Editor's note: As one of the well-known research institutions that has been bullish on BTC, 10X Research recently issued another latest view on the recent sharp decline in the market: "The selling pressure brought by the large unlocking of altcoins is dragging down Bitcoin." Subsequently, 10X Research further elaborated on this view in the Newsletter.

Cryptocurrency plummets, altcoins suffer heavy losses

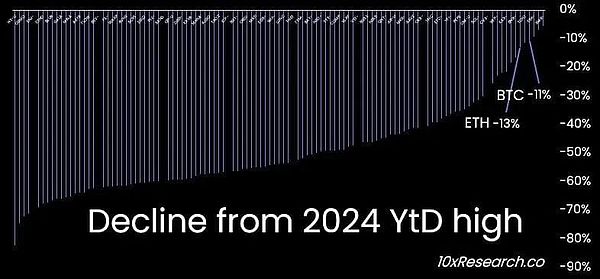

I believe the title of this article resonates with everyone who has traded altcoins in 2017 or 2021. We have analyzed 115 cryptocurrencies in depth: from the price highs in 2024, these cryptocurrencies have fallen by an average of about 50%. As described below, unless the liquidity problems in the cryptocurrency market improve, these losses will continue to worsen.

Bitcoin (-11% ) and Ethereum (-13% ) performed relatively well, likely benefiting from some traders converting altcoins into these two major currencies, a phenomenon that also occurred in the previous two market cycles.

10X Research: A look at some cryptocurrency price declines

The key to surviving the altcoin bear market is effective risk management.

The large amount of token unlocking and scarce cryptocurrency liquidity indicators are the main reasons for the altcoin crash.

On May 8, we warned the market that "nearly $2 billion in token unlocking over the next ten weeks could cause the altcoin market to shrink further." The main point of the article was that venture capital funds invested $13 billion in investment funds in the first quarter of 2022, but the market then turned into a sluggish bear market. Now, these funds are facing pressure from investors to return funds because artificial intelligence has become a hotter investment area.

VC blockchain field investment scale and Bitcoin price trend

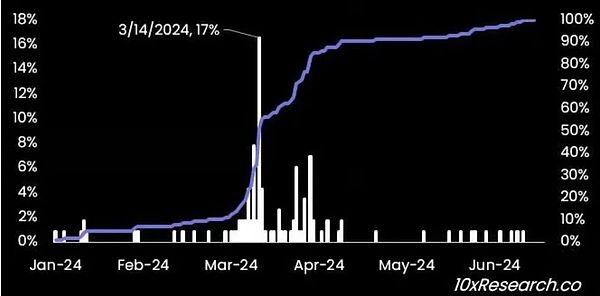

Today, altcoins are in a brutal bear market. This year, 73% of these 115 cryptocurrencies reached new highs in March. We have been doing a good job predicting Bitcoin’s outperformance of other cryptocurrencies, including Ethereum, but in early March, the market situation changed.

So what happened in March that was unique?

March became a turning point, and the lack of liquidity began to emerge

In early March 2024, the price of Bitcoin reached our potential target of $70,000, which we expect to reach by the end of the year.

Last year, we accurately predicted a target of $45,000 for Bitcoin by the end of 2023.

In October 2022, we also successfully predicted that Bitcoin would rise to around $63,000 before the halving in 2024. At that time, although we could have obtained a higher price target through quantitative analysis (such as a rise in Bitcoin price to $125,000), we did not make such an assertion due to the reduction in liquidity in the cryptocurrency market, which affected market performance.

Subsequently, we gradually turned to a cautious attitude and tried to buy a potential bullish breakout above $70,000, but set $68,300 as our "lowest" stop loss price. After all, we are traders, not real gamblers.

When Bitcoin falls below $60,000, we lower the stop loss price to $62,000 as a criterion for re-buying in case the short-term target of $55,000 is not achieved.

17% of 115 cryptocurrencies (left) reached price highs on March 14, and all are currently in a retracement (right)

There is no doubt that we are at a critical juncture in this bull market.

Understanding and following risk management principles is what separates traders from those who end up holding altcoins and suffer losses, as altcoins tend to fall at the end of bull markets.

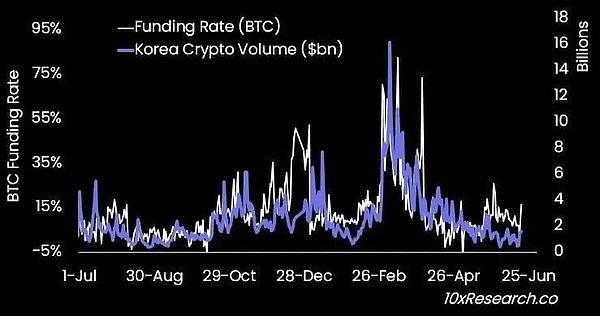

In late February 2024, Solana’s meme coin craze exploded.

South Korea’s ruling People’s Power Party made several promises around the cryptocurrency industry (including the possibility of allowing a Bitcoin spot ETF) in the run-up to the April 10 national election, which caused the country’s cryptocurrency market to surge from $3 billion to $16 billion per day (twice the volume of the South Korean stock market). Shiba Inu became the most actively traded coin for several days.

But as time passed in March, the market performance was sluggish.

Changes in Bitcoin Funding Rate and Changes in Korean Cryptocurrency Trading Volume

Behind the currency waiting for the rise, there may be a trap of gradually returning to zero

We occasionally dabble in altcoins, but we mainly focus on high-quality altcoins with large trading volumes.

We usually use the dynamic average as a stop loss standard because it is crucial to manage downside risks.

The cryptocurrency market is highly cyclical, and the conventional investment strategy of buying and holding is unlikely to work in the medium and long term. Instead, it is more appropriate to analyze crypto liquidity and the macro environment and use a trader's mindset (risk management) framework to protect capital in order to be well positioned when the market cycle is on the rise. This is why our investment approach is generally tactical and we can take a more proactive approach when the market environment turns positive.

On April 4, we introduced the "Bitcoin Self-Reinforcing Mechanism Framework", which shows how Bitcoin ETF inflows have contributed to positive market sentiment, but at the same time, this liquidity is the result of increased arbitrage liquidity after retail speculative buying that drives funding rates higher.

But now, this liquidity is close to being exhausted. As we can see, despite the lower inflation data this month, Bitcoin ETFs have still seen significant outflows (down $900 million in the past seven trading days).

With Bitcoin’s funding rate (and CME futures premium) approaching zero, we may see more liquidations before the next monthly settlement date, when open interest will be rolled over to the next CME contract cycle (expiring on June 28). While many people are now aware that Bitcoin spot ETF liquidity is mainly arbitrage liquidity funds (we estimate the proportion to be 30%-40%), they are obviously no longer sending positive market signals, and with funding rates close to zero, it is unlikely that this liquidity funds will return.

In March, Bitcoin ETF inflows also stagnated as the market began to worry about higher inflation data, and most altcoins also reached their price highs at that time. The speed of stablecoin minting began to slow down shortly after Bitcoin’s halving, failing to provide additional liquidity for altcoins. The subsequent unlocking of $2 billion in various tokens is just the final step.

With the significant increase in trading activity (especially meme coin-related transactions) in March and early April, many traders may have accumulated a lot of positions at poor price points. Altcoins ebb and flow, back and forth, but Bitcoin will remain standing in the next bull market.

Like the previous bull market, many traders may hold on to altcoins to wait for the rise, but smart traders will protect their assets by transferring their positions to Bitcoin when liquidity slows down.

The difference between retail and institutional traders is that institutional risk managers will eventually force institutional altcoin traders to close their positions and stop losses at the appropriate time; while retail investors are unwilling to bear the obvious losses and will hold altcoins until they return to zero.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund Brian

Brian Huang Bo

Huang Bo Coindesk

Coindesk Coinlive

Coinlive  Tristan

Tristan Bitcoinist

Bitcoinist