“In this era of change and innovation, the future outlook for the Bitcoin ecosystem is particularly important.” On the evening of May 23, OKLink was invited by the industry media Chain Catcher to be a guest at a live discussion on the theme of “BTC Ecosystem Outlook for the Future”, analyzing and looking forward from the perspective of on-chain data analysis, and seeing the big picture through data trends.

How is the fourth halving different from the past?

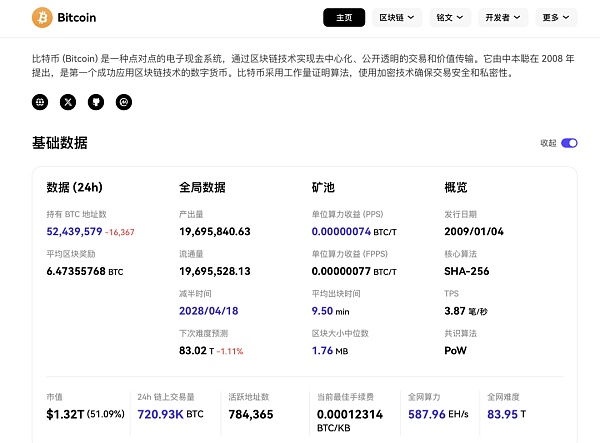

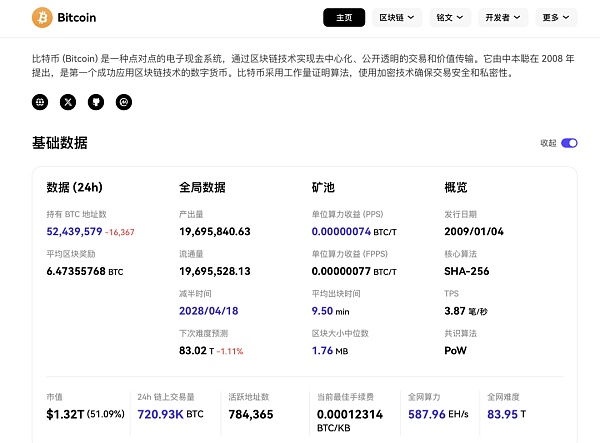

With the continued growth of the BTC ecosystem since 2023, the activity of the Bitcoin network is very different from the last halving, and the block reward has dropped to 3.125 BTC.

According to OKLink miner income data, the total income of miners usually decreases after halving, but will rise afterwards, because miners' income includes transaction fees in addition to block rewards. Due to the sharp increase in transaction volume in the market before and after halving, miners get more fees. Generally speaking, block rewards are often much higher than fees. During this halving, the fees miners received exceeded block rewards for the first time, reaching about 70% of total income.

Although it is a short-term phenomenon, it at least proves that without considering block rewards, the increase in transaction fees brought about by Bitcoin chain activities is theoretically sufficient to generate continuous positive incentives for the miner group.

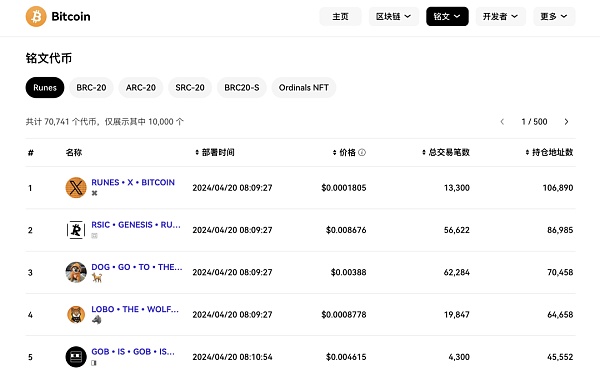

For this phenomenon to continue, the necessary premise is that the on-chain activities are active enough, so more on-chain applications such as Bitcoin Runes that can attract market attention and create incremental value are needed. From this perspective, BTC halving will promote the development of the BTC chain ecology to some extent, and may become a "catalyst" for accelerating ecological innovation. However, with the continued prosperity of the BTC ecology, the impact of BTC halving on the market will become smaller and smaller in the future.

Which data is more worthy of attention in the BTC market outlook?

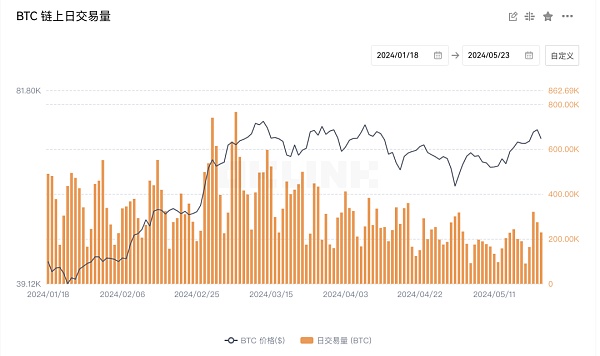

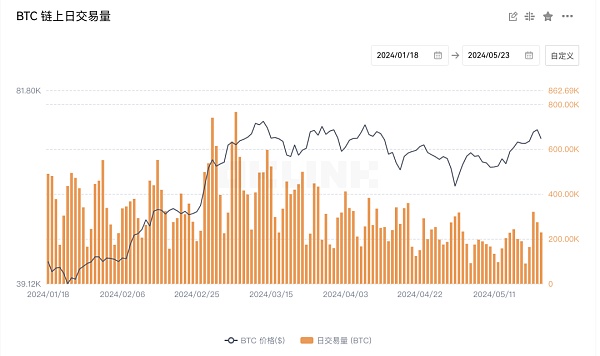

Transaction volume is a barometer of market heat. When it surges, it shows the strong interest of investors or the rise of speculative sentiment, and vice versa.

Indicators such as the number of active addresses and the growth of decentralized applications (DApps) can provide information about the actual use and adoption of cryptocurrencies. According to the OKLink browser active address data, the average active address of BTC accounts for 1.43% of the total number of addresses, higher than Ethereum's 0.66%. The number of new addresses added to BTC per day has remained at around 300,000 since 2016. Data is the key to decision-making.

How data helps the development of BTC ecology

BTC ecology is one of OKLink's key focuses, and it is focusing on developing support for Bitcoin Layer2, as well as cross-chain transaction data between Layer 1 and Layer2.

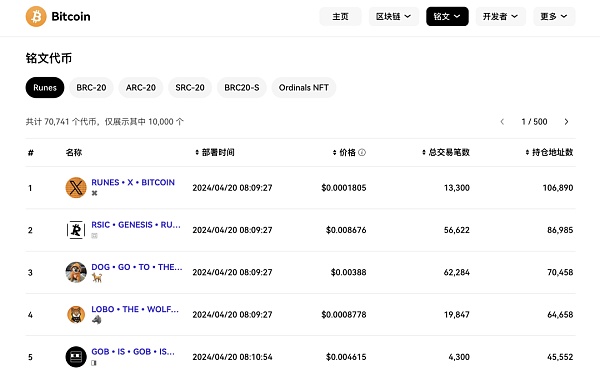

OKLink now supports 44 public chains, including all BTC's inscription NFTs and tokens, transaction lists, transaction details, etc. Users can also easily query the details of a certain address, historical transactions, etc. At the same time, it also provides a variety of integrated data analysis tools, including large amount broadcast, real-time Gas Fee statistics, on-chain indicator analysis, transaction volume, position, computing power indicator analysis and other data. Users can intuitively view the trends and changes of the data and quickly obtain key information.

It also provides more key data about BTC inscriptions, such as inscription token status, inscription transactions and inscription lists. Currently, it supports Runes, BRC-20, ARC-20, SRC-20, BRC20-S and Ordinals NFT.

The market is volatile, and only data is the ultimate weapon for decision-making. The objectivity, accuracy and analyzability of data are its strengths, which can help us better understand the market performance after halving and make judgments on future trends.

Anais

Anais