Source: Liu Jiaolian

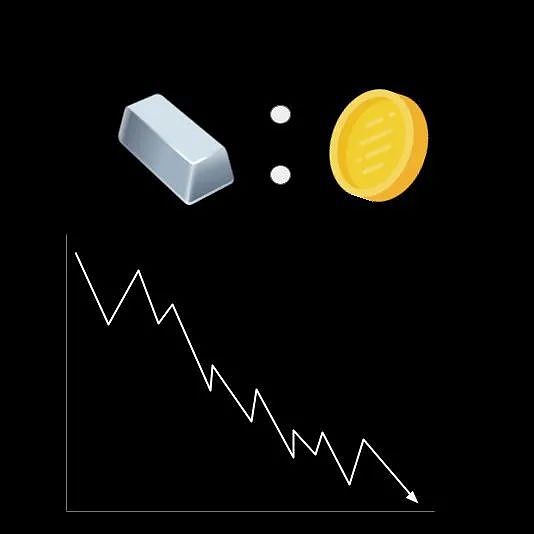

The spot price of gold is more than $2,300, which multiplied by the ratio of kilograms to troy ounces of 32.15 is approximately equal to 74k US dollars per kilogram. BTC (Bitcoin) has temporarily fallen back from 74k to around 62k, which is less than 20% different from 1 kilogram of gold.

Historically, when BTC was at the top of the two bulls in 2021, 1 BTC briefly caught up with or even surpassed the value of 1 kilogram of gold.

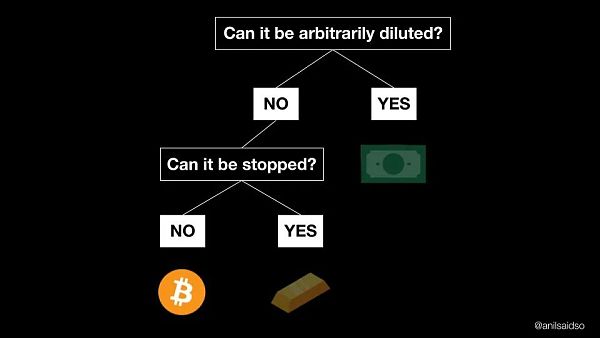

In this halving cycle, BTC, whose S2F hardness (or rarity) has exceeded that of gold, will begin to compete with the hard currency with the most global consensus on this blue planet.

In the end, who will win? To think about this problem, we need to fully understand the birth and selection evolution process of currency. A few slides drawn by netizen Anil will help us quickly understand this problem.

Initially, when there was no currency available, we adopted "barter" transactions.

In fact, you can see that we have signed a lot of currency swap agreements with many countries in recent years. The essence is to carry out a kind of barter trade when "the US dollar does not exist". This is to prepare for the withdrawal of the US dollar hegemony from the historical stage.

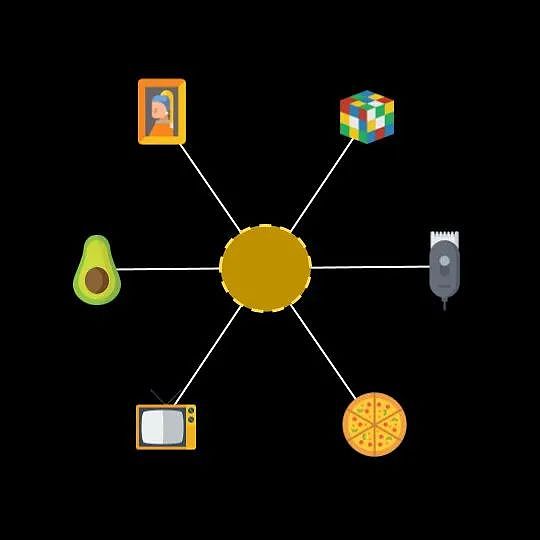

However, barter transactions have an obvious disadvantage, that is, the combinatorial explosion problem. Even for the following situation with only 6 items:

If they are exchanged two by two, there will be up to 15 "exchange rates".

However, the currency swap agreement mentioned in the above teaching link can greatly alleviate the combinatorial explosion problem. The legal currencies of the two countries in the currency swap agreement play the role of "agent". It is just that the countries participating in the swap need to determine the swap exchange rate between each other.

If the entire currency swap network has a particularly large dominant country, which is the main trading partner of other countries, it will be further simplified into a "bus" structure, with the dominant country signing swap agreements with other countries in pairs. In this way, the number of agreements (number of network connections) is further reduced to the number of signatory countries.

In fact, the logic of the evolution of general equivalents from barter transactions is similar, but general equivalents are simpler and more convenient than swap agreements. However, global consensus is not easily established.

So, what characteristics of goods can be selected as general equivalents?

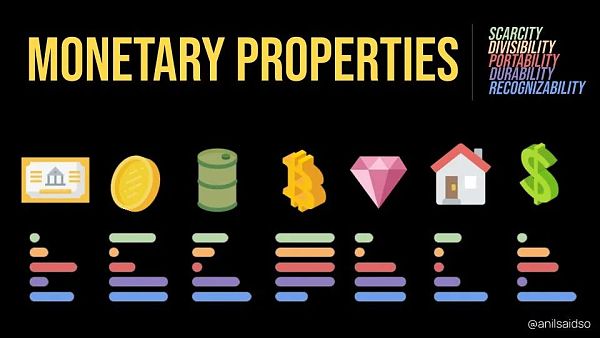

It is generally believed that the following characteristics are very critical:

1. Scarcity. Very difficult to produce, and can resist artificial manipulation and devaluation of supply.

2. Divisibility. Can be combined or divided at any scale.

3. Portability. High value density, very easy to move in space.

4. Durability. Will not wear out and will not deteriorate over time (i.e. easy to move in time).

5. Recognizable. It is easy to authenticate and its value can be easily verified by anyone.

A general equivalent with these characteristics can perform the functions of currency.

In order to find the best currency, people have used these key criteria to examine all commodities throughout history.

The first question we have to ask ourselves is, which is the best choice for storing value? If you choose the wrong store of value, you will become poorer and poorer relative to those who make the right choice.

People will repeat this comparison and selection process until they find the one that wins.

You may think: I never actively choose, the currency has always been there.

This is why it has never been more important to break out of the rut and recognize the old trick of fiat currency. The old trick has been tried again and again in one place after another around the world, and each time it ended in hyperinflation.

Three points ensure the monopoly of currency: 1. Physical boundaries; 2. Capital control; 3. Legal currency law.

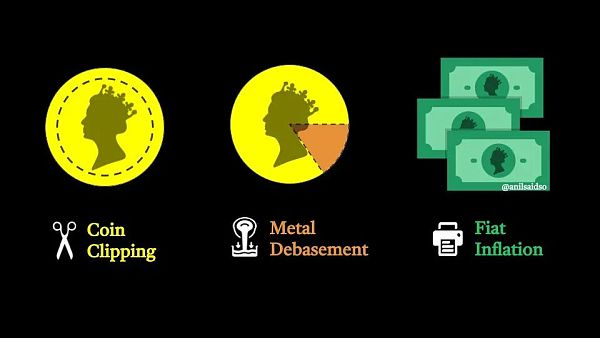

Why do governments prefer to let citizens adopt their currency? Because in this way, your savings will become the government's piggy bank, and when needed, they will extract value through devaluation (in the past era of coinage) or inflation (in today's legal currency era).

This is why sovereign governments around the world today are widely opposed to privately issuing currencies and being outside the banking system.

Now you can think about it for a moment: Why would they allow BTC to exist?

They won't. It's just that they have no feasible way to stop an idea when the time for this idea comes.

The most powerful thing in human society is not money, nor power (violence), but history. The historical trend is mighty and unstoppable. The driving force behind the creation of world history is not the gods and emperors, not the dignitaries, but you, me, him, and billions of ordinary and ordinary people around the world.

When everyone is awakened, when everyone thinks that the unreasonable needs to be changed, then it will definitely change. All ignorance and reaction will eventually be swept into the garbage dump by history.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo dailyhodl

dailyhodl Coindesk

Coindesk Nell

Nell Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph