Author: Liu Jiaolian

The desert is filled with smoke, and the long river is filled with sunset.

On April 5, Jiaolian's internal reference "Researchers say BTC is expected to return to $70,000 this weekend" mentioned that the Federal Reserve has recently been managing expectations (fooling) and suppressing the market's expectations of interest rate cuts. "On Thursday (April 4), Minneapolis Fed President Neel Kashkari said that if inflation remains sticky, there may be no need to cut interest rates this year. Federal Reserve Chairman Jerome Powell also said on Wednesday (April 3) that the Fed needs more evidence that inflation is continuing to move toward its 2% target before cutting interest rates."

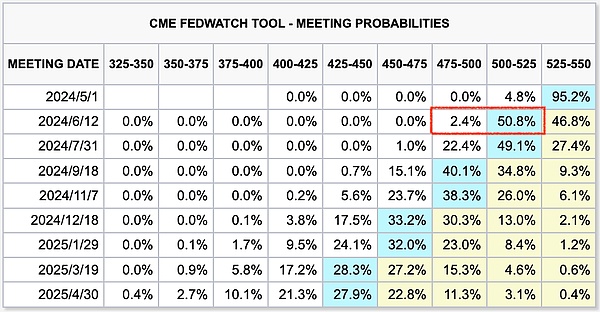

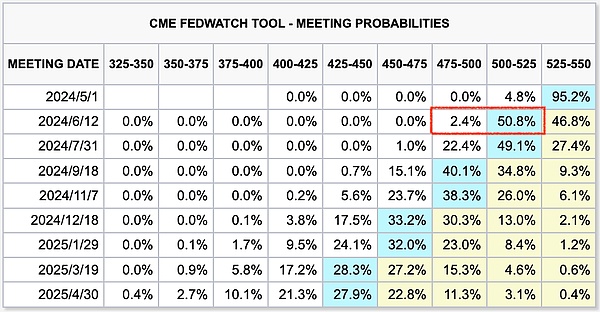

Affected by the Fed's hawkish tone, expectations for a rate cut in June have been falling again and again, from 70% not long ago to around 50%. Undecided, hesitant, and in a dilemma.

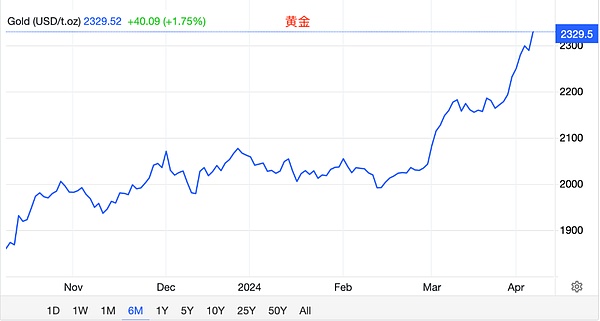

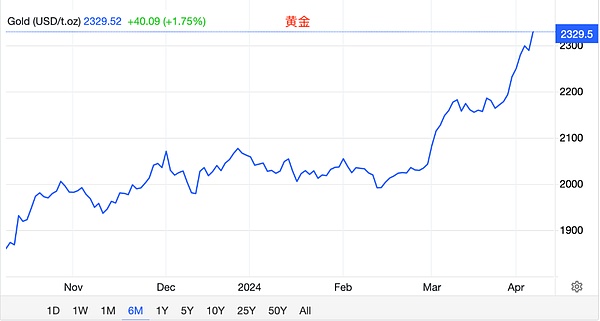

However, gold did not give the Fed any face at all, and continued to rush to a new historical high of $2,300/ounce, giving the Fed's hawkish statement a head-on blow.

The Fed holds the switch to cut interest rates, which is the main reason why it speaks. The Federal Reserve verbally stated that it would reduce expectations for interest rate cuts. The expectations for interest rate cuts have been reduced, and expectations for liquidity easing have weakened, which should suppress gold and BTC. However, gold and BTC responded to all this with an increase.

However, there is another way to tell the story.

The market is priced in expectations. And the rise and fall of the market is the derivative of expectations.

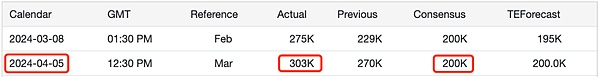

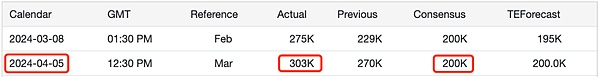

On April 5, the US non-farm payrolls data was released. It was far beyond expectations.

Non-farm payrolls increased by 303,000 in March, far exceeding the expected 200,000.

In a fairy-tale-like beautiful story, the Federal Reserve saw this employment data that far exceeded expectations in advance, and was worried that the data would be released suddenly and the market would be frightened, so it took the lead and sang hawkishly for two days before the data was released to manage expectations.

This is like when we tell someone a bad news, we always look solemn first. When others saw our heavy expressions, they were prepared for the bad news they would hear next.

It was really flattering to see the Fed protect the market so much.

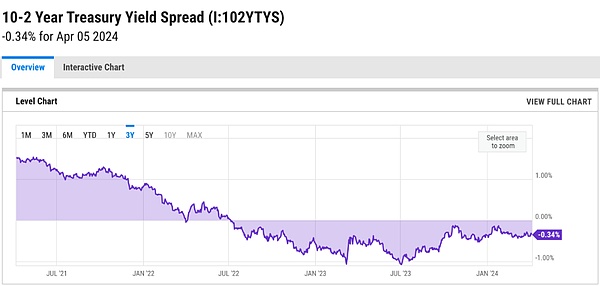

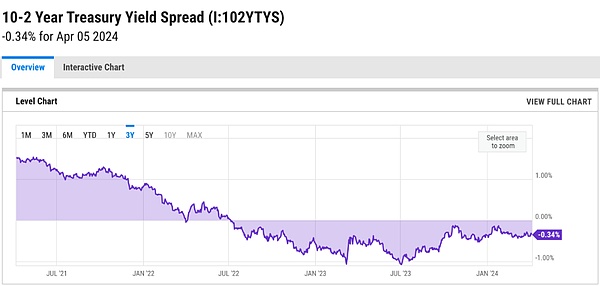

The long-term and short-term interest rates of U.S. Treasuries have been inverted for 1 year and 9 months.

In the article "Israel-Palestine War, Fed Surrenders" published on October 10 last year (2023), the relationship between the long-term and short-term interest rate inversion of U.S. Treasuries and economic recessions was shown. It is precisely related and has no omissions. And every recession will force the Fed to reverse its high-interest rate policy and switch to a rate cut channel.

For long-term holders of BTC, they only need to wait quietly, and victory will inevitably come.

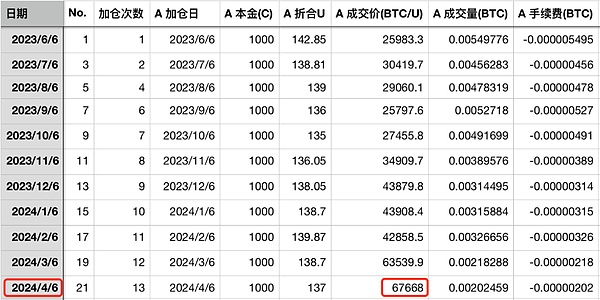

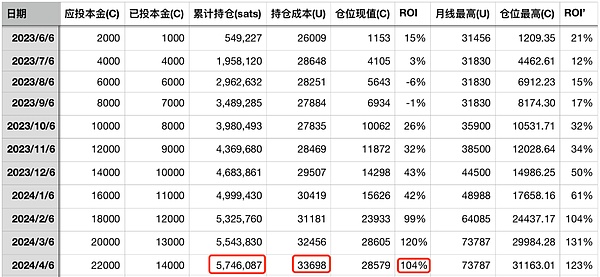

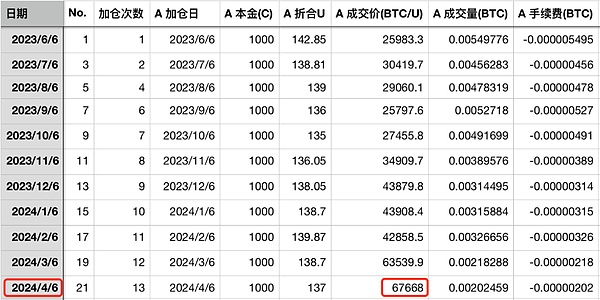

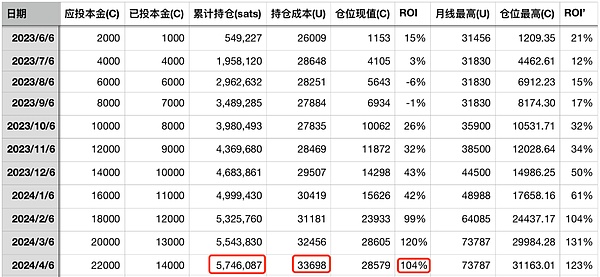

The "Eight Characters · Ten Years' Appointment" real-time witness plan, which was launched on June 6, 2023, ushered in the 21st record and the 13th position increase today (April 6, 2024). The price of this position increase is 67,668 dollars.

After the position increase, the position has accumulated to 5.746 million satoshis, with an average cost of 33,698 dollars and an ROI (return rate) of 104%.

The rain outside the curtain is gurgling, and the spring is fading.

The silk quilt cannot stand the cold at five o'clock.

In the dream, I don't know that I am a guest, and I am greedy for a while.

Don't lean on the railing alone, there are endless rivers and mountains.

It is easy to say goodbye, but it is hard to meet again.

Flowing water and falling flowers are gone, and the world is heaven and earth.

JinseFinance

JinseFinance