Author: Arthur Hayes, Medium; Compiled by: Songxue, Golden Finance

U.S. Treasury Secretary Bud Gur Janet Yellen and her silly Federal Reserve Chairman Jerome Powell Oscillates between decisive action and vague talking points. When they act, it's best not to fight them. But when they are just talking, be careful because many market signals will point you down a path destined for loss.

On November 1, 2023, the U.S. Treasury Department’s Quarterly Refund Announcement (QRA) included an announcement that it would transfer most borrowings to short-term Treasury bills (T-bills) with maturities of less than one year. ). This prompted money market funds (MMFs) to withdraw funds from the Fed's reverse repurchase program (RRP) and invest in higher-yielding Treasury bonds. Liquidity infusions were and are being provided, and once completed, the total will be close to $1 trillion.

In mid-December 2023, at the FOMC press conference, Powell announced that governors were discussing a rate cut in 2024. That's a dramatic departure from his comments two weeks ago, when he assured markets the Fed would keep tightening to ensure inflation didn't return. The market believes that this means that the Federal Reserve’s first interest rate cut in this cycle of interest rate hikes will occur in March this year. Then, earlier this month, Dallas Fed President Logan posed the tentative question that the pace of quantitative tightening (QT) would gradually slow as RRP balances approach zero. The reason is that the Fed does not want any problems with dollar liquidity when one source of money printing stops.

Let’s review what is talk and what is actual action. Yellen converted department borrowings into Treasury debt, adding hundreds of billions of dollars in liquidity so far. This is the actual flow of money into global financial markets. Powell and other Fed governors talked about a big game about cutting interest rates and tapering the pace of quantitative easing in the distant future. The talk did not add any monetary stimulus. However, the market viewed actions and words as the same thing and rallied after November 1, continuing to rise throughout the month.

The markets I'm referring to are the S&P 500 and Nasdaq 100, both of which are hitting all-time highs. But all was not well. A real smoke alarm in the direction of USD liquidity - Bitcoin - is sending out warning signs. Following the launch of the US spot ETF, Bitcoin has fallen from a high of $48,000 to below $40,000. In line with Bitcoin’s local highs, the 2-year U.S. Treasury yield hit a local low of 4.14% in mid-January and is currently rising.

The first argument for Bitcoin’s recent plunge is the outflow from the Grayscale Bitcoin Trust (GBTC) . This statement is false because when you net outflows from GBTC with inflows into newly listed spot Bitcoin ETFs, the result is that, as of January 22, the net inflow was $820 million.

The second argument, and my position, is that Bitcoin is expected to The Bank Term Financing Plan (BTFP) will not be updated. The event will not be positive because the Fed has not yet lowered interest rates to a level that would push the 10-year Treasury rate into the 2% to 3% range. At these levels, the bond portfolios of non-too-big-to-fail (TBTF) banks have returned to profitability, while there are currently large unrealized losses on their balance sheets. Until interest rates are reduced to the levels mentioned above, these banks cannot survive without the support provided by the government through the BTFP. The exuberance in financial markets has given Yellen and Powell a false confidence that the market will not let some non-TBTF banks fail if the BTFP is not renewed. Therefore, they believe that the politically toxic BTFP can be stopped and there will be no negative market reaction. However, I think just the opposite:The cessation of BTFP will trigger a mini-financial crisisand force the Fed Stop the talk and let Yellen start cutting rates, tapering QT and/or resuming money printing via quantitative, easing (QE). Bitcoin’s price action tells me I’m right and they’re wrong.

The Fed would rather stimulate the market through speeches and Wall Street Journal columns because they are extremely afraid of inflation. The belligerent puppets who presided over the pacifist foreign policy of the United States are now locked in another Middle East war and a never-ending battle with the Houthis in Yemen. Later in this article, I will elaborate on why this Red Sea war is important and could lead to a disturbing spike in commodity inflation in the run-up to the US election this November.

Contrary to what mainstream Western financial media tells you, Inflation is still a problem facing most bankrupt Americans question. Voters decide presidents based on the economy, and now the President of the United States, vegetable geek Joe Biden and his woke Democrats are doomed to be smoked to death by Orange Trump and his pathetic Republicans .

I believe Bitcoin will fall before the BTFP renewal decision on March 12th. I didn’t expect it to happen so soon, but I thinkBitcoin will A local bottom is found between $30,000 and $35,000. As the SPX and NDX fall from the mini-financial crisis in March, Bitcoin will rise as it will represent the Fed finally turning its rate-cutting and money-printing rhetoric into pressing the "Brrrr" button action.

Now, I'm going to quickly give readers a sense of why I think the Fed needs a mini-financial crisis to stop the "talk" and kick-start Yellen with some charts.

This is the flow of US dollars Sex chart. The index plunged as the Federal Reserve began raising interest rates and quantitative easing in March 2022. However, as suggested retail prices have fallen since June 2023, the index is back to its lowest level since April 2022.

This chart is the The subcomponent of the index is the net change in RRP and TGA balances. Since the U.S. government passed its budget in June 2023, nearly $800 billion in new liquidity has been added.

From a macro level, Although the Fed’s balance sheet decreased by 1.2 trillions of dollars, but risk assets are still pouring in due to relatively high levels of U.S. dollar liquidity.

The First Crisis

If we dig deeper into the non-TBTF bank failures, we see that Yellen and Powell were forced to take action to bail out the U.S. banking industry. The chart above is the S&P Regional Bank ETF (KRE) in white versus the 2-year Treasury yield in yellow. The banks in the index are smaller banks in the system because they do not enjoy government deposit guarantees like their better-known and more profitable TBTF brothers. Yields rose sharply in the first quarter of 2023, causing Korean real estate to plummet and three major non-TBTF banks (Silvergate, Signature, and Silicon Valley Bank) to go bankrupt within two weeks. Yields plummeted as the market knew the Fed would have to print money via BTFP to save the system.

Second Crisis

Everything was fine for a time, but markets began to focus on the out-of-control U.S. deficit and Huge amounts of bonds had to be issued to finance it. The issue was further complicated by Powell's statement at the September 2023 Federal Open Market Committee (FOMC) press conference, in which he said financial markets would do the job of monetary tightening for the Fed. The bond market is hoping the Fed will raise interest rates further to combat inflation and raise government borrowing costs, rather than just sit on the sidelines on a Bloomberg terminal. Interest rates are rising across the curve, and most worryingly, long-term rates are rising in a bearish steep fashion. KRE responded by dumping to levels not seen since the depths of the banking crisis in April. Yellen was forced to take action in November to convert borrowings into Treasury debt. This saved the bond market and triggered a vicious short-covering rally in stocks and bonds.

FED IN CRISIS

The market is now predicting when the RRP balance will approach zero and wondering what will happen next. There's been a lot of discussion about this, including speculation about how the Fed could increase liquidity without calling it printing money. But no action has been taken yet. Two-year Treasury yields recovered, but South Korean property prices continued to rise. If Yellen and Powell are right, the 10-year Treasury yield will magically drop from 3% to 2%. This won't happen without new dollars to buy bonds. This is the disconnect between the 2-year Treasury yield and KRE. I believe the market is in for a nasty surprise as it becomes clear that Powell is all about barking and not biting.

This chart shows The difference between Bitcoin (white) and the 2-year Treasury yield (green) tells the same story, while the SPX (yellow) tells a different story. Since November 1, 2023, Bitcoin and the SPX Index have risen as the 2-year Treasury yield has fallen. Once the 2-year yield bottomed out and reversed direction, Bitcoin fell while the SPX continued to rise.

Bitcoin tells the world that the Fed is caught between inflation and a banking crisis. The Fed's solution is to try to convince the market that the banks are sound without providing the necessary funding to make this illusion a reality.

Jim Bianco has produced some excellent charts, which I will rely heavily on in the remainder of this article.

As readers know, I spend the Northern Hemisphere winter in Hokkaido, Japan. One notable change this season is the sheer number of Americans. Even for someone living in Asia, traveling to this powder paradise can be a harrowing experience. If you live in the United States, this can be more time-consuming and expensive. However, U.S. baby boomers are skiing at resorts in significantly greater numbers. Baby boomers are the wealthiest people in their lives. That's because both the stock market and home prices are at historically high levels. Additionally, their cash reserves are generating earnings for the first time in decades. For a group of humans who have just seen their lives flash by during a pandemic (remember, the pandemic killed mostly older obese people, the baby boomers), now is the time to travel the world.

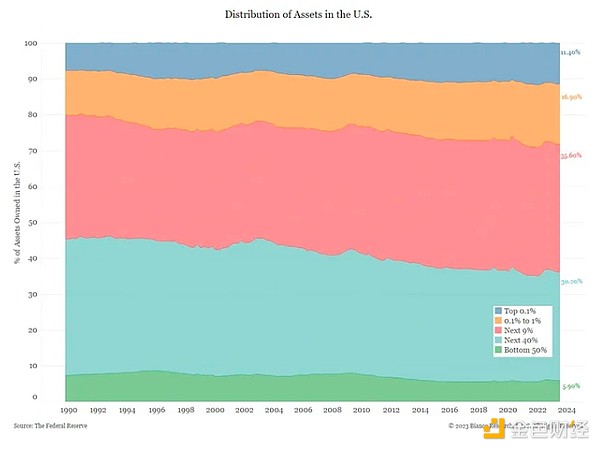

The richest man in America 10% of households own approximately 65% of the financial assets injected by the Fed through various money-printing programs. Baby boomers are the wealthiest generation, and their spending is powering a very strong U.S. economy.

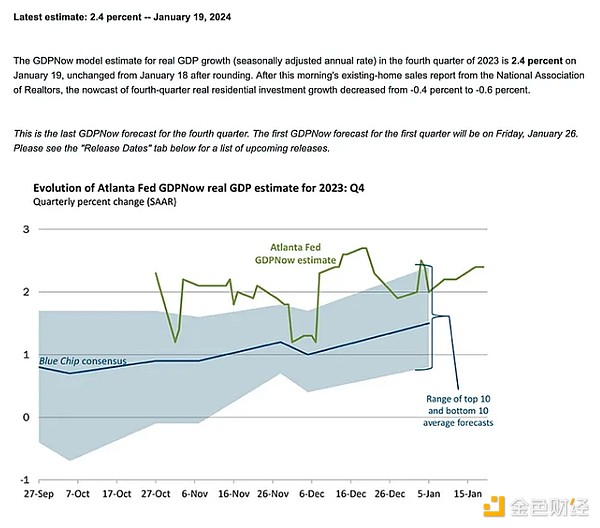

Atlanta Fed expected 2023 GDP will grow strongly at 2.4% in the fourth quarter of 2020 - strong to very strong!

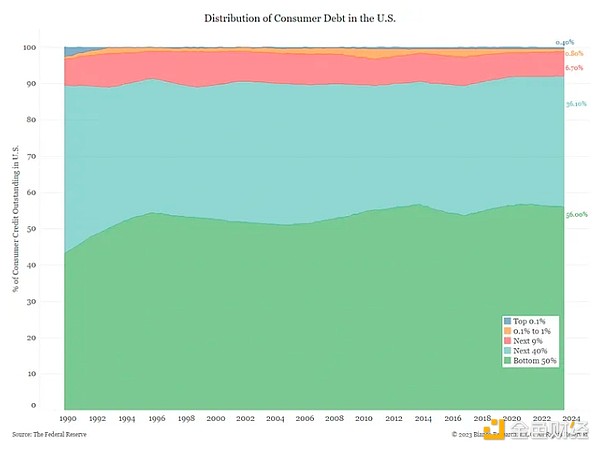

However, the rest of the country is bankrupt and deeply in debt.

The top 10% hold about 65% of financial assets but only about 8% of debt. The bottom 90% hold 92% of the debt but only 35% of the assets. This high level of inequality in the distribution of wealth and debt creates a problem for politicians in democracies. While politicians are determined to do whatever it takes to make the rich richer, they need to get elected by gaining the support of bankrupt civilians. That's why when inflation occurs, it's a problem.

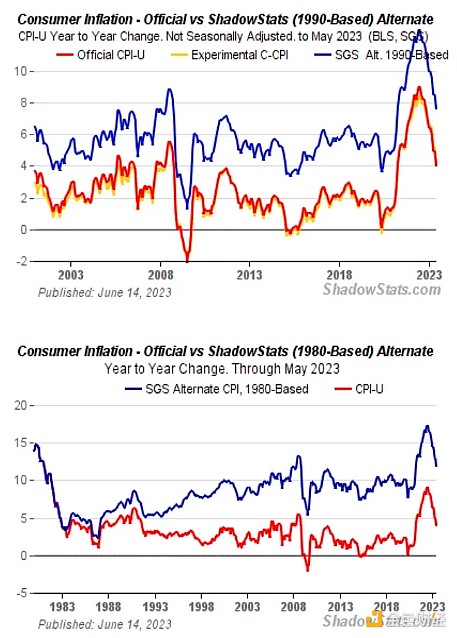

The current calculation method for the Consumer Price Index (CPI) is Fugazi. If we go back to the CPI calculations of 1980 or 1990, real inflation was about +10% versus the +3% inflation rate you read about in the news.

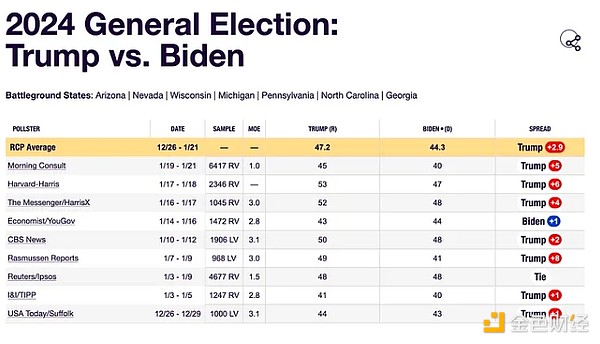

This is why according to According to the latest polls, Trump is slightly more likely to defeat Biden.

In a nutshell , American politics is like a circus, where the rich buy ads to increase the popularity of their favorite clown, who dances and sings to win the votes of the common people. Biden must hand out goodies to rich and poor alike to win. On a cynical macro level, the strategy is to pump up the stock market owned by the rich, thus increasing tax revenues, and then use the loot collected from the rich to provide relief to the poor.

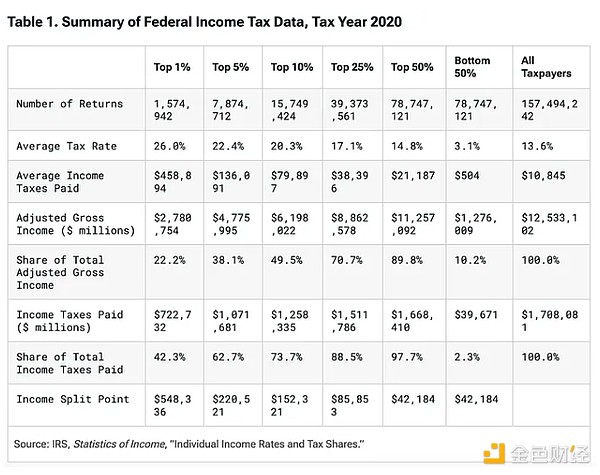

The top 10% pay 74% of income taxes. Their huge contributions stem from huge capital gains taxes levied by governments during stock market gains. Therefore, the U.S. government's finances are tied to the performance of the stock market.

Biden has two financial generals with different missions. Yellen must use the power of the U.S. Treasury Department to boost stocks. She could do this by adjusting the U.S. Treasury’s bond issuance schedule or by scaling back the TGA. Powell must reduce inflation to acceptable levels. He can do this by raising interest rates and shrinking the Fed's balance sheet.

Yellen’s job is much easier than Powell’s. Yellen could unilaterally boost stocks by issuing more Treasuries and bonds, or by reducing the TGA to zero from the current $750 billion. Powell can reduce the money supply and raise interest rates, but he has zero control over geopolitical issues. Nor can he influence the size of government deficits or surpluses. Assuming the government is committed to running large deficits, Yellen will provide funding appropriately, thereby increasing demand for goods and services. In this case, Powell's anti-inflation actions at the Fed will be weakened.

The reason post-COVID-19 U.S. inflation is so pronounced is because the government has given people stimulus funded by the Federal Reserve’s money printing at a time when the world is struggling to ship goods. There have been shutdowns and labor shortages due to pandemic lockdown policies. The result has been inflation reaching levels not seen since the late 1970s and early 1980s.

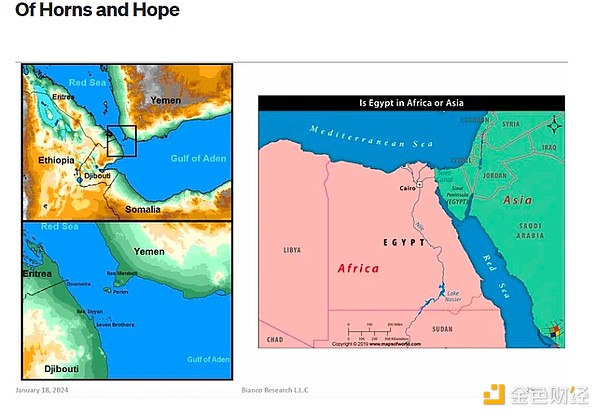

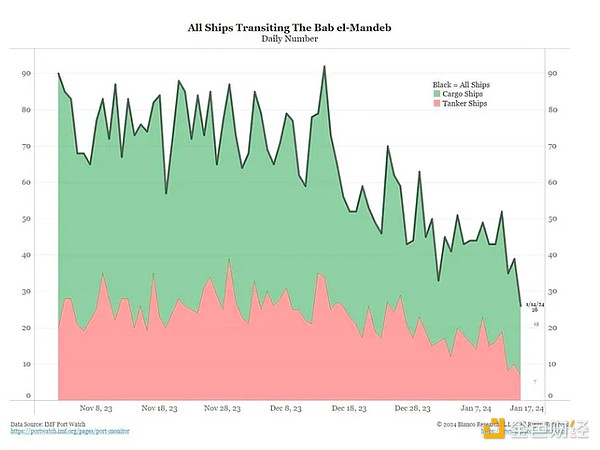

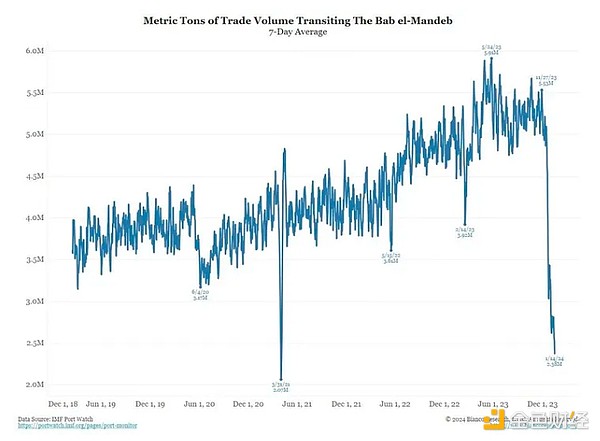

A similar global supply chain crisis is unfolding, but this time, difficulties in transporting goods are caused by El Niño and Caused by the suspension of Western shipping in the Bab el-Mandab Strait.

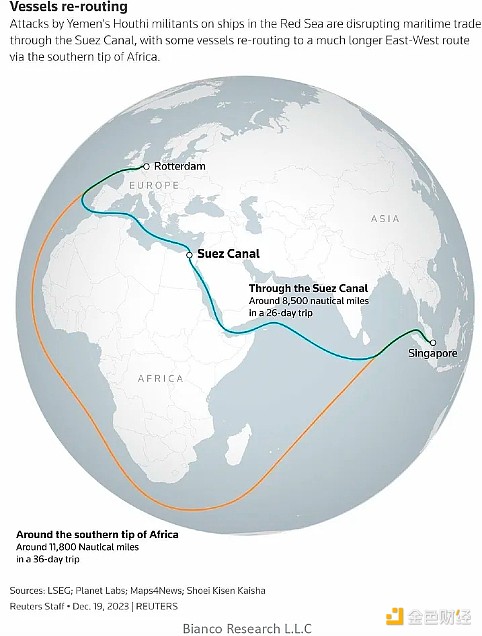

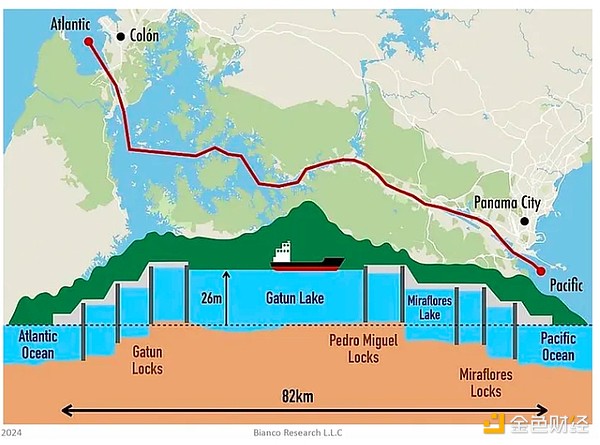

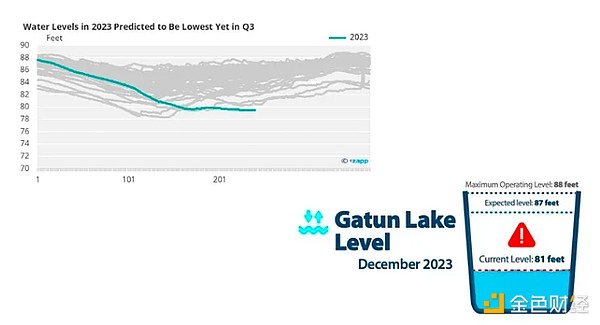

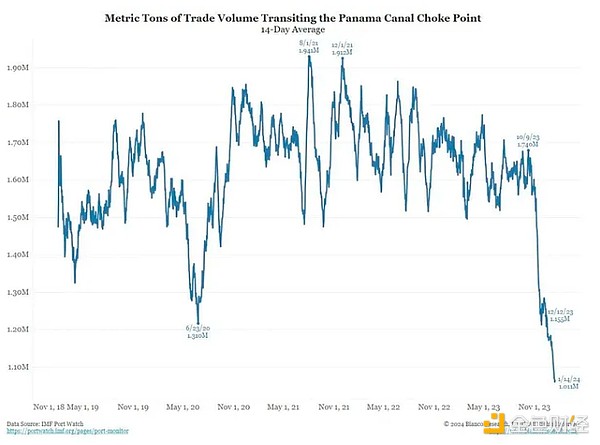

Shipping is an old but important business. Sea transport has the cheapest cost per kilometer of travel compared to rail, road or air. Without the Panama Canal or Bab el-Mandeb Strait, ships would have to go around Cape Horn or the Cape of Good Hope. The onset of an El Niño weather pattern is causing drought in the Panama Canal, resulting in lower than average water levels in the canal, meaning fewer ships can pass through. Asymmetric drone warfare by Yemen's Houthis has effectively blocked the Bab el-Mandeb Strait to Western shipping. They now had to sail around the Cape of Good Hope.

The impact of this diversion It accounts for 20% to 30% of global transportation and adds a lot of time and expense. To an inflation statistician, anything that travels by boat becomes more expensive, all else being equal. Given that inflation operates with a considerable lag, if this continues, the effects will not be felt for several months. While markets were pleased with lower year-over-year inflation data in the U.S. and elsewhere, it could be a Pyrrhic victory.

The El Niño weather pattern has just begun. Mild El Niño conditions typically last one to two years. No matter how severe this El Niño is, it will still happen in November this year. Sadly, if you're a Biden supporter, there's not much he can do about the weather. Humanity is not even a Kardashov Type I civilization. El Niño and climate change in general have lowered water levels in the Panama Canal, reducing the number of ships that can transit.

Reducing shipping activity through the Panama Canal is important because the United States is rerouting some cargo through Europe to eastern seaboard ports to avoid passing through the Panama Canal. However, shipping costs and times will increase given that cargo loaded on Western ships from Asia to Europe must now go around Africa rather than through the Red Sea.

The Houthis have declared that they will attack any ship from any country that supports Israel. They believe that Israel's war in Gaza is an act of genocide, prosecuted by war criminals such as Prime Minister "Bibi" Netanyahu. In solidarity with their fellow Muslims and Arabs, they used $2,000 worth of drones to attack merchant ships. A cheap drone can completely disable a ship worth hundreds of millions of dollars, which is the definition of asymmetric warfare. Think about it: To disable a $2,000 drone, the United States would have to launch a $2.1 million missile. Even if the Houthis never hit a single target, each drone they send costs 1,000 times more to defend than the United States. Mathematically, this is an unwinnable war for the United States.

The cost of using expensive Navy missiles (which can cost up to $2.1 million each) to destroy simple Houthi drones (estimated at thousands of dollars each) is getting higher and higher, according to three other Defense Department officials. It's getting more and more worrying. —— Politico

Given that the United States, as the issuer of the global reserve currency, is responsible for global maritime security, the world is watching how Pax Americana responds to this blatant military attack. Judging from the Houthi armed forces' statement, if the United States cuts off diplomatic relations with Israel and forces Bibi to end the war, the Houthi armed forces will stop their attacks.

Even if Biden loudly calls for an end to the war and an end to the murder of so many Gazan men, women and children, Biden will never stop the financial and military blockade of the Israelis for fear of losing face. The result is that the entire world has a front-row seat to future wars. The traditional U.S. Navy, represented by fleets of aircraft carriers that cost trillions to float, is going head-to-head with adversaries launching drones that cost less than a zero-bond bar label.

I predict that we will see firsthand how difficult it is for the mighty red, white, and blue fists to defeat a swarm of drones. In order for shipping lines to have the confidence to cross the Red Sea again, the U.S. Navy must perform flawlessly in every engagement. Every drone must be destroyed. Because even a direct impact from a drone payload could incapacitate a commercial vessel. Additionally, with the United States now at war with the Houthis in Yemen, shipping insurance premiums will skyrocket, making sailing through the Red Sea even less economical.

Rising transportation costs due to weather and geopolitical factors could lead to a spike in inflation in the third and fourth quarters of this year. Since Powell is undoubtedly aware of these issues, he will make every effort to talk about a rate cut without necessarily actually cutting rates. Inflation is likely to rise modestly due to higher transportation costs, but interest rate cuts and the restart of quantitative easing are likely to exacerbate this rise. The market is not aware of this fact yet, but Bitcoin is.

The only thing better than fighting inflation is a financial crisis. That's why, in order to achieve cuts, QT tapering, and the market's belief that QE may resume in March, we first need to have some banks fail when BTFP doesn't update.

Tactical Trading

ETF approved high corrected 30% from $48,000 to now $33,600. Therefore, I see support forming for Bitcoin between $30,000 and $35,000. This is why I purchased $35,000 of puts on March 29, 2024. I also sold off my Solana and Bonk trading positions at a small loss.

Bitcoin and cryptocurrencies in general are the last freely traded markets in the world. Therefore, they will predict changes in USD liquidity before the TradFi fiat stock and bond markets are manipulated. Bitcoin tells us to look for Yellen, not just talk.

Yellen has the opportunity to inject more energy into the market in the upcoming QRA, which is due to be released on January 31. If she says she's going to cut the TGA from $750 billion to zero, then we know there's another source of liquidity that the market didn't anticipate that could support the market. The question then becomes: will the BTFP be enough to prevent any bank failure once it is not updated?

I don’t think the Treasury Funding Program (BTFP) will be updated because neither Yellen nor Powell mentioned it. So the natural assumption is that it will mature and banks will have to pay back the nearly $200 billion they borrowed. If things change and they make it clear that it's going to be extended, then the market will change. I would close out my put options holdings and increase my risk level to the maximum by continuing to sell Treasuries and buy cryptocurrencies.

If my base case comes true, I will start looking for a bottom once Bitcoin breaks below $35,000 . I would buy Solana and $WIF heavily. Bonk was the Dogecoin of the last cycle, and if it weren’t for Wif Hat, it would be worthless.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Kikyo

Kikyo Sanya

Sanya Clement

Clement Bitcoinworld

Bitcoinworld dailyhodl

dailyhodl TheBlock

TheBlock Ledgerinsights

Ledgerinsights Others

Others