Author: Climber, Golden Finance

Around the New Year, Binance launched multiple GameFi projects one after another, seemingly intending to dominate 2024 as the year of blockchain gaming. Looking back on the past year, OKX has made a lot of money because of its early layout of inscriptions. Will the same drama happen again this year?

On February 29, Binance launched the Web3 gaming platform Portal. Looking back in time, Binance has launched multiple chain game projects in the past three months, such as Pixels, Ronin, Sleepless AI, Xai, Fusionist, and Heroes of Mavia’s project currency contracts. It is obvious that Binance’s attention is focused on the long-dormant GameFi track.

Since the rapid fall of Axie Infinity, the king of chain games, in November 2021, the chain game sector has not returned to its former prosperity. Now that two years have passed, Binance also intends to help blockchain games once again ascend to the iron throne of the currency circle. It's just that GameFi has added more narratives and the games are more novel. Under the logic of hyping the new and not the old, which new force has the greatest potential as the new king? The shuttle bus in the blockchain gaming sector is getting fuel. Is now the best time to buy tickets?

The overall situation of the chain game track

2023 is encryption In a year when the market turned from bear to bull, many track sectors ushered in Indian Summer due to the influence of the rising trend of Bitcoin. However, there are still some tracks that are in a dormant period ready to take off, including chain travel. However, recent data on many chains show that the overall chain gaming track has a upward trend.

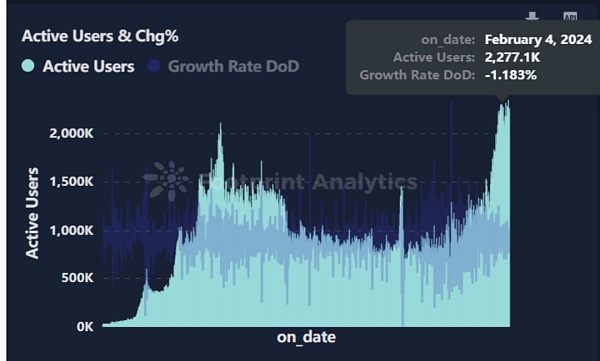

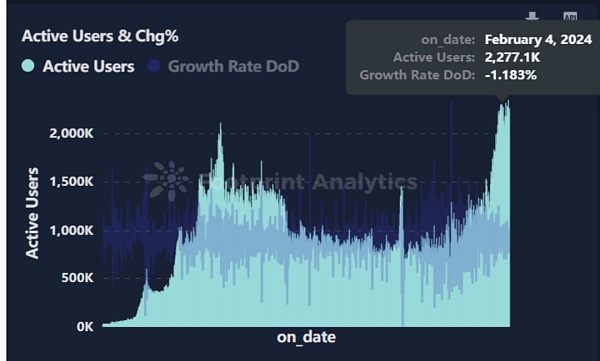

Data chain According to data from the gaming platform My Meta Data, the number of active users on the chain gaming circuit has been rising since May 2023, from approximately 700,000 to 2.2 million, an increase of 214%. The number of games increased from 2300 to 2800, an increase of approximately 21.73.

Similarly, we can see similar trends on Footprint Analytics, another on-chain data platform, but it is worth noting that the number of active users of chain games has exceeded the previous high in November 2021. This shows from the side that currently users have a high degree of recognition of chain games, and if the chain game track can explode again in the future, it will inevitably attract the influx of more users, eventually forming a virtuous cycle.

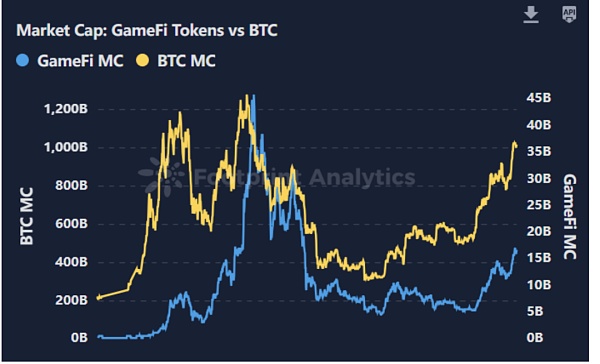

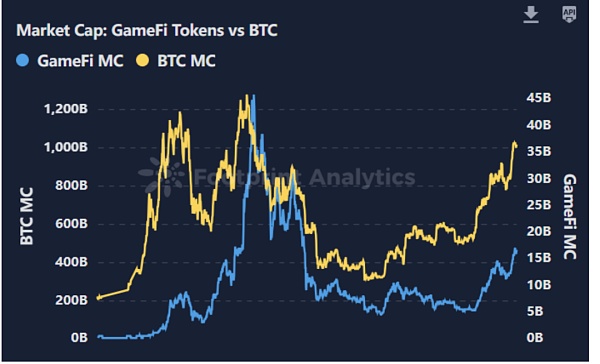

The indicator that best reflects the recovery of the blockchain game track is its overall market capitalization (MC). As can be seen from the above figure, GameFi MC is almost in sync with BTC MC, and even surpassed it at its peak. At present, the price of BTC has reached US$64,000, which is only one step away from the historical high. With the entry of traditional institutional investors, it is only a matter of time before the price of BTC continues to rise in the future. If the phenomenon shown above can continue, the market share of the GameFi track will also increase simultaneously.

In terms of financing, it can be seen from RootData data that the number and amount of financing in the game track have rebounded in the second half of 2023. And the total amount of financing ranks second only to the DeFi track.

Comparison of new chain game projects

February 29 On the same day, Binance launched the Web3 gaming platform Portal, which once again focused the attention of the encryption market on blockchain gaming projects. Binance has previously launched multiple blockchain gaming projects in the past three months. What important information does these blockchain gaming projects that have been listed in a short period of time contain? Who is the leader in this batch of projects?

Let's first briefly understand these new chain game projects. Portal is a Web3 game platform, Ronin is developed by Axie Infinity The Ethereum side chain built by developer Sky Mavis, Pixels is a social casual web3 game supported by Ronin Network, Sleepless AI is a virtual companion game based on AI, and Xai is an Arbitrum ecosystem The first L3 project in the system, Fusionist is a 3A level Web3 blockchain turn-based strategy game, and Heroes of Mavia is an MMO (large-scale multiplayer) developed by Skrice Studios People Online) strategy mobile games.

As can be seen from the above introduction, four of the newly launched chain game projects are game works, while the others are game platforms and infrastructure.

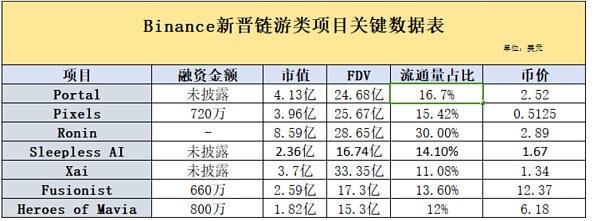

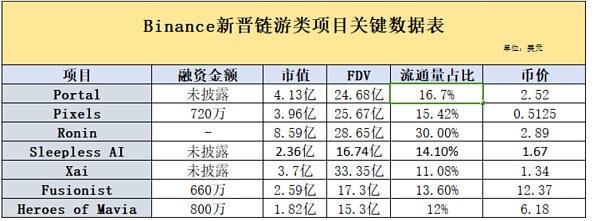

Golden Finance has sorted out the key data of these seven chain game projects. Through comparison, we can see:

In terms of project financing amount, it can be The numbers of financing are clearly visible for Pixels, Fusionist and Heroes of Mavia. Among them, Heroes of Mavia has the largest amount of financing, which is US$8 million, but the spot has not yet been listed on Binance. Other projects either do not disclose financing information, or only the financing status of their development teams, such as Sky Mavis.

In terms of market value, Ronin currently has the highest market value, but it is an established project compared to several other projects and has experienced several waves of currency price fluctuations. rise. The market values of several projects as new forces in chain games are close to each other, and the gap is not big.

In addition, it can be seen from the two data of circulation ratio and FDV that the circulation volume of chain game projects is less than 30%, and most of them are 15%. Line left and right. At the same time, including Ronin, the fully diluted valuation (FDV) of each project is more than 3 times its market capitalization (MC), and the largest one is nearly 8 times. In other words, there is generally a lot of pressure to unlock new blockchain game projects. Even if the currency price rises in the future, there will be a risk of falling due to selling.

As for currency prices, as of this writing, Fusionist has the highest price and Pixels has the lowest price. The currency price of the newly launched Portal has not performed well, with the currency price only is 2.52.

Binance’s timely decision: seeking stability and profit

Since mid-December last year, most of the new projects listed on Binance are chain games, and the platform seems to be interested in directing crypto market liquidity to the GameFi track. Some time ago, the news circulated in the media was still about the Binance Web3 wallet and the entrance to the inscription track, but judging from the current actions of the platform, it is obvious that chain games are more attractive.

So for a world-class exchange, what is the reason that prompted it to "leverage" on the chain game?

First of all, it can be seen from the overall situation of the chain game track mentioned above that the current number of active users and the number of chain game projects in this sector have clearly passed the ice age. , and there is a stabilizing and improving trend. In addition, GameFi's MC and financing amount are generally rising.

Based on the general situation of the blockchain game environment, it is obviously a very appropriate time for Binance to promote the blockchain game project at this time.

< p style="text-align: left;">

Secondly, according to My Meta Data statistics, BNB Chain’s chain game projects The quantity and transaction volume accounted for 29.81% and 27.62% respectively, leading other major public chains, ranking first. It can be seen from the proportion that BNB Chain has occupied nearly 30% of the GameFi sector.

In addition, from the investment and financing background information of the above-mentioned seven new chain game projects, it can be found that Binance Labs invested in three of them, namely Fusionist, Sleepless AI, Heroes of Mavia.

As a chain game project incubated by its own capital, it is not surprising that it will be launched on its own trading platform.

Finally, considering capital gains, Binance is somewhat helpless in betting on the blockchain gaming industry at this time.

A number of Binance chain game projects have been listed on its own exchange before, but since the ebb of the chain game in November 2021, most of them have plummeted and failed to recover. For example, BinaryX, Voxies, MOBOX , League of Kingdoms, etc. Therefore, while Binance is in urgent need of new chain game projects to prove itself, it also needs to use this to raise some funds.

Talking about funding issues, we cannot fail to mention the $4.3 billion fine paid by Binance in November last year as a result of the settlement with the U.S. Department of Justice. Although this did not have any impact on Binance The impact of breaking the muscles and bones, but it is not a small sum after all.

There are also considerable risks. For this point, you can refer to the early trend of the inscription sector. Therefore, for now, pushing the chain game project is the safest choice from all aspects.

Conclusion

Chain games will be regarded as One of the popular narratives in the crypto industry, one with huge potential from its perspective. But in terms of the quality of chain games that have been released so far, there are very few projects that are both playable and profitable. Binance has successively released bracelet games, which shows that it has some confidence in these projects that have been launched.

Furthermore, the chain gaming circuit has undergone more than two years of innovation since its peak, and the quality of games has also improved. Coupled with the sector rotation effect of the investment market, there is no guarantee that the next trend this year will not happen to blockchain games. However, it should be noted that the cloak of publicity and hype is difficult to withstand the test of the market for a long time, and chain games may not be immune to the cold spring.

Xu Lin

Xu Lin