Author: Ryan Weeks, Bloomberg; Compiler: Deng Tong, Golden Finance

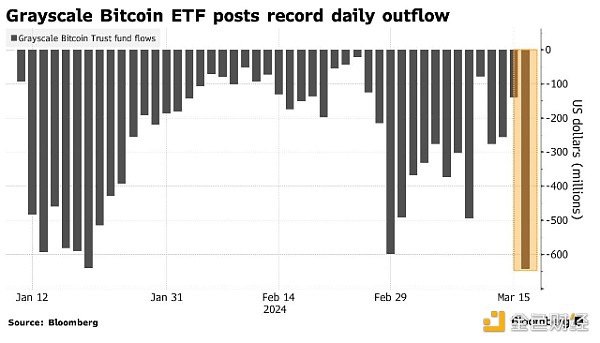

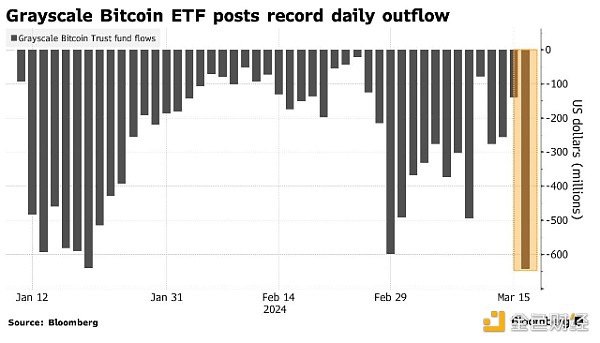

On March 18, Grayscale Fund outflowed US$643 million;

Bitcoin’s rally has cooled since last week’s record high of US$73,798.

As Investors digest world’s largest exchange-traded fund record With single-day capital outflows and the weakening of expectations for an interest rate cut by the Federal Reserve, Bitcoin continued its correction.

As of 1 pm on Tuesday, Bitcoin, Singapore's largest digital asset, fell about 3% to $65,380. Other major coins such as Ethereum, Solana and the most popular Dogecoin also posted losses.

Data show that The $25 billion Grayscale Bitcoin Trust (GBTC) announced 6.43 on Monday Billions of dollars in capital outflows, the largest outflow since the switch to ETFs on January 11. Earlier, strong demand for the nine new spot Bitcoin ETFs that launched simultaneously more than made up for the massive GBTC exits.

But the funds flowing into giant products such as Fidelity Investments and BlackRock Inc. are also cooling down. On March 18, these 10 stocks The overall net outflow of ETFs was US$154 million.

Singapore-based cryptocurrency trading firm QCP Capital wrote in a report on Tuesday that it will "closely track today's total ETF flow data," adding “A net negative number would be a clear bearish signal”.

Since the start of trading , ETFs attracted a total of $12 billion in net funds. Investor interest pushed Bitcoin to a record high of $73,798 last week. The cryptocurrency leader’s status has since faltered as the initial pulse of demand for the product waned amid warnings of bubble-like characteristics in some assets.

The risks brought by monetary policy are one of the uncertain factors. Ongoing inflationary pressures are dampening expectations for easing from the Federal Reserve, while Japan has just ended its most aggressive monetary stimulus program in modern history, abolishing the world's last run of negative interest rates.

Grayscale Investments LLC, GBTC’s management company, plans to launch a clone of the fund to compete with rivals offering cheaper products. Fees are expected to be lower than GBTC, a person familiar with the matter told Bloomberg earlier.

JinseFinance

JinseFinance