DeFi data

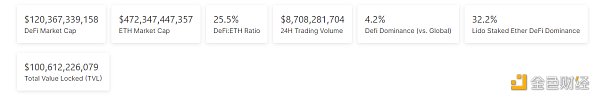

1. Total market value of DeFi tokens: US$120.367 billion

DeFi total market capitalization data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$6.126 billion

Decentralization over the past 24 hours Source of exchange trading volume data: coingecko

3. Assets locked in DeFi: US$10.368 billion

DeFi project's top ten rankings of locked assets and locked positions data source: defillama

NFT data

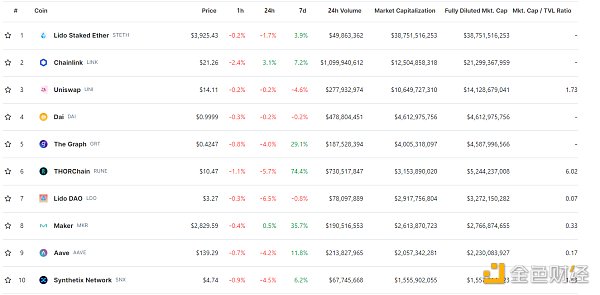

1.NFT total market value: US$7.688 billion

Data source for NFT total market value and top ten projects by market value: Coinmarketcap

2.24-hour NFT transaction volume: 409 millionUSD< /strong>

NFT total market value and market value of the top ten projects Data source: Coinmarketcap

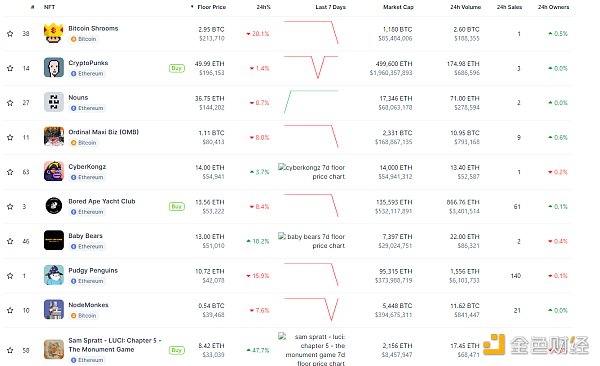

Top NFT in 3.24 hours

The top ten NFTs with the highest sales growth within 24 hours Data source: NFTGO

< /strong>

Headlines

BNB Chain Launches Rollup as a Service Solution< /strong>

BNB Chain has launched Rollup as a Service (RaaS) solution to support the expansion of custom L2 networks in its ecosystem.

RaaS will provide dapp projects with the infrastructure needed to build cost-effective purpose-built rollups on the BNB Smart Chain (BSC), including no-code deployment options.

According to DeFiLlama, BSC is the third largest blockchain by total value locked, with a TVL of $6.1 billion, compared with Ethereum’s $56.7 billion and Tron’s $10.5 billion.

NFTHotPoint

1.Ronin: Kaidro’s first free NFT casting is online

According to official news, Ronin announced that Kaidro’s first free NFT casting has been officially launched Online, early participants can now mint Journal NFT on its platform and apply for it. It is reported that NFT holders may have priority in participating in the next round of Mech casting.

2.Hivemind Capital launches NFT fund "Hivemind Digital Culture Fund" to raise US$50 million

Headquarters in New York Hivemind Capital Partners, an investment institution, has launched a fund dedicated to the intersection of digital art and blockchain, called Hivemind Digital Culture Fund, and will raise US$50 million for the fund. According to Matt Zhang, founder and managing partner of Hivemind Capital, the fund has achieved about half of its financing goal and plans to continue raising capital during the remainder of 2024 and then deploy funds over the next three years.

DeFi hotspots

1.Bank for International Settlements research: DeFi borrower behavior is a measure of tokenization risk The key

News on March 14, a study by the Bank for International Settlements (BIS) concluded that when designing and managing platforms involving tokenized assets, borrowers in DeFi The behavior of the field and DeFi market dynamics are important considerations.

It noted that because DeFi borrowers face huge losses in automatic liquidations (collateral is automatically sold when a borrower’s position becomes too risky), they often avoid over-leveraging. Borrowers took a conservative approach and had sizable cushions.

Additionally, DeFi users tend to deposit more money if they have had higher returns in the past. The study’s authors, Lioba Heimbach and Wenqian Huang, said their findings may be relevant to understanding financial stability concerns raised by DeFi. It conducted the research using data from the Ethereum blockchain, focusing on loan resilience and strategic substitution behavior

2.OKX Ventures announces investment in first native Bitcoin Coin DeFi protocol DLC.Link

On March 14, OKX Ventures announced its investment in DLC.Link, a groundbreaking project aimed at bringing the power and innovation of DeFi to the Enter the Bitcoin ecosystem. DLC.Link partners with institutions to mint dlcBTC, a decentralized wrapper for Bitcoin. Unlike other forms of wrapped Bitcoin, dlcBTC does not require the Bitcoins to be held in escrow or bridged to another blockchain.

Dora, founder of OKX Ventures, said that he is pleased to support the vision and mission of DLC.Link, which has brought revolutionary progress to the application of Bitcoin in the field of decentralized finance (DeFi) through its dlcBTC solution, dlcBTC A non-custodial wrapper that allows users to manage their Bitcoins themselves without worrying about third-party risks, such as asset mismanagement or theft.

3.OKX Web3 wallet is now officially launched on the Atomics market

According to official news, OKX Web3 wallet Atomics market is now available Officially launched on the Atomics market, which is completely decentralized and free of platform service fees for interaction. Users can view and trade Atomics protocol assets, including ARC-20 and Atomics NFT assets, through the OKX Atomics market. Previously, the OKX Web3 wallet inscription market has supported the Ordinals market and has developed into the industry's largest BRC20 inscription and BTC NFT trading market. Currently, users can experience it immediately by updating the OKX APP to version 6.58.0 and above or the latest version of the OKX Web3 plug-in wallet.

4.LK Venture announced that it will co-lead the investment in Bitcoin cross-chain bridge XLink

News on March 14, listed in Hong Kong LK Venture, an encryption investment research institution associated with the company Linekong Interactive (8267.HK), announced that it has jointly led the investment in the Bitcoin cross-chain bridge project XLink through the Bitcoin Network Ecological Investment Management Fund BTC NEXT.

XLink, a Bitcoin cross-chain bridge developed by the AlexLabs team, aims to connect Bitcoin DeFi with the liquidity of Ethereum and other ecosystems, and provide access to protocol assets such as BRC20, ARC20, and Runes based on the Bitcoin mainnet, as well as Bitcoin Liquidity aggregation of Layer2 ecological assets. Since its launch on December 1, 2023, XLink’s total transaction volume has exceeded US$60 million.

In early November 2023, LK Venture launched the Bitcoin network ecological investment management fund BTC NEXT with a total scale of US$15 million. It has currently invested in projects such as UniSat, ALEX Labs, MAP Protocol, BiHelix, bitSmiley, Merlin Chain and a series of emerging assets in the Bitcoin ecosystem. . LK Venture is also a founding institutional member of BTC Security Lab.

5.Base chain bridge TVL exceeded 350,000 ETH

Dune data shows that Ethereum supported by Coinbase The second-layer expansion solution Base chain bridge TVL exceeded 350,000 ETH, reaching 359,416 ETH at the time of writing this article, which is approximately US$1.43 billion based on current prices.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

Brian

Brian

Brian

Brian Cheng Yuan

Cheng Yuan Others

Others Beincrypto

Beincrypto Finbold

Finbold Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist