Author: Tom Mitchelhill, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Analysts warn that Ripple's native XRP token could experience a "leverage-driven" rally as the asset's price surges to its highest level since 2021.

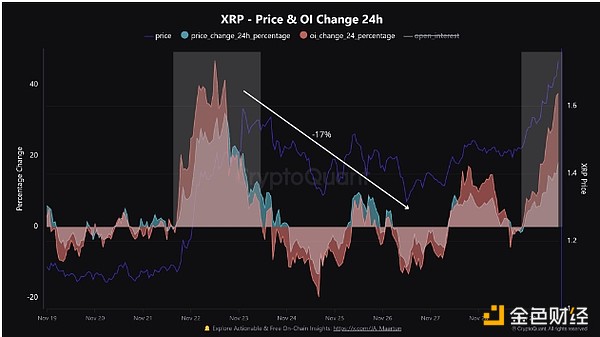

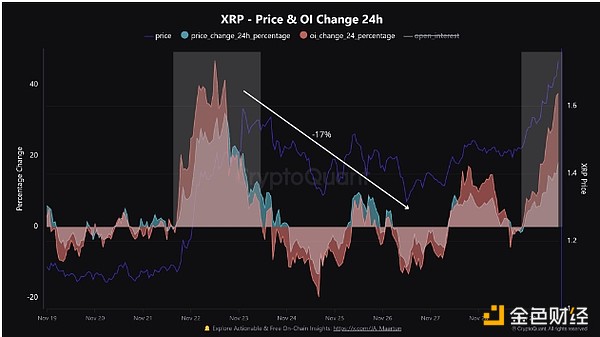

In a Dec. 1 article for X, CryptoQuant analyst Maarten Regterschot noted that XRP's open interest, a measure of open derivatives positions, had surged in the past 24 hours, and warned that a sharp rise could lead to a rapid sell-off.

“Open interest has risen by 37% - watch out for volatility. The last similar event led to a 17% drop.”

“Stay sharp and manage risk accordingly.”

Source: Maarten Regterschot

According to CoinGlass, XRP’s open interest has surged 30% in the past 24 hours, reaching $4 billion across major exchanges and trading platforms.

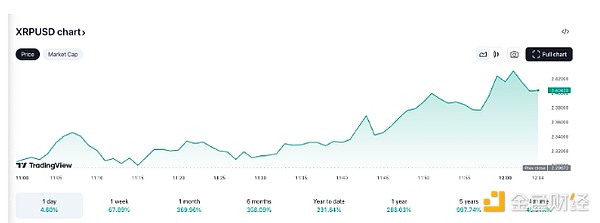

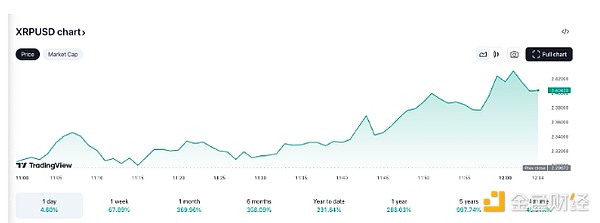

At the time of publishing, XRP is changing hands at $2.39, up 68% over the past month, according to TradingView.

XRP is up nearly 70% in the last week. Source: TradingView

After Donald Trump won the election on November 6, XRP began to rise along with major crypto assets including Bitcoin and Solana, but XRP has begun to outperform other major tokens.

On December 1, XRP's market capitalization surpassed Solana, and has since surpassed Tether, becoming the third largest crypto asset by total value.

XRP's super high cost performance stems from a growing number of key partners, new product development by Ripple Labs, the possibility of an XRP ETF, and unconfirmed rumors that Elon Musk will make a large investment in XRP and Ripple.

Asset management company 21Shares applied for an XRP ETF on November 1, 2024, raising investors' expectations that the U.S. Securities and Exchange Commission (SEC), which may be led by new leadership in January 2025, will approve the ETF application.

Catherine

Catherine