Author: GryphsisAcademy Source: medium

TL;DR

Analysoor is the first Meta Protocol on the Solana chain , takes a unique approach to creating and distributing NFTs and tokens. It provides users with Fair Launch’s minting mechanism by using the block hash as a random number generator and selecting a winner on each block. This mechanism has proven successful so far, effectively eliminating the impact of bots in the minting of $ZERO and Index ONE NFTs.

Fairness and liquidity guidance are the core value supports of Fair Launch. Under this mechanism, there are no pre-sales and whitelists, no team allocation, and no GAS fee front-running transactions. Everyone is on the same starting line, and the gap in capital volume cannot bring about competitive advantages in the casting process. The fees generated by minting will not flow to the wallets of the project parties or miners, but will all be used to create liquidity, feed back the ecology and community, and form a positive flywheel.

Analysoor is forming a strong community consensus, and its value and potential are being realized and recognized by more and more people. At the same time, its developers are constantly using more innovative methods to further combat potential bot behaviors so that fairness can be maintained and guaranteed in the long term. Among them, the application of AI algorithms and machine learning will be what we are most likely to see next.

Compared with the market value of mainstream Lanchpad projects on other public chains such as Auction, Turt, Bake, etc., Analysoor’s current market value may be Seriously underestimated. Considering that there is currently no leading Launchpad protocol in the Solana ecosystem, Analysoor will very likely become this role and will have huge room for value growth in the future.

The market's demand for fairness and transparency is growing, and the mechanism of Fair Launch will become an inevitable trend, so it may be This is the year Meta Protocol exploded (especially on high-performance public chains like Solana), and Analysoor, as the pioneer of Fair Launch on the Solana chain, has great potential and a very strong vision. We may see it being used in the future. Bring it to more diverse tracks and become a multi-functional Launchpad, not just the casting of MEME coins and NFTs.

Introduction

Since the encryption market entered 2023, the popularity of the blockchain inscription market represented by the Ordinals protocol and its derivatives has surged. However, what is brought about by this crazy market is people's desire for more efficient blockchain functions. The increasing demand for lower gas fees and operational complexity, as well as fairer market participation.

At this time, the Solana ecosystem has experienced an impressive rebound. Driven by diverse innovative projects and a strong ecosystem, Solana will Once again the hottest contender in the bull market, especially its high-throughput and low-latency transaction characteristics are critical to the inscription and NFT markets. As of December 17, 2023, the total number of inscriptions on the Solana chain has exceeded 1 million.

Analysoor makes full use of the characteristics of Solana ecosystem to build an innovative Fair Launch mechanism, dedicated to solving the fairness problem in traditional mechanisms. , and will bring a huge change to the inscription and NFT market.

Project Introduction

Analysoor Protocol is an innovative inscription and NFT casting protocol on the Solana chain, and is also the first Meta Protocol in the Solana ecosystem. It beautifully blends the high throughput, low transaction fees, and fast transaction confirmation features of the Solana ecosystem with the essence of the Ordinals protocol, creating a "block lottery" minting mechanism with a gambling nature. The core value lies in solving the problems of fair distribution and liquidity guidance of inscriptions and NFTs in the casting process. By using Fair Launch, it filters out Bots and "scientists" to the greatest extent, creating a platform for truly enthusiastic participants. A high-experience casting environment that is completely fair and transparent, has lower thresholds and is easier to operate.

When other developers use Analysoor to carry out minting and distribution activities, its Fair Launch mechanism will effectively attract a large number of real users to actively participate, and these Users will be able to bring a lot of heat and topics to the casting target in a short period of time, promoting the rapid formation of community consensus.

Under the mechanism of Fair Launch, no matter you are a whale with huge funds or a retail novice who has just joined the industry, everyone is in the same position. On the same starting line, there are equal opportunities to earn income. At the same time, more decentralized and equal distribution results further increase the community’s voice. We have every reason to believe that Analysoor is setting off a huge wave of disruption to the public chain inscription protocol, and look forward to it becoming a change leader and leading project in the inscription and NFT casting launchpad within the Solana ecosystem.

Analysoor is still in its early stages, and its protocol and ecology still have huge imagination and development potential. As of now, there has been no financing activity for the agreement and there are no plans to do so.

Developers and community construction

Analysoor was founded by @Pland__, Pland is a data scientist and engineers, possessing excellent technical capabilities and innovative thinking. Once launched, Analysoor aroused widespread discussion in the encryption community and attracted the interest of a large number of users. Moreover, Plan once stated in the community that because he has a background in Data Science, he is trying to integrate more AI algorithm elements into the protocol to continuously improve and make further innovations. This also makes the community have doubts about the future of Analysoor. There are more expectations for development.

Although Plan has invested a lot of time and energy in the construction and innovation of the protocol, he has also put in a lot of effort in community building. Plan actively communicates with participants in the community every day, solicits opinions and answers questions from community users, which is crucial to maintaining community activity and building community consensus. At the same time, Plan has also set up discussion channels in different languages (such as Chinese, Japanese, Korean, French, etc.) in the DC community, which not only avoids misunderstandings about the project due to language problems, but also helps members of the same language Provides a platform for discussion that will help disseminate the protocol within the wider multilingual community.

As of the date of writing this article, according to data on the Solscan chain, its protocol token $ZERO has 7866 currency holding addresses. After the protocol DC community is opened, Within 48 hours, the number of community users has exceeded 500, and is still rising (you need to hold at least 100 $ZERO or 1 Index ONE NFT to enter the community).

Protocol revenue source

Developers currently only charge 2.5% from the Index ONE NFT project Royalty fees, Planland said this revenue is enough to maintain the operation of its agreement. At the same time, Plan also holds about 1.69% of the total supply of $ZERO (currently the fourth largest currency holding address on the chain, with a total of about 355,000 coins). He has repeatedly stated that his goal is always the long-term development of the protocol, not the long-term development of the protocol. Become a short-term rugger.

1. What problems may exist in the traditional deployment mechanism?

On October 3, 2023, a person named Rijndael on Twitter passed the BRC-20 "first come, first served" and most The public nature of Bitcoin transactions, the release of the BRC-20 sniper robot Sophon. The bot monitors transactions for BRC-20 deployment inscriptions and then preempts them by increasing the GAS fee.

In this way, Rijndael can reliably defeat other BRC-20 inscription deployment transactions in the block, making his own transaction an "official" transaction. At the same time, this also gives him the power to change the total supply and maximum minting amount of the token.

After this, Rijndael decided to set the supply of each token on which Sophon is deployed to 1 , which means that each token will only have 1 owner Or, completely prevent the development of the token.

As shown in the figure, after Sophon is deployed, the entire The inscription activity of BRC-20 on the chain has dropped sharply, with only a handful or even close to 0 per day. Since then, as Sophon has run out of money, activity numbers have returned to previous highs.

Afterwards, according to data released by Rijndael, Sophon only spent 0.0129 Bitcoin to achieve a 75% success rate of preemptive transactions , it can be said that he single-handedly created a short-term "bear market" scene for the BRC-20 inscription market, which is currently in the midst of a boom.

Although Rijndael has proven after this incident that he is only stress testing and experimenting with ideas and not for the purpose of destroying the ecosystem, this time The incident still deserves our vigilance - if there are multiple Sophons existing at the same time, what will happen to the market? Do we still have a chance to participate in the market? At least, when a few people can dominate the entire market through technical means or capital advantages, the interests of ordinary investors cannot be protected at all.

2. How is Analysoor’s Fair Launch mechanism implemented?

Through Analysoor's Fair Launch gameplay, users will no longer need to conduct crazy bidding by massively increasing GAS fees like in other traditional minting modes. Instead, the cost is fixed for each user each time they participate in a mint. When a user participates in a mint, they can be understood as buying a "block lottery", and then the block's randomly generated hash The value will be used as a basis to determine which transaction (lottery) in the block will become the winning transaction (winner).

In general, the first number in the block hash value will be used as the lottery number, and the parity of the number combination in the hash value will be used as the judge. Basis for counting order (in most cases each block will contain at least one number in its hash). Therefore, the winner judgment logic can be divided into two situations. The following are examples of the two situations.

This judgment logic creates a double gap for the casting allocation process. layers of security protection measures. Under this mechanism, if someone wants to manipulate the new process, he must buy a large number of "lottery tickets" in a block (at least 20 in a perfect case) to try to occupy both the top and the bottom. 10 trades from 0-9, and this becomes a very expensive "bet".

At the same time, the developers of the Analysoor protocol also retain the possibility of randomly making minor changes to the judgment logic in each future casting event. Related information It will be announced after each casting event, and verification channels will be open to users. Its core purpose is still to prevent robots from finding ways to disrupt the market in long-term fixed patterns, thereby further reducing the possibility of fairness being destroyed.

In addition, in the Analysoor protocol, the costs incurred by all users in the process of participating in the minting will neither flow to the miners as GAS fees nor to the developers. wallet. All these fees will be used to repay investors for the inscription project itself.

For example, during the minting process of $ZERO, all fees generated were added to the AMM pool to provide liquidity; while in Index ONE During the casting of NFT, all fees received are used to protect ONE at a floor price, and holders will always be able to sell ONE at a minimum price of 2.5 Sol. This method successfully prevents liquidity from flowing out of the Inscription Ecosystem, and the income generated will also attract investors to reinvest, feeding back the ecological protocol, forming a positive cycle.

3. Does Analysoor’s Fair Launch model work?

In this section, we will use statistical data from the $ZERO minting process to analyze whether Analysoor 's Fair Launch model truly achieves fair distribution .

According to new statistics, this time $ZERO casting A total of 4914 addresses participated, of which 2654 completed at least 1 successful casting, accounting for 54% . A total of 113,244 casting attempts were calculated, resulting in a weighted average win rate of 9.27%. Now we put the respective number of attempts and win rates for all participants into a scatter plot.

From this picture we can see that Fair in Analysoor Under the Launch model, as the number of attempts increases, the distribution of winning percentages remains relatively flat and does not show significant improvement. On the contrary, the "lucky ones" tend to appear among participants with a low number of attempts. The more attempts they make, the closer their winning rate will be to the weighted average winning rate.

From this box plot, we can also further see The distribution of the winning rates of the participants is shown. The third quartile (Q3) number is about 13.04%, indicating that 75% of the participants have a winning rate lower than this number. Combined with the previous scatter chart, it is not difficult to find that the other 25% of participants are the "lucky ones" who participate less often. This is a very normal phenomenon in the lottery mechanism and does not give us the fair distribution we expected. The results have an impact.

At the same time, the linear regression results show that the number of attempts The coefficient is -0.0056 , and the P value of 0.162 also prevents us from rejecting the null hypothesis, so this result once again proves that there is no significant linear relationship between the winning rate and the number of attempts.

In summary, the method of suppressing other participants by increasing costs and relying on the amount of funds is not applicable in Analysoor’s Fair Launch model. Participants do not need to worry that the amount of funds will affect the fairness of their distribution results. This also confirms what we said before, Fair Launch gives retail investors and whales the same starting line, and there are no indicators indicating that there is any behavior that undermines fairness during the $ZERO casting process.

4. How will machine learning and AI algorithms help address potential hazards?

Thanks to Solana's high throughput and block production speed, the block hash value is used as a random number generator and selected in each block A winner's approach brings us exciting fairness. However, this is not without its pitfalls. During the minting of the Index ONE NFT, we saw the transaction volume on the Solana chain reach an average of about 7,000 transactions per minute, approximately 120 TPS, and that was just from this one minting event.

With the significant increase in demand for Fair Launch in the future and the chain With the massive increase in casting activity, the high load is likely to result in a single block being unable to effectively accommodate all castings, thereby preventing the casting process from proceeding smoothly. More importantly, this will lead to the failure of the fair lottery mechanism achieved by utilizing block hash values, limiting the possibility of Analysoor’s Fair Launch being widely adopted.

Therefore, looking for other potential alternatives has become an important issue worth thinking about. Machine learning and AI algorithms propose new solutions and directions for this risk.

Pland proposed that the classification method (Classification) in AI algorithms is a solution worth trying. Specifically, the AI will be trained using Solana’s complete historical data so that it can determine whether each address is a participant or holder that meets the standards through its activities in the secondary market. In this process, multiple data oracles that provide the same proof will be used in the system to help AI assign a weight to these addresses as a filter based on possible factors such as transaction frequency, transaction volume, market influence, asset size, etc. condition.

Simply put, we will rely on AI algorithms to set thresholds to filter suspicious bot addresses (similar to filtering spam emails). The level of the threshold depends on The selection is made by different token deployers each time, and the lottery method changes from "draw once per block" to "draw all winners from a larger pool at once."

Different from the existing mechanism, in the new scheme, liquidity guidance will no longer be a necessary condition. Therefore, we are likely to see that when the lottery results are announced, only the winners will need to pay the participation fee, and the fees of the participants who did not win will be fully refunded. However, the specific adoption plan can be continuously adjusted and changed according to market conditions and needs.

This approach will drive Analysoor towards true decentralization and solve the potential Solana block overload problem, providing a foundation for the widespread adoption of Analysoor . Moreover, as a Launchpad service provider, diversified deployment options and flexibility will allow deployers to customize TGE on the basis of Fair Launch according to their own and market needs, greatly enhancing Analysoor's appeal to currency issuers.

However, there are some key issues that still deserve our attention in the future. For example, the biggest challenge of this mechanism is how to ensure that the process of calculating weights can comprehensively consider various factors while ensuring fairness. If the threshold is set too low, the bot may increase the winning rate by using a large number of addresses to enter the prize pool. If the threshold is set too high, it may eventually form a whitelist effect, which also violates the core of fairness. in principle. Another aspect that needs to be clarified is whether the weight calculated by the algorithm will affect the winning rate of the address, which may cause widespread discussion among users about fairness. In addition, the risk of hackers doing evil by attacking oracles is also a factor that must be considered.

If such problems can be truly solved, then we will have sufficient reason to believe that Analysoor is writing a new historical chapter in the on-chain token issuance model. And it is expected to achieve huge value enhancement in the future, so we are very much looking forward to seeing what specific implementation plans Analysoor will propose in these aspects.

Tokenomics

1. $ZERO

$ZERO is the first token issued by Analysoor using the Fair Launch model, and it is also its only SPL Token (smart contract token on the Solana chain). The total issuance supply is 21 million, of which 1050 Ten thousand coins (50%) are provided to the winning minter, and another 10.5 million coins (50%) are used to create liquidity on AMM. There is no team allocation, and there is no private sale or pre-sale. 98% of LP Tokens in AMM will be locked until April 20, 2026, and the proceeds generated will be automatically reinvested into AMM to further expand liquidity. The minting rights of $ZERO have been given up and no additional issuance will be carried out in the future.

During the casting process of $ZERO, a total of 8847.3 SOL was incurred in casting fees, all of which were put into the AMM on Metaora.

Currently, according to Metaora data, the transactions of SOL and ZERO The TVL of the AMM pool has reached 9.32M, making it the AMM pool with the highest TVL on Metaora.

In terms of market capitalization, the current market capitalization of $ZERO is 38.01 M (current price $ 1.81). Considering that Analysoor is a Fair Launch on the Solana chain As the founder of the mechanism, coupled with its strong vision for future development and the potential increase in market demand for Fair Launch, we have reason to believe that its market value is still undervalued.

Currency holdings

According to Solscan data, currently There are 10 addresses holding more than 1% of $ZERO on the chain, totaling 32.4%, and the remaining addresses hold 67.6% of the currency. Among them, developer Plan, as the fourth largest currency holding address, holds 1.69% of the tokens.

Value capture

$ZERO has no clear conclusion in terms of empowerment. In Analysoor’s third deployment event and the first community MEME coin $WHEN’s casting event, we participated Players will be charged 1 $ZERO and 0.05 $SOL for each minting attempt.

However, this is not a long-term sure empowerment for $ZERO. All $ZERO fees generated from this minting will be deposited into a wallet in order to raise sufficient liquidity for its future listing on the three major centralized exchanges. This brings certain future expectations to community members and holders, but the long-term application scenarios of $ZERO are still unclear.

2. Index ONE NFT

Index ONE is the first one issued on Analysoor There are 10,002 NFTs in total, 2 of which are rare NFTs and have not participated in the deployment. A total of 9,708 of the remaining 10,000 NFTs have been successfully minted. To ensure fairness, the remaining 292 will be burned.

During the casting process of ONE, a total of about 25,000 addresses participated in the casting, resulting in 536,136 casting attempts. A minting fee of approximately 26,000 $SOL was generated, and the average minting win rate was approximately 2%.

From this statistical data we can see that here In the first round of casting, even for those addresses with the most attempts, their winning rate was not significantly higher than the average winning rate of 2%, which once again shows that the amount of funds is still unable to create a significant competitive advantage under this Fair Launch mechanism, resulting in The emergence of unfairness. It is worth mentioning that the reason why all 10,000 NFTs were not minted is because as the minting was nearing the end, there were as many as 110-130 minting requests in each block, which led the project team to suspect that there might be a bot. appeared, thus ending the casting process early to prevent fairness from being violated.

Of all minting fees incurred, 5,000 $SOL are used as floor price protection in 4 NFT markets. This protection The mechanism ensures that the price of ONE will never be lower than 2.5 $SOL. If someone triggers the protection mechanism and sells ONE at this price, the ONE will be burned and will not flow back into the market. Another 21,000 $SOL were pledged at a yield of 7.3% APY, of which $100,000 worth of assets will be withdrawn to pay the art designer of ONE NFT. The use of the remaining proceeds generated from the pledge has not yet been decided. One possible guess is that the proceeds may be used to increase the price of protective flooring.

Currently, ONE can be used for NFT lending on Banx and will be available on more similar platforms. The final design of ONE NFT will be decided by community voting, with the goal of creating an NFT that is similar or even better than Bitmap and Solmap. For comparison, Bitmap's current market capitalization is approximately 254 M, Solmap's market capitalization is approximately 15 M, and ONE's current market capitalization is only approximately 6.6 M.

A misunderstanding

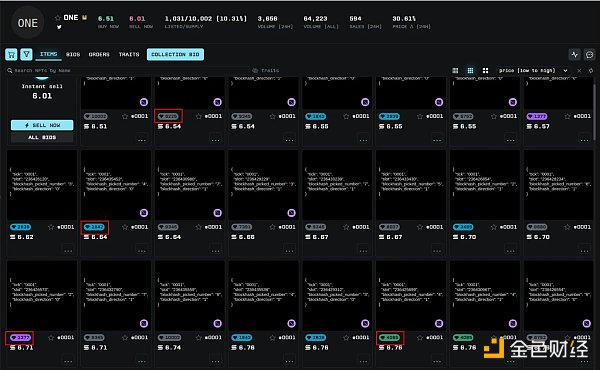

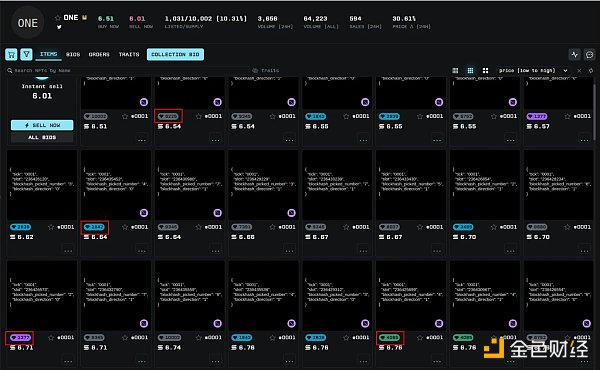

Source:https://www.tensor.trade/trade/one

When we are in NFT When Index ONE is traded in the market, we may see the rarity as shown in the picture, and we may find that the price of some ONEs with high rarity is significantly higher than those with low rarity.

However, developer Plan said in the community that this rarity is just a bug, not a real rarity, and the only real rarity is 10,002 ONEs. 2 pieces.

We cannot completely rule out the possibility that developers will reconsider designing for this rarity in the future. But at least for now, investors need to clearly understand this when buying before making an investment decision.

Value Capture

Similar to $ZERO, ONE NFT There is also no clear conclusion on empowerment. During the minting event of the community MEME coin $WHEN, ONE NFT holders will share 3% of the total supply of $WHEN as airdrop rewards.

Similarly, this is not a long-term definite empowerment of ONE NFT. Analysoor will not force other projects using the launchpad to empower ONE holders in the future. Issuing airdrops, because this is considered to significantly reduce the number of potential project parties, which is not conducive to the long-term development of Analysoor.

In terms of overall market value, we selected the market values of three other currently mainstream Launchpad Services to compare with Analysoor. It can also be seen that Analysoor's current market value still has very optimistic room for growth.

In general, although the long-term empowerment of $ZERO and ONE has not yet been decided, their developers have made it clear that they are trying to find A solution that allows $ZERO and ONE to combine and profit together without affecting the long-term development of the protocol.

What we can confirm at present is that both $ZERO and Index ONE will be Analysoor’s only two tokens associated with its ecological value in the long term. , is also the pioneering "totem" of the Fair Launch model on the Solana chain, which provides motivation for us to become early holders and expect them to obtain considerable value increases in the future, and the core value support will still come from the market's future support for Fair Demand for the Launch mechanism grows.

Analysoor Future Development Plan

< span style="display: inline !important;">Developer Plan said in the community that before allowing more other projects to start using Analysoor for token deployment, he will first work on building a better Legal Structure, including creating a public verification channel for the casting situation on the chain, etc.

At the same time, he will carry out community construction of the first community MEME coin $WHEN and the art creation process of Index ONE NFT, and further improve Analysoor website to improve its friendliness to new users. Most importantly, the development team will continue to make efforts to combat bots, including but not limited to the use of AI technology, to maintain a long-term and stable Fair Launch mechanism.

In the future, we may see Analysoor cooperate with other Solana ecological projects to jointly maintain fairness while also being able to Fair Mode Bring it to more tracks, not just as a Launchpad for MEME coins and NFTs.

Outlook - How will the Fair Launch mechanism change the market?

As the market’s demand for fairness and transparency grows, Fair Launch will become a more popular choice. In the cryptocurrency market in particular, there is a growing focus on the value of decentralization and equal participation, and Fair Launch aligns with these values. Additionally, as the regulatory environment matures, the Fair Launch approach may be viewed as a more compliant launch method. Fair Launch has the following most critical features and advantages:

Fairness and equal opportunity:At its core, Fair Launch is about providing equal opportunity to all participants, regardless of background or financial resources. This approach increases the overall inclusivity of the project, helping to increase trust in the project and wider adoption by the community.

No pre-mining or pre-sale of tokens: In Fair Launch, all tokens are Created and assigned transparently after project launch. This means that no one person or group has an unfair advantage by owning a large amount of tokens before anyone else. Typically in a Fair Launch model, project owners add liquid pairs directly to decentralized exchanges (DEXs), making the tokens tradable from the start of the project (as Analysoor did with $ZERO’s minting event) .

Prevent Price Manipulation: The Fair Launch development team is continually implementing bot-proofing measures designed to Maintain market fairness and prevent price manipulation and unfair trading practices.

Community Engagement: Fair launches often emphasize community involvement and engagement. This may include community voting, open discussions and forums, and other ways to ensure everyone has a say in the development of the project. This community-driven approach promotes long-term participation, creates a loyal user base, and may lead to a more resilient and decentralized network.

Reducing risk: By creating a level playing field and involving broader community engagement, Fair Launch helps reduce the overall risk associated with a new cryptocurrency or blockchain project. This helps prevent potential scams or fraudulent activity, which is a significant risk for investors and users in the crypto space.

Overall Fair Launch is a powerful concept that is revolutionizing the cryptocurrency, blockchain and financial fields. By promoting equality, transparency and community engagement, Fair Launch redefines how cryptocurrencies and tokens are distributed, effectively avoiding the concentration of wealth and power and will facilitate the growth of decentralized networks. As the industry continues to evolve, projects and investors alike need to embrace the principles of Fair Launch.

As market participants pay increasing attention to fairness and transparency, we expect Fair Launch to become more popular in the future, and Analysoor as an on-chain Solana As the founder of Fair Launch, we have reason to believe that it will be fed back in the future as the entire ecosystem develops and demand expands.

If you are also a fan of inscriptions and NFTs, hope to participate in the market fairly, and have been endlessly involved in this violent inscription craze. If you are tired of entering the GAS fee "war", then Analysoor 's Fair Launch mechanism will be a gold-mining opportunity that you definitely want to try.

Conclusion and risk warning

In summary, we can Analysoor The main advantages and risks are summarized below.

Advantages:

Analysoor has a strong vision and narrative that brings new dimensions and possibilities to NFT minting and token distribution in the Solana ecosystem. This forward-looking initiative will greatly to meet the needs of investors and the market.

Considering that multiple projects have already introduced this mechanism, we believe that Analysoor can take advantage of its first-mover advantage to take the lead in developing and Fair Launch form that integrates various micro-innovations. This will provide more diversified TGE options for project deployers and participants in the future, ultimately making Analysoor a multi-functional Launchpad on Solana.

Analysoor's approach reflects a commitment to innovation and adapting to changing market trends and user needs, which helps build a Stronger communities and increased robustness of their ecosystems.

The Analysoor protocol is still in its early stages, and the value of its token $ZERO and NFT ONE is still undervalued. This provides investors with good odds. At the same time, the idea of combining $ZERO and ONE for empowerment also gives holders greater imagination for the future.

Risk point:

Fair Launch's models do not guarantee a project's success or viability, they simply provide a fairer starting point, and ensuring true fairness and transparency can be There are challenges, and the process may still be susceptible to manipulation by those with greater resources or technical expertise, including but not limited to smart contract vulnerabilities, hacker attacks, or other security issues.

Analysoor's current degree of decentralization is still lacking, and its developers still have the final independent right to make decisions.

As Analysoor moves towards open source, its Fair Launch innovative mechanism may be imitated. Considering that the Analysoor team is small and has a small amount of funding, if a large team imitates it, larger funding and a stronger development team may have a certain impact on Analysoor's influence.

Overall, we still have strong expectations for Analysoor's Fair Launch model and its future development, and look forward to ;Analysoor can become the leading project of the Fair Launch model and Launchpad on the Solana chain, ultimately leading a storm of change in the entire encryption industry.

Reference

https://blog.ordinalhub.com/how-1-man -singlehandedly-cause-the-bitcoin-ordinals-bear-market/

https://twitter.com/analysoor?ref_src=twsrc%5Egoogle%7Ctwcamp% 5Eserp%7Ctwgr%5Eauthor

https://dune.com/cryptokoryo/brc20?ref=blog.ordinalhub.com

Statement

This report was completed by @0x markyzl, a student of @GryphsisAcademy, under the guidance of @CryptoScott_ETH, @Zou_Block Original works. The authors are solely responsible for all content, which does not necessarily reflect the views of Gryphsis Academy, nor the views of the organization that commissioned the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be relied upon for investment decisions. It is strongly recommended that you conduct your own research and consult with an unbiased financial, tax or legal advisor before making any investment decisions. Remember, the past performance of any asset does not guarantee future returns.

Edmund

Edmund