Author: Wesley Pryor, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

Does every cryptocurrency have a pump-and-sell plan? Many people rightly ask this question because almost every time a coin is listed on a new exchange, users notice a common theme and that isSignificant price increases to unsustainable levels, followed by a cliche collapse that holds players accountable.

Who is behind the scenes? The answer is market makerss, companies retained by cryptocurrency projects to manage the tokens (or liquidity) initially used for trading when listed on a new exchange.

The transition of digital assets from private market trading to public market trading through an initial listing is the same as an initial public offering (IPO) in the traditional securities market, but there is one significant difference: The opening price of digital asset markets is often deliberately undervalued by digital asset issuers, resulting in first-day performance that is much higher than that of traditional markets.

In traditional markets, passive investors primarily hold stocks, while in digital asset markets, tokens are best held by active participants. The success of the token market depends on the strength of its holders. Unlike IPOs, where investment banks set the offering price, tokens in public funding rounds are often priced below fair market value, leading to higher first-day gains in digital markets.

During the initial listing, market makers (MMs) take a large portion of the circulating supply of tokens and sell them. This is done on the exchange's pre-market order book, allowing market makers to place liquidity before public trading. The goal is to ensure there is sufficient liquidity at market opening to enable efficient price discovery.

However, some MMs inflate short-term profits through insufficient order book capital, harming the token community and projects. This practice is called "parasitic" market making, which puts MM profits over market health.

The different ways to provide liquidity to primary listings through pre-market order structuring are as follows.

Parasite: Parasitism creates artificial scarcity sex and manipulate emotions to take advantage of pre-market conditions. They wait for retail bids to rise, then aggressively short the token, placing high sell orders to absorb demand, causing the token price to fall. This harmful strategy takes advantage of initial demand and often causes irreversible market damage.

Transient: Parasitic MMs run roughshod over the pre-market order book, placing large sell orders to fill positions and maximize fees or close OTC trades. This approach results in a quick exit from the market, eliminating potential price gains through a massive sell-off of tokens.

Symbiosis: In contrast, market makers use their understanding of the pre-market order book to strategically place open liquidity, building long-term value and ensure accurate price discovery. By providing liquidity to both parties, MM facilitates an orderly price discovery process that reflects the true market value of the asset.

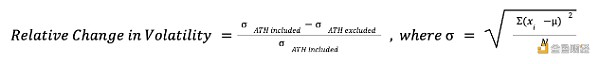

To classify market makers according to their approach, we tracked the price multiple performance of tokens during two key periods: the first two days after listing. days (hourly analysis) and the previous two weeks (daily analysis). This data is sourced from the project's main trading platform or reliable aggregator and is standardized to allow for comparative analysis between different projects. Central to our analysis is relative change in volatility (RCV), a method we introduced previously in our case study.

< span style="font-size: 14px;">The formula for relative change in volatility (RCV). Source: Acheron Trading

< span style="font-size: 14px;">The formula for relative change in volatility (RCV). Source: Acheron Trading

RCV’s formula measures the coin’s all-time high (ATH) with or without ) changes in price volatility. If the value is positive, the order book is undersupplied, indicating insufficient pre-market liquidity. Negative values indicate that the order book is oversupplied, which indicates active market making and that the asset is overpriced. A neutral value means that liquidity is correct for orderly price discovery.

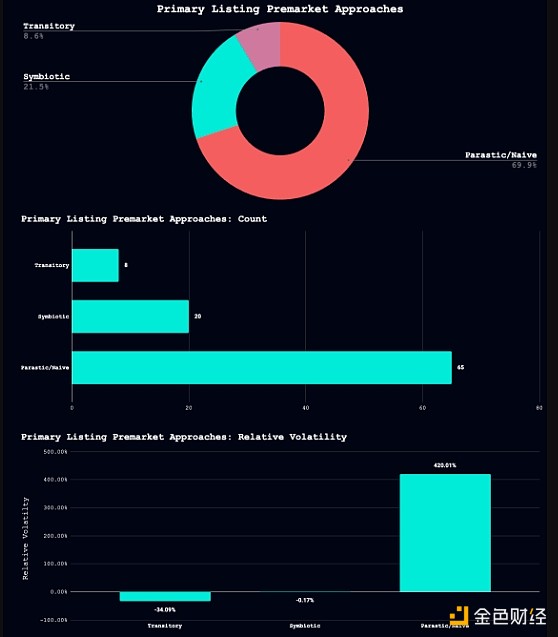

To evaluate major listings and MM methods, we apply the RCV method to 93 listings since April 2024, including Bybit, Kucoin, Binance, Coinbase, Kraken and OKX.

Breakdown of pre-launch listing methods. Source: Acheron Trading

We found that 69.9% were classified as "parasitic", 8.6% were classified as "transient" and only 21.5% were "symbiotic". This means that 78.5% of releases are done in a way that promotes fair price discovery, which has benefits for both end users and the project itself Negative Effects.

For Parasitic issuance, including ATH points leads to a 420% increase in market volatility, indicating severe undersupply and price increases. In contrast, Transitory's volatility when ATH is included Sex dropped by 34%, indicating an oversaturated order book and poor initial supply management that only benefited MM at the expense of the community.

Both parasitic and transient approaches can seriously impair price discovery and reduce the likelihood of sustained market participation. In contrast, the symbiotic approach has an RCV of approximately plus or minus 20%, providing a stable basis for a fair and healthy price discovery process.

As the digital asset industry continues to grow in legitimacy and scale, market makers must correct the mismanagement of major listings. Asset issuers and exchanges should work with market makers and utilize the RCV method to analyze whether the market maker constructed the initial order book correctly.

Market makers have a bad image, and as the data shows, there's good reason for that. Now is the time to raise the bar, eliminate parasitic operators, and allow market makers to assume their critical role in enabling efficient price discovery.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya Coinlive

Coinlive  Bitcoinist

Bitcoinist Beincrypto

Beincrypto Coindesk

Coindesk Nulltx

Nulltx Bitcoinist

Bitcoinist