Author: Sunil Jagtiani, Bloomberg; Compiler: Deng Tong, Golden Finance

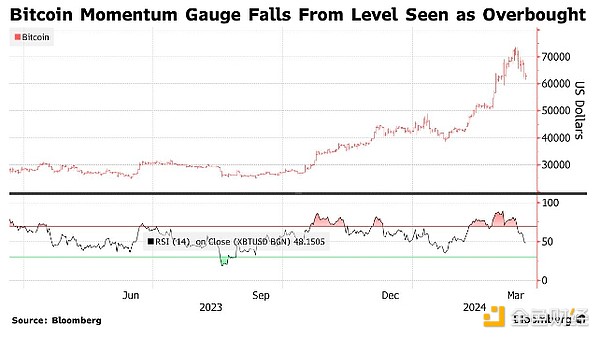

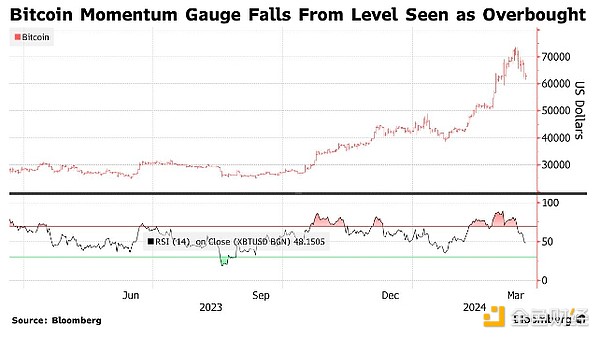

Bitcoin hovers near its lowest level in about two weeks Why It was lower flows into dedicated exchange-traded funds and concerns that the scope of U.S. interest rate cuts was narrowing.

The digital asset has fallen almost daily since hitting an all-time high of nearly $73,798 on March 14, raising questions about whether the cryptocurrency is temporarily dead. Peaking question.

The decline comes amid concerns over whether above-target inflation will lead Federal Reserve policymakers to There is uncertainty about lowering expectations for interest rate cuts at the meeting, which indicates that the environment for speculative investment is not very favorable.

Meanwhile, regards the U.S. Spot, which was launched to much fanfare on January 11 Demand for Bitcoin ETFs has cooled. The products have seen net inflows of $11.6 billion so far, but investors pulled money from the group on Monday.

Although Bitcoin has recently The woes are partly related to the Fed’s outlook, but “the commitment of some latecomers to buy more than $60,000 — expected to see steady inflows into new Bitcoin ETFs — is now being tested,” said IG Australia Pty. said market analyst Tony Sycamore.

The broader cryptocurrency market has lost about $420 billion since hitting $2.9 trillion last week, according to CoinGecko. Tokens like Ethereum and BNB, as well as crowd favorite Dogecoin, have all suffered during this period.

K33 Research said Bullish bets using derivatives could see further washouts, suggesting the numbers A rapid recovery in asset markets could hit roadblocks.

Anders Helseth and Vetle Lunde of K33 Research wrote in a report: “Therefore, The risk of continued amplification of downside volatility due to prolonged liquidation remains considerable."

Coinglass data shows that about $483 million worth of bullish cryptocurrency bets are on It was liquidated in the past 24 hours, one of the biggest declines in the past two weeks.

Digital asset optimists continue to predict that an impending reduction in Bitcoin supply growth will spur Bitcoin development. But pessimism now prevails, underlined by plunges this week in cryptocurrency-related stocks such as U.S. exchange operator Coinbase Global Inc., bitcoin holder MicroStrategy Inc. and Japanese financial services firm Monex Group.

Kikyo

Kikyo