The recent crypto market has rebounded, Bitcoin has returned to 70,000, and Trump also gave a passionate speech at the Bitcoin Conference... In the favorable situation, we need to pay attention to new assets.

However, too many infrastructure projects are still being unlocked, and Meme makes golden dogs every now and then, which is difficult to catch.

Only application projects seem to be absent in this atypical bull market.

Investment is a game of finding non-consensus opportunities. In the tide of infrastructure memes, it may be more likely to find retrogrades in application categories.

From the trend of CEX listings, we can also see clues of this opportunity --- On July 29, OKX's Jumpstart launched the token $MAX of the gaming project Matr1x, and on August 5, it will start trading on multiple CEXs such as OKX and BingX.

The secondary market does need new assets, but the vision of funds and users will be more picky.

For new assets in applications and even game projects, if they want to succeed, they need stable value capture and solid product construction. The death spiral and rough gold farming in the last round can no longer stand out, either in terms of narrative or product.

So, will Matr1x's $MAX be a good target favored by the market?

Bet on tokens, in essence, bet on the good or bad development of crypto projects. Before MAX is about to be listed for trading, let's take a look at Matr1x's existing product matrix and ecological situation, and explore whether MAX tokens can become a legitimate gaming project.

$MAX surfaced, and its value depends on the "people/goods/field" of Web3

First of all, let's get straight to the point and take a look at the basic situation of $MAX tokens:

Platform incentives: 27.6% (276,000,000 pieces)

Ecosystem: 16% (160,000,000 pieces)

Community: 10% (100,000,000 pieces)

NFT Airdrop: 9.4% (94,000,000 pieces)

Early Bird Event: 5.5% (55,000,000 pieces)

Team and investors: 30% (300,000,000 coins)

Advisor : 1.5% (15,000,000 pieces)

Before analyzing the utility and supply and demand of MAX in detail, if you are a person who knows nothing about the Matr1x project, how should you evaluate the value of MAX? And how should you judge whether it is worth holding?

Because betting on tokens is betting on the development of the project, it is obvious that to answer the above questions, we need to explore the entire product and ecology of Matr1x in depth.

However, before we start, we have to have an analytical idea.

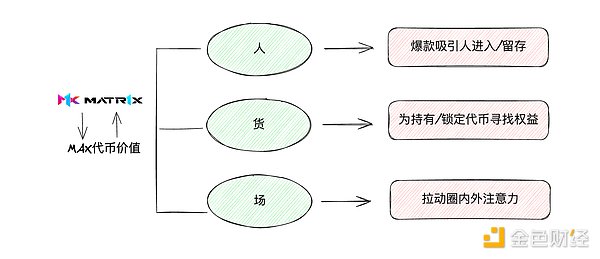

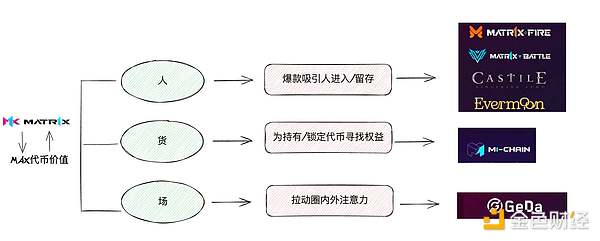

For gaming projects, whether the tokens are valuable and whether the business can survive is actually inseparable from the logic of "people, goods, and venues":

People: Are there explosive and subsequent products that continue to attract new players to enter and retain?

Goods: Is there a self-consistent design that can bring value to holding/locking tokens?

Field: Is there a sustainable ecosystem to attract attention from both inside and outside the circle?

After a round of bull and bear markets, investors, users and speculators have clearly understood that pure P2E mining, selling and withdrawal have no market, and there is no real thing that can justify the name of application projects.

So, how does Matr1x do in the "people, goods and market", and can it continue to bring value to MAX tokens?

Hot products and self-consistency: MATR1X FIRE lays the foundation for attracting fans

At the "people" level, the initial fan attraction is very important, and there needs to be a product to constitute the basic plate of MAX tokens.

MATR1X FIRE obviously takes on this responsibility.

As a well-known FPS shooting 5V5 battle game, players familiar with CS can almost seamlessly understand the rules and maps in the game.

At the same time, the FPS game category is also one of the most popular categories among global players. Looking at the number of simultaneous online players in CS2, you can also feel the popularity of shooting games.

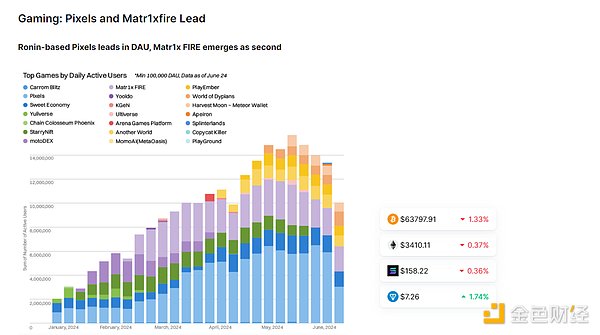

So far, MATR1X FIRE has been downloaded more than 2.5 million times in major mobile phone stores; the industry report released by CoinmarketCap this year shows that the game is also the TOP2 in Web3 Game.

And the friends in the encryption industry around me basically play a few games of MATR1X FIRE in their free time. At the same time, the official also holds various offline competitions from time to time.

Ask yourself, how many Web3 games are you still playing? How many of the games with impressive names in the last cycle are still left?

In the category of games, it is not the last one standing that wins, but the strongest that always win --- A hit product must have a self-consistent logic of success:

First of all, the product is playable. The shooting category has been confirmed, CS on PC, PUBG on mobile, repeated games do not mean repeated loss of fun;

Secondly, the business model of stable game + skin change has been confirmed. Referring to the success of CS accessories market and King's skin, similar designs grafted onto Web3 just avoid the death loop of gold farming -- the output you get from your investment is random, not directly utilitarian-oriented, and accessories are produced to add icing on the cake for the game, and the price of accessories follows the market.

If you ask what this has to do with $MAX tokens?

Imagine, what would happen if MAX holders could share a piece of the revenue generated by the MATR1X FIRE accessories market and the props in the game?

As long as the basic base of the hit game is there, the lower limit of MAX's value will be maintained.

Platform and Ecosystem: Game Distribution + E-sports + Chain Revitalize the Upstream and Downstream of the Industry

Best-selling games solve the problem of people coming in, but people will inevitably lose in the same game; Web3 game projects only make games, and single products will inevitably not escape the fate of the dilution of the value of MAX tokens.

Therefore, the upper limit of MAX's value lies in having more abundant "goods" and "fields" to undertake more value capture and utility.

Corresponding to Matr1x, it is necessary to establish more product matrices and ecosystems in addition to the hit single products of MATR1X FIRE.

In the entertainment industry, there is often a saying that good actors can sing, and artists generally build relevant skill matrices around a long version of themselves;

In the crypto industry, it is also a common path for applications to be platformized, that is, based on their own hit applications, to build platforms to connect to a larger ecosystem and value.

For example, Axie is to Ronin, and similar platforming includes Immutable X and Gala.

How did Matr1x do it?

From 1 hit game to game matrix:

Matr1x now has four 3A-level games, MATR1X FIRE, MATR1X BATTLE, Castile, and Evermoon, corresponding to FPS, escape, card, and MOBA, which basically cover the most successful and money-making game types that have been proven by popular mobile games.

From game self-development to helping game distribution:

The distribution and launch of quality web3 games is actually a business with a lot of room for imagination. The projects on BNB Launchpool are very popular, and Valve's Steam earns $9 billion a year through game distribution;

What about the launchpad for a new Web3 game? Indeed, there is a promising future.

From playing games to watching e-sports:

The core players are in the inner field, how can the outsiders participate?

Some competitive games may actually be too demanding for most blue ocean players, but it does not prevent them from enjoying the excitement of the game by watching the game.

Therefore, the GEDA e-sports platform in the MATR1X ecosystem attracts more players to participate in the form of Watch to Earn by hosting various game events to expand the base beyond the core players.

The principle of attention economy is self-evident. Being able to attract attention outside the circle and increase the volume is the prerequisite for more cooperation and business expansion.

From application to game chain:

Matr1x not only makes applications, but also creates a game public chain M1-Chain based on OP, providing technical support for the transaction/transfer of all game assets in the above platforms and ecosystems. It does not rely on the existence of other public chain ecosystems, and can also build its own chain to specialize in specific matters. The valuation after having the chain is incomparable.

So far, what is Matr1x?

Multiple popular games + public game chains + Web3 game distribution platform + Web3 e-sports platform.

Both making games and issuing, watching games and chains, this obviously raises the expected use of MAX tokens:

It doesn’t matter if you are not good at playing, what if you can also get MAX tokens by watching the game?

If you do game issuance, after holding MAX currency, all newly released games can get the assets in them?

What about the income generated by the staking tokens of the game chain?

Obviously, a larger platform and ecosystem brings more "goods" and "fields", raising the upper limit of MAX value.

If we compare it with other similar crypto projects, we may be able to provide a value reference for MAX's value:

The total market value of AXS and RON has reached 4 billion US dollars, and the total value of IMX and its two game tokens ILV and GODS has also reached about 4 billion US dollars;

MAX, in comparison, has actually done something similar to Axie and Immutable X, so the theoretical valuation may also be around 4 billion US dollars.

Golden shovel and dividend rights: $MAX leverages the value of the entire Matr1x universe

After integrating the above "people, goods and places" information, we have understood the possible sources of MAX's value capture:

Lower limit: asset value linkage and profit distribution of a single hit game;

Upper limit: governance of the entire Matr1x ecosystem, asset issuance, game issuance, income dividends, public chain pledge...

Looking at the official MAX token utility, you will find that the above analysis can basically match:

Community governance: Participate in MATR1X community governance, propose and vote

Ecosystem value capture: Allocation of platform treasury, participation in MATR1X Launchpool, obtaining airdrops from other projects, etc.

Exclusive privileges: Have exclusive privileges, including publishing games on the MATR1X platform, competing for club seats, etc.

Pledgeand rewards: Pledge $MAX to become a MATR1X ecological node to receive rewards, and participate in the governance decision-making of the MATR1X blockchain, including profit distribution, etc."

To put it bluntly, MAX is the golden shovel of the entire ecosystem, and can get dividend rights for multiple related assets.

From the perspective of value capture, MAX has multiple use values, and the design on the demand side is rich and self-consistent;

But what about the supply side? Is there a constant selling pressure and unlocking of VC coins?

The official webpage for the latest token value introduction shows that MAX, which belongs to VC and the team, will have a one-year lock-up period and a four-year unlocking period, which shows the confidence of investment institutions and the long-termism of MATR1X.

In addition, from historical experience, after the circulation and issuance of Matr1x FIRE's own game token FIRE, the price has been well maintained through lock-up and other designs.

In the bear market a while ago, the price of FIRE did not fall but rose, and it remained above 1 US dollar for a long time, while the game tokens fell during the same period;

At the same time, the price of NFT assets associated with MATR1X did not fall much. This also reflects the team's experience in market value management and supply design, but more importantly, it is concerned about the price of project assets.

Obviously, the Matr1x project itself knows that asset prices are the key to maintaining project confidence and popularity, and the concern for prices is a concern for crypto players.

With the increase of games and the increase of people in the universe, the consumption of MAX will also increase (such as unpacking, etc.). If the official is supplemented by a burning mechanism, it can also play a good role in regulating the supply.

Overall, MAX has good fundamentals and has experience in market value management and economic regulation. However, how the price of MAX changes after it goes online will also test the subsequent wisdom of the project party.

Calling for those who go against the flow and rewarding those who go with them

Crypto applications need more people to use them, and Web3 games need more people to play them. But unfortunately, the current market is probably not in this trend.

There are not many projects with things, but there are many concepts with narratives. Therefore, we call on retrogrades like Matr1x to go against the tide of empty infrastructure and short-term pleasure in the meme tide and go to the other side of pragmatism.

From the perspective of classical economics, the value of a commodity comes from its use value.

Only when there are people using it and developing it, can the token have a future.

Those who walk with the retrogrades and become the right Holder may bring long-term sustainable returns.

Alex

Alex

Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Kikyo

Kikyo Anais

Anais Catherine

Catherine Joy

Joy Alex

Alex Miyuki

Miyuki Anais

Anais