Author: BIT FM; Source: Crypto Kitchen

In the past 2023, based on Segregated Witness, Taproot The Ordinals theory and protocol that were born from upgrading these two technological innovations unexpectedly pushed Bitcoin, the strongest decentralized consensus, to begin to transcend its single narrative of "value storage". The Ordinals Protocol, and the Ordinals Protocol are based on or influenced by it. The theories, protocols, token standards, and projects inspired by BRC20, Runes Protocol, Atomic Protocol, DMT digital material theory, NAT non-arbitrary token, Bitmap and other theories, protocols, token standards, and projects are emerging in endlessly, and are building the cornerstone of a decentralized value network for a digital and intelligent future. .

Can Bitcoin Ordinals surpass Ethereum NFTs?

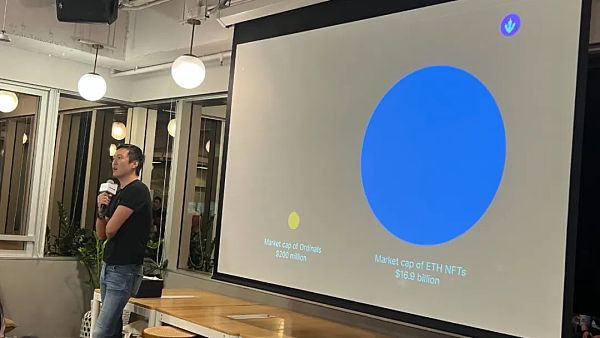

Participated in OrdCon hosted by Mempool in Hong Kong on April 14 last year When I took this video of the speech, I didn’t dare think about the above question.

11 months ago, the total market value of Ethereum NFT was US$16.9 billion, Ordinals' was US$200 million, the former was the latter 84.5 times. According to a CryptoSlam report, the total sales volume of Ethereum NFT and Bitcoin Ordinals in the last week of last month was almost the same, at US$177.4 million and US$176.4 million respectively - although the sales statistics of Bitcoin Ordinals include BRC20 tokens, both of which The data are not entirely comparable.

Although the price of Ethereum has doubled in the past year, the day before yesterday on the 11th It exceeded US$4,000, but in the past week, the floor price of Ethereum blue-chip NFT has generally fallen. BAYC fell 19% on the 7th, and the floor price of DeGods fell more than 40% on the 7th; Pudgy Penguins, LilPudgys, and Azuki also experienced 10%-20% 7 daily decline. This market has lasted for more than a month, and the floor prices of blue-chip NFTs have dropped by more than 30%: the floor prices of Pudgy Penguins and BAYC have both fallen from more than 20 ETH to around 13 ETH.

Looking at the Ordinals Bitcoin NFT ecosystem, it is prosperous. Taking NodeMonkes as an example, NodeMonkes numbered 2769 was sold on the Magic Eden market for 17 Bitcoins ($1.08 million) on March 4, becoming the largest amount since the project was launched and the second-highest sale in Ordinals history. On that day, only one Ethereum CryptoPunk worth $16 million was sold more than NodeMonkes, which achieved approximately $11.7 million in sales in one day. In the last week of February, NodeMonkes became the best-selling Ordinals project, with $45 million in secondary market sales. From the NodeMonkes Dutch auction price of 0.03 BTC (approximately $1,325) in December last year to the highest floor price of 0.82 BTC (approximately $54,400), the 27-fold increase occurred in just over two months. Bitcoin Puppets, Natcats, Ordinal Maxi Biz, and Bitcoin Frogs also set impressive records.

At OrdCon 11 months ago, the organizer also invited Magic Eden’s market leader to give a speech introducing their entry into Bitcoin. , supports Ordinals trading strategies. At that time, I admired the Solana ecosystem’s largest NFT market for its determination to survive the bankruptcy of the FTX exchange and seize the opportunities of Ordinals. I did not expect that Magic Eden is now reshaping the NFT market structure: with US$184 million in the past seven days The transaction volume ranked first in the market, accounting for 33.35% of the overall NFT transactions. Blur, which only supports Ethereum, ranked second, accounting for approximately 32.26% of the market share with a transaction volume of US$178 million, while Opensea, the dominant player that year, ranked third with a market share of US$55.12 million and 9.97%. 43% of Magic Eden’s trading volume comes from Ordinals (Tiexo data).

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance cryptopotato

cryptopotato cryptopotato

cryptopotato CryptoSlate

CryptoSlate nftnow

nftnow