Author: Will Awang; Source: Web3 Xiaolu

Since Blackrock successfully promoted the landing of BTC Spot ETF this year and introduced crypto assets into traditional finance, two months later on March 21, 2024, Blackrock and Securitize launched the first tokenized fund BUIDL "BlackRock USD Institutional Digital Liquidity Fund" on the public blockchain Ethereum, and introduced traditional finance into the crypto market.

The launch of the BUIDL fund marks an important milestone in the tokenization of RWA assets. Blackrock, the world's largest asset management company, has enabled people to witness the future of blockchain technology transforming the financial system through the BUIDL fund, and to achieve a seamless connection between crypto assets and real-world assets.

Our article last year analyzed the importance of tokenized funds in connecting TradFi and DeFi, and the asset form of funds is the best carrier of RWA assets because (1) they are regulated and (2) they are relatively standardized digital expressions. Reference article: RWA 10,000-word research report: the value, exploration and practice of fund tokenization.

So this article will deeply analyze Blackrock's tokenized fund BUIDL to see how it works and how to graft DeFi through USDC to open the door from traditional finance to the crypto world.

1. How does the BUIDL fund work?

If you put $1,000 into the stablecoin USDC, Circle, the issuer of USDC, will invest the funds in assets such as government bonds, but the income generated will be obtained by Circle. If you put $1,000 into Blackrock's BUIDL fund, the fund will help you manage your finances while promising to provide a stable value of $1 per token, allowing you to obtain investment returns.

This is BUIDL, which looks like a stablecoin, but it is actually a "security".

Let's first talk about the "security" attribute of BUIDL, and then talk about its possibility of becoming a liquid stablecoin.

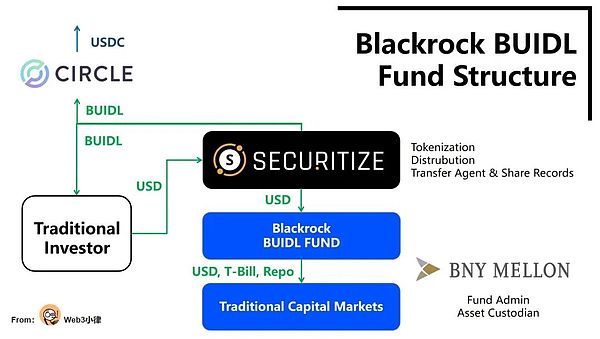

A. Fund Entity

BUIDL Fund is a new SPV entity established by Blackrock in BVI. In accordance with the provisions of the U.S. Securities Act and the Investment Company Act, this entity has applied to the SEC for the securities exemption of Reg D and is only open to qualified investors.

B. Tokenization and on-chain logic

As the tokenization platform of the BUIDL Fund, Securitize LLC is responsible for the on-chain logic of the fund and converts the on-chain logic of the fund into document data required for supervision to meet regulatory requirements;

At the same time, Securitize LLC, as the transfer agent of the fund, manages the shares of the tokenized fund and reports on fund subscription, redemption and distribution matters;

Securitize Markets (holding the US Alternative Trading System license and registered Broker Dealer qualifications with FINRA) will serve as the fund sales agent to provide this product to qualified investors;

Investors have flexible crypto asset custody options: Anchorage Digital Bank, BitGo, Coinbase, Fireblocks.

C. Operation of underlying assets

BlackRock Financial, as the fund manager, is responsible for the investment of the fund;

Bank of New York Mellon is the custodian and fund administrator of the fund's underlying assets;

PwC has been appointed as the fund's auditor.

D. Fund Management

100% of the total assets of the BUIDL fund will be invested in "quasi" US dollar cash assets (such as cash, short-term US Treasury bonds and overnight repurchase agreements), so that each BUIDL token maintains a stable value of US$1.

BUIDL tokens are distributed monthly (Paid Monthly) through Rebase, that is, the daily accrued dividends are directly "airdropped" into the investor's wallet account in the form of new tokens.

E. 24/7/365 Instant Subscription/Redemption

Securitize provides investors with 24/7/365 fund subscription/redemption (Issuance & Redemption Process) in fiat currency USD. This instant settlement and real-time redemption function is what many traditional financial institutions are very eager to achieve.

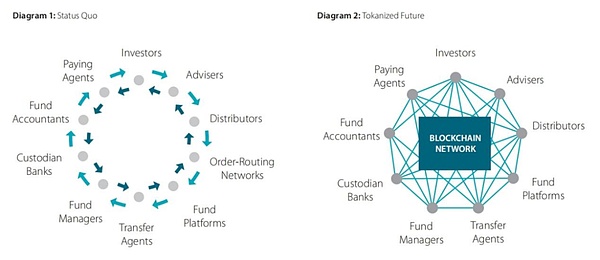

(SS&C, Tokenization of Funds - Mapping a Way Forward)

The operation process of traditional funds is inefficient in comparison. Many participants have their own ledgers (such as securities ledgers and bank ledgers), so there is often a delay of T+3+5+N days in the subscription/redemption process.

In contrast, because the tokenization of funds can realize real-time settlement of unified ledgers on the chain, transaction costs are greatly reduced and capital efficiency is improved, which is a milestone innovation for the financial industry.

Other advantages include:

All fund participants can access and view data on the blockchain, so there is no need for multi-party reporting and reconciliation, which greatly simplifies the registration requirements of multiple fund participants;

and the subscription and redemption of the fund can be directly settled and enter the investor's account (electronic wallet), and the transaction has settlement finality, thereby eliminating market and counterparty risks;

In addition, more efficient atomic settlement based on blockchain can also achieve real-time pricing and settlement around the clock.

Second, who is the BUIDL token with the essence of "securities" suitable for?

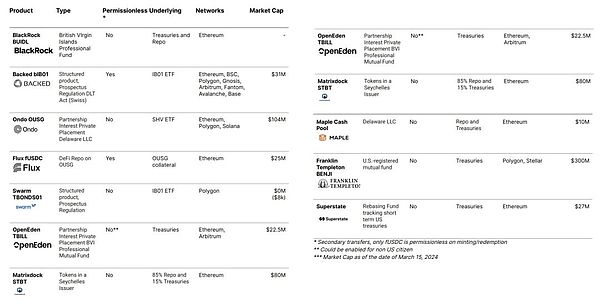

2.1 Permissioned ERC-20 Tokens

Although BUIDL tokens are ERC-20 tokens issued on Ethereum, due to their "securities" nature, KYC/AML/CTF compliance requirements, and a minimum investment limit of $5 million, BUIDL tokens can only be circulated among verified "whitelist" investors, and are a type of permissioned ERC-20 tokens.

According to Steakhouse's research report, we can also see that most U.S. Treasury RWA projects have chosen to issue permissioned tokens on public blockchains for regulatory compliance reasons.

(Overview of BUIDL, BlackRock USD Institutional Digital Liquidity Fund, Ltd)

2.2 Who is BUIDL token suitable for?

The strong compliance "securities" nature of the BUIDL fund, coupled with the permissioned ERC-20 token features, can ensure sufficient security of assets:

(1) Security of underlying assets: There is only one counterparty risk (Blackrock); SPV's bankruptcy isolation and bank-level compliance custody of underlying assets.

(2) Security of on-chain assets: Strict KYC access with permission; access to SEC-compliant trading markets; cooperation with institutional-level crypto asset custodians.

Leaving aside traditional financial scenarios, under such a strong compliance configuration, BUIDL has built an institutional-level (including becoming the treasury of any stablecoin issuer, DeFi, L2 and other project parties) collateral layer (Collateral Layer) of crypto assets, ensuring that assets are sufficiently secure while generating stable interest.

Assuming that Tether, the issuer of the USDT stablecoin, can deploy most of the assets in its treasury in the BUIDL fund, it can solve its biggest compliance problem - the opacity of the underlying assets. If Circle's underlying assets are also managed by Blackrock, this is at least more credible than Tether issuing some audit reports all day long.

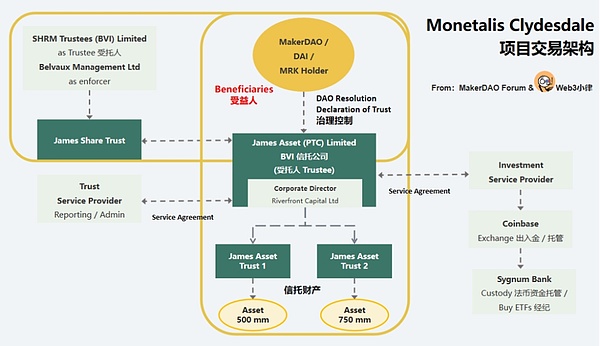

Let’s look at the complex Blackrock U.S. Treasury ETF procurement path that MakerDAO previously spent more than 1 million U.S. dollars to build. Now, it can be achieved by simply asking MakerDAO to Securitize to open a qualified investor account. It is safe, convenient and risk-free.

3. USDC liquidity of tokenized funds

3.1 BUIDL liquidity through USDC

As mentioned earlier, due to the "securities" restriction, BUIDL tokens are limited to the circulation between "whitelisted" investors, so it is far from enough to achieve 24/7/365 subscription/redemption.

As a result, Blackrock and Circle have cooperated to establish a smart contract-controlled USDC liquidity pool to achieve 24/7365 real-time exchange of BUIDL: USDC = 1:1.

(twitter.com/jerallaire/status/1778416442691428778)

Circle co-founder and CEO Jeremy Allaire said on April 11: "The tokenization of real-world assets is a rapidly emerging product category that solves investor pain points. USDC can help investors quickly transfer tokenized assets, thereby reducing costs and eliminating friction. We are very happy to provide this feature to BUIDL investors and demonstrate the core advantages of blockchain transactions-speed, transparency and efficiency."

This is a milestone move that can open up a new world of DeFi for RWA assets.

3.2 ONDO Finance's BUIDL liquidity attempt

ONDO Finance, the leader of the RWA U.S. bond project, added $95 million of BUIDL tokens to its tokenized fund product OUSG on March 27, and combined with the USDC liquidity pool provided by Circle for BUIDL, this move solved its users' biggest pain point - T+2 fund redemption, and realized 24/7/365 real-time subscription/redemption of Ondo OUSG fund shares.

This also marks the first large-scale adoption of BUIDL by a DeFi protocol.

(Introducing Instant, 24/7/365 Subscriptions and Redemptions; Shifting OUSG Funds into BlackRock’s BUIDL)

3.3 The future of BUIDL

After Circle opened the door to DeFi for the BUIDL fund, it undoubtedly provided an important fund management option for participants in the crypto market.

In Bankless’ interview with Securitize CEO, Carlos Domingo said: Currently, the BUIDL fund is particularly suitable for institutional market participants, such as:

(1) Web3 project parties that have received a large amount of huge financing. They all have a large amount of funds stored off-chain, and can achieve seamless connection between on-chain and off-chain through BUIDL. There will be billions of dollars in scale here;

(2) Stablecoin issuers. They themselves have a rigid demand for capital allocation, such as Circle’s capital allocation is managed by Blackrock, such as the capital allocation of the above-mentioned ONDO Finance OUSG fund, and Mountain Protocol also intends to allocate BUIDL assets. There will be tens of billions of dollars in scale here;

(3) Stablecoins themselves. Currently, USDC and USDT stablecoins are non-interest bearing. If these non-interest bearing stablecoins are replaced with interest bearing stablecoins and can be circulated after packaging, there is a huge room for imagination. The stablecoin market itself has a scale of hundreds of billions.

For example, we see that ONDO Finance's USDY stablecoin is making such attempts, and it has layouts in Aptos and Solana, while ensuring that assets are sufficiently safe, stable interest bearing and circulation.

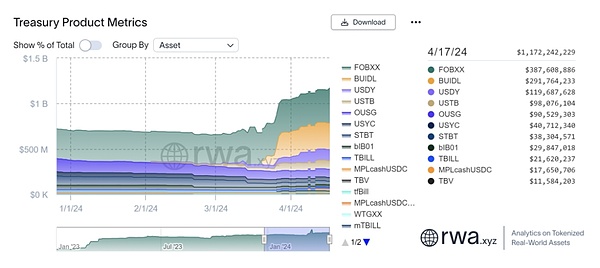

Fourth, RWA tokenization brings huge potential

In an exclusive interview with Bloomberg, Blackrock CEO Larry Fink made it clear that asset tokenization will be the next development direction of Blackrock: "We believe that the tokenization of financial assets will be the next trend, which means that every stock and bond will be recorded on a general ledger."

Although Franklin Templeton has already realized tokenized funds on public blockchains, the Blackrock aircraft carrier has undoubtedly opened the door for traditional finance to the new world of RWA. In particular, after Circle provided BUIDL with a USDC liquidity pool, it undoubtedly opened the door to DeFi composability.

The most realistic thing is: BUIDL has built a collateral layer (Collateral Layer) of institutional-level crypto assets, which ensures that assets are sufficiently safe and stable while generating interest. We have seen this being achieved in the case of ONDO Finance, which enables 24/7/365 real-time subscription/redemption of on-chain fund products.

(app.rwa.xyz/treasuries)

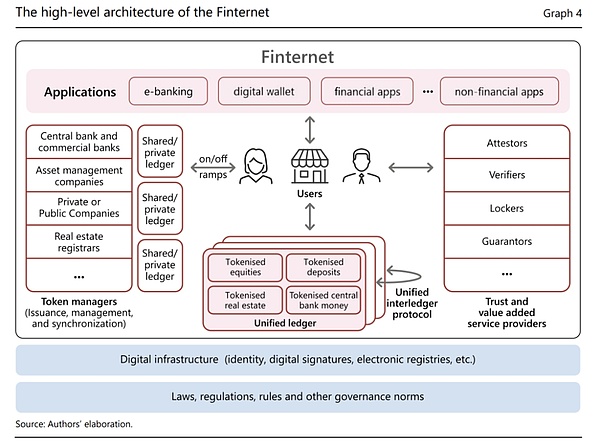

Finally, I would like to end with the recent research report Finternet: the Financial System for the Future released by the Bank for International Settlements (BIS):

“Although advances in digital technology have changed people’s lives in recent decades, a large part of the financial system remains in the past. Many transactions still take days to complete and rely on time-consuming clearing, messaging and settlement systems and physical paper records. Therefore, improving the operation of the financial system is an important public policy goal.

This blockchain-based Finternet will be the future of the financial system.”

(Finternet: the Financial System for the Future)

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan