Author: Catherine Bosley, Bloomberg; Compiler: Tao Zhu, Golden Finance

A global stock sell-off intensified on Monday as investors turned to the safety of bonds amid growing concerns that the Federal Reserve is lagging behind in its policies to support a slowing U.S. economy.Japanese stocks plunged as traders bet on further increases in domestic interest rates.

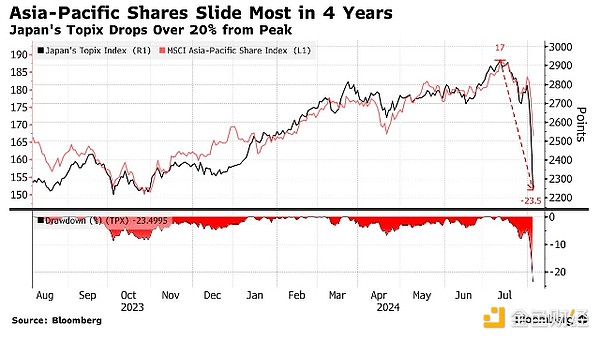

Both the Topix and Nikkei fell more than 13%. Taiwan's benchmark index had its worst day ever, while Asian stock indexes posted their biggest drop in four years, with financial and industrial stocks the biggest drag. European and U.S. stock futures also fell, while the yen rose more than 2.5% against the dollar.

Data on Friday showed U.S. nonfarm payrolls posted one of the weakest readings since the pandemic, while the unemployment rate unexpectedly climbed above the Federal Reserve's year-end forecast, raising a closely watched recession indicator. Concerns about the health of the U.S. economy sent U.S. Treasury yields lower, while Asian investment-grade dollar bond spreads were on track for their biggest gain in 22 months.

"This is a fairly dramatic turnaround and suggests that the recent trend has been largely supported by expectations of a soft U.S. landing," said Charu Chanana, head of FX strategy at Saxo Bank. "The more the U.S. soft landing assumption is questioned, the more we may see a further pullback in equities and strategies funded in low-yielding currencies, where positioning is heavily imbalanced."

Japan's benchmark 10-year bond yield fell to its lowest level since April, down 17 basis points on Monday. Shares of Mitsubishi UFJ Financial Group Inc., the country's largest lender, posted their biggest intraday drop ever as falling bond yields threatened lending margins.

Bond traders have repeatedly misjudged the direction of interest rates since the pandemic ended, sometimes overshooting in both directions. Global bonds have recovered lost ground this year as signs of a deteriorating U.S. economy spurred demand for fixed income.

The global stock market decline reflects concerns about the economic outlook, geopolitical risks and questions about whether heavy investments in artificial intelligence can live up to the hype about the technology. Goldman Sachs Group Inc. economists raised the odds of a U.S. recession next year to 25% from 15%, although it added there were reasons not to worry about a recession.

Sentiment was also weighed by news that Berkshire Hathaway Inc. cut its stake in Apple Inc. by nearly 50% as part of a massive second-quarter sell-off.

Asian currencies rose -- led by the Malaysian ringgit -- while the Mexican peso extended its losses as traders continued to unwind emerging market carry trades. A sudden rise in funding currencies such as the yen and yuan hurt carry trades, which typically involve traders borrowing money at lower rates to invest in higher-yielding assets.

Elsewhere, oil prices fluctuated near seven-month lows as a broader financial market sell-off offset rising tensions in the Middle East. Israel is preparing for possible attacks by Iran and regional militias in retaliation for assassinations of Hezbollah and Hamas officials. Cryptocurrencies also took a hit on Monday as risk aversion gripped global markets.

With only three Federal Reserve meetings left, swaps pricing reflects a growing view that the central bank will need to make unusually large half-point adjustments at a single meeting or act between scheduled meetings -- quickly to boost economic growth.

Still, large policy moves and aggressive responses could mean an emergency, sparking more unease among traders, with Goldman Sachs raising the odds of a recession next year to 25% from 15%.

"From the Fed's perspective, this doesn't mean they will rush into policy decisions, but it should help them take off their rose-colored glasses when they evaluate policy decisions at their next meeting," said Charlie Ripley of Allianz Investment Management.

Bank of America Corp.'s Michael Hartnett said stocks will likely fall when the Fed first cuts rates because the shift will be accompanied by data suggesting the U.S. economy is headed for a hard landing rather than a soft one.

Since 1970, when the Fed began easing policy, rate cuts in response to economic downturns have had a negative impact on stocks and a positive impact on bonds, the Bank of America strategist wrote in a note, citing seven examples to illustrate the pattern. "A very important difference in 2024 will be the extent to which risk assets get ahead of the Fed's rate cuts," Hartnett said.

Aaron

Aaron

Aaron

Aaron Jasper

Jasper Kikyo

Kikyo Clement

Clement Hui Xin

Hui Xin Clement

Clement Jasper

Jasper Catherine

Catherine Clement

Clement Snake

Snake