Author: Billy Bambrough Forbes;Compiler: Liam

On September 19, according to Forbes, BlackRock recently revealed that they are quietly preparing for a $35 trillion debt crisis-this crisis is expected to trigger a surge in Bitcoin prices.

After the Federal Reserve announced its first interest rate cut after the epidemic, the price of Bitcoin suddenly soared, and Bitcoin prices are expected to achieve a "surge".

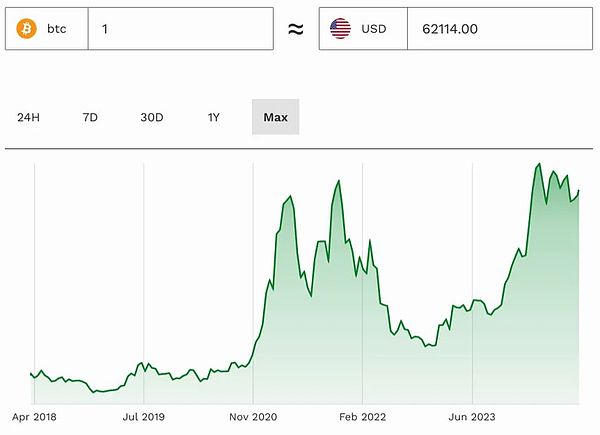

The price of Bitcoin has climbed to more than $62,000 per coin. After the Federal Reserve unexpectedly cut interest rates by 50 basis points, traders have now turned their attention to the Chinese financial market, which will start a new round of liquidity cycle, which may put the Bitcoin and cryptocurrency markets on the "cusp" of major changes.

Now, with the dollar “on the brink of a full-blown collapse” as fears spread, BlackRock, the world’s largest asset manager, has warned that growing concerns about the U.S.’s $35 trillion debt are expected to drive “institutional interest in Bitcoin.”

“Growing concerns about the U.S. federal deficit and debt situation both inside and outside the U.S. increase the appeal of alternative reserve assets as a potential hedge against future events that could impact the dollar,” BlackRock’s chief investment officer for ETFs and head of global macro for crypto and fixed income wrote in a paper outlining the investment case for Bitcoin.

“This is why some are calling Bitcoin the Second Amendment to money,” Bloomberg ETF analyst Eric Balchunas wrote on X, adding that the U.S. debt is $35 trillion and growing at a rate of $1 trillion every 100 days, with “no end in sight.”

“This dynamic also appears to be playing out in other countries where debt accumulation is significant,” the authors of the BlackRock paper added. "Based on our experience with clients to date, this explains the recent increase in institutional interest in Bitcoin."

BlackRock, which manages about $10 trillion in assets, describes Bitcoin as a "unique diversification tool" that can be used to hedge economic and political risks.

The report concluded: While Bitcoin has short-term co-movements with stocks and other risk assets, its fundamental drivers over the long term are very different from most traditional investment assets, and in many cases are the opposite.

In July, BlackRock CEO Larry Fink said he had previously dismissed Bitcoin as a "tool for money laundering" and now admitted that he was "wrong" and recognized Bitcoin as "digital gold" and a "legitimate" financial instrument.

Last year, BlackRock successfully brought a full-fledged U.S. Bitcoin spot exchange-traded fund (ETF) to market, which was one of the main drivers of Bitcoin's price rise in 2024 as Wall Street flocked to the Bitcoin market.

Bitcoin prices have surged this year, driven by the Fed's dovish shift and BlackRock.

In May, BlackRock's iShares Bitcoin Trust (IBIT) replaced Grayscale Bitcoin Trust (GBTC) as the world's largest Bitcoin exchange-traded investment fund, and IBIT's inflows recently exceeded $21 billion.

Many Bitcoin and cryptocurrency observers expect that the rebound in Bitcoin prices after the Federal Reserve's historic 50 basis point rate cut heralds the beginning of a new round of Bitcoin bull market.

Samir Kerbage, chief investment officer of Bitcoin and cryptocurrency investment firm Hashdex, said in emailed comments: "While there are other macro factors affecting Bitcoin and other risk assets at present, including geopolitical tensions and election uncertainty, these markets should benefit from the formalization of the Fed's dovish shift."

"Our long-term investment view on Bitcoin remains unchanged, regardless of the short-term direction of monetary policy, Bitcoin's growth prospects remain good as institutional adoption continues to gain momentum."

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Zoey

Zoey Olive

Olive Coindesk

Coindesk Beincrypto

Beincrypto Beincrypto

Beincrypto Bitcoinist

Bitcoinist Ftftx

Ftftx