Author: Mensh, ChainCatcher

On October 18, the U.S. Securities and Exchange Commission approved the applications of the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange (CBOE), which will enable 11 approved Bitcoin ETF providers to conduct options trading. Currently, Bitcoin continues to rise, and the high point has exceeded $69,000.

ETF analyst Seyffart said at the Permissionless conference that Bitcoin ETF options may be launched before the end of the year, but the CFTC and OCC do not have strict deadlines, so there may be further delays, and it is more likely to be launched in Q1 2025.

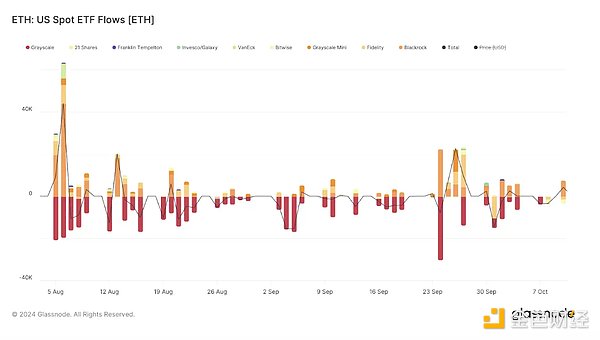

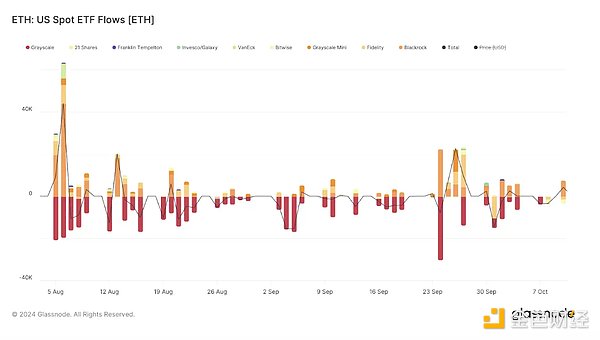

At the same time, the SEC postponed the approval of Bitwise and Grayscale Ethereum ETF options. The market speculated that this was due to the fact that the amount of funds flowing into the Ethereum ETF after its approval was less than expected. The SEC hopes to further investigate the impact of this proposal on market stability and will make a ruling on November 10.

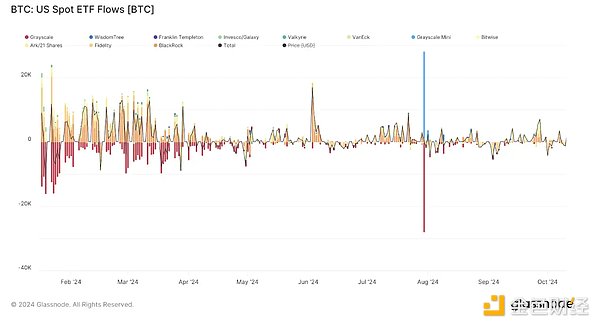

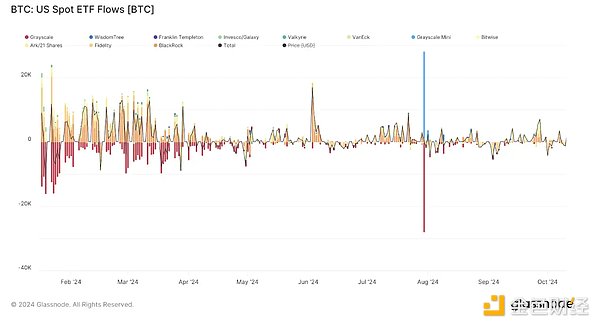

Bitcoin, Ethereum ETF inflows and outflows:

Why are Bitcoin ETF options important?

Bitcoin options are contracts that give holders the right, but not the obligation, to buy or sell Bitcoin at a predetermined price within a certain period of time. For institutional investors, these options provide a means of hedging against price fluctuations or speculating on market trends without holding the underlying asset. These Bitcoin index options offer institutional investors and traders a quick and cost-effective way to expand their exposure to Bitcoin, providing an alternative way to hedge their exposure to the world's largest cryptocurrency.

Why is the passage of Bitcoin ETF options particularly important? Although there are many crypto options products on the market, most of them lack regulation, making institutional investors reluctant to participate due to compliance requirements. In addition, there are no options products that are both compliant and liquid.

The most liquid options product is launched by Deribit, the world's largest Bitcoin options exchange. Deribit supports 24/7/365 trading of Bitcoin and Ethereum options. Options are European-style and settled in the physical underlying cryptocurrency. However, due to its cryptocurrency-only nature, Deribit users cannot cross margin with assets in traditional portfolios such as ETFs and stocks. And it is not legal in many countries, including the United States. Without the endorsement of a clearing house, there is no way to properly address counterparty risk.

The bid-ask spreads of Bitcoin futures options on CME and Bitcoin options on LedgerX, a crypto options exchange regulated by the CFTC, are very large. Limited functionality, such as LedgerX’s lack of a margin mechanism. Each call option on LedgerX must be sold in a price form (with the underlying Bitcoin), and each put option must be sold in cash (with the cash value of the strike price), resulting in high transaction costs.

Options on Bitcoin-related assets, such as MicroStrategy options or BITO options, have large tracking errors.

The sharp rise in MSTR’s stock price since the beginning of the year can also indirectly indicate that there is a market demand for Bitcoin hedging transactions. What Bitcoin ETF options can provide the market is an option product that is both compliant and has trading depth. Bloomberg researcher Jeff Park pointed out: "With Bitcoin options, investors can now make portfolio allocations based on duration, especially long-term investments."

Enhance or reduce volatility?

The debate has different opinions on what impact the listing of Bitcoin ETF options will have on Bitcoin volatility.

The party that believes that volatility may be enhanced believes that once options are listed, there will be a lot of retail investors rushing into very short-term options, and gamma squeezes similar to meme stocks such as GME and AMC will occur. Gamma squeeze means that if there is accelerated volatility, the trend will continue because investors buy these options, and their counterparties, large trading platforms and market makers, must continue to hedge their positions and buy stocks, pushing prices further up and creating more demand for call options.

But since there are only 21 million bitcoins. Bitcoin is absolutely scarce, and if a gamma squeeze occurs on IBIT, the only sellers will be those who already own Bitcoin and are willing to trade at a higher dollar price. Because everyone knows that there will not be more Bitcoin to drive down the price, these sellers will not choose to sell. The listed options products have not seen the phenomenon of gamma squeeze, which may indicate that such concerns are redundant.

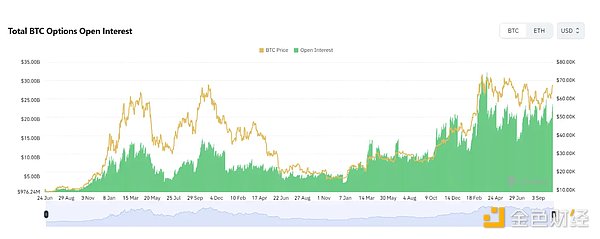

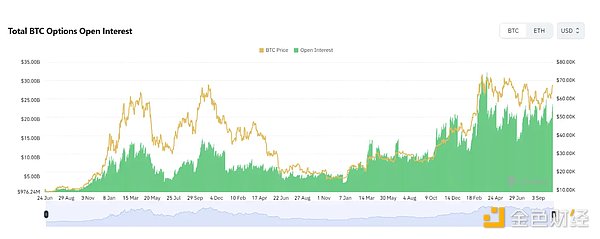

The concentrated expiration of options will also cause market volatility in the short term. Deribit CEO Luuk Strijers said that the open interest of Bitcoin options expiring at the end of September is the second largest in history, and there are currently about $58 billion in open contracts on Deribit. He believes that more than $5.8 billion of options may expire this time, which may cause significant market volatility after expiration.

https://www.coinglass.com/options

Historically, option expiration does affect market volatility. As option expiration approaches, traders need to decide whether to exercise options, let them expire, or adjust their positions, which usually increases trading activity as traders try to hedge their bets or take advantage of potential price changes. In particular, if the price of Bitcoin is close to the strike price when the option expires, option holders may exercise their options, which may lead to greater buying and selling pressure in the market. This pressure may trigger price fluctuations after the option expires.

Those who believe that volatility will be flattened are more looking at it from a long-term perspective. Because option prices reflect implied volatility, that is, investors' expectations of future volatility. IBIT brings new liquidity and attracts more issuance of structured notes, which may lead to lower potential volatility because if implied volatility is too high, more options products will enter the market to level it out.

Bigger pools of capital attract bigger fish

The launch of options will further attract liquidity, and the trading convenience brought by liquidity will further attract liquidity, thus forming a positive cycle of liquidity. At present, there is almost a consensus in the market that the launch of options has an attractive effect on liquidity both in itself and in terms of the additional consequences it brings.

As option market makers participate in dynamic hedging strategies, options will create more liquidity for the underlying assets. This continuous buying and selling of option traders provides a steady flow of transactions, smooths price fluctuations and increases the overall liquidity of the market, allowing a larger pool of capital to enter the market while reducing slippage.

The launch of IBIT options may also attract more institutional investors, especially those who manage large portfolios, as they often need complex tools to hedge their positions. This ability lowers the perceived risk barrier, allowing more capital to flow into the market.

Many institutional investors manage large portfolios and have very specific requirements for risk management, purchasing power, and leverage. Spot ETFs alone cannot solve the problem. Options can create very complex structured products, allowing more institutional capital to participate in Bitcoin.

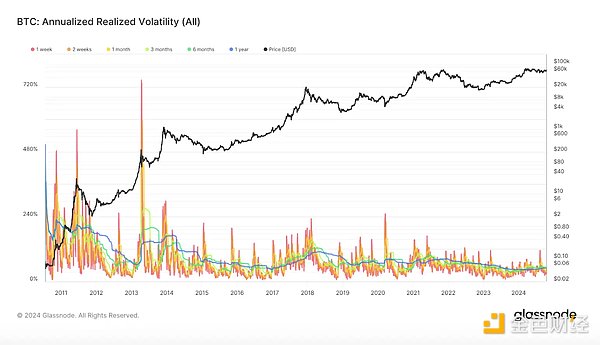

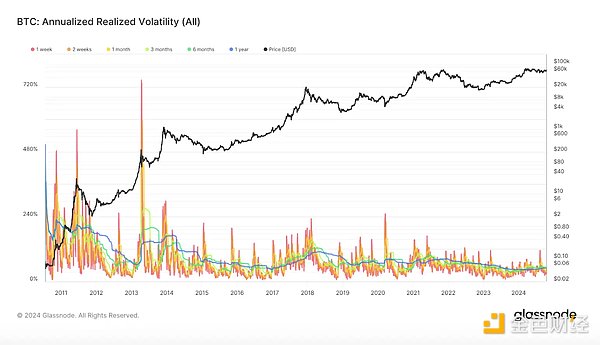

With the approval of IBIT options, investors are able to invest in Bitcoin's volatility, which may bring considerable returns considering Bitcoin's own higher volatility than other assets.

Bitcoin's annual realized volatility:

Bloomberg analyst Eric Balchunas pointed out that the passage of options is a major win for Bitcoin ETFs because it will bring deeper liquidity and attract "bigger fish."

At the same time, the approval of IBIT options is another clear statement on the regulatory side. Galaxy Digital CEO Mike Novogratz said in a CNBC interview that "Unlike traditional Bitcoin futures ETFs, these options allow trading at specific time intervals, which may attract more funds due to the inherent volatility of Bitcoin. The approval of ETF options may attract more investors. MicroStrategy's trading volume reflects the strong demand for Bitcoin. Regulatory clarity may pave the way for the future growth of digital assets."

For the existing options market, the approval of ETF options will also bring greater gains. In the Unchained podcast, Joshua Lim, co-founder of Arbelos Markets, speculated that the liquidity growth of CME options will be the most obvious because both face traditional investors, and the arbitrage opportunities formed will increase the liquidity of both markets at the same time.

Variation of price performance

The introduction of options not only brings more diversified operation space to investors, but also brings with it price performance that was not expected before.

For example, when Joshua Lim was trading, he found that many people were buying post-election call options, which means that people are willing to make some kind of hedge bet that the regulatory environment for cryptocurrencies will be relaxed after the November 5 election. There are usually some price fluctuations around the expiration date of these options, and such fluctuations are usually highly concentrated. If many people buy options with a strike price of $65,000 for Bitcoin, because traders hedge their risks at this position, usually traders will buy when the price is below $65,000 and then sell when the price is above this price, and the price of Bitcoin will be nailed to the strike price.

If there is a trend, it is usually delayed until the option expires, and there are many reasons. For example, options usually expire on the last Friday of the month, but this does not necessarily coincide with the end of the calendar month, which is particularly important because it marks the performance evaluation and share buying and selling of hedge funds, which will create capital and buying pressure flowing into the asset class. Due to all these dynamics, the spot market will indeed fluctuate after the option expires, because perhaps a lot of dealer hedging activities before expiration will weaken after expiration.

Options are not traded on weekends, and the very high gamma value of IBIT at the close of the market on Friday may force traders to buy Bitcoin spot on the weekend to hedge their delta. Since IBIT is a cash redemption, there may be some risks in transferring Bitcoin to IBIT. All of these risks may eventually spread to the Bitcoin market. You may see a widening of the bid-ask spread.

Conclusion

For institutions, Bitcoin ETF options can greatly expand hedging means, more accurately control risks and returns, and make more diversified portfolios possible. For retail investors, Bitcoin ETF options are a way to participate in Bitcoin volatility. The versatility of options may also trigger bullish sentiment in the classic reflexivity of the market, and liquidity brings more liquidity. However, whether options can effectively attract funds, have sufficient liquidity, and form a positive cycle of attracting funds still needs to be verified by the market.

Catherine

Catherine