Author: Trustless Labs

Blast has airdropped $Blast tokens to the community at 10 pm on June 26, which also announced the end of a huge airdrop feast. There is no doubt that Blast is the only king-level project that can be compared with ZKsync this year in terms of investment institutions, community popularity and TVL. Layer2 has entered the next stage. After the large-scale and controversial airdrop activities, how will Blast itself and the Layer2 ecosystem develop in the future?

1. Project Background

Environment-driven innovation

For a long time, in the conventional Layer 2 ecosystem, users have obtained Layer2 ecosystem tokens as income by staking ecosystem tokens, stablecoins and other tokens. At the same time, Layer2 project parties use pledged tokens to complete transaction verification and other behaviors under the POS model, and are also willing to provide tokens to encourage users to participate in the maintenance and development of the network, achieving a win-win situation. Generally speaking, since Layer2 is built on Layer1, the funds pledged on Layer2 need to bear two system risks from Layer2 and Layer1, so Layer2 projects often need to provide a higher interest rate than Layer1 pledge as risk compensation. Taking the Polygon network as an example, Matic's annual interest rate can generally reach 8%-14%, while the annual interest rate of ETH on the ETH network is generally 4%-7%. So is there a way to take the capital gains obtained by Layer2 to a higher level? So Blast came into being.

Figure 1 Blast-logo

Basic information

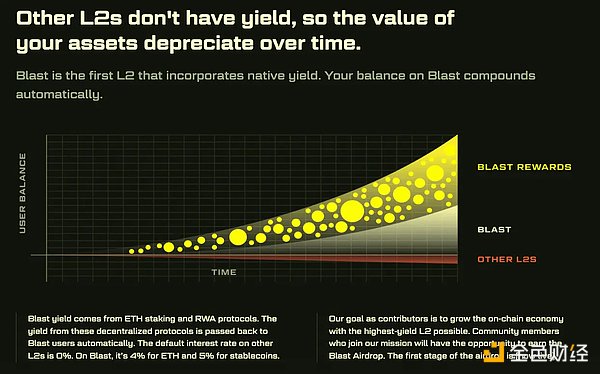

Blast is an Ethereum second-layer network based on Optimistic Rollups launched by PacMan, the founder of Blur. Blur, created by PacMan, once distributed the fifth largest airdrop in history. Compared with other Layer2 projects that are aimed at expanding transaction capacity, improving transaction speed, and reducing gas fees, Blast focuses on improving the shortcomings of Layer1 while providing higher economic benefits. In general, Blast will be the first Layer2 to provide fixed income for ETH and stablecoin staking, and this narrative based on income may guide the construction of Layer2 to return from technical attributes to the financial attributes of Web3 itself.

Development History

In November 2023, the project was launched: Blast was founded by PacMan, the founder of the NFT platform Blur, and began to operate as an Ethereum expansion solution. The project received a $20 million seed round of financing led by Paradigm and Standard Crypto.

In November 2023, a turning point statement: Blast announced its unique profit model, which returns the profits of Ethereum staking and RWA protocol to users. The project provides 4% ETH income and 5% stablecoin income.

February 2024, mainnet launch: Blast officially launched the mainnet, but before that, users were unable to withdraw funds locked on the platform, which caused dissatisfaction among some users.

June 26, 2024, airdrop: Blast will airdrop on June 26, 50% of the airdrop rewards will be allocated to developers (through Blast Gold points), and the other 50% will be allocated to early users (including users who bridged funds to the network before the mainnet launch.

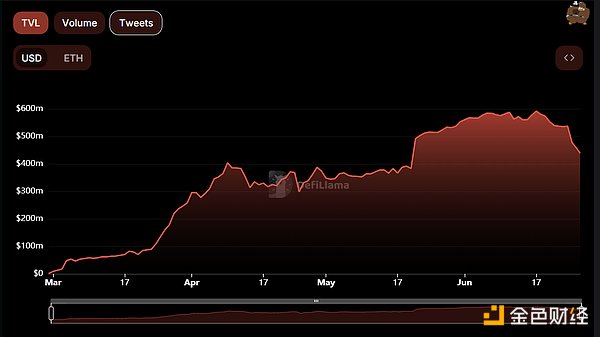

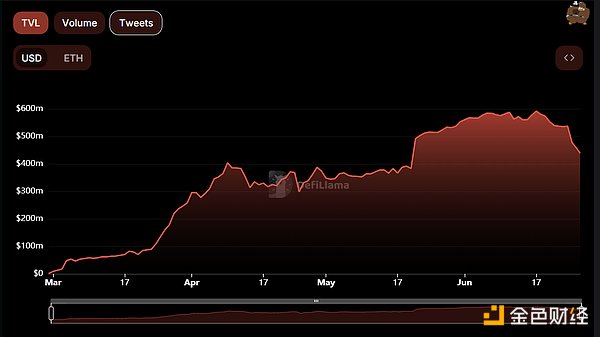

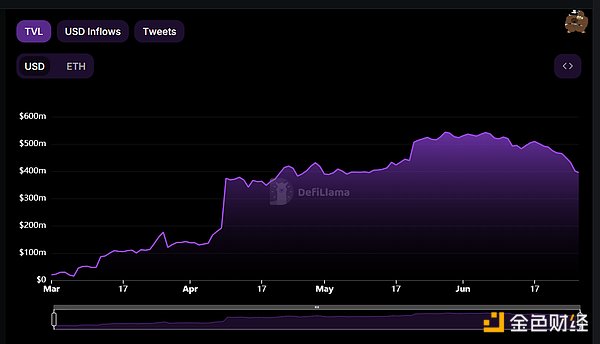

Market Growth

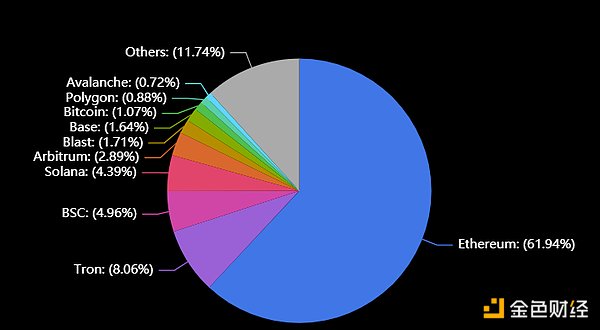

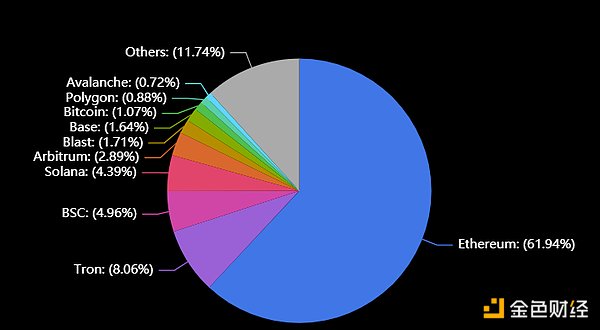

The Blast chain has been strongly sought after by the market and it continues to grow. As of the time of writing, its TVL is as high as $1.6B, making it the 6th ranked TVL and the 11th ranked Protocols chain. At the same time, its locked assets account for 1.71% of all locked assets on all chains.

Figure 2 Blast locked asset ratio

Figure 3 Blast indicators change

II. Token Economics

Token Function

$Blast token will be similar to other Layer2 tokens in terms of token function, with basic functions such as ecological governance, airdrop incentives, and staking income. So far, it does not have too outstanding features. However, in terms of ecological governance, the Blast ecosystem has more complete governance regulations and rules and regulations than other Layer2 ecosystems, which may reflect the relative completeness of Blast ecosystem construction.

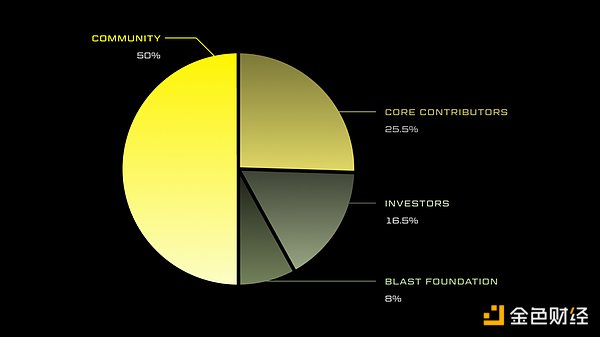

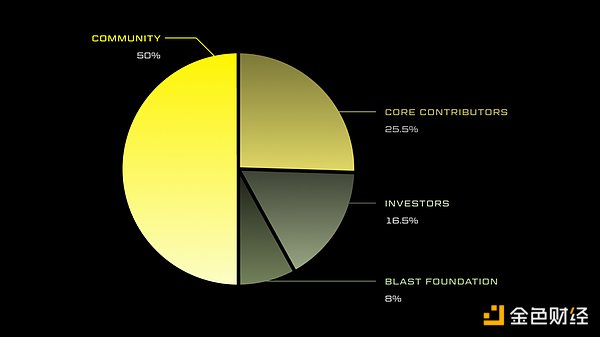

The total supply of Blast tokens is 10 billion, which are distributed to the community, core contributors, investors and the foundation.

The community gets 50% of the airdrop, a total of 50,000,000,000 tokens, which will be unlocked linearly over 3 years from the TGE date.

Core contributors get 25.5% of the airdrop, a total of 25,480,226,842 tokens, of which 25% will be unlocked 1 year after the TGE date, and 75% will be unlocked linearly over the next 3 years.

Investors get 16.5% of the airdrop, a total of 16,519,773,158 tokens, of which 25% will be unlocked 1 year after the TGE date, and 75% will be unlocked linearly over the next 3 years.

The Blast Foundation receives 8% of the airdrop, a total of 8,000,000,000 tokens, which will be unlocked linearly within 4 years from the TGE date.

Figure 4 Blast airdrop distribution

First phase airdrop

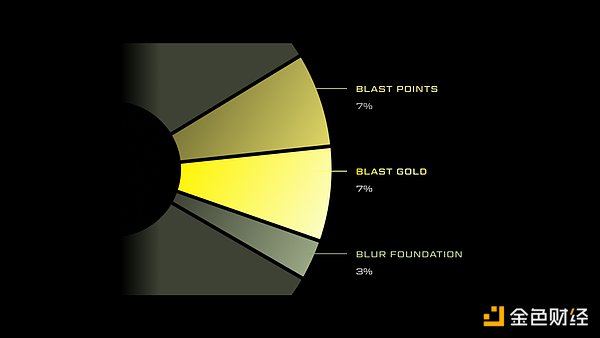

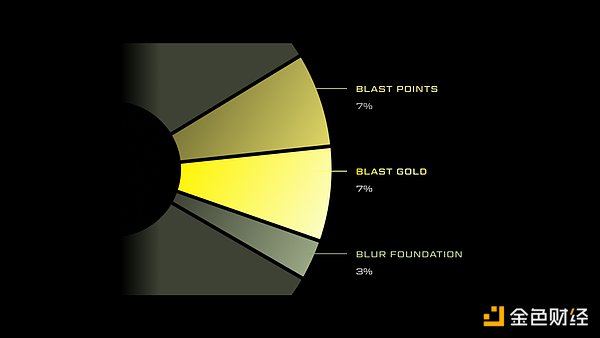

Users holding Blast Points will share 7% of the total supply of airdrop rewards according to the number of points.

Users holding Blast Goal points will share 7% of the total supply of airdrop rewards according to the number of points.

Blur Foundation will receive 3% of the total supply as airdrop rewards for distribution to the Blur community.

In addition, the airdrops of the top 0.1% of wallets will be released linearly within 6 months. This measure has greatly reduced the huge selling pressure when the token is released. At the same time, the number of Blast Goals is far less than that of Blast Points, so the benefits of holding Blast Goals are far higher than Blast Points.

Figure 5 Blast first quarter airdrop allocation

III. Narrative characteristics

Perfect compatibility of EVM

The level of EVM compatibility is very important for Layer2 on ETH. The higher the compatibility, the lower the migration cost and the faster the ecological construction speed. Although the perfect compatibility of EVM is not original to Blast, the Blast chain has adopted a free choice approach in compatibility, which reflects a certain degree of innovation.

Blast's perfect compatibility with EVM relies on the function that the contract can freely choose "whether to Auto-Rebasing". Auto-Rebasing means automatic rebasing. In the contract, you can choose whether to participate in this mechanism. For contracts that do not need to choose this mechanism, the migration of DAPP can be easily completed with less code modification.

The perfect solution to kill two birds with one stone

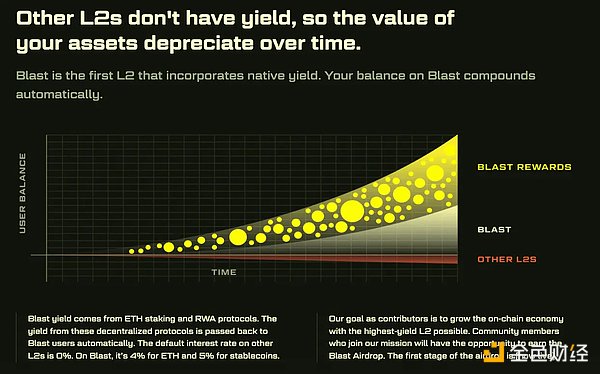

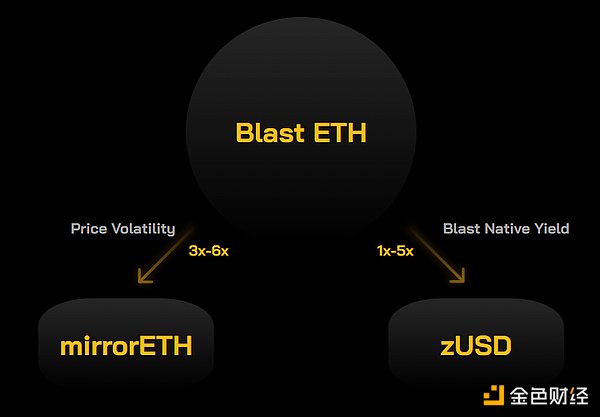

The slogan of the Blast ecosystem is that it is the only Layer2 that can achieve native returns on ETH and stablecoins. How is this solved?

ETH is not an ERC-20 native token. Generally speaking, in blockchain and DeFi, we deposit ETH into the contract, and the wallet can obtain the corresponding amount of WETH, etc., and the WETH obtained through conversion can obtain returns in DEX, lending platforms, liquidity pools, etc. In such a process, high gas fees are often lost, resulting in users with smaller funds being unable to participate in staking activities. At the same time, ETH staking on platforms such as Lido needs to be converted into STETH, etc., and also faces similar loss problems.

At this time, Blast proposed the Auto-Rebasing scheme, which aims to automatically update the user's account balance without WETH, STETH or any other ERC20 tokens. At the same time, the ETH staked in Blast is currently automatically staked with Lido, directly updating the native ETH balance, allowing users to automatically obtain benefits without operation. In addition, the native stablecoin USDB provided by Blast can be exchanged for DAI when bridged back to Ethereum through MakerDAO's T-Bill protocol.

This scheme seems very complicated. In essence, it is to automatically stake the tokens originally locked in the contract in DeFi such as Lido and MakerDAO, and continuously convert them into native token benefits, realizing compound interest operations while avoiding high gas fees. At the same time, the Blast R&D team has shown that it has the ability to achieve this operation without Lido and MakerDAO in the future. Therefore, the funds staked in Blast may not only obtain the staking rewards of the Blast chain itself, but also have a base interest rate similar to that of the ETH chain, achieving a perfect one-fish-two-kill.

Figure 6 Comparison of Blast with other L2s

IV. Ecosystem construction

Blast ecosystem construction covers multiple tracks such as SocialFi, GameFi, DeFi, NFT, etc. Compared with traditional Layer2, Blast ecosystem has better narrative and comprehensiveness, integrating multiple functions and features to form a diversified ecosystem.

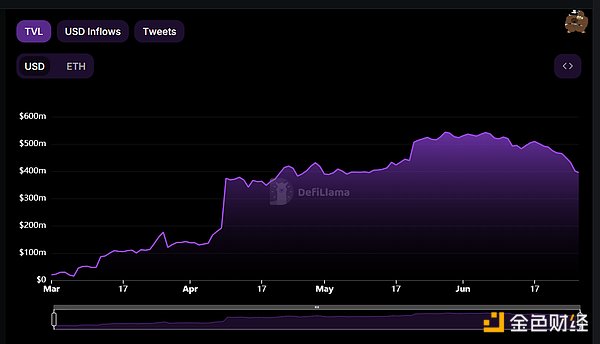

DEX leader Thruster

Thruster is a revenue-first DEX built specifically for degens, supported by Blast Points chads, founders and excellent communities. Its TVL has been growing rapidly since March and is currently as high as $438m. In the Blast airdrop event, users can obtain Blast Points and Thruster Credits by cross-chain and providing liquidity, and enjoy multiple benefits

Figure 7 Thruster TVL growth

Thruster inherits the AMM model of conventional DeFi, allowing users to provide liquidity and earn fees.

Thruster provides a web UI in simple mode and complex mode, which is convenient for users.

Thruster utilized the USDB and ETH pledge income automated by the Blast chain, thereby improving the liquidity and transaction efficiency of the DEX itself and providing support for the launch of new tokens.

Thruster has uniquely designed a weekly lossless lottery Thruster Treasure pool reward, which has attracted a large number of active users to participate.

Figure 8 Thruster—logo

In addition, Thruster also provides versions of different AMM models. For example, Thruster V3 uses centralized liquidity AMM, combined with different transaction fee structures, which is suitable for high-frequency traders.

Juice Finance, the leader in leveraged lending

Juice Finance is currently the largest leveraged lending platform on the Blast chain. It uses an innovative cross-margin Defi protocol, mainly providing lending and yield farming functions, and optimizes users' earnings and point acquisition by integrating Blast's native rebase tokens (such as ETH, WETH and USDB) and gas refund mechanisms. Its current TVL is as high as $394m.

Figure 9 Juice Finance TVL growth

Leveraged lending: Users can lock WETH as collateral in the protocol and borrow up to 3 times USDB. USDB can be deployed in other income strategies on the Blast chain to maximize income.

Yield farms: Similar to other yield farms, Juice Finance provides users with a variety of strategy vaults. Users deposit USDB to earn income. It is worth mentioning that Thruster is also in the strategy vault service provided.

Figure 10 Juice Finance

Compared to other lending platforms, Juice Finance also has permissionless lending and cross-margin functions, providing a basis for users to make full use of their financial advantages to make capital gains.

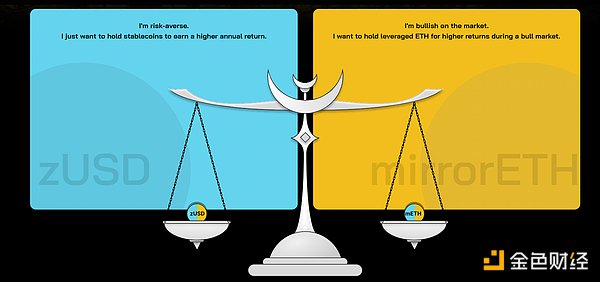

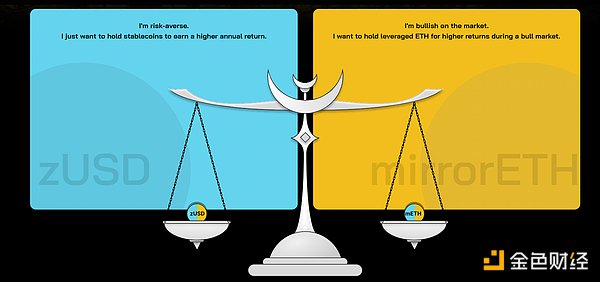

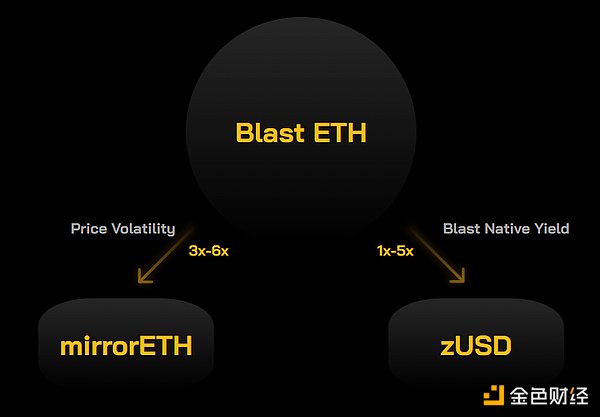

Zest, a platform for improving capital effect

Figure 11 Zest platform

On conventional mortgage platforms, the general mortgage rate reaches 150%, which cannot fully play the utility of tokens. Zest will use the native ETH income of the Blast chain to

improve capital efficiency. When a user pledges $150 worth of ETH in Zest, he can get $100 worth of zUSD and $50 of Leveraged ETH. The yield of ETH is inherited by zUSD, and the volatility is inherited by Leveraged ETH. Because all fluctuations of ETH are absorbed by Leveraged ETH, zUSD has risk-free leveraged returns, which improves capital efficiency.

Therefore, compared with other platforms, Zest provides a higher-yield, lower-risk auxiliary solution, which is suitable for cooperating with other DeFi to achieve higher returns.

Figure 12 Zest income chart

SocialFi leader

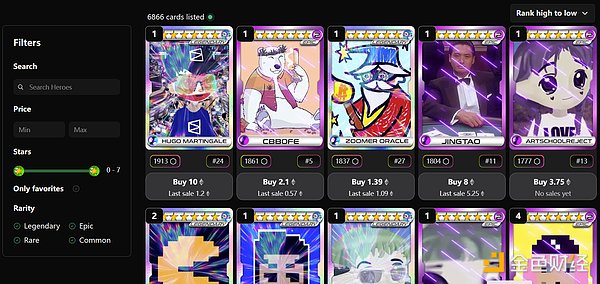

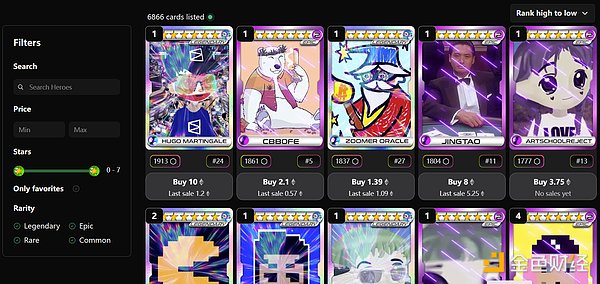

Fantasy is a revolutionary social financial trading card game that combines elements of social finance and trading card games to provide users with a new interaction and income model.

Figure 13 Fantasy Market

The Fantasy project was originally launched by Travis Bickle on the Blast mainnet on May 1 and became one of the 47 winning works in the BIG BANG competition. Compared with traditional SocialFi projects, Fantasy defines a new way to link social media influence with platform currency and collections, and points out a new direction for SocialFi to improve user stickiness.

Essential features: The Fantasy platform provides cards with well-known traders, investors, industry analysts and project initiators as avatars based on the Crypto Twitter community, and uses cards as a medium for revenue distribution, which is different from traditional SocialFi.

Income characteristics: Players holding cards can earn 4% of the original income of the Blast chain itself, while passively earning 1.5% of the ETH of their card trading volume.

Nature of competition: Cards purchased by players form a deck, and they are ranked according to market trading activity and social media influence in weekly competitions to obtain rewards.

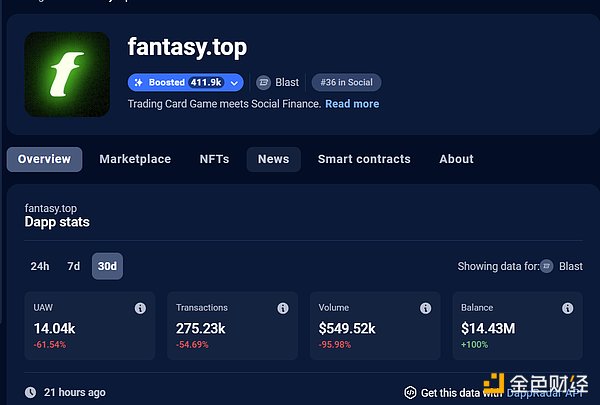

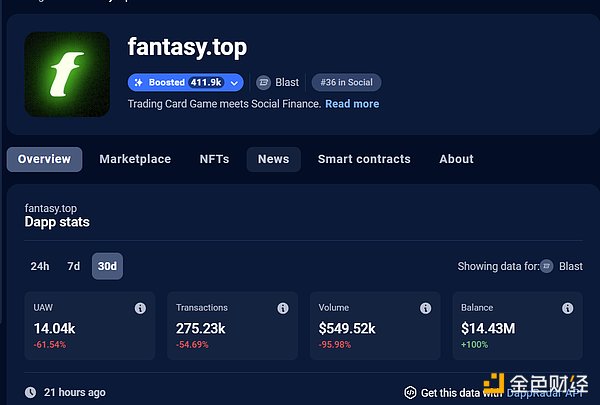

As of the time of writing, the total NFT transaction volume of the Fantasy platform has reached $93.11M, with as many as 36.7K participants, making it the fifth SocialFi in the comprehensive ranking of the Blast chain.

Figure 14 Fantasy data

Although Fantasy currently does a good job of connecting users closely to the platform through card decks, how to retain users after the rewards and even attract more users to participate remains a major challenge. So far, the actual user base of Web3 cannot be compared with the user base of traditional media platforms, and users are much more profit-seeking than traditional platforms, so this problem is also a dilemma that all SocialFi platforms must face.

V. Future Development and Risk Opinions

Figure 15 Blast Promotional Picture

Future Development Trends

Due to the high-yield characteristics of Blast, in the long run, it will inevitably draw funds from other Layer2 and the Ethereum chain itself until the income characteristics of the Blast chain are balanced with those of other chains.

The automatic income ability of the Blast chain provides fertile ground for the development of DeFi. DeFi projects built on Blast naturally have higher and more stable income than DeFi projects on other chains, and will also have a faster development speed.

Hidden Risk Analysis

Blast Chain relies on the powerful Auto-Rebasing function to automatically obtain Layer1 staking income and avoid currency losses caused by inflation; this is essentially an automated way of killing two birds with one stone, obtaining both Layer1 and Layer2 income on Layer2.

From a technical perspective, Blast has achieved automated staking through Auto-Rebasing, reduced the gas fee for staking, reduced the personal risk of a single user operation, and optimized overall capital efficiency.

From a risk level perspective, staking through Lido and MakerDAO to obtain income will undoubtedly greatly increase the systemic risk of the entire chain's funds. At the same time, it is still unknown whether the funds will not be recovered in time due to market fluctuations, resulting in losses.

From the perspective of authority, Blast automatically pledges funds to Lido and MakerDAO, and users automatically bear the corresponding risks. Whether this damages the user's right to dispose of funds is also worth our consideration.

Overall, Blast's high returns are not free, and they are accompanied by an increase in the overall risk of the fund system. However, for small personal funds, the increase in returns is obviously far greater than the increase in risks, and it still has very good prospects. At the same time, the income characteristics of Blast are likely to be adopted by other Layer2s, and it is also worth continuous attention.

ZeZheng

ZeZheng