and projects that have formed moats among them will become this Choose investment targets with strong trends in one cycle.

2 Track Overview: Decentralized computing power is the core direction of laying out the AI track

Among the many subdivided tracks of Crypto×AI,decentralized computing The force will be a direction that satisfies narrative hype and value investmentat the same time.

First of all, the demand for computing power in the AI industry itself is growing rapidly, and insufficient computing power and high costs are becoming problems for the entire AI industry. On the supply side, the production of AI GPUs is being exclusively monopolized by NVIDA. The major giants control the AI computing power, part of which is used for training new models, and the other part for leasing. Highly centralized and monopolized cloud platforms are controlling it. Focus on computing power pricing power. On the demand side, the demand for model training and model inference is growing rapidly. Model training competition is intensifying the competition for computing power. Small model training and fine-tuning also require lower-cost computing power support. The large-scale adoption of AI applications is increasing the number of models. The computing power required for reasoning.

Secondly, among the many AI subdivisions, decentralized computing power is the direction with the closest integration of Crypto and AI and the clearest business logic. The use of tokens to incentivize the supply of computing power, or the broader business logic of DePIN, has already proven its feasibility in decentralized storage tracks such as Filecoin in the previous stage. Whether it is an AI application such as Wrapper or the underlying protocol of Agent, the importance of tokens in the entire system is actually not high. In decentralized computing power projects, cryptocurrency has a deep binding relationship with the entire business logic. Crypto’s inspiring role has truly been used to reshape the AI landscape.

With the recent NVIDIA conference, decentralized computing power has ushered in a new wave of climax. Leading projects have experienced impressive growth, and a number of new computing power-related projects have emerged. The current characteristics of the decentralized computing power track are: a large number of projects, similar project business logic, fierce competition, and leading projects with a moat in terms of computing power resource supply and demand stability.

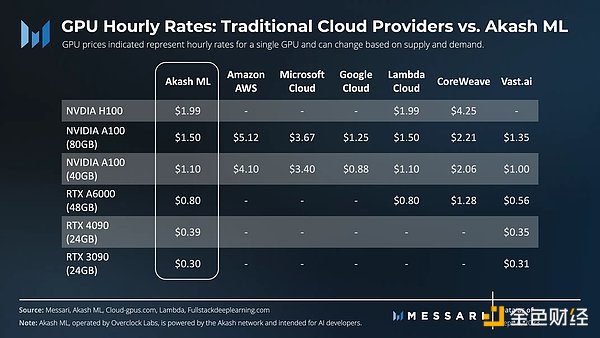

In terms of business logic, these types of projects are basically similar: using cryptocurrency as an incentive to allow suppliers with CPUs and GPUs to provide computing power, so that small and medium-sized enterprises can use leasing without permission. The computing power provided by providers, and token incentives make the price of computing power much lower than that of centralized suppliers. At the same time, the requirements for communication and parallel computing for decentralized model training are higher, and the computing purpose is changing from training to reasoning. Therefore, most current projects focus on distributed reasoning, with a high degree of homogeneity.

Although the NVIDIA Conference has driven the growth of a series of GPU concept projects,** we expect that the future development of this track will be further aggregated and centralized. After the leading projects are out, small projects will be in China. long-term recession. **Both the supply of computing power and the users who are willing to adopt decentralized computing power are scarce. When the business logic is highly homogeneous, resources on both sides of supply and demand will preferentially flow to the head projects. In addition, users need large-scale and stable computing power guarantees, and an overly decentralized track structure will be even more unfavorable to compete with centralized cloud service providers.

In summary, decentralized computing power will be the key direction in laying out the AI track. With medium and long-term investment, leading projects that already have a certain moat will have continued competitiveness. . Under this logic, we believe that Akash will be the core target for laying out this track.

3 Akash Network: Fundamentals and Token Economic Analysis

3.1 Fundamental Analysis

Akash Network is a decentralized cloud computing platform , aims to integrate underutilized computing resources around the world by providing a peer-to-peer market, and establish an open and transparent market so that users can freely publish resource requirements and allow global resource suppliers to bid in real time, reducing costs the cost of cloud services. According to Messari's report, Akash costs significantly less than other cloud vendors for the same hardware.

Akash was founded in 2015 and launched the mainnet in the Cosmos ecosystem in 2020. Akash initially focused on CPU computing. On August 31, 2023, Akash Network completed the mainnet 6 upgrade and began to support the GPU cloud market.

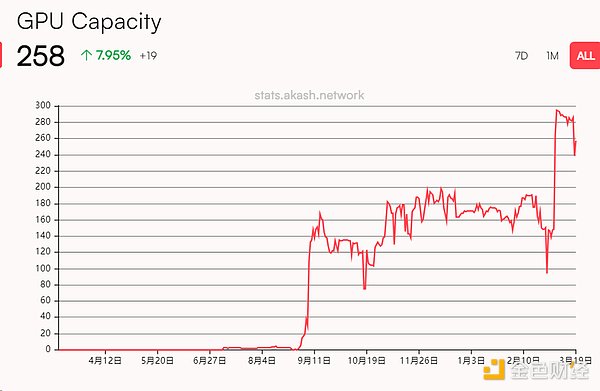

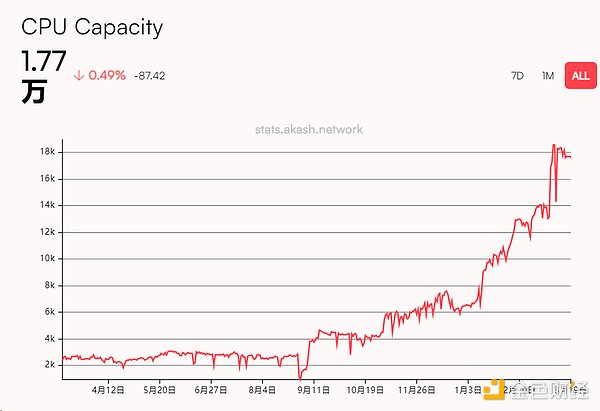

The supply side of computing power mainly comes from data centers, miners and consumer computing power. After mainstream public chains shift to the PoS (Proof of Stake) mechanism, the idle computing power of a large number of mines has become a problem to be solved. Akash Network is effectively utilizing these idle resources by cooperating with multiple large miners and has obtained a large number of high-performance computing resources of nearly 500 V100 equivalent GPUs. Foundry, the largest Bitcoin miner in North America, has added 48 to the Akash GPU network. NVIDIA A100. Personal computers scattered around the world also contain a large amount of underutilized low-end computing power. Currently, there are more than 17,700 CPUs and 258 GPUs in the Akash network, and the number is constantly rising. In addition, Akash has also launched specific incentive programs, such as a $5 million pilot incentive program, aimed at attracting more computing power providers to join the platform.

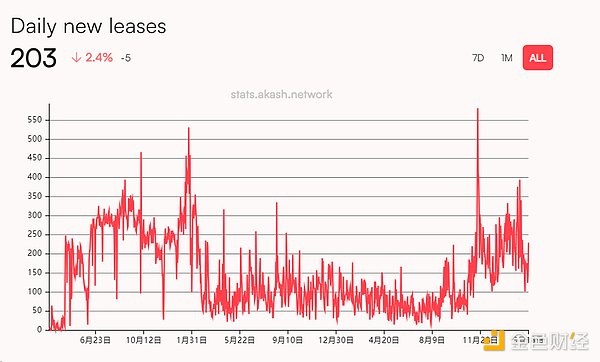

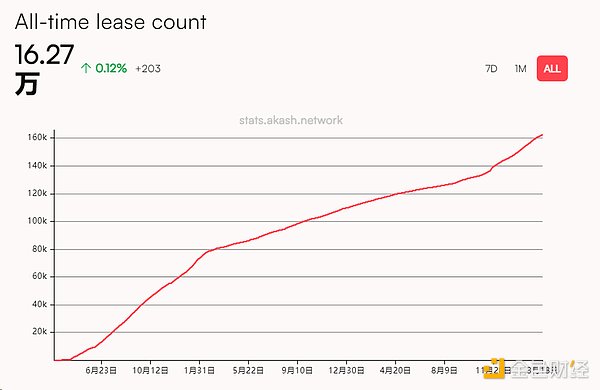

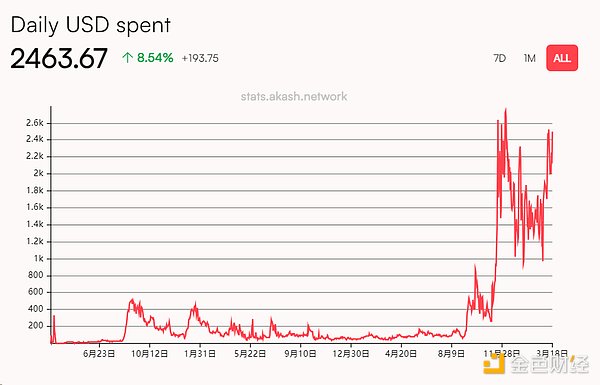

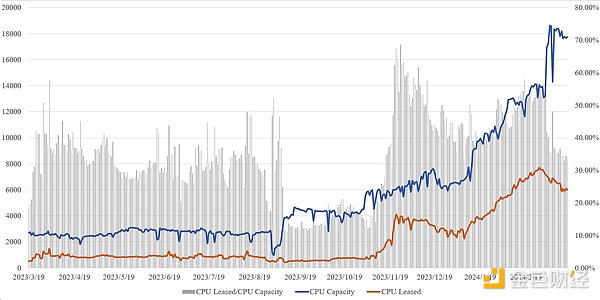

On the demand side, Akash Network is committed to attracting more developers to join by establishing its own open source community , which not only helps strengthen the moat of its ecosystem, but also brings continuous innovation and development momentum to the platform. In addition, Akash is also actively seeking cooperation with other decentralized AI protocols to expand its service scope and improve the competitiveness of the platform. At present, Akash has reached a cooperative relationship with two major decentralized first-level protocols, Gensyn and Bittensor. This not only brings a large amount of fixed demand to Akash, but also proves the attractiveness of its platform in the decentralized computing power market. and strength. After the introduction of GPUs in August 2023, Akash's daily rental volume has also increased significantly. Currently, 162,700 rentals have been completed, and the daily income from rentals is also growing.

In terms of matching between supply and demand, Akash uses the reverse auction (Reverse Auction) mechanism, that is, users create orders and computing power is supplied Suppliers bid for the order, and the user completes the selection based on the supplier's bid and other information, and signs a lease.

In terms of specific business, Akash Network’s computing power is mainly used for data preprocessing and model reasoning, but recently it is trying and developing model training. Starting in August 2023, Overclock Labs began to train basic AI models with ThumperAI, and eventually committed to creating an open source artificial intelligence model named "Akash-Thumper" and sharing it on Huggingface. If the training of the model can be successfully completed, the process of training the model using distributed computing will be defined, attracting demand for the Akash network and improving utilization.

GPU is available and the price is attractive, so there is only one final barrier that prevents developers from using Akash: **Crypto Barrier. **Akash Network has adopted a series of measures to reduce user difficulty:

DevelopmentCloudmos DeployandAkash Console, developers can Examples in the friction management network;

Integrated Cosmos Swap on Metamask, users can authorize AKT transactions on Metamask;

-

Supporting stablecoin payment, Noble’s upcoming USDC native to Cosmos can also significantly lower the entry barrier for developers.

3.2 Token Economics Analysis

AKT token plays multiple key roles in the Akash ecosystem: as a staking medium to enhance network security; Governance, lease settlement units and benchmarks for market pricing.

By staking AKT, users can participate in the governance of the network, with voting weight depending on the number and duration of their pledged tokens, thus promoting the decentralized decision-making process of the network.

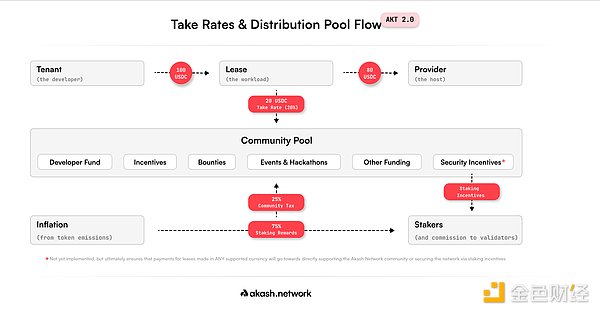

AKT is mainly used to pay rental fees. Akash sets different handling rates (such as 4% handling fee for AKT payment and 20% for USDC payment) and annual inflation of up to 13%. rate to regulate supply and demand, while allocating a portion of inflation and fee income to the community pool for public funds, incentives, and possible token destruction to ensure the sustainable development and value circulation of the ecosystem.

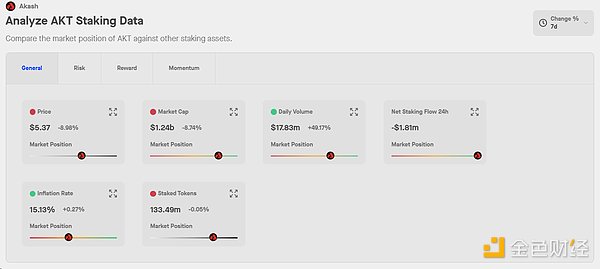

According to Coingecko data, as of March 20, 2024, the circulating supply of AKT is 230,816,799, and all AKT tokens have been fully unlocked, so they no longer face high unlocking selling pressure. The current main increase in circulation comes from inflationary incentives, with the maximum supply being 388,539,008. According to Stakerewards data, the current annual inflation rate is still as high as around 15%. About 133.49m AKT was used for pledge, accounting for 57.8%. The pledge ratio is relatively high.

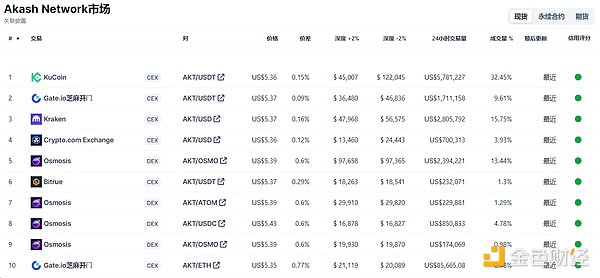

In terms of liquidity, Akash’s main liquidity is concentrated in three central exchanges: KuCoin, Kraken and Gate. It is worth noting that AKT has not yet been listed on first-tier large exchanges such as Binance, resulting in its relatively low visibility in the Chinese area. However, AKT has been listed on leading US exchange Kraken for some time and is already listed on Coinbase. Historical cases show that projects such as Bonk and Ondo often experience price rediscovery and significant growth after entering Coinbase's Roadmap. Based on this trend, the listing of AKT will stimulate market enthusiasm and investor interest, thereby promoting its price increase and market value growth.

4 Competitive Landscape Analysis

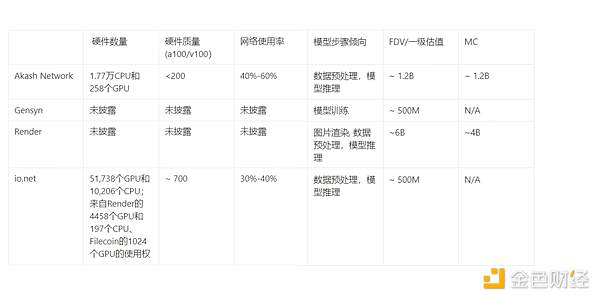

Based on the previous judgment, the competition in the decentralized computing power track is fierce, and the moats of leading projects are relatively high. We believe that the two core competitive indicators of the decentralized computing power track are: computing power supply and computing power demand.

The importance of computing power supply is self-evident. Having a larger number and higher quality GPUs can handle more complex computing tasks more stably and efficiently. When computing resources are extremely scarce, it will become the moat of the platform. Computing power requirements are equally important, as shown in Coinbase’s latest research report pointed out that although the supply of computing power in decentralized platforms has increased significantly, platform revenue has not increased at the same time, thus raising doubts about the market demand for decentralized computing. The supply and demand of computing power will act as a positive flywheel, driving the rapid growth of the entire ecosystem.

In this track, projects that share the leading position with Akash include Render, io.net , Gensyn. Among them, Akash and Render were born earlier and were not born for AI computing. Akash was originally used for general computing, Render is mainly used for video and image rendering, and io.net is specially designed for AI computing, but in AI computing power will After the demand has increased to a higher level, these projects have tended to develop in AI. While Akash, io.net and Render focus on AI reasoning, Gensyn focuses on AI model training. Gensyn is trying to establish such a verification layer to ensure the correctness of calculations through probabilistic learning proofs, graph-based precise positioning protocols and incentives. .

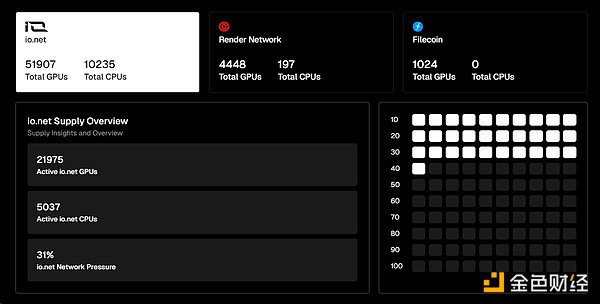

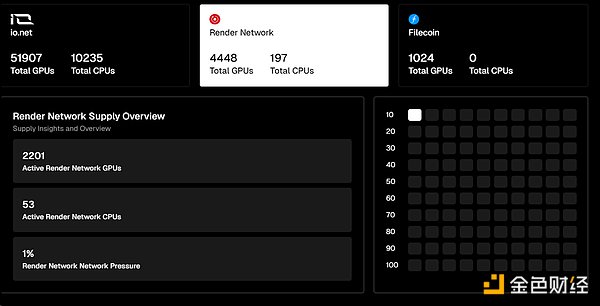

From the perspective of computing power supply, Akash currently has 17,700 CPUs and 258 GPUs. In contrast, Render has not disclosed hardware data to the outside world, and io.net has more GPU computing power. As of March 20, 2024, io.net has 51,738 GPUs and 10,206 CPUs. It has also reached agreements with Render and Filecoin. Cooperate to obtain the right to use 4458 GPUs and 197 CPUs from Render and 1024 GPUs from Filecoin. The quantity and quality of computing resources far exceed Akash, but it should be noted that io.net is using extremely attractive The airdrop incentives attract computing resources, and the number of GPUs on the platform is changing rapidly. We still need to observe how much computing power can remain on the io.net platform after the airdrop is over. In contrast, Akash's computing power comes from a relatively stable and cooperative relationship, and its computing power resources have been in a process of steady growth.

In terms of the use of computing power, Render has not yet disclosed relevant data, but its current business focus is still on image rendering. In addition, it has established a computing client to promote the use of artificial intelligence, that is, providing An API that allows other projects to access Render's GPU network to support use cases such as AI inference, training, fine-tuning, etc. Currently accepted Projects included in Render include io.net, Beam, FedML, Nosana, and Prime Intellect and Exabits are currently being voted on.

The overall network usage of io.net is around 30%-40%, and the computing power connected from Render and Filecoin is almost unused.

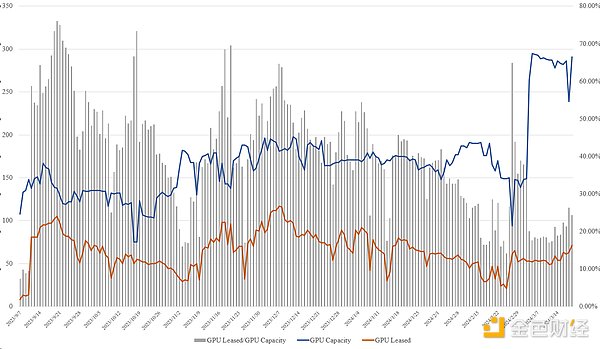

The GPU usage rate of the Akash network remains at around 40%-60%, which is a relatively advanced level among decentralized computing power platforms. In recent days, due to the There was a significant increase in power supply and a temporary decline in usage. The CPU network usage also remains at a high level of 50-60%.

(Data source: calculated based on Akashstats)

From a valuation perspective, Akash’s current FDV and MC are both 1.2B, RNDR’s FDV is about 5 times, and MC is about 3 times. io.net and Gensyn have not yet issued tokens. Among them, io.net’s latest round of primary financing was valued at 500M. However, with the market sentiment for io.net rising, the price of secondary tokens after the opening is expected to far exceed this. A value.

5 Conclusion

Based on the above analysis, Akash will be a target that fits the core narrative of this cycle and has medium and long-term investment value.

From the perspective of narrative themes and fundamentals, the AI track has become the main track in this cycle. Decentralized computing power is the core direction in this track. On the one hand, it comes from external NVIDIA On the other hand, the attention and hype surrounding computing power comes from the close integration of crypto and AI in the DePIN concept. Akash is the leading project of decentralized computing power. In the next round of AI sector rotation, the direction of decentralized computing power will definitely be one of the focuses, and Akash will also be sought after by funds because of its competitiveness and moat.

From a financial perspective, Akash has completed the unlocking of all investors and teams, and will not face huge selling pressure in this cycle. At the same time, the token pledge ratio exceeds half. Calculated based on the current token circulation and the inflation rate of 15%, 94,609 AKT will be unlocked every day. The currency price is $5, and the daily unlocking amount is about 500,000 US dollars. The inflationary selling pressure brought about is not large. In addition, Coinbase has listed AKT on March 20, which will open up the US market for AKT and enhance liquidity. Since AKT has not been listed on Binance, there are still high expectations for listing.

We should continue to pay attention to the development of Akash in attracting computing resources and expanding customer relationships in the future, and be especially wary of the risk of insufficient competitive advantages between Akash and similar projects. Projects including io.net and Render are Akash Strong competitors, especially io.net, are currently attracting a huge amount of computing power resources due to the expected airdrop. Akash is a CPU computing background. Can he obtain continuous expansion of computing power resources on GPU and have sustained and stable use cases? and customers are the core of its competition with other projects.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Wilfred

Wilfred Wilfred

Wilfred WenJun

WenJun JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance