Source: Metaverse Daily Explosion

When a digital artwork by crypto artist Beeple sold for a sky-high price of US$69.34 million at Christie’s, NFT became popular all over the world overnight. This new type of digital art The carrier has emerged from Web3 and entered the mainstream art collection market.

However, as the encryption market enters a bear market, the non-fungible token NFT market has also become sluggish. Famous auction houses including Christie’s, Sotheby’s, etc. have increased their turnover in digital artworks. All are decreasing sharply. Until the emergence of Bitcoin NFT, digital art had a new inscription "picture", and another NFT market showed vitality.

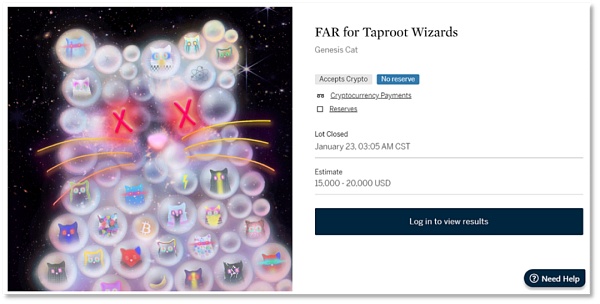

As of January 23, 19 Bitcoin NFTs have been sold at Sotheby’s auction for a total price of approximately US$1.1 million. Among them, visual artist FAR (Francisco Alarcon) is in the Bitcoin area. Genesis Cat, a digital art image cast on the blockchain network, was sold for US$254,000, but this is not the highest.

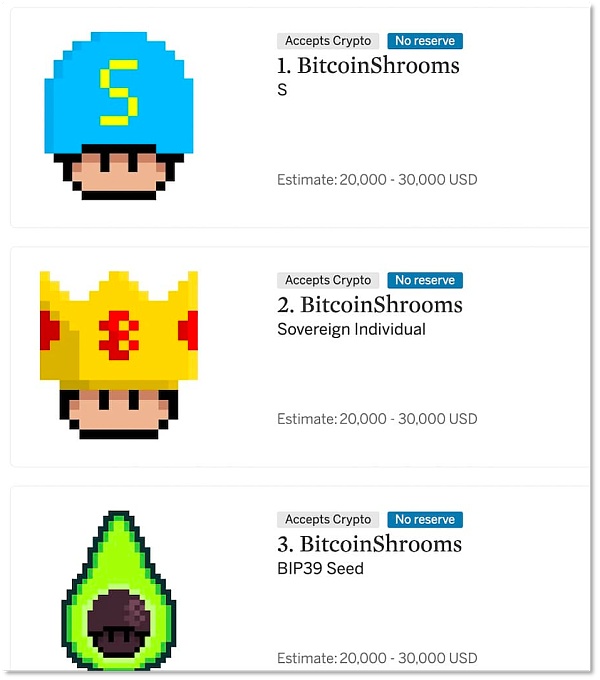

In December last year, Bitcoin NFT artwork was listed at Sotheby’s auction house for the first time. Three Super Mario-themed pixel-style digital artworks were sold for approximately US$450,000, which was approximately the highest price. Five times the estimated value.

Compared with the earlier Ethereum NFT, Bitcoin NFT uses protocol tools to be completely stored on the Bitcoin network. Based on the market value of crypto assets, Bitcoin is the blockchain network with the highest market value in the world, currently at US$7846.6 trillion.

The blockchain network, which was previously considered to be only used for Bitcoin transaction records, has new functions, and Taproot Wizards is the tool developer to add this new function, which is why it produces The reason why Bitcoin NFT can sell at a high price. Using this tool, more NFT works are appearing in the Bitcoin ecosystem, and everyone can mint them.

The transaction price of US$254,000 exceeded the estimate by 12 times

Following Nyan Cat and CryptoKitties, another cat-themed NFT has become popular. On January 22, an NFT named Genesis Cat was sold for US$254,000 at Sotheby's, the world's leading art and luxury auction house. This transaction The price was more than 12 times the lot’s estimate of $15,000 to $20,000.

Genesis Cat landed on the Sotheby’s auction platform

Genesis Cat landed on the Sotheby’s auction platform

This high-priced NFT artwork was created by visual arts and technical artist/engineer FAR (Francisco Alarcon) on the Bitcoin blockchain network, and Genesis Cat is a single digital artwork in the Quantum Cat NFT (Quantum Cat) series. Quantum Cat will be the first NFT series released by Taproot Wizards, the development team of the Bitcoin Ordinals protocol, consisting of 3333 cat-image Bitcoin NFTs.

Genesis Cat is not the most valuable Bitcoin NFT sold by Sotheby’s.

Previously in December 2023, this long-established auction house auctioned a Bitcoin NFT work for the first time - a pixel style Super Mario style picture group. The auction price was approximately US$450,000, approximately Five times the high estimate. As of January 23, 19 Bitcoin NFTs have been sold at Sotheby's auction, with a total transaction price of approximately US$1.1 million.

The Mario-themed Bitcoin NFT series was sold for US$450,000

The Mario-themed Bitcoin NFT series was sold for US$450,000

If you trace Sotheby’s NFT auction history, it is not difficult to find that a series of Bitcoin NFTs are not sky-high prices.

This auction house first got involved in NFT digital art in 2021, and once created a number of record-breaking transaction volumes, such as the single item CryptoPunk No. 7623 sold for US$11.75 million, and The Cube series (Bored Ape Yacht Club) series with the largest number of transactions - 23,598 NFTs, with a total transaction volume of US$14 million.

Some statistics of NFT auctioned by Sotheby’s

Some statistics of NFT auctioned by Sotheby’s

But as time goes by, the transaction prices of single NFT artworks listed on Sotheby’s are getting lower and lower. According to Sotheby's 2021 annual report, its total auction turnover in 2021 reached US$7.3 billion, setting a historical record in more than two hundred years, of which the auction turnover of NFT collections reached US$100 million. By 2023, digital art auctions have only generated approximately US$35 million in turnover.

This is related to the downturn of the entire NFT market. 2023 will undoubtedly be the bleakest. CryptoSlam data shows that the overall sales of the NFT market on various blockchains in 2023 will be only US$8.7 billion, far lower than the US$23.734 billion in 2022. However, the number of transactions reached 90.6 million, 1.65 times the 54.85 million in 2022.

In such a market, the emergence of Bitcoin NFT is adding vitality to the market.

1.14 million Bitcoin NFTs were produced in 200 days

The special thing about Genesis Cat NFT is that it uses the Ordinals protocol to generate 1.14 million Bitcoin NFTs in the Bitcoin block. The process of digital art images recorded on the chain network is called "inscription", and the result is also called "inscription".

As digital artworks created by Ordinals protocol development team Taproot Wizards land at Sotheby’s, Bitcoin inscription works are being transacted on the market at an unprecedented rate.

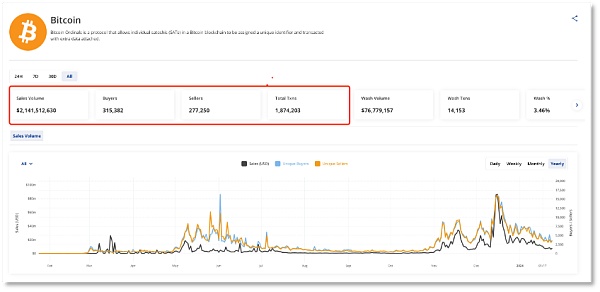

Cryptoslam data shows that as of January 25, the sales of Bitcoin NFTs have reached 2.141 billion US dollars, with a total number of transactions of 1.874 million; while the sales of Ethereum NFTs, which have the best sales, are 421.88 billion, and the total number of transactions was 45.497 million. Although the total sales of Bitcoin NFTs is only 5% of Ethereum NFTs, this data was created by the Bitcoin NFT market in the remaining 200 days.

There have been more buyers than sellers of Bitcoin NFTs in the past year

There have been more buyers than sellers of Bitcoin NFTs in the past year

Since the Ordinals protocol was launched in March 2023 and the Bitcoin blockchain network has the function of creating NFTs, within 200 days , 1.14 million image inscriptions were created. In the same period of time, this speed far exceeded the "old bases" of NFT - 1.14 million is the total number of NFTs produced on the Ethereum, Solana and Polygon blockchain networks in the first 200 days.

Why is Bitcoin NFT developing so rapidly? This has to do with the value the market views it as.

Unlike NFTs on other blockchain networks such as Ethereum, Bitcoin NFTs are created and stored on the Bitcoin blockchain. On other blockchain networks with smart contract functions, the creation and transaction data of NFT are recorded, but pictures, texts and even video content are actually stored off-chain.

The Ordinals protocol provides the function of minting NFTs for the Bitcoin network. Simply put, this protocol can number the smallest unit of Bitcoin "Sat" in time sequence and store it in the network allowed Enter text, pictures and even video information within the space. The result of this inscription is the Bitcoin inscription.

The "numbering" and "engraving" characteristics of inscriptions have given rise to many new cryptoassets. If different comments and different contents are entered for Sat, it conforms to the characteristics of "non-fungible token" NFT; if the same comments and the same content are entered, it is equivalent to producing something like BTC and ETH. of fungible tokens.

You must know that since the birth of the Bitcoin network, its function has been to generate and record Bitcoin transactions. These transactions are publicly available and cannot be modified. Since the upper limit of the capacity of a Bitcoin block is only 1MB, it can record up to 4096 transactions, which is not conducive to carrying more information.

The Ordinals protocol proves that Bitcoin can actually add information. The unique numbering content is even given commemorative significance due to the unmodifiable nature of Bitcoin records. Some market audiences regard it as a "digital cultural relic." ". Of course, "engraving" on the Bitcoin network will also increase the burden on the network, resulting in an unfavorable situation of reduced network transaction speed and increased transaction fees.

Not long ago, some core developers of the Bitcoin software system Bitcoin Core denounced inscriptions as "worthless" due to the poor network caused by inscription casting. However, judging from the subsequent output of Bitcoin NFT and related tokens, market participants do not seem to care about the developers' attitude.

The successful auction of Bitcoin NFTs such as Genesis Cat at Sotheby’s also proves the interest of the digital art investment market in Bitcoin NFTs. A report by Galaxy Research and Mining predicts that the market value of the inscription market created by Ordinals will reach US$5 billion by 2025.

Coinlive

Coinlive

Coinlive

Coinlive  Others

Others Bitcoinist

Bitcoinist Beincrypto

Beincrypto Coindesk

Coindesk Bitcoinist

Bitcoinist Nulltx

Nulltx Nulltx

Nulltx Ftftx

Ftftx Cointelegraph

Cointelegraph