Recently, I have seen a topic that has been discussed a lot in the stock market, which is the large-scale liquidation of a structured financial product called "Snowball", which was comparable to an avalanche.

Some people are discussing there, what kind of power is this, and it goes against the country’s major policy of encouraging the development of the capital market, and trampled Big A into this? Are you going to blow up this pile of snowballs?

How can the big Vs know the true power that can turn the world upside down? How dare they mention it if they know it?

Financial markets are ruthless. Killing your parents can be forgiven, but blocking someone's way of making money is unforgivable.

If you lose money, don’t expect to find the truth from public posts. The truth is in everyone's heart. If you use your brain a little, you will know which one is the real culprit.

In criminal investigation, looking for clues to murder means thinking about who will benefit the most if this person dies?

Learn briefly about this structured financial product that has become a hit due to the bull market in 2021.

Technically speaking, the essence of this thing is an OTC option.

More specifically, it is a put option (put).

A further step is to sell a put option, which is the so-called "sell put".

If you want to add some additional explanation, it should be a sell put with a profit stop (such as 15%) and leverage (such as 4 times).

To be honest, there are so many people rushing for such a complex product. I really admire the courage of high-net-worth people to gamble and win big, and the sales staff's eloquent tongue. Ability!

So, what kind of words moved so many people to donate generously and join the game? It is the high probability of profit that is shiny on the surface of the snowball structure:

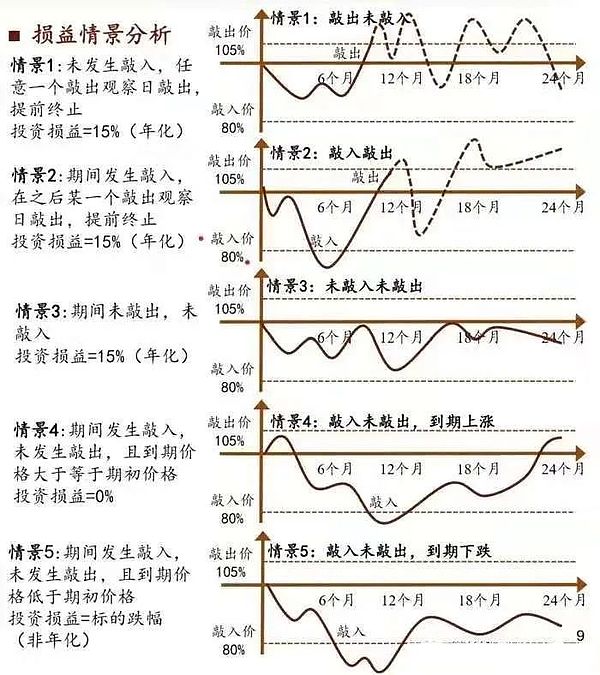

If the market goes up, you will take profit. The faster the price rises, the faster the profit will be taken. The faster you reinvest, the more time you spend. If coupled with 4x leverage, tsk tsk, you won’t have to count money until your hands get cramps.

If the market does not rise or fall (the box fluctuates), then at the end of the period, the brokerage will return your principal and attach the same amount as the take-profit The "borrowing interest" of the income (i.e. 15%) is used as the consideration for occupying your funds during the financial management period (such as the past 2 years).

If the market falls during the period and falls below the exercise price (called the "knock-in price" in Snowball products), then as long as the market rebounds at the expiration If it reaches the box (beginning price ~ take-profit price) and then breaks through the box, resulting in a take-profit, then you will still earn 15% profit.

If the market falls during the period and falls below the exercise price ("knock-in price"), then as long as the market rebounds back to the box at the expiration, but If the price does not break through the box and cause a profit stop, then you will be able to recover your principal in full without any loss.

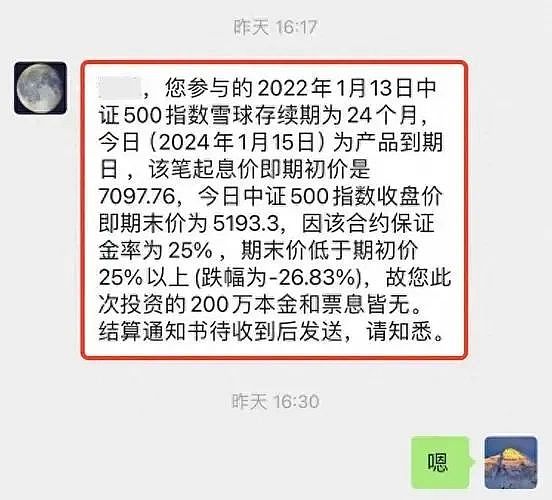

Only when the market falls during the period, falls below the exercise price ("knock-in price"), and does not return to the box until expiration, Then the principal will be lost at this time. If leverage is used, the loss will be doubled. If you lose your margin, you will be liquidated.

If this structure uses an index that has a high probability of not going down, but a high probability of going up, such as a certain index, then do you feel that the chance of winning is huge? Is it about to go up? Is it necessary to get leverage?

But this unexpected thing happened. In the past year, risks have increased all over the world, but only A has steadily achieved a high cost-effective gold discount.

The snowballs could no longer roll, but hit the south wall, causing snow to splash on the spot.

But why? Snow Child expressed that he would not die in peace.

Because this is a product that looks glamorous on the surface, but actually has an extremely poor risk-benefit ratio.

Many people know that Duan Yongping likes to sell put. He treats selling put as an alternative operation to buying spot. When the price falls, he is willing to buy the spot, and then hold it for a long time to gain unlimited upside profits. Even if he doesn't fall in place, he can still make a small amount of royalties.

For people who buy put, put is like an "insurance". If the market falls below the exercise price, he can sell the spot at a locked price and buy the spot at a lower price, thus earning the difference; if the market does not fall below the exercise price, he can give up the exercise. In this way, he hedges against the downside risk of the market. And the price he paid for this was the royalty he paid to buy the put. Therefore, the royalty can be compared to the "premium".

So for the person who sells put, he thinks exactly the opposite. He was originally going to buy the spot, but now the price is a bit high, so he sold a put at a lower price and collected the "premium" first. If the market falls below the exercise price, then he buys the spot at the exercise price; otherwise, he cannot buy the spot, but he still earns a "premium". This is a little more clever than placing a limit order and waiting for the transaction to be completed.

Through this put, the buyer transfers the market downside risk to the seller. The reason why the seller dares to take this risk must be because he has more patience and confidence and is bullish on the spot in the long term.

However, investors who are also selling put and using snowball structure financial management are completely different from Duan Yongping.

In the snowball structure, the long term is cut into the short term (2 years), the upside profit space is unlimited and the profit limit is capped at 15%, and the downside is The limited loss and resilience can be turned into a rigid liquidation position with a 100% loss of principal through the use of leverage.

Through clever parameter design, a clever trick to sell put has been turned into a bet with a small chance of winning and a big chance of losing.

If it skyrockets, you get 15%, and the rest goes to the brokerage.

If it plummets, your position is liquidated, and the brokerage has no loss.

If it doesn’t rise or fall, the brokerage will pay you back.

Those who buy this financial management tool are betting that a market will neither rise nor fall sharply within 2 years. What do you think his chances of winning are?

Bearing the risk of losing all the principal, but only getting a maximum of 15% of the contingent income, and being complacent and thinking that you have made a bargain, such a leek , will only become a feast for the wolves.

JinseFinance

JinseFinance

JinseFinance

JinseFinance decrypt

decrypt Coinlive

Coinlive  Coindesk

Coindesk Coindesk

Coindesk Coindesk

Coindesk Beincrypto

Beincrypto

Ftftx

Ftftx Cointelegraph

Cointelegraph