Author: BitpushNews Mary Liu

Pre-halving weakness continued to affect the price trend of the cryptocurrency market on Wednesday, and Bitcoin faced huge downward pressure.

Bitpush terminal data showed that after Bitcoin hit a high of around $65,540 in the early morning of the Eastern Time, it fell all the way throughout the trading day, hitting a low of $59,640 (a figure that was 18% lower than the peak in March), and then rebounded slightly to above $60,000. As of the time of writing, the trading price was $61,434, a 24-hour drop of 3.1%.

The altcoin market fell under pressure earlier in the day and rebounded in the afternoon, with mixed performance, and the top 200 tokens by market value rose and fell. Injective (INJ) led the gains, rising 14.8% to $27.93, while Book of Meme (BOME) rose 14.2% and Sui (SUI) rose 12.3%. Mantra (OM) fell the most, falling 11.4%, followed by Saga (SAGA) which fell 10.1% and Echelon Prime (PRIME) which fell 9.4%.

The overall market value of cryptocurrencies is currently $2.24 trillion, and Bitcoin's dominance rate is 53.6%.

U.S. stocks opened higher and fell as traders assessed the risks posed to the market by the conflict in the Middle East. Uncertainty about the timing of rate cuts also made investors hesitant to increase their exposure to risky assets, leading to further weakness. As of the close, the S&P, Dow Jones and Nasdaq all fell, down 0.58%, 0.12% and 1.15% respectively.

Have institutional investors stopped buying Bitcoin?

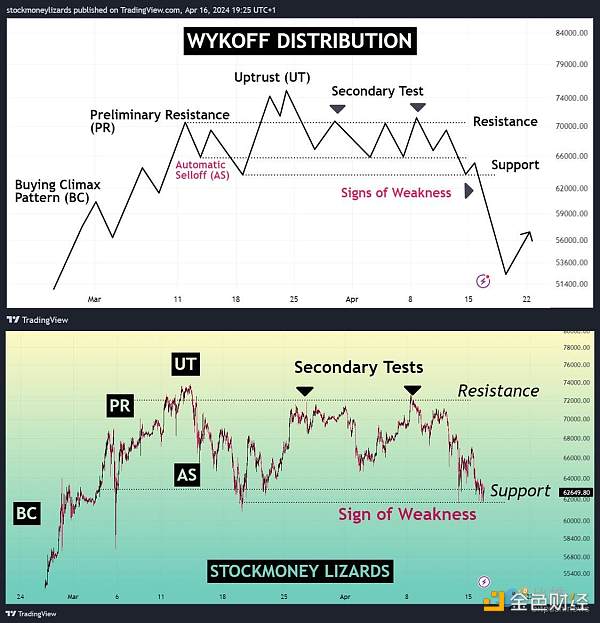

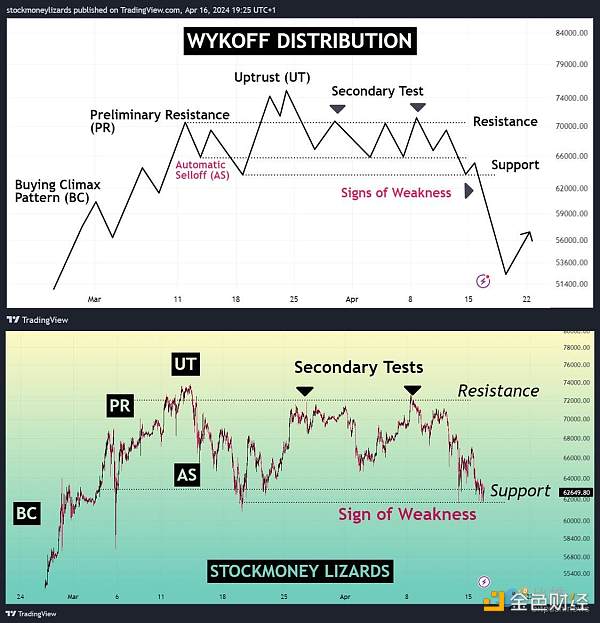

Stockmoney Lizards analysts said in an Xpostthat more downside moves in Bitcoin are in line with the Wyckoff analysis method.

As shown in the figure below, Bitcoin's recent price rise and fall are similar to the trends typically seen during the formation of the Wyckof distribution model, and as of April 17, BTC has entered the "signs of weakness" phase of the model.

As shown in the figure below, Bitcoin's recent price rise and fall are similar to the trends typically seen during the formation of the Wyckof distribution model.

This phase indicates that demand is weakening, which in turn causes the asset to fall. StockMoney Lizards believes that in the case of Bitcoin, the lack of demand is due to the growing risk aversion caused by the Federal Reserve's long-term higher interest rate policy and the escalating conflict between Iran and Israel.

Analysts believe that "large institutions have paused buying for now," adding: "ETF inflows are at an all-time low. Our guess is that they sense that difficult times may be coming for the market."

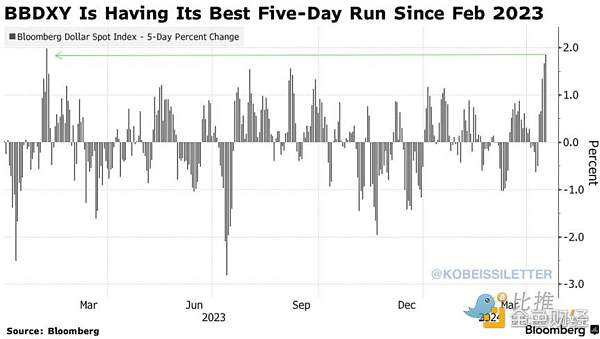

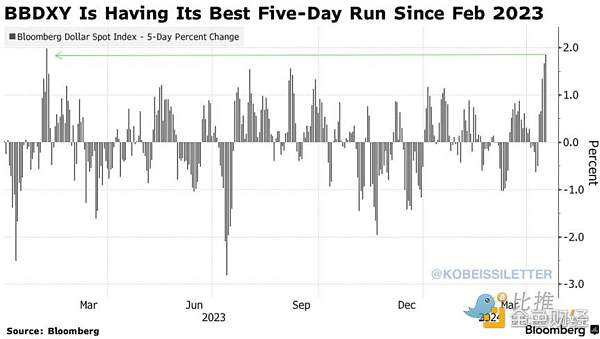

Data from Farside Investors shows that U.S. spot Bitcoin ETFs have seen outflows of nearly $150 million since the outbreak of the Iran-Israel conflict on April 12. The weakness in bitcoin and broader financial markets came as the dollar experienced its best five-day gain since February, gaining more than 2% since April 10. As of writing, the U.S. dollar index DXY is trading at 106.23, the highest level since November 2.

Historically, higher interest rates have led to higher returns from investors buying U.S. Treasuries and time deposits, thereby increasing demand for the U.S. dollar, which is reflected in the recent rise in the U.S. dollar index.

Market analyst Bitcoin Schmitcoin posted on the X platform that the DXY index is moving in the opposite direction of the crypto market.

He believes: "Crypto bull market = DXY bear market; crypto bear market = DXY bull market; crypto top = DXY bottom; crypto bottom = DXY top, and while DXY is consolidating, it is an indicator of crypto/stock volatility."

This begs the question: Will the halving become a sell-off news event?

Bitcoin Schmitcoin said: "We are seeing a possible top in major stock markets, and the dollar gold is showing tremendous strength after clearing a decade-long consolidation. All of this suggests that we are beginning to see investors turn to hedging mechanisms to cope with macro uncertainties. DXY broke out because people are looking for cash rather than assets. People buy gold because they are hedging. This is not a good sign, and as much as I want to be bullish on BTC, it is really hard for me to stay in this bullish camp. Remember my words: If the US dollar index starts to rise, everything else will fall as a result."

The price reaction to Bitcoin halving may not happen immediately

With only two days left until the 2024 Bitcoin halving, cautious investors are choosing to wait and see whether the BTC price will retreat again or rebound sharply. Coinify CEO Rikke Staer said in a report that Bitcoin's price reaction to the upcoming halving may take several months, and replicating the large percentage gains observed in the past may be challenging. "Price reactions are not usually immediate, and historically, major growth after halvings has occurred within 6-18 months, and as the market size increases, larger price fluctuations become statistically less likely," he said. Staer added that due to the current large size and liquidity of the Bitcoin market, the huge percentage gains observed in previous halvings may be difficult to replicate.

JinseFinance

JinseFinance