Author: Primev Source: mirror Translation: Shan Ouba, Golden Finance

Summary

This post follows our previous post on EIP-4844, using data and insights from the emerging Blob market. The post focuses on the Blob publishing strategies used by Blob producers such as Optimism and Base, and quantitatively analyzes strategy efficiency metrics such as the speed at which Blobs are included in blocks and the priority fee premium paid for them.

Blob Market Utilization

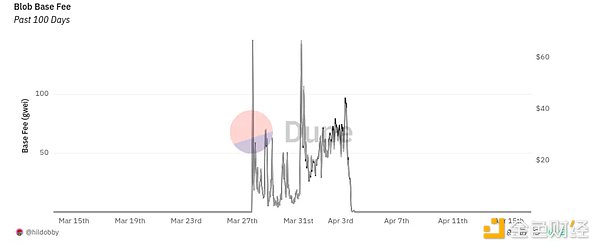

As of April 16 (one month after the Dencun upgrade), about 40% of blocks contain Blobs. As the average Blob fee remains at a minimum level of 1 wei (below the target of an average of 3 Blobs per block), this figure indicates that the market is not yet saturated.

In the last week of March, the Blob base fee briefly exceeded the block base fee as "blobscriptions" temporarily pushed the Blob market to full capacity.

The current limit for blobs released per hour is about 400. The saturation point of the Ethereum data availability market is around 900 blobs per hour (to meet the 3 Blobs per block target), which suggests that the market is currently only utilizing 40% of capacity. 900 blobs per hour is the preset 3 Blob target (reference source: https://dune.com/hashed_official/blobfarm).

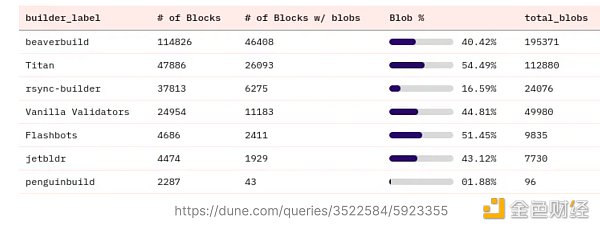

Flashbots’ Blob-Block Builder dashboard provides builder-level insights into Blob data. Since 40% of blocks contain Blobs, we can safely assume that the builder’s Blob inclusion rate should also be around 40%.

Currently, builders accounting for 20% of total block production have a lower-than-expected Blob inclusion rate, ranging from 1% to 16%, suggesting that builders may delay inclusion due to the lack of incentives we predicted in our previous article on EIP 4844.

Of the top 7 builders accounting for 96% of Ethereum block production, the 3rd and 7th builders by market share (20% in total) show much lower concentrations of blobs in their blocks. This suggests that they are forgoing blob transactions when building block content due to a lack of economic incentive.

Blocks built by normal validators (which we define as validators that build their own blocks locally) have fewer MEV opportunities and therefore less precedent for economic competition on inclusion and latency. These validators also typically do not run MEV-optimized code. Since these validators build their own blocks, there is no longer a timing game for blob propagation latency through relays. Most other top builders maintain similar blob inclusion rates to normal validators, suggesting good will to adapt to the blob market. However, it remains to be seen whether this altruistic strategy will be effective during periods of intense MEV competition.

Optimism and Base Blob Strategy Insights

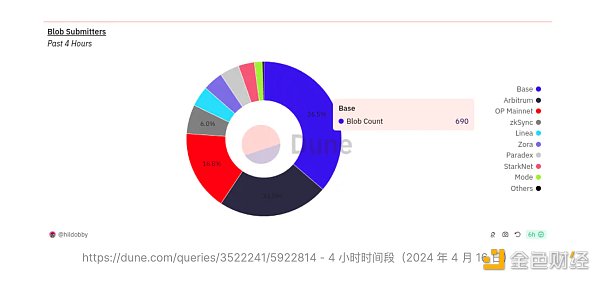

Currently, Optimism and Base use a blob maximization strategy - publishing up to 6 blobs per transaction, effectively filling the block's blob space with a single type 3 transaction. The advantage of submitting 6 blobs in each transaction is that it minimizes gas costs. The fee is only paid once, instead of paying the transaction block base fee 6 times for 6 blobs.

This strategy increases Blob Gas by up to 12.5%, resulting in higher Blob Gas fees for blobs in the next block. If different rollups are only publishing 1 blob at a time and sharing the mempool with transactions of size 6 blobs, depending on the gas cost of the blobs, it may be more advantageous for the rollup to try to front-end run the base blob transaction and avoid the 12.5% blob fee increase. While the amount saved is currently negligible due to low blob contention, blob front running could be a viable strategy for future cost savings if the strategy holds. It also means that others who adopt this strategy could be subject to indefinite censorship of individual blob blocks submitted by other rollup or inscription users.

Base is currently the largest user of the blob market, followed by Arbitrum and Optimism. Overall, the strategies employed by Optimism and Base account for about half of the blob market utilization. We emphasize that the market is currently underutilized, so competition among market participants has not yet intensified.

Blob Inclusion Rate Analysis

The effectiveness of the above blob release strategy can be measured by the slot inclusion rate and the correlation of the EIP-1559 priority fee premium with the slot inclusion rate.

The first measurement is the slot inclusion rate. This represents the number of slots required for a blob to be included in the beacon chain, with higher rates indicating slower inclusion times. The optimal slot inclusion rate is 1, indicating inclusion within a single block. However, since blobs slowly traverse the memory pool as very large transactions, we consider 2 slots as an acceptable slot inclusion rate target.

The second measurement is to understand the correlation between the EIP-1559 priority fee premium and faster slot inclusion rates. Ideally, higher priority fees would result in faster slot inclusion rates.

Block Inclusion Rates

Despite underutilized markets (visible in the chart below), Optimism and Base have had fairly slow blob inclusion rates, with frequent spikes above 2 blocks. At first glance, it seems counterintuitive to see delayed blob inclusions in a market that is not operating at full capacity.

EIP-1559 Priority Fee Premium and Slot Inclusion Rate Correlation

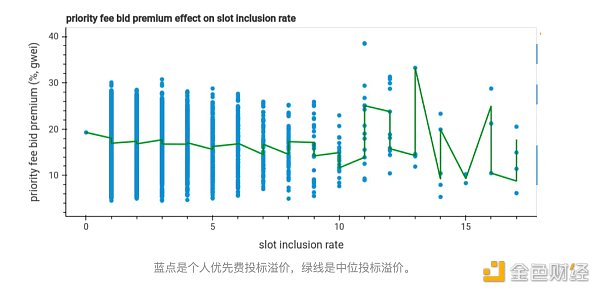

The bidding strategy for Optimism and Base follows the Geth specification of doubling all parameters when resubmitting a blob. The chart below shows that this bidding strategy has no significant effect on speeding up slot inclusions, with even priority fees as high as 40 gwei sometimes requiring more than 10 blocks to be included, while priority fees as low as 2 gwei can sometimes be included within a single block.

It is not clear what the optimal priority fee is for reliable slot inclusion. Generally speaking, there is no benefit for blobs to sit in the mempool. Slower slot inclusion rates increase uncertainty around gas price discrepancies, rotating builder selection, and occasional mev opportunities.

Blob Market Adoption and Expansion

The blob market is still nascent and its adoption is still a work in progress - Scroll recently adopted EIP-4844, and zk rollups like Aztec and Taiko plan to go live on mainnet later this year. According to L2Beat, there are more rollups using Ethereum calldata as a data availability layer than using blobs.

In addition, Blob descriptions are designed to make Blob space more accessible to non-Rollup users through an easy-to-use front-end UI. After enabling Blob descriptions, we saw the Blob Market reach capacity quickly, although activity has decreased since then.

Following EIP-4844, the next major technical step to scale Blob usage is to implement full sharding after a potential increase in the target value of 3. Implementing data availability sampling technology will enable the current Blob Market to scale from 6 blobs to 64 and eventually 256 blobs.

Blob Market Outlook

Blob producers seeking reasonable block inclusion rates are currently limited to using EIP-1559's highest priority fee, which is not a valid parameter as there is no significant correlation between priority fees and faster blob inclusion rates. In addition, priority fees are slow to update as the entire blob needs to be resubmitted to the memory pool. As blob adoption continues to rise, we expect it will be more difficult to rely on this bidding mechanism as bandwidth usage increases and inclusion feedback slows.

As the blob market matures, it will require more sophisticated bidding strategies to ensure on-demand access to the data availability layer. Primev has been closely monitoring the blob market and proposed mev-commit's blob pre-confirmation as a viable solution for reliable blob inclusion. If you are a Blob producer or other Ethereum participant interested in optimizing Blob inclusion, please contact our team to participate in our experiment.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Huang Bo

Huang Bo Joy

Joy Hui Xin

Hui Xin Clement

Clement Beincrypto

Beincrypto Others

Others Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph