Author: Benjamin Taubman Source: Bloomberg Translation: Shan Ouba, Golden Finance

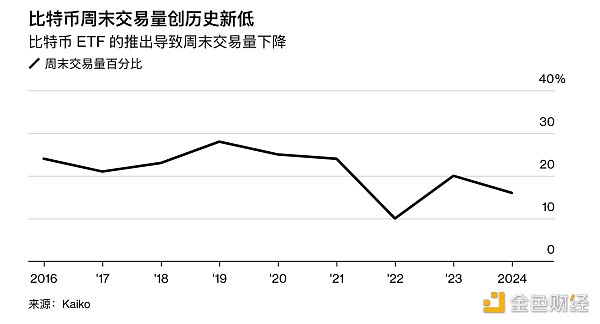

Cryptocurrency research company Kaiko The proportion of Bitcoin traded on weekends this year has dropped to an all-time low of 16%, according to data from .

The decline follows the launch of a spot Bitcoin exchange-traded fund that appears to have changed the Bitcoin trading schedule, Making it more consistent with traditional stock exchange schedules and reducing Bitcoin price volatility. A distinctive feature of cryptocurrencies is that, unlike stocks, it can be traded around the clock, even on Saturdays and Sundays. In the past, Bitcoin trading was notorious for its "crazy weekends," during which the digital currency's price would fluctuate wildly.

But the phenomenon appears to be cooling down, as Bitcoin’s weekend trading volume has continued to decline from a 2019 high of 28%. The launch of a Bitcoin ETF may be a big reason why.

Kaiko senior analyst Dessislava Aubert said the decline in weekend trading volume is "a trend that has been going on for years, but ETFs have exacerbated it." .

In early 2024, the Bitcoin ETF was launched with approval from the U.S. Securities and Exchange Commission and has since been sought after by investors, causing the price of Bitcoin to surge to All time high. While some of those gains have been pared, the largest cryptocurrency is still up about 45% this year, to about $61,000.

Unlike most crypto tokens that can be readily traded on exchanges like Binance, theBitcoin ETF follows the rules of the traditional stock exchanges on which it trades. Schedule – This means no weekend trading.

The proportion of Bitcoin traded between 3 pm and 4 pm on weekdays increased to 6.7% from 4.5% in the fourth quarter of 2023 . This period of time is known as the base pricing window, during which the owner of the ETF determines the price of Bitcoin, which is then used to calculate the ETF's net asset value.

The collapse of crypto-friendly banks Silicon Valley Bank and Signature Bank in March 2023 also contributed to a decline in weekend trading volumes. This is because market makers can no longer use banks’ 24/7 payment networks to buy and sell cryptocurrencies in real time.

The report states:The price difference between weekends and weekdays is likely to persist as market makers earn revenue from large volumes of transactions, thereby earning the bid-ask spread. , and in an environment with lower trading volumes, market makers have less incentive to provide liquidity.

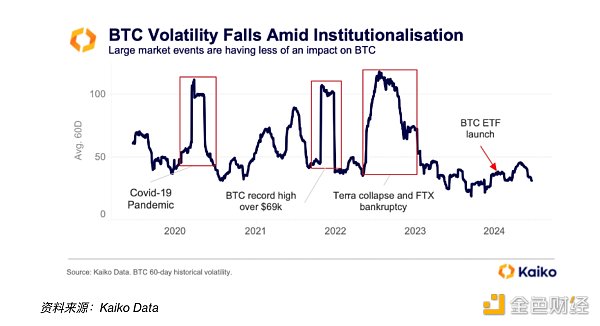

A separate report from Kaiko saidInstitutional adoption of cryptocurrencies through Bitcoin ETFs has also led to a significant reduction in price volatility.

When Bitcoin last hit an all-time high in November 2021, volatility spiked to nearly 106%. Volatility is just 40% after Bitcoin hit an all-time high of $73,798 in March, driven by optimism about the ETF.

p>

The trend towards lower volatility, and the fact that it has remained below 50% since early 2023, suggests thatBitcoin is becoming a more mature asset . While it’s too early to say this is the new normal, changes in Bitcoin’s market structure over the past year may help explain why price action has been relatively ‘uninteresting’. ”

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Coindesk

Coindesk Bitcoinist

Bitcoinist Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Nulltx

Nulltx Cointelegraph

Cointelegraph