Author: Ken

The quality of Binance's recent new coin mining projects has been significantly improved, such as AEVO, ETHFI and Ethena. Both the mining income and the subsequent performance of the tokens after they are launched are still quite impressive.

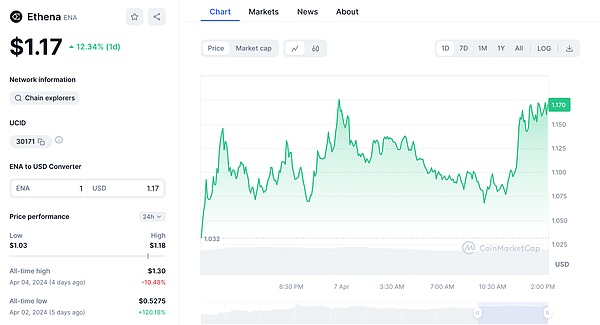

Take the algorithmic stablecoin Ethena (ENA) launched on April 2 as an example. After the launch, the price has increased by 120% from the low to the present.

What are the innovations of Ethena?

1. Innovation of Ethena

The inspiration of the Ethena project comes from the article Dust on Crust published by Arthur Hayes, the founder of BitMEX, last year.

The article mentioned his idea of a new generation of stablecoins, that is, to create a stablecoin supported by an equal amount of BTC spot longs and futures shorts.

Ethena Labs turned Arthur's idea into reality, but did not use BTC as the main underlying asset for opening positions, but chose ETH.

In other words, Ethena is a synthetic dollar protocol built on Ethereum. It has launched a US dollar stablecoin USDe, and ENA is its platform token.

USDe is actually an algorithmic stablecoin. Different from the minting mechanism of USDT and USDC, the stablecoin USDe minted through the Ethena protocol has ETH as its underlying asset instead of USD.

Specifically, USDe's collateral assets are composed of an equal amount of spot ETH longs and futures ETH shorts, so that hedging can be achieved, which is what we often hear about as hedging.

Therefore, regardless of whether the price of ETH rises or falls, USDe can remain "stable", which, in professional terms, is to achieve "Delta neutrality".

Moreover, these ETH assets are not stored in centralized exchanges, but are hosted on platforms such as Copper, CEFFU, and Cobo, which can avoid the risks of exchanges running away or misappropriating to a certain extent.

Second, Source of Income

The competition in the stablecoin track is very fierce. Facing old stablecoins such as USDT, USDC, and DAI, how can USDe gain more market share?

The biggest highlight of USDe is the yield rate. USDe staking users can share the double income from the pledged assets.

First, 2024 is the year of pledge. There are more and more projects in the pledge and re-pledge track. The underlying assets of USDe (such as ETH, etc.) can at least obtain relatively stable pledge income through these pledge platforms. For example, ETH can be pledged on platforms such as Lido to obtain an annualized income of about 4%, which can guarantee a basic stable income.

Second, a certain funding rate can be obtained on these futures platforms. Although the funding rate is an unstable factor, for short positions, the funding rate is positive most of the time in the long run, which also means that the overall return will be positive.

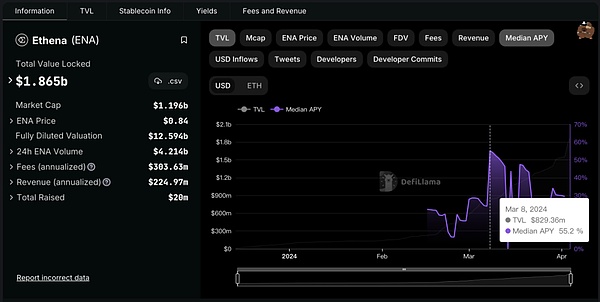

Let's take a look at Ethena's specific APY (annualized rate of return).

According to statistics from the defillama platform, Ethena's Median APY is as low as 5% and as high as 55%, which is much higher than the yields provided by other DeFi platforms.

III. Financing

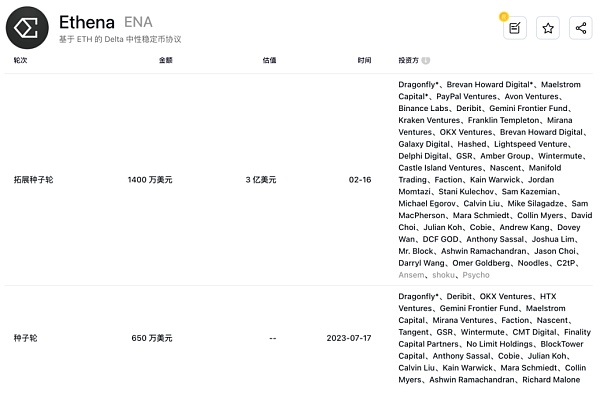

Ethena has raised a total of $20.5 million through two rounds of financing. The most recent round of financing took place on February 16 this year, with a $14 million financing at a valuation of $300 million.

Ethena's investment team is very luxurious, such as Binance Labs, OKX Ventures, Dragonfly, etc. Among them, OKX Ventures and Dragonfly participated in both rounds of financing.

In the Ethena investment team, we also see the presence of traditional financial giants such as Paypal and Franklin.

In addition, the founders of multiple CEX platforms and derivatives trading platforms also participated in the investment in Ethena.

Fourth, TVL and Revenue

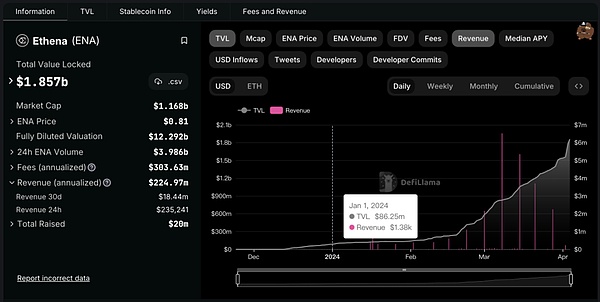

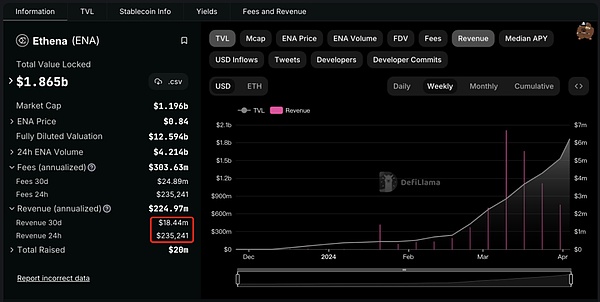

According to statistics from the defillama platform, Ethena TVL has grown very fast. At the beginning of this year, it was only more than 8,600 US dollars, and now it has reached 1.857 billion US dollars. In 3 months, TVL has increased by 21 times. The APY provided by the Ethena platform is much higher than other platforms.

Currently, the minting volume of USDe has exceeded 1.9 billion.

According to the data from the Defillama platform, the average monthly revenue of the Ethena platform can reach more than 18 million US dollars, and the average daily revenue can reach more than 230,000 US dollars. Compared with the profitability of other DeFi platforms, the profitability of the Ethena platform can be said to be quite strong. Of course, whether this high return can be sustained remains to be seen.

V. Risks

The risks faced by Ethena mainly come from:

1. Risk of pledge platform

Putting USDe's underlying assets on a pledge platform to earn income will, of course, involve some risks, such as the pledge platform being hacked, etc. Of course, this is not just a risk faced by USDe.

2. Risks of futures contract platforms

For example, the platform commits evil, is attacked by hackers, etc.

3. Funding rate risk

Although the funding rate of short positions is positive most of the time, there is also the possibility of turning negative. If the comprehensive rate of return after weighted staking income is negative, the impact on "stablecoins" will be relatively large.

In short, although algorithmic stablecoins are not original to Ethena, compared to Luna, Ethena has many innovations. For example, Ethena uses the hedging model of holding spot ETH longs and futures ETH shorts to achieve the stability of USDe value.

Currently, the market share of stablecoins has exceeded 150 billion US dollars and is still growing. Among them, USDT has exceeded 100 billion US dollars, while Ethena's USDe is currently less than 2 billion US dollars, which is more than 50 times the gap from USDT.

In addition, if the issuance of USDT is determined by the project party, then the issuance of USDe is determined by the users. The final scale of USDe will be determined by the users. If Ethena can continue to provide high returns, it will attract more users to cast. If this model can continue, the scale of USDe is likely to exceed our imagination. As the scale of USDe grows and the platform continues to run smoothly, there will be more and more application scenarios for USDe, and it will be embedded in more DeFi applications, and it may even become a basic stable currency.

As the Ethena platform token, ENA will capture the value brought by the development of the Ethena platform. As the scale of USDe grows and the use scenarios become more and more abundant, the price of ENA will naturally rise. At present, the market value of ENA has exceeded 1 billion US dollars. If compared with the market value of LUNA of tens of billions of US dollars, ENA still has a lot of room for development. Of course, whether Ethena's innovative model can continue to exist remains to be seen. We will have to wait and see.

P.S This article does not constitute any investment advice.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance Weiliang

Weiliang JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cryptohayes

Cryptohayes Nulltx

Nulltx