Source: Liu Jiaolian

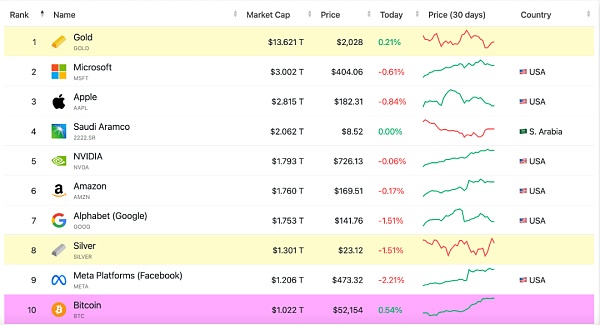

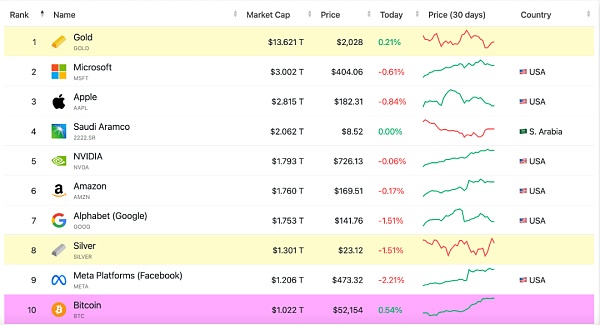

As we all know, since the U.S. SEC approved the Bitcoin spot ETF to land on the U.S. stock market, it has opened the door for the flooded liquidity in the U.S. financial market to flow into Bitcoin. In just 30 trading days, the Bitcoin ETF expanded from zero to nearly 40 billion U.S. dollars, surpassing the size of the silver ETF by about 10 billion U.S. dollars, and temporarily formed the gold ETF with a size of about 90 billion U.S. dollars. A pattern of "30-70" was formed.

A large amount of US dollar liquidity injection has kept the price of Bitcoin at 52k position. The Bitcoin spot ETF has thus become the fastest-growing ETF in Wall Street history. (See Liu Jiaolian’s 2024.2.11 article "US Bitcoin ETF holdings cross the 200,000 BTC mark, Becoming the most popular ETF in the history of Wall Street!》)

So, where does the liquidity flowing into the Bitcoin ETF come from?

Data shows that it is likely that half of it comes from the loss of liquidity in gold ETFs.

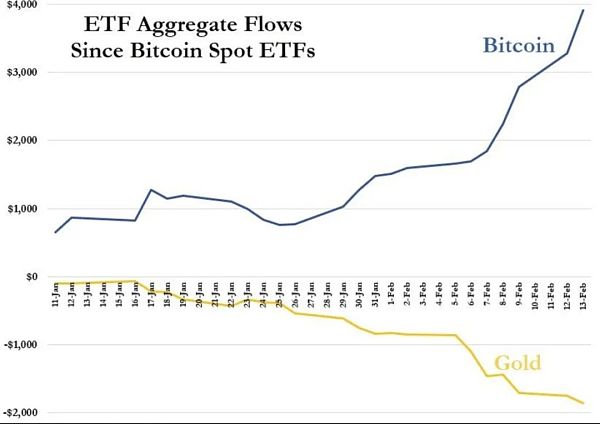

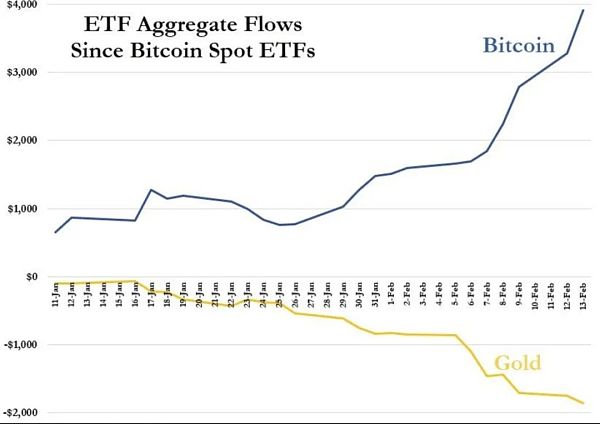

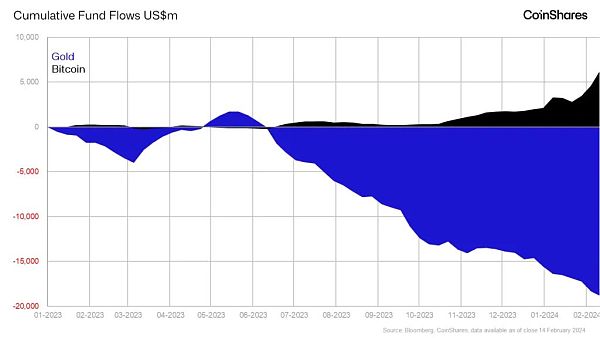

As can be seen from the figure, since the Bitcoin spot ETF was launched in January , the cumulative net inflow of ten Bitcoin ETFs has reached approximately US$4 billion. During the same period, 14 leading gold ETFs lost more than US$2 billion in liquidity.

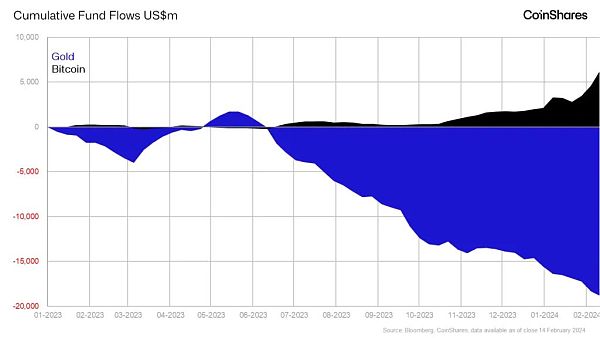

Of course, if the horizon is extended to 2023 and broadened to the whole world related ETFs, then we can see that the accelerated outflow of gold ETFs has been unstoppable from mid-2023.

This ironclad fact undoubtedly confirms a statement that we have repeated many times. :Bitcoin is better gold.

As early as February 22, 2020, Jiaolian said:

“The whole process of monetizing a commodity (commodity) will probably go through several stages: (1) Collectibles; (2) Speculative products; (3) Hedging products (SoV, Storage of Value); (4) Media of Exchange (MoE, Media of Exchange); (5) Pricing unit.

“It has taken thousands of years for gold to complete the above process. The monetization of Bitcoin may be a great monetization process that our generation can witness in our lifetime (maybe not live long enough until the process is fully completed).

“In the past decade, Bitcoin has gone through the first two stages, driven by idealists and fanatical speculators respectively. From 2019 Starting from the first half of the year, Bitcoin has officially entered the third stage."

Obviously, although Jiaolian has said many times that Bitcoin's ultimate mission is to defeat the US dollar, but before that, In other words, at the current stage, its historical mission is to first defeat and surpass gold. There is no other reason than the objective laws of the monetization process mentioned above. Bitcoin must first defeat stocks at the level of speculative goods, and then beat gold at the level of value storage before it can move to the next stage and challenge the U.S. dollar's global status as the king of currencies as a medium of exchange and unit of account.

Currently, Bitcoin has just crossed the $1 trillion total market value mark. The total global market value of gold is nearly 14 trillion US dollars.

Jiaolian wrote this in December 2022:

"As before As said, the crypto industry cycle is still driven by Bitcoin. In other words, it is driven by the incremental funds and leveraged funds brought by Bitcoin. It is Bitcoin that drives the bull market and creates hot spots; it is not driven by hot spots. The bull market has created Bitcoin.

"Today, the price of Bitcoin at 16k-17k may be roughly It is equivalent to US$230 at the end of 2015, or US$5,000 below the "312" meltdown low in 2020. Maybe next, Bitcoin will either go through a slow and arduous climbing repair process like 2015-2016, or go through the kind of recovery in 2019 The market is volatile at the bottom. But in any case, before the Bitcoin output is halved again (from 6.25 to 3.125) on April 20, 2024 (expected), the entire market should still be repairing the various explosions caused by the 2022 downturn. Amidst the trauma, it is unlikely to reach new highs in the short term.

"By the end of 2023, we may see different Bitcoin below 25k and no higher than 69k (previous high). Before the end of 2024, Bitcoin is expected to rise back to the range of US$40,000-100,000. If we can usher in the next big bubble of the bull market around 2025 In the future, we may have the opportunity to see Bitcoin quickly break through from below 100,000 US dollars, and become unstoppable, challenging the cycle upper limit of 400,000 to 500,000 US dollars.

"During the peak of the bull market bubble in 2021, Bitcoin's market value once ranked among the top ten assets in the world, comparable to the market value of the top companies in the US stock market. At the same time, Bitcoin also showed a strong trend with the US stock market. Relevance. If the 2021 cycle is defined as challenging U.S. stocks, the 2024-2025 bull market cycle will challenge the world’s number one asset category—gold.

"Today, the total market value of gold is approximately US$12 trillion. At the price of Bitcoin at US$17k, the market value is approximately US$330 billion, which is still 36 times the total market value of gold. Bitcoin Today's total amount is 19.22 million. It is estimated that about 660,000 will be produced in the two years 2023-2024. The total amount will reach 19.88 million. Calculated based on an approximate number of 20 million, the market value will reach 12 trillion US dollars, and the unit price should be 60 One Bitcoin costs US$10,000.

"In the last round of bear market, the bottom was more than 3,000 at the end of 2018, and the top of the bull market was 69k at the end of 2021, an increase of About 23 times. According to the current 17k increase of 23 times, one Bitcoin is about 390,000 US dollars and 400,000 US dollars. Multiplied by 20 million, the total market value is 8 trillion US dollars, which is about 67% of gold’s 12 trillion US dollars market value.

"Even based on a smaller increase, such as 17 or 8 times, reaching 300,000 US dollars per Bitcoin, the total market value is 6 Trillion US dollars, about half of gold. Even if it does not exceed the market value of gold, it can be said to be comparable to gold if it reaches a similar order of magnitude.

"If the market value of Bitcoin accounts for 30-50% of the entire crytpo industry by then, it can be estimated that the total market value of the crypto industry will reach about 12-20 trillion US dollars by then. This number is 8700 today About 13-22 times of US$12-20 trillion.

"Who can get a share of this market value of US$12-20 trillion? , who will be the lucky one to get dividends in the next bull market cycle."

Looking back at 2023 today, it basically confirms the original judgment. The unexpected early approval of the Bitcoin spot ETF in early 2024 brought a surge of incremental funds to Bitcoin.

Bitcoin lived up to expectations and quickly launched an attack on gold, which stood in the same ecological niche, quickly eroding the latter's market, proving that it is indeed the "better gold" and better value in everyone's mind. Storage (SoV).

BlackRock, a financial "upstart", also used Bitcoin ETFs to quietly challenge JP Morgan, the global gold trader.

Bitcoin versus gold, new money versus old money. The charge to launch a general attack on gold has sounded. When the trumpet sounds, Loulan will be destroyed!

Huang Bo

Huang Bo