Author: Arthur Hayes, Medium; Translator: Tao Zhu, Golden Finance

Some of you think you are now the masters of the universe because you bought Solana for less than $10 and sold it for $200. Others did the smart thing and sold fiat for crypto during the bear market from 2021 to 2023, but lightened up as prices soared in the first quarter of this year. If you trade your shitcoins for Bitcoin, you get a pass. Bitcoin is the most difficult currency ever created.

Bull markets don't come often; it's a travesty when you make the right decision but don't maximize your profit potential. Too many of us try to make bull market reasoning. As long as the bull market continues, they will buy, hold, and buy again.

Sometimes I find myself thinking like a loser. When I do this, I have to remind myself of the overarching macro theme that the entire retail and institutional investment community has come to believe. That is, all major economic groups (the United States, China, the European Union, and Japan) are devaluing their currencies to reduce leverage on government balance sheets. Now that TradFi can profit directly from this narrative through its US and soon-to-be-launched UK and Hong Kong spot Bitcoin ETFs, they are urging clients to use these crypto derivatives to preserve the energy purchasing power of their wealth.

I want to quickly explain the fundamental reasons for the massive rally in cryptocurrencies relative to fiat currencies. Of course, there will come a time when this narrative will lose its potency, but that time is not now. At this moment, I will resist the urge to take my chips off the table.

As we exit the window of weakness that I predict will occur due to the April 15 US tax payment and the Bitcoin halving, I want to remind readers why the bull run will continue and prices will get even more stupid. There are very few things in the market that get you here (Bitcoin from zero in 2009 to $70,000 in 2024) that get you there (Bitcoin to $1,000,000). However, the macro environment that has led to the surge in fiat liquidity, driving Bitcoin higher, will only become more pronounced as the sovereign debt bubble begins to burst.

Gross Domestic Product (GDP) in Nominal

What is the purpose of government? Governments provide public goods such as roads, education, health care, social order, etc. Obviously this is the wish list of many governments, but instead they provide death and despair… but I digress. In return for these services, we citizens pay taxes. A government with a balanced budget provides as many services as possible for a given amount of tax revenue.

Sometimes, however, a government will borrow money to do something it believes will produce long-term positive value without raising taxes.

For example:

An expensive hydroelectric dam is built. Instead of raising taxes, the government issues bonds to pay for the dam. The hope is that the economic return on the dam meets or exceeds the yield on the bonds. The government entices citizens to invest in the future by paying a rate of return close to the economic growth that the dam will create. If, in 10 years, the dam will increase the economy by 10%, then the government bond yield should be at least 10% to attract investors. If the government pays less than 10%, then its profits come at the expense of the public. If the government pays more than 10%, then the public profits at the government's expense.

Let's zoom out a bit and talk about the economy at a macro level. The rate of economic growth for a particular nation-state is its nominal GDP, which is made up of inflation and real growth. If the government wants to drive nominal GDP growth by running a budget deficit, then it is natural and logical for investors to receive a return equal to the growth rate of nominal GDP.

While it is natural for investors to expect a return equal to the growth of nominal GDP, politicians would rather pay less than that. If politicians can create a situation where the yield on government debt is less than the growth rate of nominal GDP, then politicians can spend money faster than Sam Bankman-Fried can in effective altruism philanthropy. The best part is that taxes don't need to be raised to pay for this spending.

How do politicians create such a utopia? They financially oppress savers with the help of the TradFi banking system. The simplest way to ensure that government bond yields are lower than nominal GDP growth is to instruct the central bank to print money, buy government bonds, and artificially lower bond yields. Banks are then told that government bonds are the only "appropriate" investment for the public. In this way, the public's savings are secretly invested in low-yielding government debt.

The problem with artificially low government bond yields is that it promotes malinvestment. The first project is usually worthwhile. However, as politicians try to generate growth in order to be re-elected, the quality of the projects deteriorates. At this point, government debt is growing faster than nominal GDP. Politicians now need to make a difficult decision. The losses from malinvestment must be recognized today through a severe financial crisis or tomorrow through low or even zero growth. Often, politicians choose long periods of economic stagnation because the future happens after they leave office.

A good example of malinvestment is green energy projects that are only possible through government subsidies. After years of generous subsidies, some projects fail to earn a return on the invested capital or the actual cost to consumers is too high. Predictably, once government support is withdrawn, demand weakens and projects stall.

During bad economic times, when central banks are pressing the "Brrrr" button harder than Lord Ashdrake is pressing the "Sell" button, bond yields become even more distorted. Government bond yields stay below nominal GDP growth, allowing the government's debt burden to be offset by inflation.

Yields

The key task for investors is to understand when government bonds are a good investment. The simplest way to do this is to compare the year-over-year nominal GDP growth rate with the yield on the 10-year government bond. The 10-year bond yield should be a market signal that gives us an idea of what to expect in terms of future nominal growth.

Real Yield = 10-Year Government Bond Yield - Nominal GDP Growth

When real yields are positive, government bonds are a good investment. Governments are usually the most creditworthy borrowers.

Government bonds are a bad investment when real yields are negative. The trick for investors is to find assets outside the banking system that are growing faster than inflation.

All four major economies have policies that have financially squeezed savers and led to negative real yields. China, the European Union, and Japan have all ultimately taken their monetary policy cues from the United States. Therefore, I will focus on the past and future monetary and fiscal conditions in the United States. As the United States engineers loosening financial conditions, the rest of the world will follow.

The chart shows real yields (.USNOM index) in white and the Federal Reserve (Fed) balance sheet in yellow. I start in 2009 because that was the year Bitcoin’s genesis block was launched.

As you can see, real yields turned from positive to negative following the deflationary shock of the 2008 global financial crisis. They briefly turned positive again due to the deflationary shock of the pandemic.

A deflationary shock is when real yields spike in response to a sharp drop in economic activity.

With the exception of 2009 and 2020, government bonds have always been a terrible investment compared to stocks, real estate, cryptocurrencies, etc. Bond investors can only perform well by using insane amounts of leverage to trade. For you Hedge Fund Puppet readers, this is the essence of risk parity.

This unnatural state of affairs occurs because the Fed expands its balance sheet by buying government bonds with printed money, a process called quantitative easing (QE).

The safety valve for negative real returns during this period was and is Bitcoin (yellow). Bitcoin has risen in a non-linear fashion on a logarithmic chart. Bitcoin's rise is purely a function of a finite number of assets priced in depreciating fiat dollars.

This explains the past, but markets are forward-looking. Why should you continue your crypto investments and have confidence that this bull market is only just beginning?

Free Shit

Everyone wants something for nothing. Obviously, the universe will never provide something so cheap, but that doesn't stop politicians from promising benefits without raising taxes. Support for any politician, both at the ballot box in a democracy and implicitly in more authoritarian systems, stems from the politician’s ability to generate economic growth. When simple and obviously growth-supportive policies are enacted, politicians use the printing presses to funnel money to their favored constituencies at the expense of the population as a whole.

As long as the government borrows at a negative real rate of return, politicians can give their supporters free stuff. Therefore, the more partisan and polarized a nation-state is, the more incentive the ruling party has to improve its reelection odds by spending money they don’t have.

2024 is a critical year for the world, with many major countries holding presidential elections. The US election is of global importance, as the ruling Democratic Party will do everything in their power to keep their office (as evidenced by the questionable things they did to the Republicans since the Orange Man “lost” the last election). A large portion of Americans believe that the Democrats somehow cheated Trump out of winning. Whether you believe this to be true or not, the fact that a large portion of the population holds this view ensures that the stakes for this election are very high. As I said before, fiscal and monetary policy under the Pax Americana will be emulated by China, the EU, and Japan, which is why it's important to keep an eye on the election.

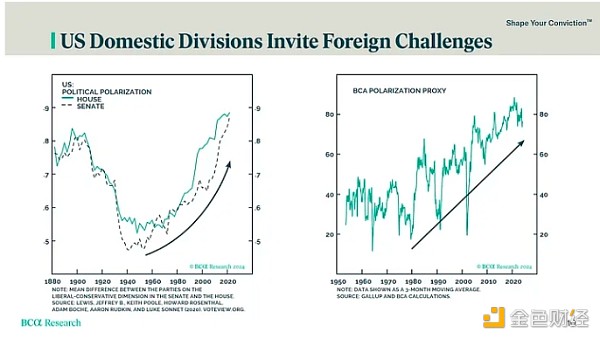

Above is a chart from BCA Research showing political polarization in the U.S. over time. As you can see, the electorate has not been this polarized since the late 19th century. From an electoral perspective, this makes for a winner-take-all situation. The Democrats know that if they lose, the Republicans will reverse many of their policies. The next question is, what is the easiest way to ensure reelection?

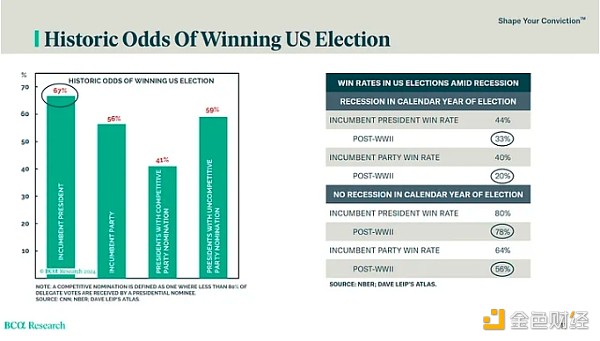

It's stupid economics. Voters who have yet to decide on the winner of the election decide based on their views on the economy. As shown in the chart above, if the public believes the economy is in recession during an election year, the incumbent president's chances of reelection drop from 67% to 33%. How does a ruling party that controls monetary and fiscal policy ensure there is no recession?

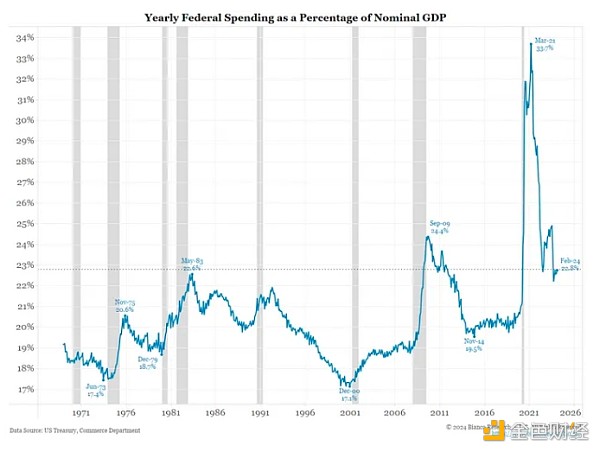

Nominal GDP growth is directly affected by government spending. As you can see from this Bianco Research chart, the US government's spending is 23% of nominal GDP. This means that the ruling party can print as much GDP as they want, as long as they are willing to borrow enough to meet the desired level of spending.

The Chinese government decides the GDP growth rate every year. The banking system then creates enough credit to drive economic activity to the desired level. For many Western-trained economists, the "strength" of the US economy is confusing because many of the main economic variables they monitor suggest a recession is imminent. But as long as the ruling party can borrow at negative interest rates, it can create the economic growth it needs to stay in power.

The above is why the Democratic Party, led by US President Biden, will do everything in its power to increase government spending. Then, US Treasury Secretary Bud Gur Yellen and her Fed Chairman Jerome Powell will need to ensure that US Treasury yields are significantly lower than nominal GDP growth. I don't know what kind of money printing euphemisms they will create to ensure that negative real yields persist, but I am sure they will do what is necessary to get their boss and his party re-elected.

However, the Orange Man may win. What happens to government spending in this case?

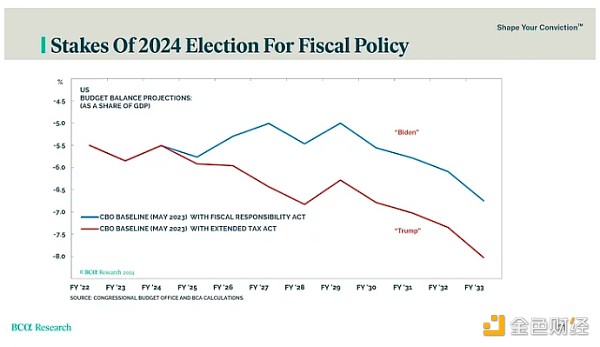

The above chart estimates the deficits under a Biden or Trump presidency from 2024. As you can see, Trump is expected to spend even more than Slow Joe. Trump is seeking another round of tax cuts, which will further increase the deficit. Whichever geriatric clown is chosen, rest assured that government spending will not fall.

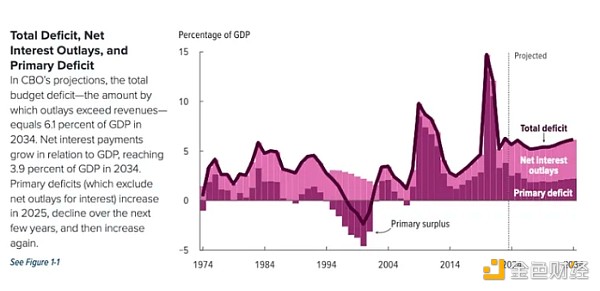

The Congressional Budget Office (CBO) projects government deficits based on the current and hypothetical future political environment, and expects massive deficits. Basically, if politicians can create 6% growth by borrowing 4%, why would they stop spending?

As mentioned above, the political situation in the United States gives me confidence in the development of the printing press. If you think what the US monetary and political elites did to "solve" the 2008 global financial crisis and the pandemic is ridiculous, you haven't seen anything yet.

The war on the periphery of Pax Americana continues to be fought primarily on the Ukrainian/Russian and Israeli/Iranian theatres. As expected, warmongers in both political parties are content to continue funding their proxies with borrowed billions in cash. The costs will only increase as the conflict escalates and more countries are drawn into the melee.

Summary

As we head into the northern hemisphere summer and policymakers get a break from reality, cryptocurrency volatility will decline. This is the perfect time to take advantage of the recent cryptocurrency dip to slowly add to your position. I have a list of shitcoins that have been hammered over the last week. I will discuss them in the next articles. There will also be many token launches, but they will not be as popular as the first quarter launches. This provides a great entry point for those who were not pre-sale investors. Whatever the taste of crypto risk excites you, the next few months will provide a prime opportunity to add to your position.

Your hunch that money printing will accelerate as politicians spend it on handouts and wars is correct. Do not underestimate the desire of the incumbent elite to remain in office. If real interest rates turn positive, reassess your crypto convictions.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph 链向资讯

链向资讯