Source: Blockchain Knight

A group of companies has accumulated $13.7 billion in BTC, which is an important milestone for the Crypto asset market.

The huge accumulation reflects growing confidence in BTC as a viable investment It also reflects BTC’s recent price surge and growing appeal among institutional investors force.

BTC ETF financial products have attracted much attention, attracting a large amount of capital inflows between February 12 and February 16, with a total of more than 2.2 billion US dollars. This surge in investment puts the BTC ETF above the 3,400 ETFs in the United States.

Bloomberg analyst Eric Balchunas emphasized the sheer strength of these inflows. He specifically mentioned BlackRock’s iShares BTC Trust, which received $1.6 billion in funding in just one week.

Balchunas added: “Last week, 10 BTC ETFs netted more than $2.3 billion, with IBIT ranking second. This brings the total net gain to over $5 billion, exceeding BlackRock's overall revenue. Again, this is a net loss for GBTC. Put that aside, and the numbers get even crazier."

This proves investor interest in BTC Getting bigger. In fact, the massive inflows into other well-known spot BTC ETFs further prove this.

For example, Fidelity’s Wise Origin BTC Fund and Ark 21Shares BTC ETF also received considerable capital injections, reflecting investors’ diversified interest in BTC investments.

p>

Despite optimistic capital inflows, the Grayscale BTC Trust Fund suffered an outflow of $624 million. However, since the SEC (U.S. Securities and Exchange Commission) approved the spot BTC ETF, the overall trend of the market remains bullish.

This nod from the regulator has boosted BTC prices, which have surged 95% in the past six months, reflecting positive market sentiment towards Crypto assets .

The resurgence in BTC’s appeal is not limited to ETFs. Major banks and financial institutions are watching the market closely.

Some institutions advocate regulatory adjustments to accommodate the growing demand for BTC custody. This reflects widespread recognition of BTC’s potential to redefine investment portfolios and its role as a contemporary asset class.

BTC’s rise is reflected in its performance compared to traditional safe-haven assets such as gold. The digital currency is up 23% so far this year, contrasting with gold's modest decline. As such, this highlights the shift in investor preferences towards digital assets.

This shift is evidenced by significant outflows from gold ETFs, a trend that contrasts sharply with inflows from the previous year.

Balchunas emphasized: “The situation in the gold ETF category is pretty bad right now. For sure, I don’t think these people are migrating to BTC ETFs, maybe a little bit, but just our stock FOMO , although this may be reversed given new ecological data."

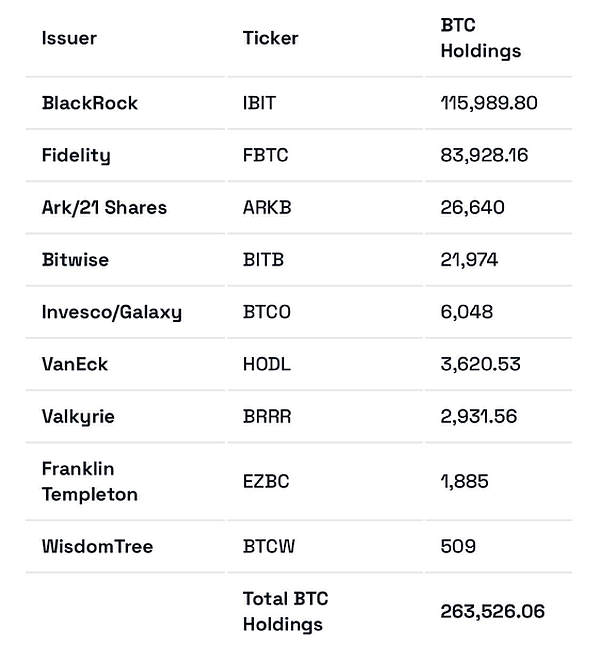

A range of companies including BlackRock, Fidelity, Ark/21 Shares and Bitwise are accumulating BTC,< strong>This marks a critical moment for financial markets. Together, these companies hold more than 260,000 BTC and are the pioneers of the financial revolution.

As BTC continues to challenge traditional investment models, institutional investors’ acceptance of it has opened a new era of digital assets being integrated into mainstream financial investment portfolios.

铭文老幺

铭文老幺

铭文老幺

铭文老幺 JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinworld

Bitcoinworld CaptainX

CaptainX Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph